With a market cap of $53.7 billion, AMETEK, Inc. (AME) is a global manufacturer of electronic instruments and electromechanical devices serving a wide range of industrial, aerospace, power, medical, and commercial markets. It operates through its Electronic Instruments Group (EIG) and Electromechanical Group (EMG), offering highly engineered solutions worldwide.

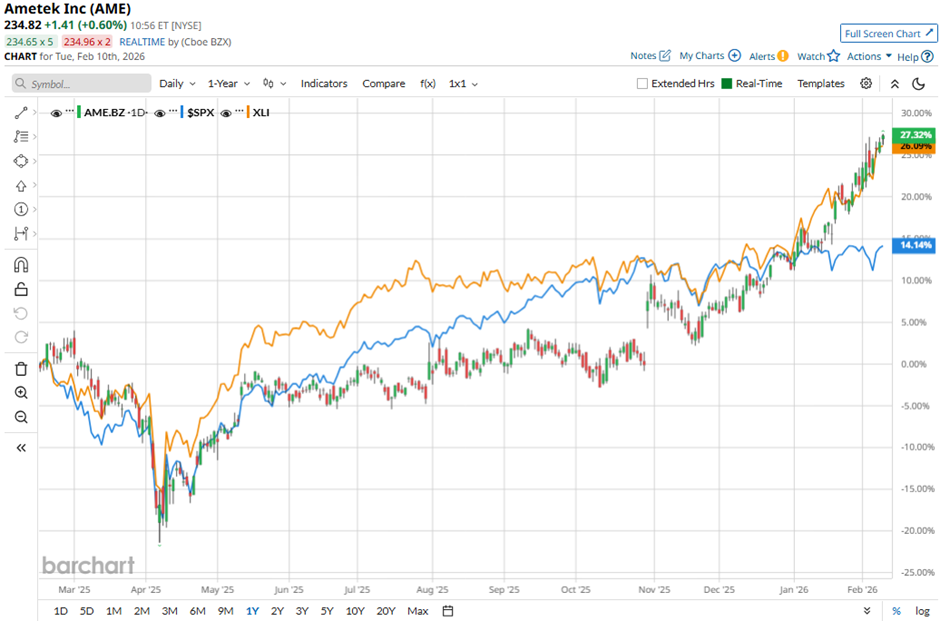

Shares of the Berwyn, Pennsylvania-based company have outpaced the broader market over the past 52 weeks. AME stock has increased 26.3% over this time frame, while the broader S&P 500 Index ($SPX) has returned 15%. Moreover, shares of AMETEK are up 14.4% on a YTD basis, compared to SPX’s 1.9% gain.

Focusing more closely, the maker of electronic instruments and electromechanical devices stock has also outperformed the State Street Industrial Select Sector SPDR ETF’s (XLI) 25.5% return over the past 52 weeks.

Shares of AMETEK rose marginally on Feb. 3 after the company reported record Q4 2025 results, with adjusted EPS of $2.01 and revenue reaching a record $2 billion. Investor sentiment was further supported by exceptionally strong cash generation, including record free cash flow of $527.3 million and a 132% free cash flow–to–net income conversion rate, along with adjusted operating income of $523 million.

For the fiscal year ending in December 2026, analysts expect AMETEK’s adjusted EPS to grow 8.2% year-over-year to $8.04. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

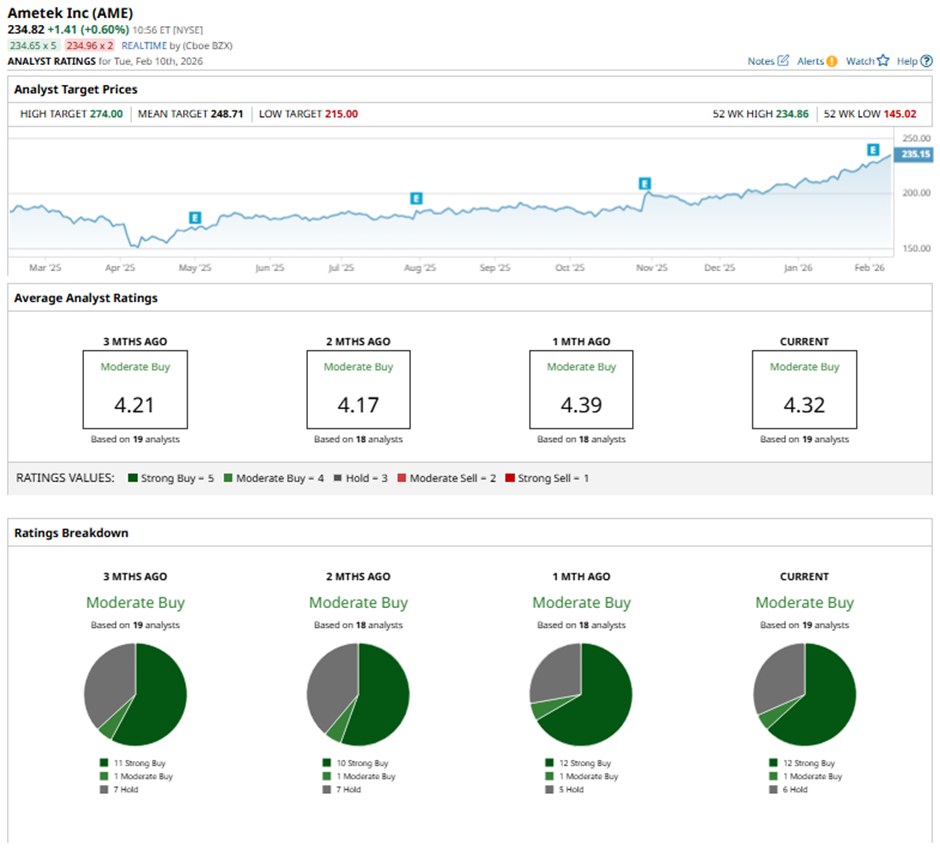

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Feb. 4, RBC Capital raised Ametek’s price target to $257 and maintained an “Outperform” rating.

The mean price target of $248.71 represents a premium of 5.9% to AME's current levels. The Street-high price target of $274 implies a potential upside of 16.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart