Weakness may be an opportunity for Spotify (SPOT). Since peaking in September, shares of the streaming and media services company are down about 43%. But that’ll happen with weaker-than-expected guidance and news: it will part ways with its longtime CEO, who will still remain involved as executive chairman.

With Earnings, the Third Quarter Looked Impressive

Spotify's EPS of 3.28 euros crushed estimates of 1.97 euros. That was also higher than the 1.45 euros posted year over year. Revenue of 4.27 billion euros was also better than estimates for 4.23 billion euros. It also saw its monthly active users jump by 11% to 713 million. Premium subscribers jumped 12% to 281 million, in line with expectations.

However, we should point out two key negatives with the report. As reported here, its gross margin of 31.6% was 50 basis points ahead of guidance because of “rights holder liabilities.” If that were to be excluded, Spotify’s gross margins would have only been “modestly ahead of guidance due to content cost favorability,” as noted by Founder and Executive Chairman Daniel Ek in Q3 2025 earnings commentary. In addition, the company added that the operating income of 582 million euros was 97 million euros better because of “social charges,” added the company. That, they added, had a positive impact on an operating income of 41 million euros.

In short, EPS numbers weren’t as impressive as first thought. Not helping, guidance wasn’t hot either, with the company forecasting fourth quarter revenue of 4.5 billion euros, which is below expectations for 4.56 billion euros. It also said it expects total premium subscribers to reach 289 million, short of estimates for 291.1 million.

However, Weakness May Be an Opportunity

With a good deal of negativity now priced into the stock, we’re seeing opportunity—especially as it attempts to pivot from technically oversold conditions. Plus, the company just raised its premium subscription cost by $1 per month, which can help strengthen financials. In fact, according to analysts at Oppenheimer, the price hike could help the stock get on track again.

Even better, analysts at Goldman Sachs have a “Buy” rating on the stock, noting that investors should take advantage of the decline in SPOT shares. The firm also has a price target of $700. “The analyst believes the streamer can grow its gross margin by 80 to 100 basis points each year for the next four years. He cited the leverage the company has over royalty payments, flat costs tied to podcasting, and surging advertising revenue,” added Barron’s.

Analysts at Jefferies also reiterated a “Buy” rating on SPOT with a $750 price target ahead of earnings. The firm believes fourth-quarter gross margin expectations are conservative and expects revenues to accelerate over the next few quarters thanks to price increases. Again, this weakness creates a buying opportunity ahead of Tuesday's earnings.

What Other Analysts Are Saying About SPOT Stock

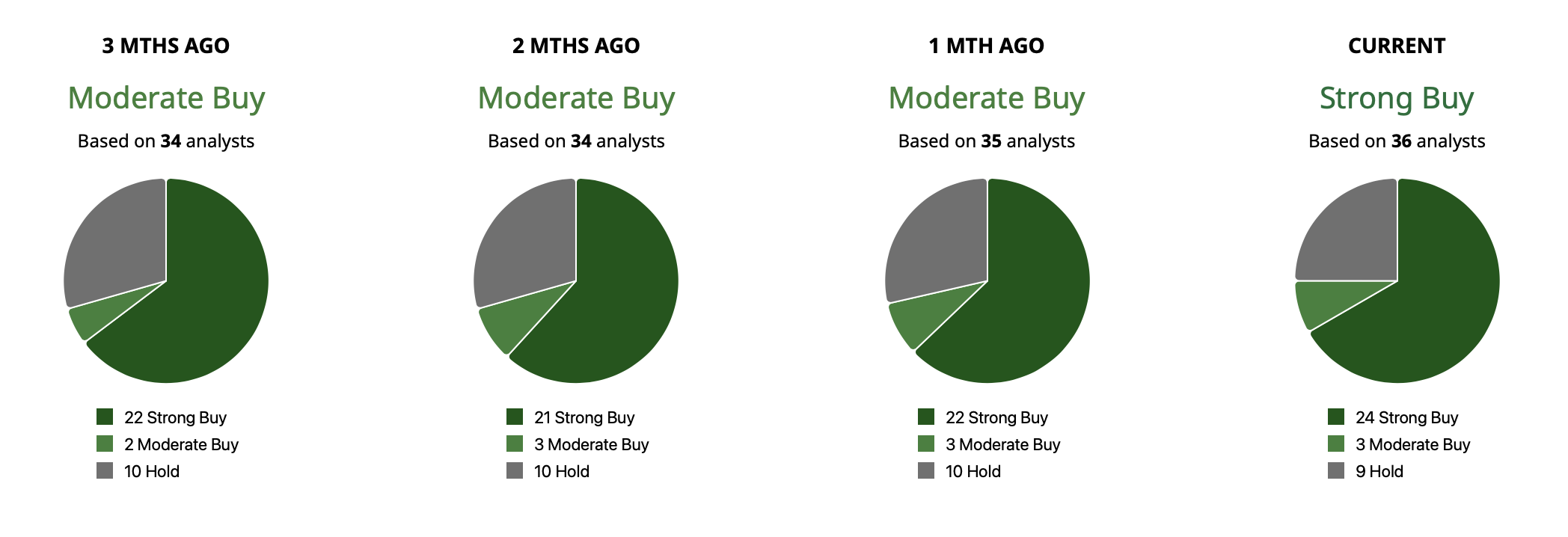

Of the 36 analysts covering the SPOT stock, 24 have it rated as a “Strong Buy,” three rate it a “Moderate Buy,” and nine rate it a “Hold.” Presently, the mean target price among analysts is $733.26, implying 73% upside. The high-end target is $900, implying 112% upside.

While Spotify’s third-quarter earnings report revealed cracks beneath the headline numbers and softer-than-expected guidance weighed heavily on the stock, much of that chaos now appears to be priced into the current share price. With SPOT down sharply from its highs, improving user growth, technically oversold conditions, and bullish analysts may set the stage for further potential upside. For investors willing to stomach near-term volatility, Spotify’s upcoming earnings on Feb. 10 could serve as a meaningful catalyst—and current weakness may prove to be an opportunity.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart