Consistency rarely makes the headlines, but I say it's what separates the best companies from the rest.

When I look for that kind of consistency in the market, dividend growth is often a good place to start. Some dividend stocks don’t need big narratives or high yields to stand out; they simply keep doing the right things and let the results compound over time.

Dividend Kings are the perfect example of consistency- but that’s not all they offer. They're often viewed as steady and conservative, sure, but a closer look reveals that a few have quietly delivered exceptional long-term performance.

So I did just that. Today, I focused on the Dividend Kings that have performed well over the past several years and identified which stands head and shoulders above all others.

How I came up with the following stocks

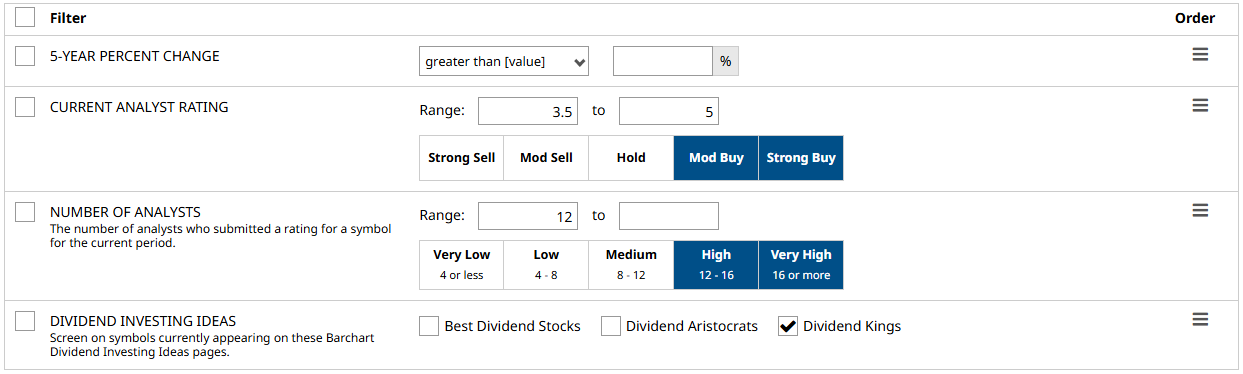

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- 5-Year Percent Change: Left blank so I can sort it from highest to lowest.

- Current Analyst Rating: Moderate to Strong Buy.

- Number of Analysts: 12 or more. The higher the number, the better.

