Dallas, Texas-based CBRE Group, Inc. (CBRE) is a commercial real estate services and investment company. Valued at a market cap of $50.5 billion, the company offers strategic advice and execution to owners, investors, and occupiers of real estate.

This real estate company has outperformed the broader market over the past 52 weeks. Shares of CBRE have soared 17.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14%. Moreover, on a YTD basis, the stock is up 5.5%, compared to SPX’s 1.3% rise.

Zooming in further, CBRE has also outpaced the State Street Real Estate Select Sector SPDR ETF (XLRE), which declined marginally over the past 52 weeks and gained 4.1% on a YTD basis.

On Oct. 23, shares of CBRE closed up marginally after its better-than-expected Q3 earnings release. The company’s revenue increased 13.5% year-over-year to $10.3 billion, surpassing consensus estimates by 3.4%. Moreover, its core EPS of $1.61 advanced 34.2% from the same period last year, topping analyst estimates of $1.47. Additionally, the company also raised its fiscal 2025 core EPS guidance, now expecting it to be between $6.25 and $6.35, supported by robust leasing momentum and solid growth in facilities management.

For the current fiscal year, ending in December, analysts expect CBRE’s EPS to grow 23.9% year over year to $6.32. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

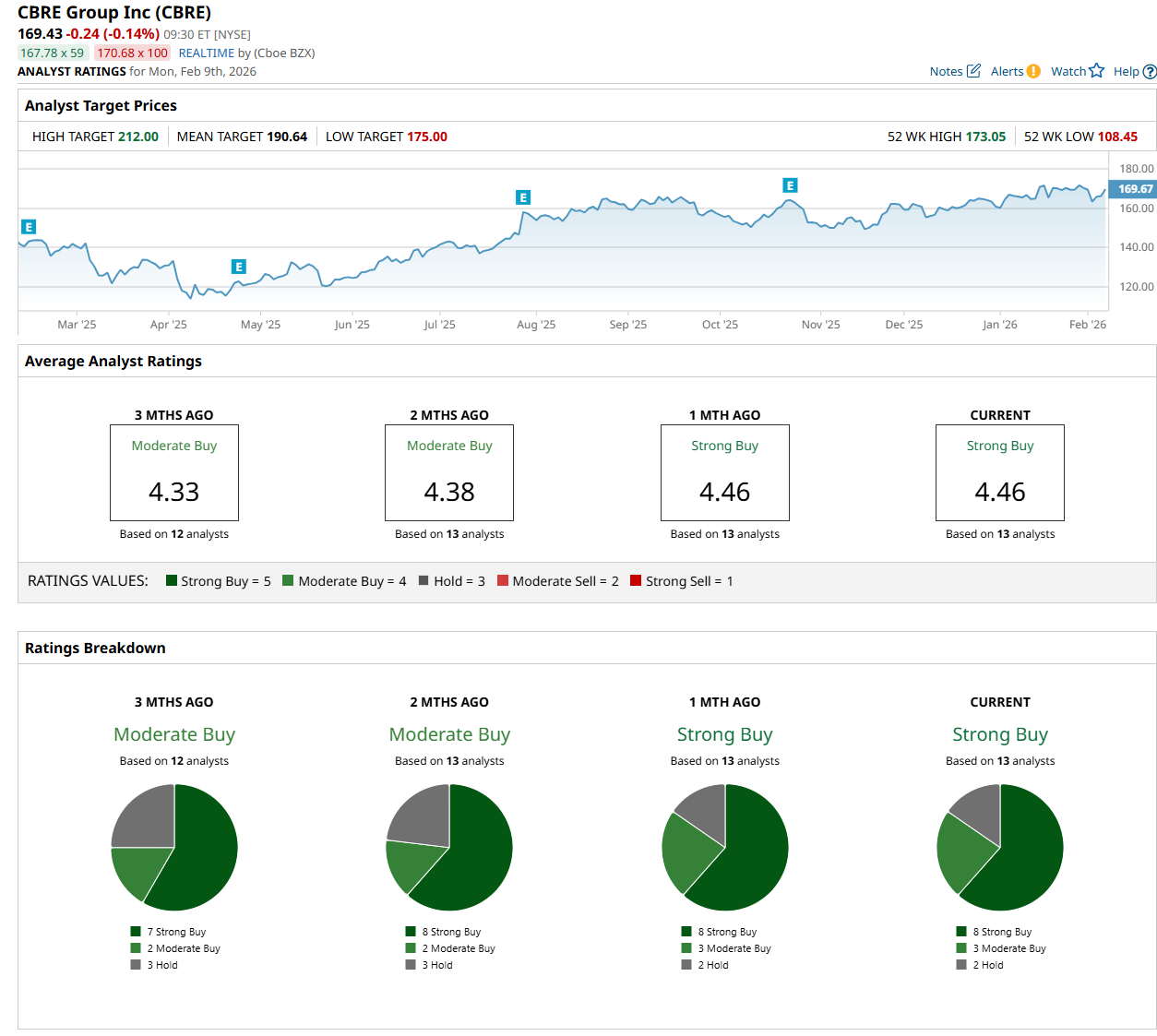

Among the 13 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on eight “Strong Buy,” three “Moderate Buy,” and two "Hold” ratings.

The configuration is more bullish than three months ago, with seven analysts suggesting a “Strong Buy” rating.

On Jan. 13, Barclays PLC (BCS) maintained an "Overweight" rating on CBRE and raised its price target to $192, indicating a 13.3% potential upside from the current levels.

The mean price target of $190.64 represents a 12.5% premium from CBRE’s current price levels, while the Street-high price target of $212 suggests a 25.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart