Valued at a market cap of $14.8 billion, Best Buy Co., Inc. (BBY) offers a wide range of products, including computers, smartphones, televisions, home appliances, and accessories, along with services such as installation, repair, and technical support. The Richfield, Minnesota-based company operates through a strong omnichannel model that combines physical stores with a robust online platform.

This retail company has notably underperformed the broader market over the past 52 weeks. Shares of BBY have declined 21% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.6%. Moreover, on a YTD basis, the stock is up marginally, compared to SPX’s 1.7% rise.

Narrowing the focus, BBY has also lagged the State Street SPDR S&P Retail ETF (XRT), which surged 13.8% over the past 52 weeks and 4.4% on a YTD basis.

On Nov. 25, BBY shares climbed 5.3% after delivering better-than-expected Q3 results. Due to strong growth across computing, gaming and mobile phones, the company’s comparable sales grew 2.7%, while its total revenue increased 2.4% year-over-year to $9.7 billion, surpassing consensus estimates by a slight margin. Moreover, its adjusted EPS advanced 11.1% from the year-ago quarter to $1.40, topping analyst expectations of $1.31. Adding to the uptick, BBY raised its fiscal 2026 outlook, expecting adjusted EPS guidance to be between $6.25 and $6.35.

For the current fiscal year, ending in January, analysts expect BBY’s EPS to decline marginally year over year to $6.31. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

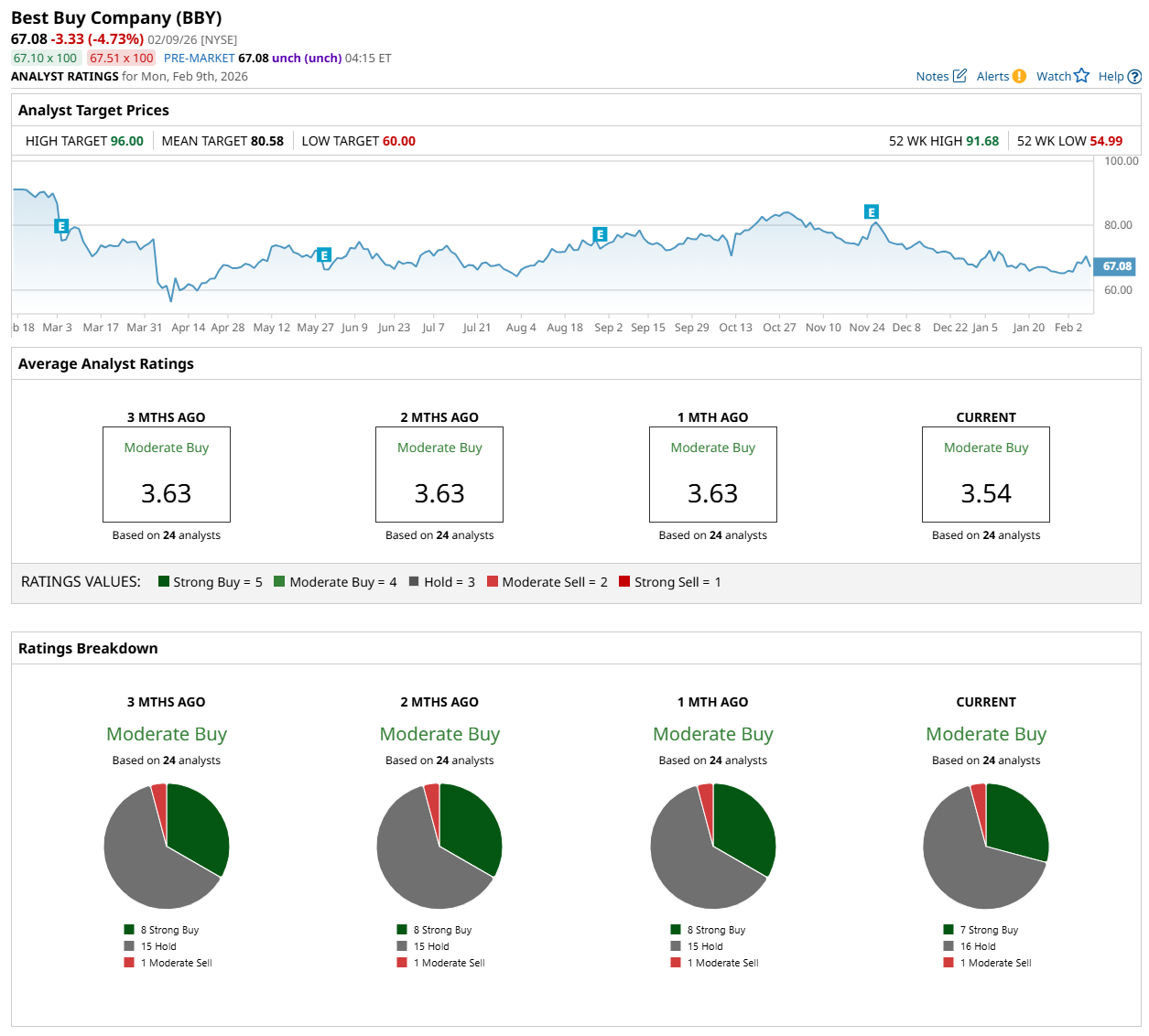

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” 16 “Hold,” and one "Moderate Sell” rating.

The configuration is less bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Feb. 3, Evercore Inc. (EVR) maintained an "In Line" rating on BBY but lowered its price target to $70, indicating a 4.4% potential upside from the current levels.

The mean price target of $80.58 represents a 20.1% premium from BBY’s current price levels, while the Street-high price target of $96 suggests a 43.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart