Houston, Texas-based EOG Resources, Inc. (EOG) develops, produces, and markets crude oil, natural gas liquids, and natural gas. Valued at a market cap of $57.6 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

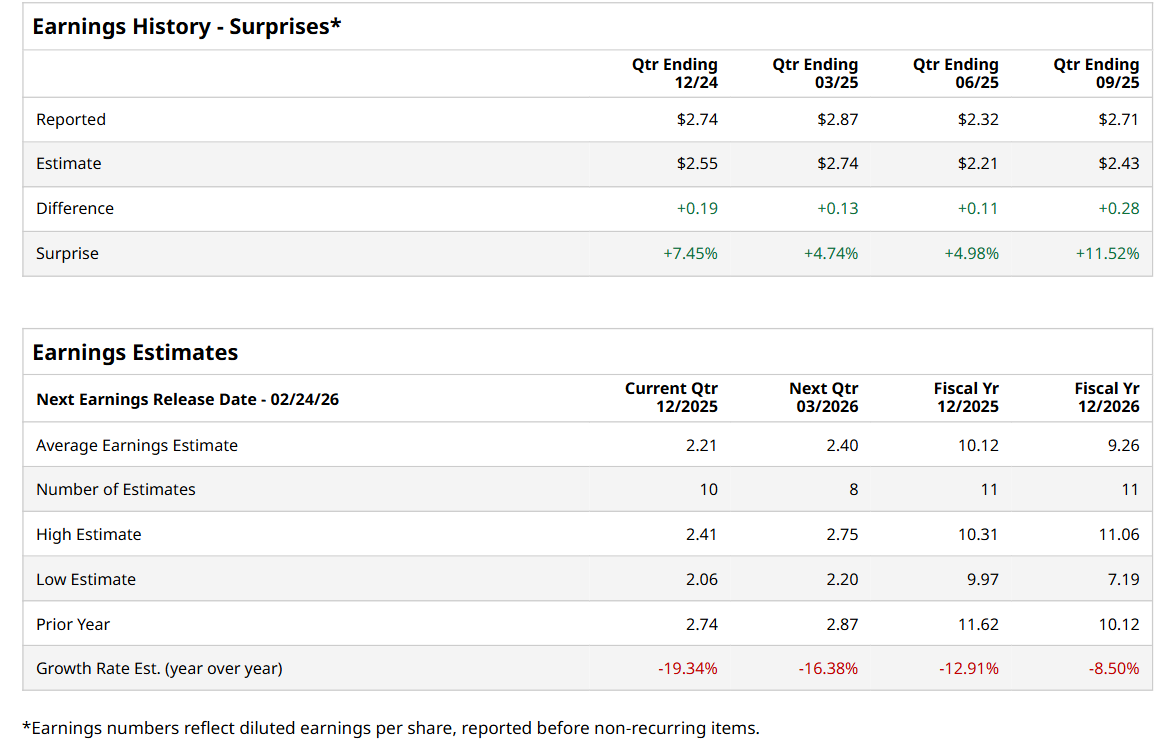

Ahead of this event, analysts expect this energy company to report a profit of $2.21 per share, down 19.3% from $2.74 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.71 per share in the previous quarter topped the consensus estimates by 11.5%.

For the current fiscal year, ending in December, analysts expect EOG to report a profit of $10.12 per share, down 12.9% from $11.62 per share in fiscal 2024. Its EPS is expected to further decline 8.5% year-over-year to $9.26 in fiscal 2026.

