Wrapping up Q3 earnings, we look at the numbers and key takeaways for the government & technical consulting stocks, including Amentum (NYSE: AMTM) and its peers.

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

The 7 government & technical consulting stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.3% on average since the latest earnings results.

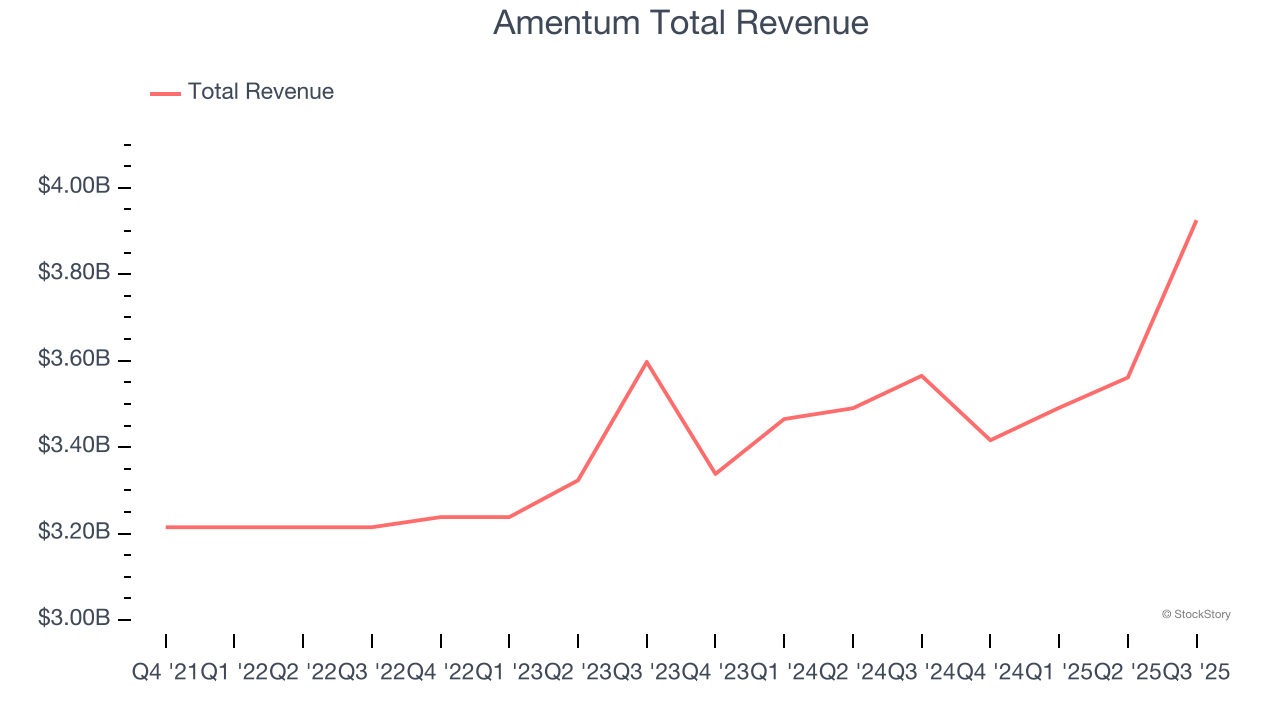

Amentum (NYSE: AMTM)

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE: AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

Amentum reported revenues of $3.93 billion, up 10.1% year on year. This print exceeded analysts’ expectations by 9%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ revenue estimates but a miss of analysts’ full-year EPS guidance estimates.

“Amentum’s strong fourth quarter results cap off what has been a remarkable first year as a public company. Financial performance exceeded our expectations, demonstrating the resilience of our business and its alignment with enduring global trends and the mission critical priorities of our customers," said Amentum Chief Executive Officer John Heller.

Amentum pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 12.4% since reporting and currently trades at $28.52.

Is now the time to buy Amentum? Access our full analysis of the earnings results here, it’s free for active Edge members.