- Dividend Investing Ideas: Dividend Kings

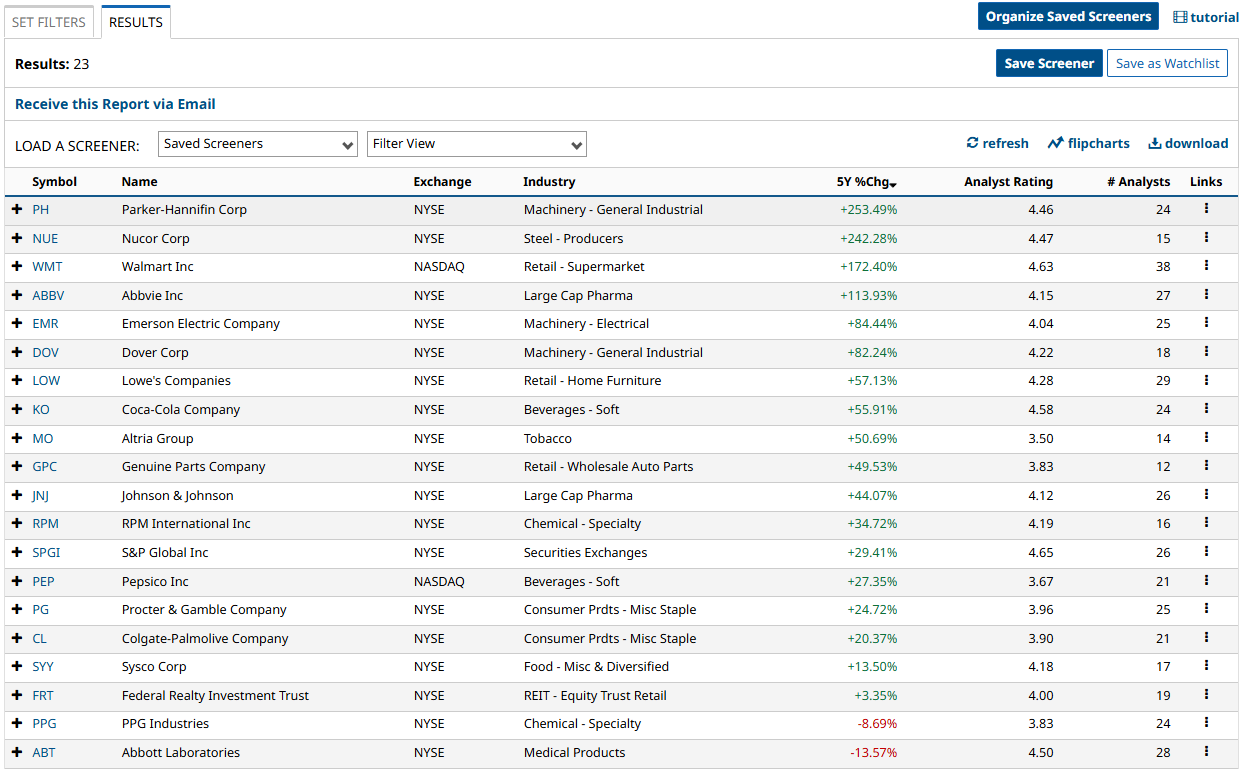

I hit the screen and got 23 results. I will cover the company with the highest 5-Year Percent Change among the group.

Parker-Hannifin Corp (PH)

Parker-Hannifin is an industrial technology company that makes the behind-the-scenes components that keep machines, vehicles, and systems moving. It specializes in motion and control technologies like hydraulics, filtration, and engineered components used across the aerospace and industrial markets, including commercial aircraft built by Airbus and Boeing.

Parker is also actively transforming its business mix through acquisitions, including its deal for Filtration Group, which expands its filtration and aftermarket exposure. I’ll get into why it matters for Parker’s growth profile later.

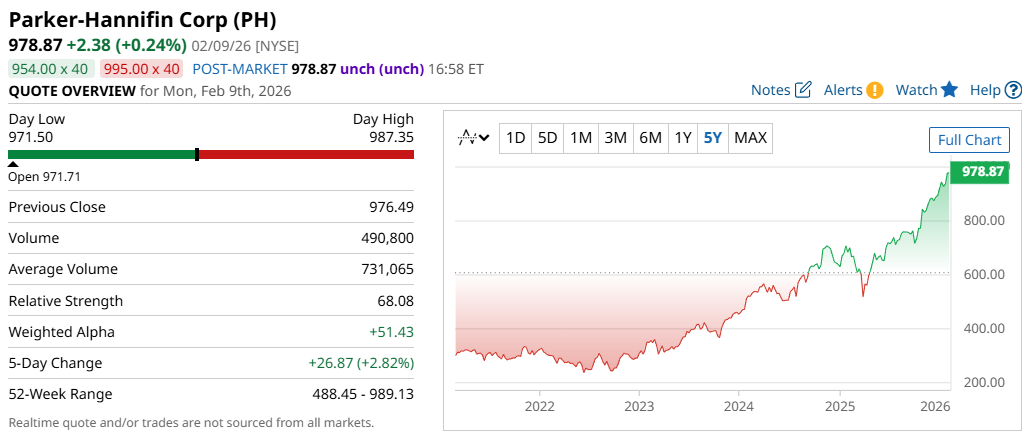

PH stock trades at around $979. It's up ~250% in the past 5 years and over 867% over the past 10 years, making it the best-performing Dividend King in both timeframes. Results like that usually say far more about consistency than hype.

With that, let’s look at Parker’s latest quarterly financials. The company reported sales were up 9% YOY to $5.2 billion. However, its net income softened 11% to $845 million due to higher costs, though that is fairly typical during periods of investment and integration, and doesn’t change the strength of Parker’s underlying business.

In terms of dividends, it pays a forward annual dividend of $7.20, translating to a yield of around 0.74%. While it looks low on the surface, Parker has made up for it many times over through steady dividend growth and long-term stock gains. In fact, Parker Hannifin has increased its dividends for 69 consecutive years- much longer than most companies have been in existence.

For me, the appeal isn’t just what Parker has done historically, but what it’s setting up next. And that brings us to its most recent acquisition: Filtration Group. The newly acquired company is geared more toward steady sales of consumables and components for regular maintenance. This diversifies Parker’s revenue sources from large, one-time equipment sales to a more recurring, cyclical stream. And, that kind of business tends to be more dependable and adds another layer of adaptability, which makes me confident that Parker will stay consistent even as industrial conditions change.

Of course, while the opportunity is clear, none of this is risk-free. Deals of this size raise the stakes around integration, execution, and capital allocation, especially for a company that has set a high bar for consistency over time.

So that’s the balancing act here: Parker already has a strong record of turning acquisitions into cash-producing segments, but Filtration Group is its largest to date. Any error within the integration will show up in the margins- and then the balance sheet.

