What Happened?

Shares of scientific instrument company Bruker (NASDAQ: BRKR). jumped 4.9% in the afternoon session after investors showed optimism ahead of the company's upcoming quarterly earnings announcement, scheduled for November 3, 2025.

Analysts anticipated the scientific instruments manufacturer would report an earnings per share (EPS) of $0.33. The positive market sentiment suggested that investors were hopeful Bruker would not only meet or exceed this estimate but also provide an encouraging forecast for the next quarter. This optimism was supported by a general consensus 'Buy' rating from nine analysts covering the stock.

Is now the time to buy Bruker? Access our full analysis report here.

What Is The Market Telling Us

Bruker’s shares are extremely volatile and have had 30 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 28 days ago when the stock gained 4.5% on the news that the company announced it had secured new orders worth approximately $10 million for its advanced scientific equipment from three prominent U.S. research institutions.

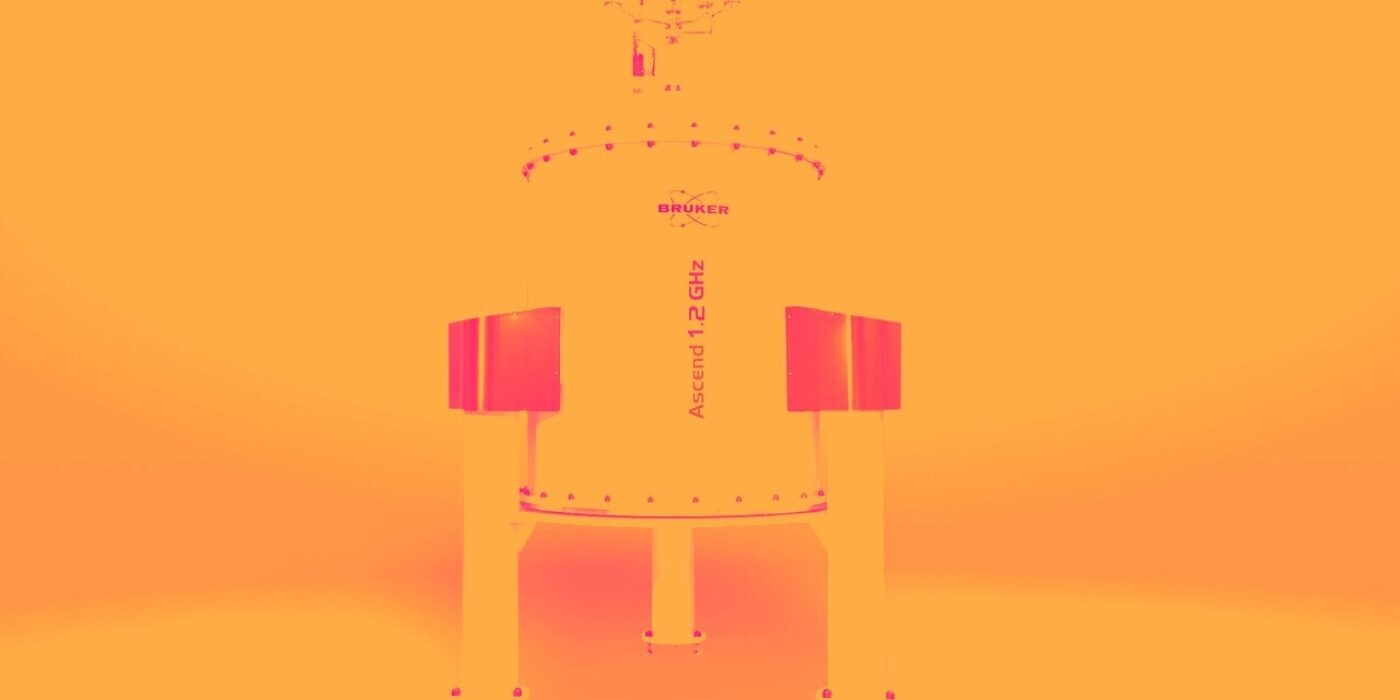

The orders were for high-performance Nuclear Magnetic Resonance (NMR) instrumentation from the New York Structural Biology Center, the University of Delaware, and Northwestern University. Funding for these systems was supported by the National Institutes of Health (NIH) and the National Science Foundation (NSF). The equipment was intended to help research teams make breakthroughs in drug discovery and the study of diseases. This news signaled strong demand for Bruker's specialized technology from leading scientific organizations. The systems were expected to be delivered and installed in 2026.

Bruker is down 34.2% since the beginning of the year, and at $38.69 per share, it is trading 38.5% below its 52-week high of $62.95 from January 2025. Investors who bought $1,000 worth of Bruker’s shares 5 years ago would now be looking at an investment worth $878.83.

The biggest winners—Microsoft, Alphabet, Coca-Cola, Monster Beverage—were all riding powerful megatrends before Wall Street caught on. We’ve just identified an under-the-radar profitable growth stock positioned at the center of the AI boom. Get it FREE here before the crowd discovers it. GO HERE NOW.