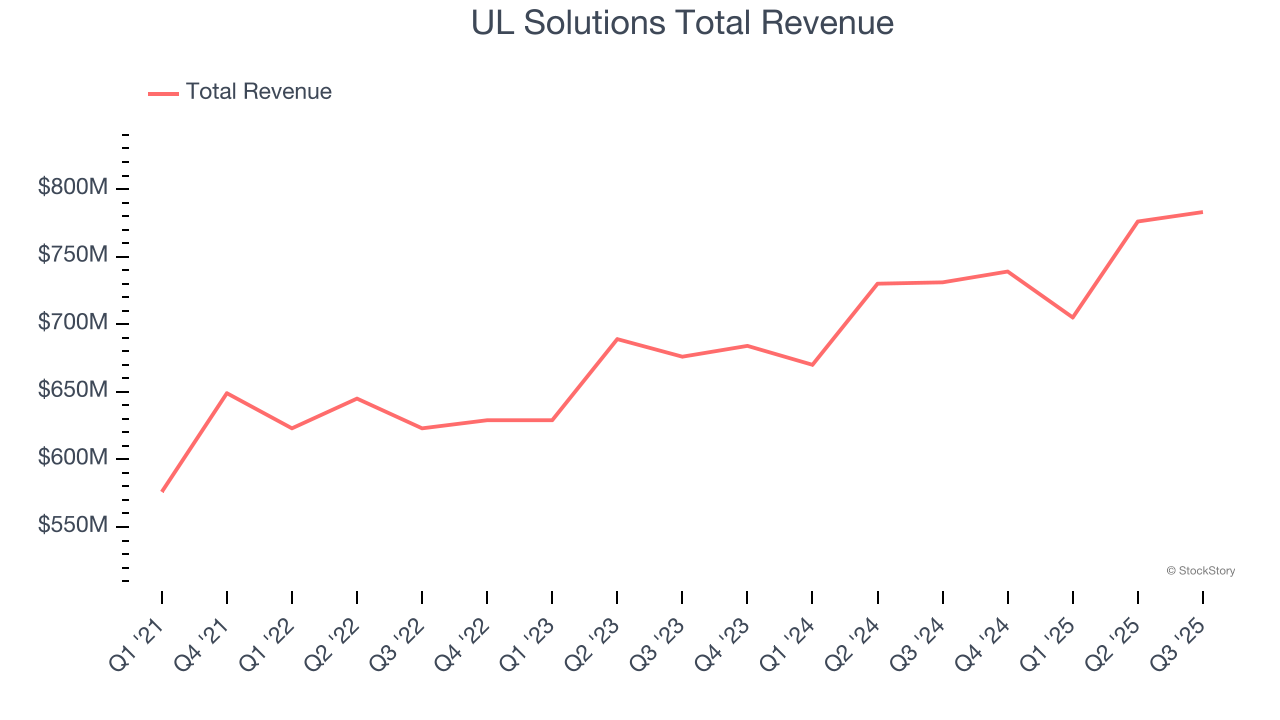

Best Q3: UL Solutions (NYSE: ULS)

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE: ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

UL Solutions reported revenues of $783 million, up 7.1% year on year, outperforming analysts’ expectations by 1.5%. The business had a very strong quarter with a beat of analysts’ EPS estimates and a decent beat of analysts’ revenue estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.4% since reporting. It currently trades at $77.52.

Is now the time to buy UL Solutions? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ICF International (NASDAQ: ICFI)

Operating at the intersection of policy, technology, and implementation for over five decades, ICF International (NASDAQ: ICFI) provides professional consulting services and technology solutions to government agencies and commercial clients across energy, health, environment, and security sectors.

ICF International reported revenues of $465.4 million, down 10% year on year, falling short of analysts’ expectations by 3.9%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

ICF International delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 2.7% since the results and currently trades at $83.16.

Read our full analysis of ICF International’s results here.

SAIC (NASDAQ: SAIC)

With over five decades of experience supporting national security missions, Science Applications International Corporation (NASDAQ: SAIC) provides technical, engineering, and enterprise IT services primarily to U.S. government agencies and military branches.

SAIC reported revenues of $1.87 billion, down 5.6% year on year. This number met analysts’ expectations. Overall, it was a very strong quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

SAIC scored the highest full-year guidance raise among its peers. The stock is up 11.2% since reporting and currently trades at $97.31.

Read our full, actionable report on SAIC here, it’s free for active Edge members.

Booz Allen Hamilton (NYSE: BAH)

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE: BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

Booz Allen Hamilton reported revenues of $2.89 billion, down 8.1% year on year. This print missed analysts’ expectations by 2.7%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ revenue estimates and a significant miss of analysts’ organic revenue estimates.

The stock is down 9.7% since reporting and currently trades at $90.53.

Read our full, actionable report on Booz Allen Hamilton here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.