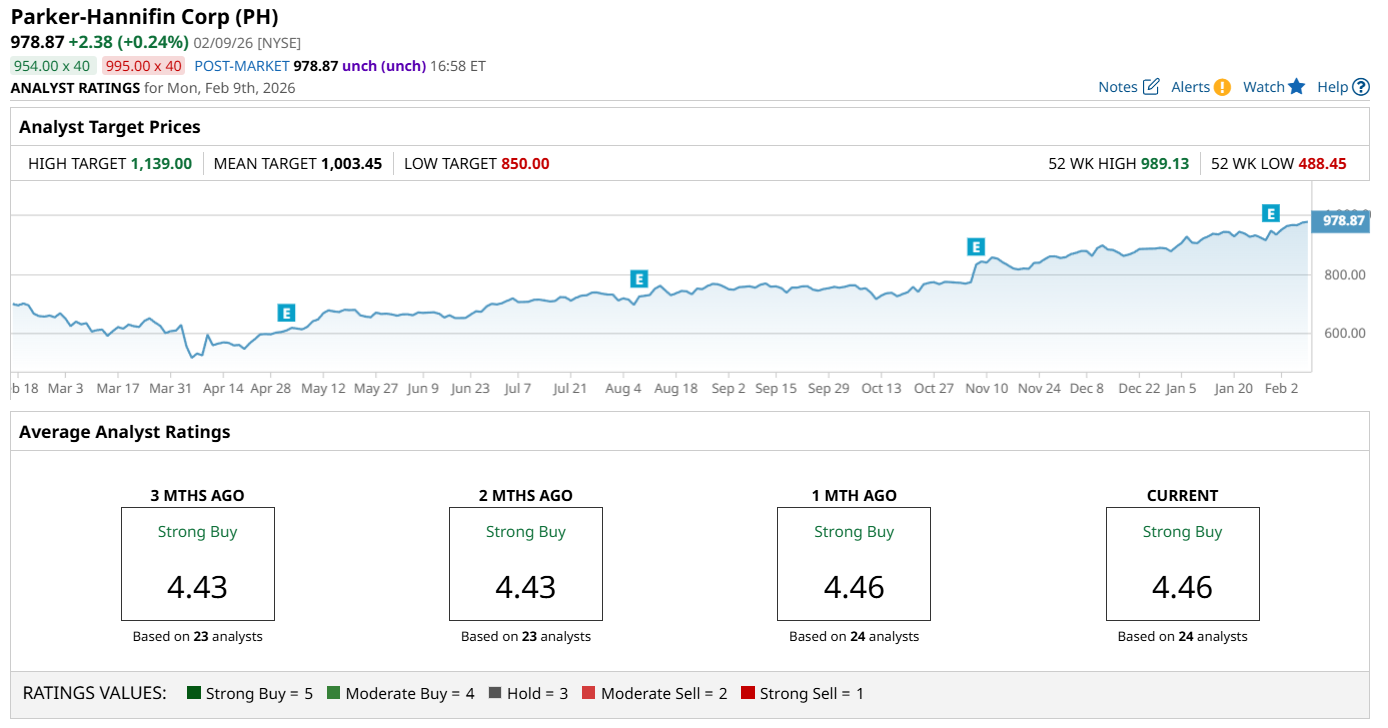

Even so, 24 analysts currently rate the stock a consensus “Strong Buy”, with as much as 16% upside- should it manage to hit its high target of $1,139.

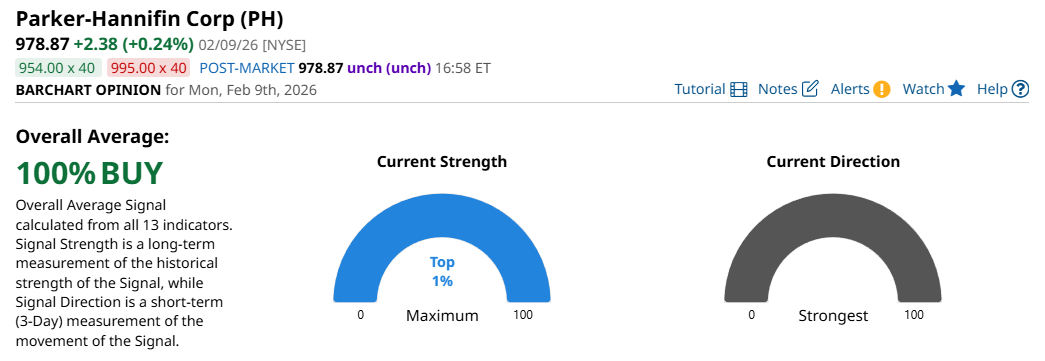

Meanwhile, the technicals signal bullish sentiment in the stock, with one of the highest Strength scores today.

Final Thoughts

While Parker-Hannifin isn’t a high-yield stock, it has consistently delivered where it counts through steady execution, disciplined capital allocation, and long-term compounding, which only a few companies can do. Just remember, history doesn’t guarantee future results, even though it's how all funds are sold… but it does explain why the stock continues to attract attention.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart