As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the personal care industry, including Olaplex (NASDAQ: OLPX) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 12 personal care stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.2% above.

While some personal care stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

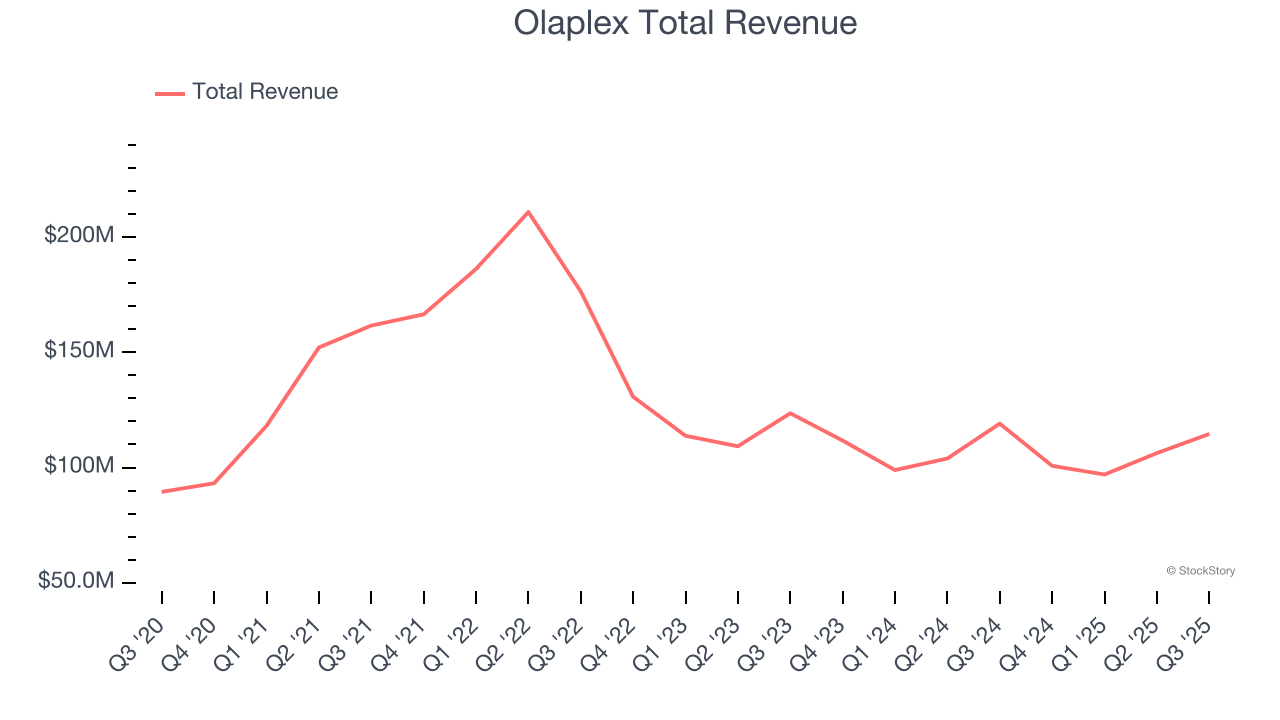

Olaplex (NASDAQ: OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $114.6 million, down 3.8% year on year. This print exceeded analysts’ expectations by 4.2%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "We are pleased with our third quarter results that reflect investments in sales and marketing, continued progress in our executional capabilities and the early results of our latest new product introductions. We are reaffirming our annual guidance and remain focused on our Bonds and Beyond strategy for sustainable, profitable long-term growth."

Interestingly, the stock is up 3.3% since reporting and currently trades at $1.10.

Is now the time to buy Olaplex? Access our full analysis of the earnings results here, it’s free for active Edge members.

