Online money transfer platform Remitly (NASDAQ: RELY) announced better-than-expected revenue in Q4 CY2025, with sales up 25.7% year on year to $442.2 million. Guidance for next quarter’s revenue was better than expected at $437 million at the midpoint, 1.8% above analysts’ estimates. Its GAAP profit of $0.19 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Remitly? Find out by accessing our full research report, it’s free.

Remitly (RELY) Q4 CY2025 Highlights:

- Revenue: $442.2 million vs analyst estimates of $427.3 million (25.7% year-on-year growth, 3.5% beat)

- EPS (GAAP): $0.19 vs analyst estimates of $0.01 (significant beat)

- Adjusted EBITDA: $88.58 million vs analyst estimates of $51.49 million (20% margin, 72.1% beat)

- Revenue Guidance for Q1 CY2026 is $437 million at the midpoint, above analyst estimates of $429.2 million

- EBITDA guidance for the upcoming financial year 2026 is $350 million at the midpoint, above analyst estimates of $309.6 million

- Operating Margin: 8.8%, up from -1.1% in the same quarter last year

- Free Cash Flow Margin: 31.7%, up from 1.2% in the previous quarter

- Active Customers: 9.3 million, up 1.5 million year on year

- Market Capitalization: $2.73 billion

“We ended 2025 with very strong results, exceeding our guidance for both revenue and Adjusted EBITDA,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Company Overview

