Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Universal Display (NASDAQ: OLED) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 7,674% above.

Thankfully, share prices of the companies have been resilient as they are up 8.8% on average since the latest earnings results.

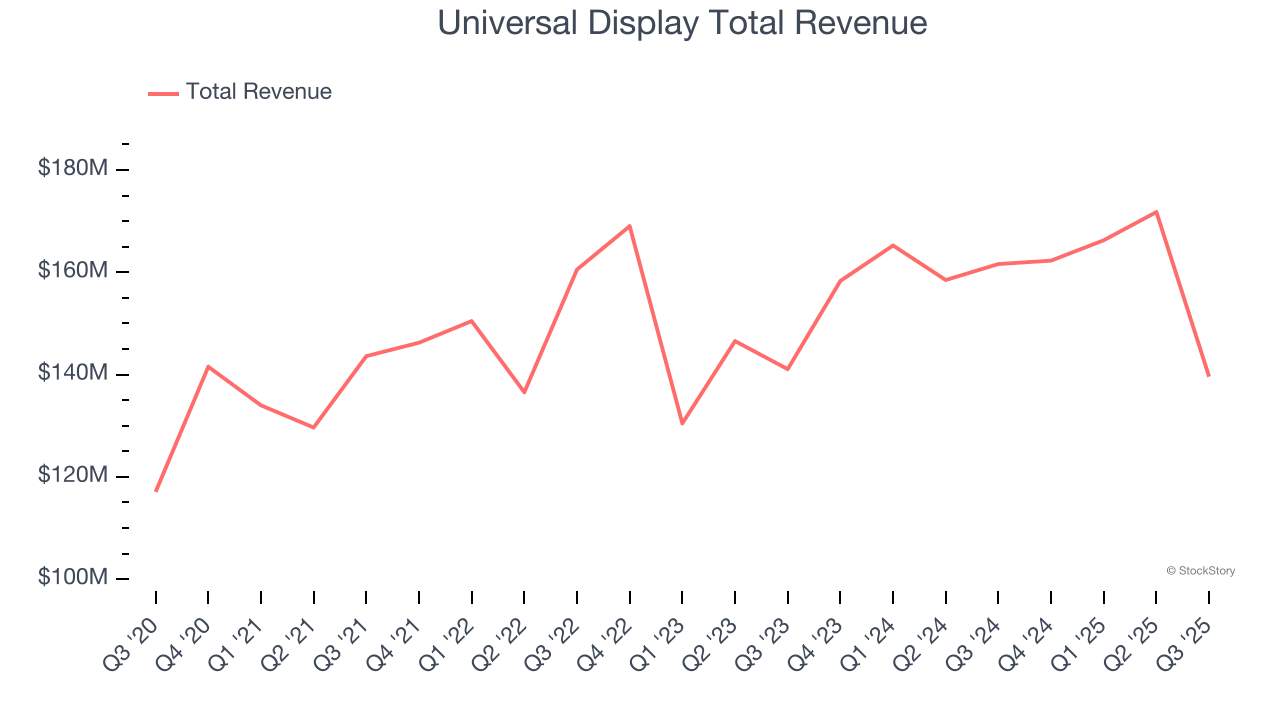

Weakest Q3: Universal Display (NASDAQ: OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $139.6 million, down 13.6% year on year. This print fell short of analysts’ expectations by 15.9%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Universal Display delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 13% since reporting and currently trades at $117.93.

Is now the time to buy Universal Display? Access our full analysis of the earnings results here, it’s free.

