Over the last six months, Shake Shack’s shares have sunk to $96.73, producing a disappointing 8.9% loss - a stark contrast to the S&P 500’s 8.6% gain. This might have investors contemplating their next move.

Is now the time to buy Shake Shack, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Shake Shack Not Exciting?

Even though the stock has become cheaper, we're swiping left on Shake Shack for now. Here are three reasons you should be careful with SHAK and a stock we'd rather own.

1. Weak Operating Margin Could Cause Trouble

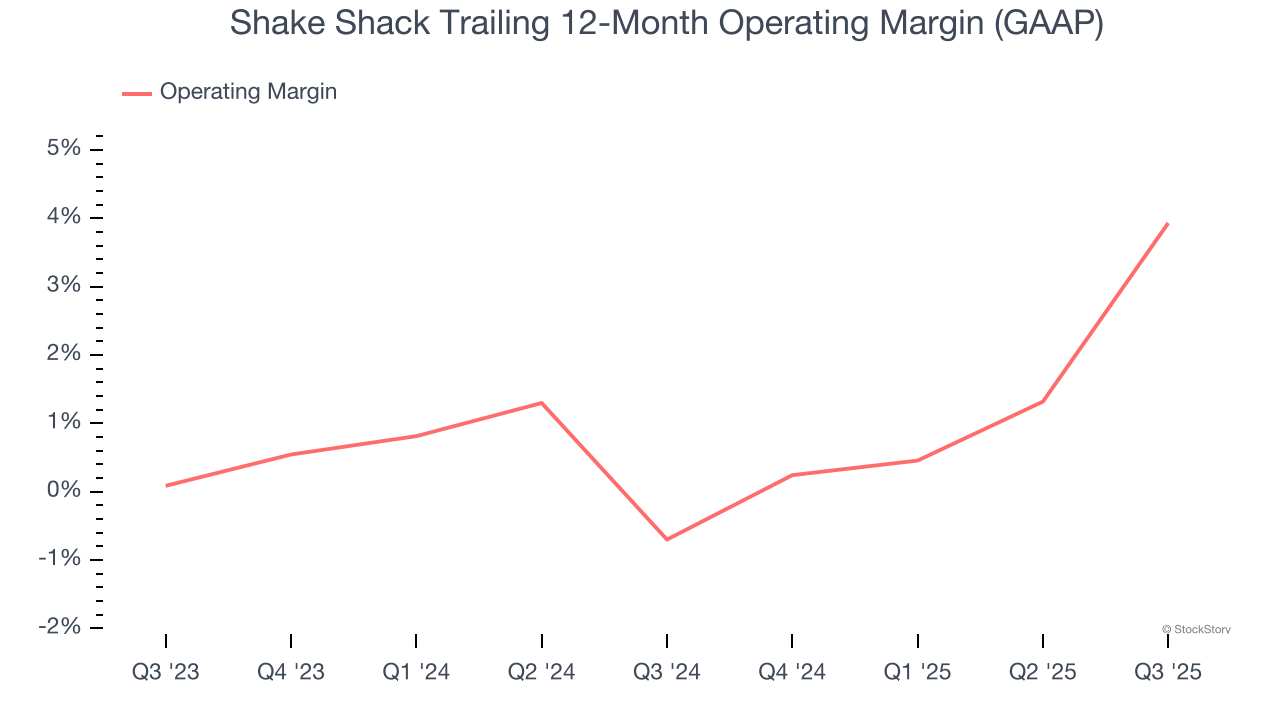

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Shake Shack was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.8% was weak for a restaurant business. This result is surprising given its high gross margin as a starting point.

2. EPS Barely Growing

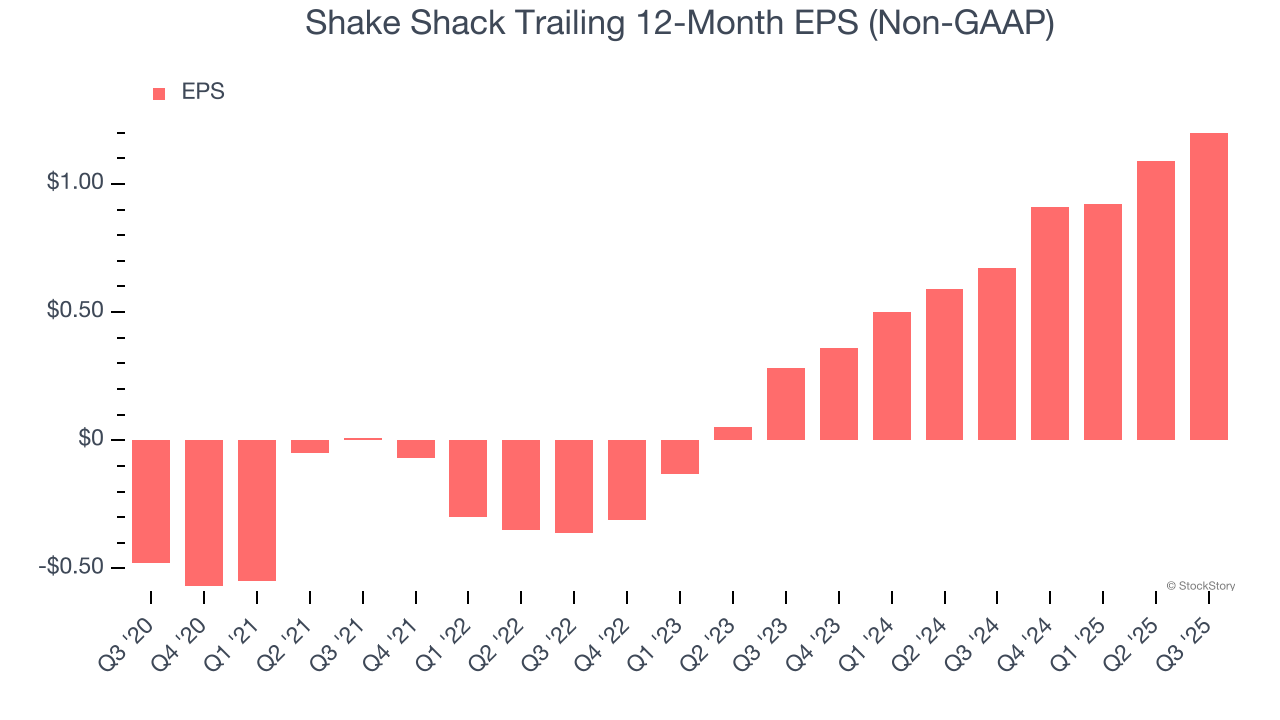

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Shake Shack’s EPS grew at an unimpressive 8.9% compounded annual growth rate over the last six years, lower than its 15.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Shake Shack’s five-year average ROIC was negative 0.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

Shake Shack isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 73.1× forward P/E (or $96.73 per share). This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.