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

Revenue Growth

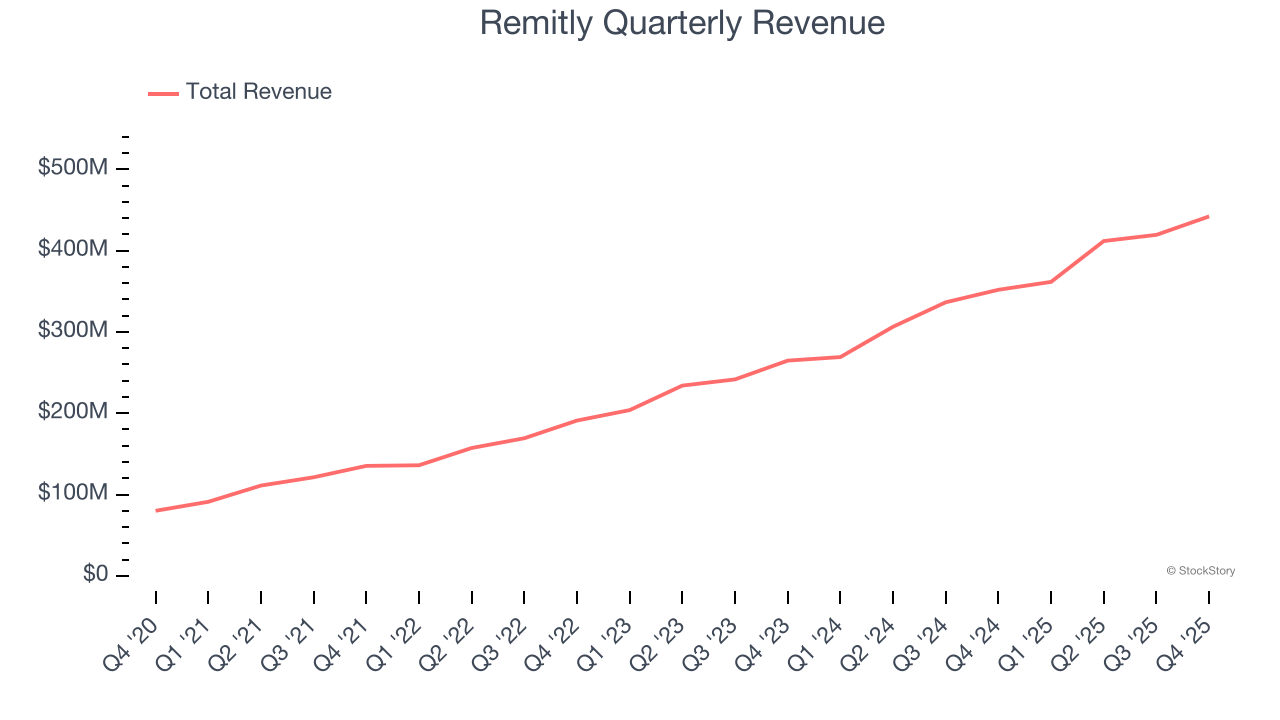

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Remitly’s sales grew at an incredible 35.8% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Remitly reported robust year-on-year revenue growth of 25.7%, and its $442.2 million of revenue topped Wall Street estimates by 3.5%. Company management is currently guiding for a 20.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and indicates the market is forecasting success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Active Customers

Customer Growth

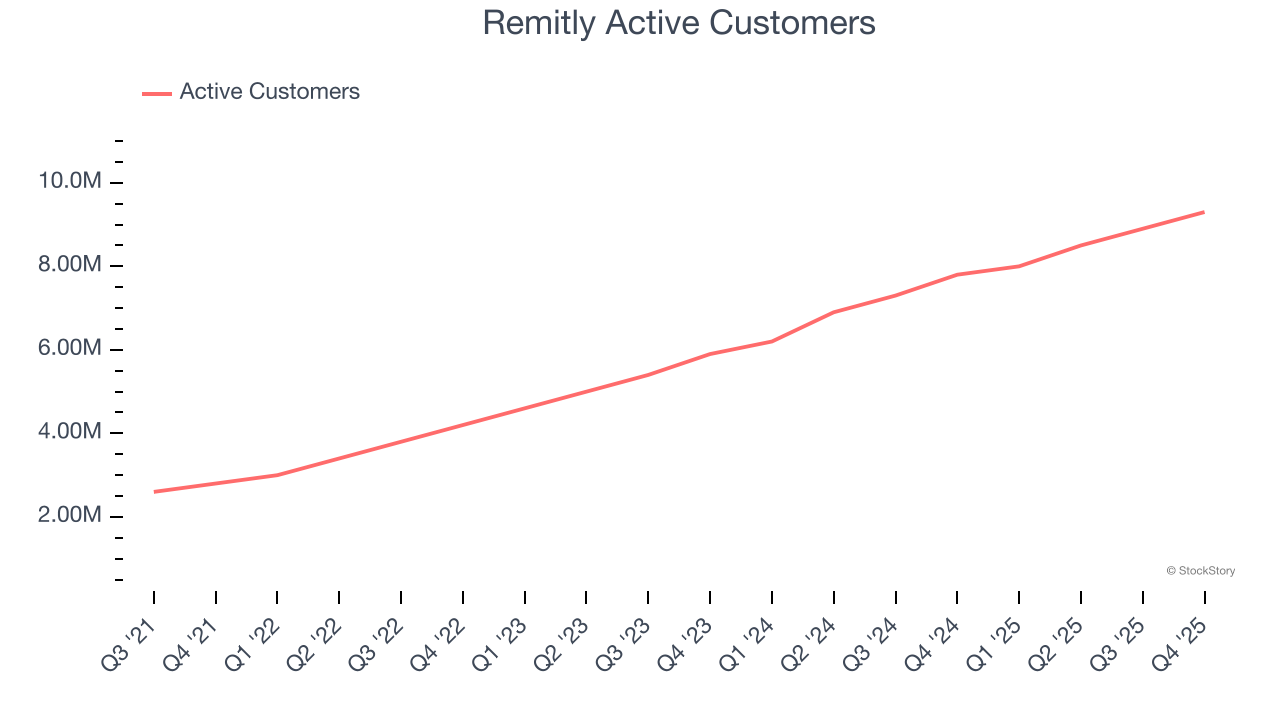

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 29.2% annually to 9.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Remitly added 1.5 million active customers, leading to 19.2% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating customer growth just yet.