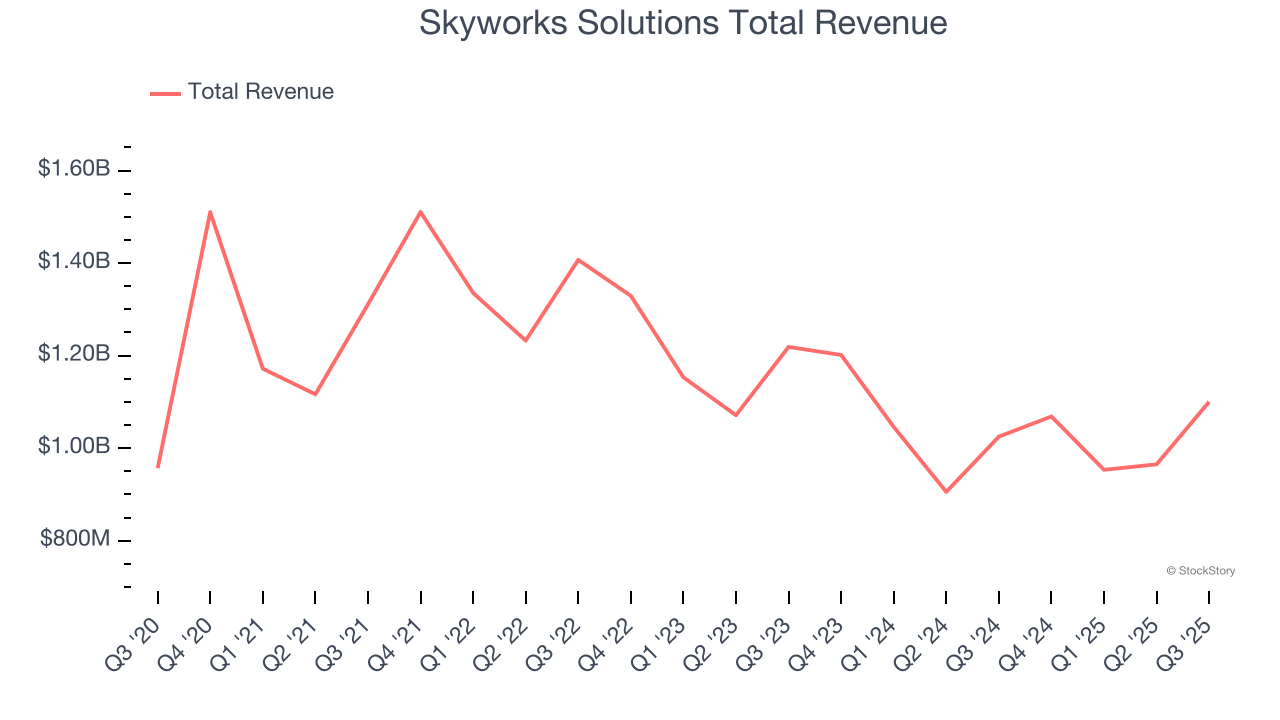

Best Q3: Skyworks Solutions (NASDAQ: SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.1 billion, up 7.3% year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.6% since reporting. It currently trades at $58.58.

Is now the time to buy Skyworks Solutions? Access our full analysis of the earnings results here, it’s free.

Magnachip (NYSE: MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE: MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $45.95 million, down 30.9% year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ adjusted operating income estimates.

Magnachip delivered the slowest revenue growth in the group. Interestingly, the stock is up 1.8% since the results and currently trades at $3.18.

Read our full analysis of Magnachip’s results here.

onsemi (NASDAQ: ON)

Spun out of Motorola in 1999 and built through a series of acquisitions, onsemi (NASDAQ: ON) is a global provider of analog chips specializing in autos, industrial applications, and power management in cloud data centers.

onsemi reported revenues of $1.55 billion, down 12% year on year. This print surpassed analysts’ expectations by 2.2%. Overall, it was a very strong quarter as it also put up a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 25.2% since reporting and currently trades at $63.45.

Read our full, actionable report on onsemi here, it’s free.

Monolithic Power Systems (NASDAQ: MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $737.2 million, up 18.9% year on year. This number beat analysts’ expectations by 2%. It was a strong quarter as it also produced a significant improvement in its inventory levels and revenue guidance for next quarter topping analysts’ expectations.

The stock is flat since reporting and currently trades at $1,083.

Read our full, actionable report on Monolithic Power Systems here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.