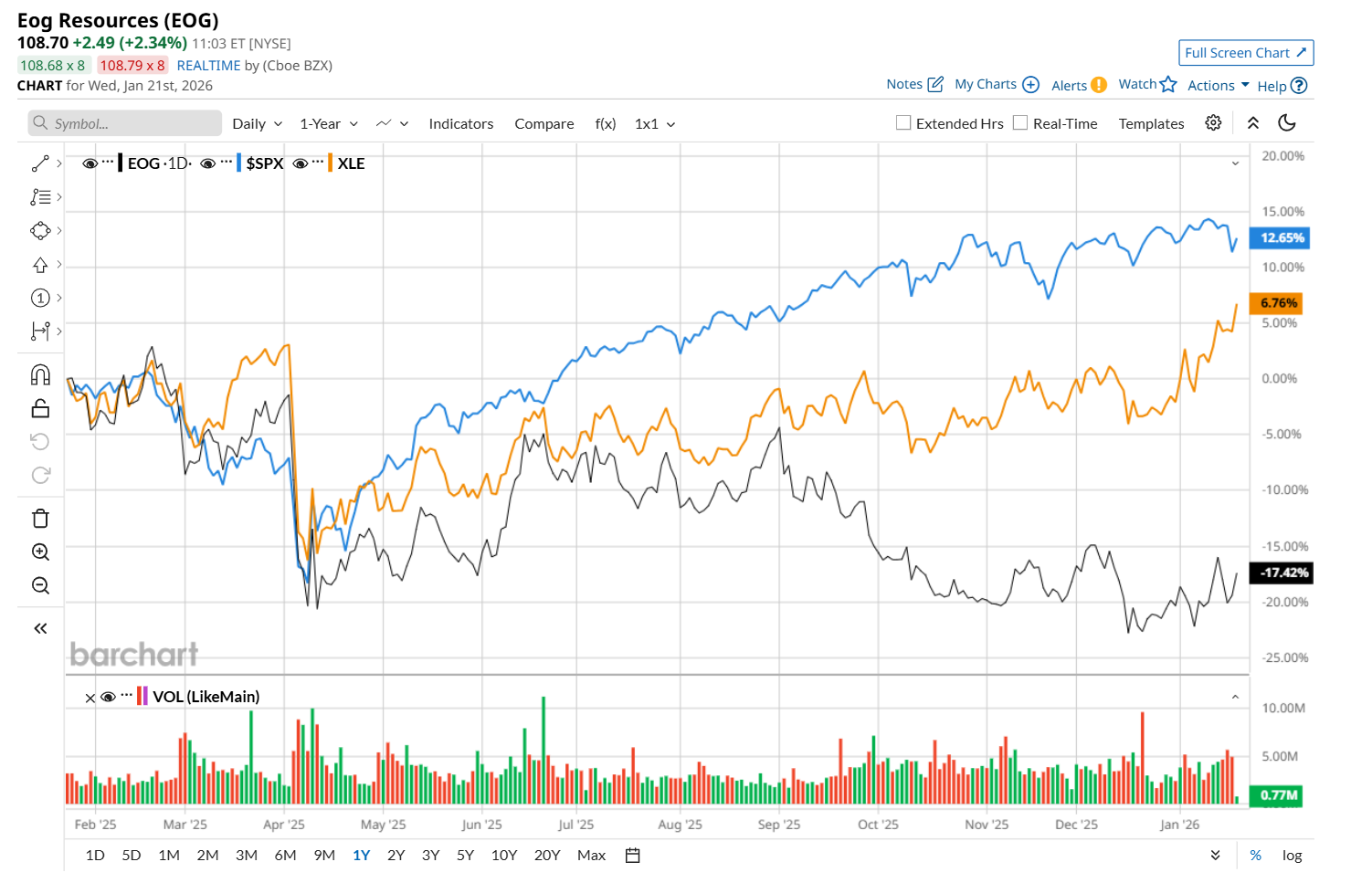

EOG has declined 20.1% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 13.3% return and the State Street Energy Select Sector SPDR ETF’s (XLE) 4% uptick over the same time period.

On Nov. 6, EOG reported mixed Q3 results, and its shares closed up marginally in the following trading session. The company’s overall revenue declined 2% year-over-year to $5.8 billion, missing consensus estimates by 1.7%. Nonetheless, its adjusted EPS also decreased 6.2% from the year-ago quarter to $2.71, but topped analyst expectations of $2.43.

Wall Street analysts are moderately optimistic about EOG’s stock, with an overall "Moderate Buy" rating. Among 34 analysts covering the stock, 13 recommend "Strong Buy," two suggest "Moderate Buy,” and 19 indicate "Hold.” The average price target for EOG is $135.20, indicating a 24.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- BitMine Immersion Just Invested $200 Million in MrBeast. What Does That Mean for BMNR Stock?

- This is the Best Way to Sell Put Options for Income Without Blowing Up Your Account

- Dear IBM Stock Fans, Mark Your Calendars for January 28

- Tesla Just Revived Its Dojo3 Supercomputer. Does That Make TSLA Stock a Buy Here?