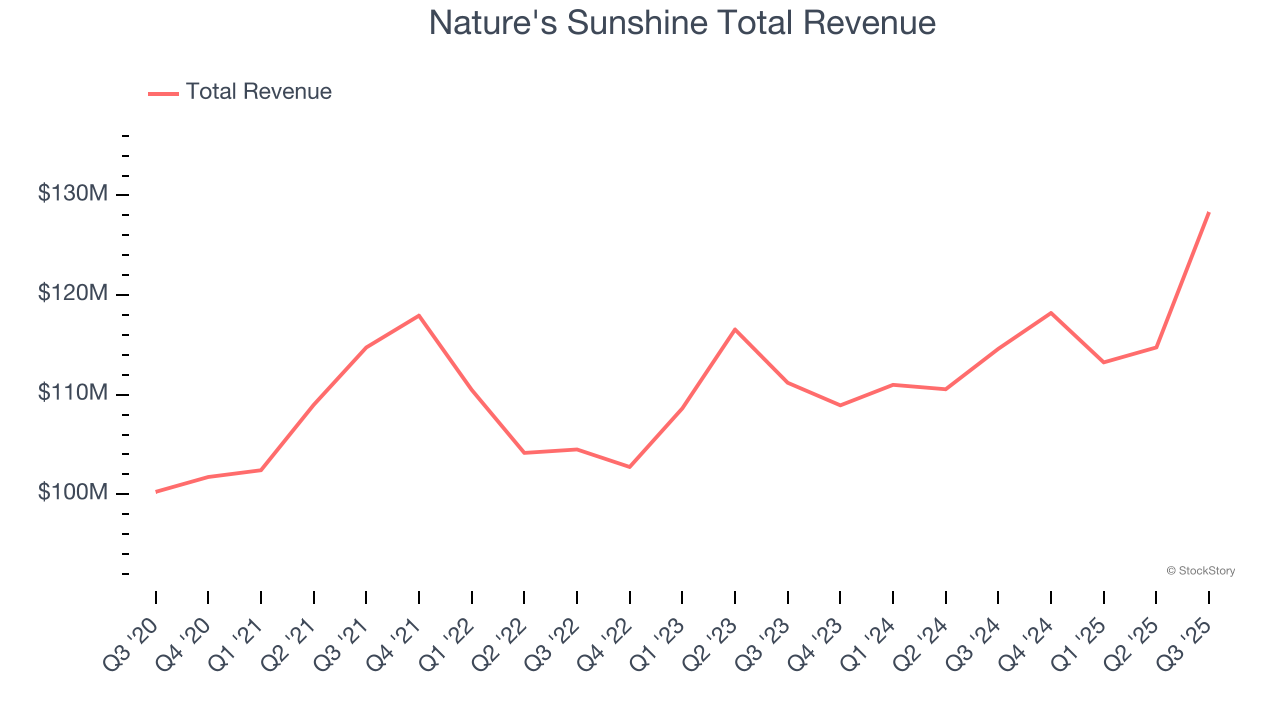

Best Q3: Nature's Sunshine (NASDAQ: NATR)

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Nature's Sunshine reported revenues of $128.3 million, up 12% year on year, outperforming analysts’ expectations by 6.7%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Nature's Sunshine pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 52.6% since reporting. It currently trades at $20.90.

Is now the time to buy Nature's Sunshine? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Edgewell Personal Care (NYSE: EPC)

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Edgewell Personal Care reported revenues of $537.2 million, up 3.8% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 7.7% since the results and currently trades at $17.46.

Read our full analysis of Edgewell Personal Care’s results here.

Medifast (NYSE: MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $89.41 million, down 36.2% year on year. This result met analysts’ expectations. Overall, it was a very strong quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

Medifast had the slowest revenue growth among its peers. The stock is down 10.9% since reporting and currently trades at $10.58.

Read our full, actionable report on Medifast here, it’s free for active Edge members.

Coty (NYSE: COTY)

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Coty reported revenues of $1.58 billion, down 5.6% year on year. This print was in line with analysts’ expectations. More broadly, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates and a slight miss of analysts’ organic revenue estimates.

The stock is down 15.6% since reporting and currently trades at $3.17.

Read our full, actionable report on Coty here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.