Revenue Per Customer

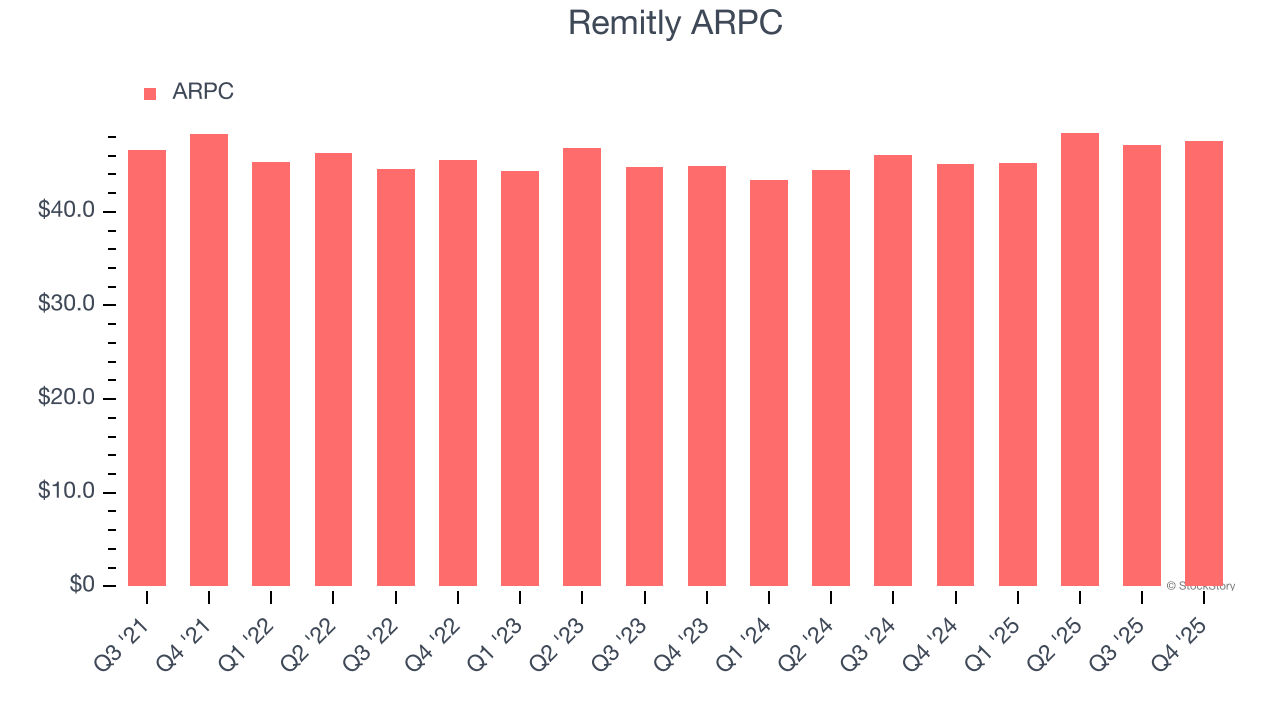

Average revenue per customer (ARPC) is a critical metric to track because it measures how much the company earns in fees from each user. ARPC also gives us unique insights into the average transaction size on Remitly’s platform and the company’s take rate, or "cut", on each transaction.

Remitly’s ARPC growth has been subpar over the last two years, averaging 2.2%. This isn’t great, but the increase in active customers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Remitly tries boosting ARPC by taking a more aggressive approach to monetization, it’s unclear whether customers can continue growing at the current pace.

This quarter, Remitly’s ARPC clocked in at $47.55. It grew by 5.4% year on year, slower than its customer growth.

Key Takeaways from Remitly’s Q4 Results

We were impressed by Remitly’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 11.3% to $15.17 immediately after reporting.

Sure, Remitly had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).