Conveyorized car wash service company Mister Car Wash (NYSE: MCW) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 4% year on year to $261.2 million. Its non-GAAP profit of $0.11 per share was in line with analysts’ consensus estimates. MCW has agreed to be taken private by Leonard Green at $7/share.

Is now the time to buy Mister Car Wash? Find out by accessing our full research report, it’s free.

Mister Car Wash (MCW) Q4 CY2025 Highlights:

- Revenue: $261.2 million vs analyst estimates of $262 million (4% year-on-year growth, in line)

- Adjusted EPS: $0.11 vs analyst estimates of $0.10 (in line)

- Adjusted EBITDA: $85.96 million vs analyst estimates of $82.89 million (32.9% margin, 3.7% beat)

- Operating Margin: 15.8%, up from 12.7% in the same quarter last year

- Free Cash Flow was -$16.77 million compared to -$20.4 million in the same quarter last year

- Locations: 548 at quarter end, up from 514 in the same quarter last year

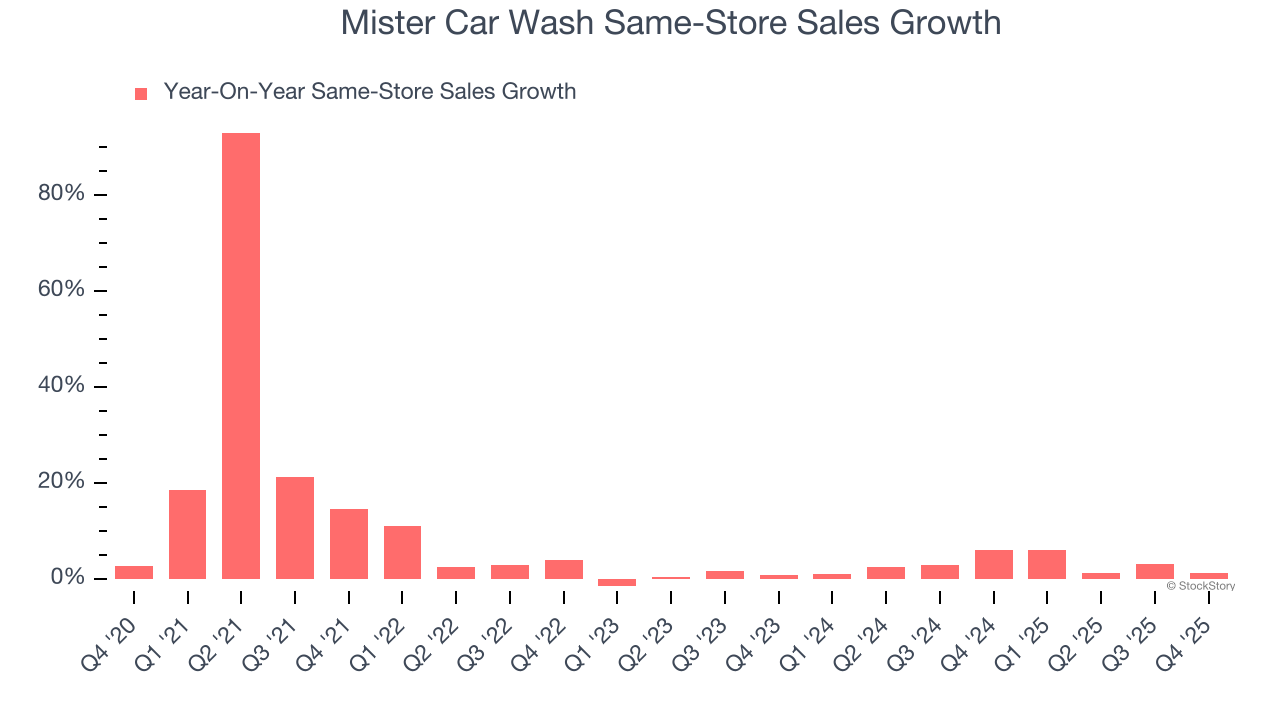

- Same-Store Sales rose 1.2% year on year (6% in the same quarter last year)

- Market Capitalization: $1.97 billion

“We delivered a strong finish to 2025, highlighted by solid membership growth of 7% in the fourth quarter to end the year with nearly 2.3 million members, positioning us exceptionally well as we enter 2026,” said John Lai, Chairperson and CEO of Mister Car Wash.

Company Overview

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE: MCW) offers car washes across the United States through its conveyorized service.

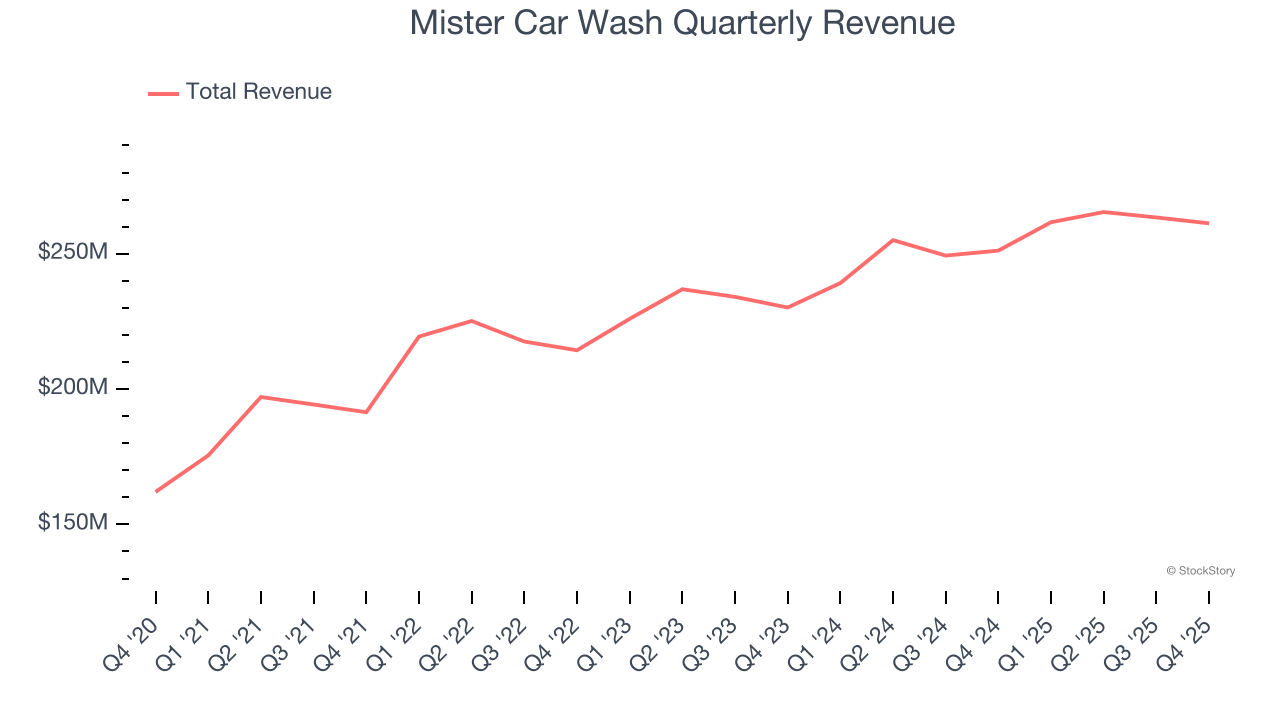

Revenue Growth

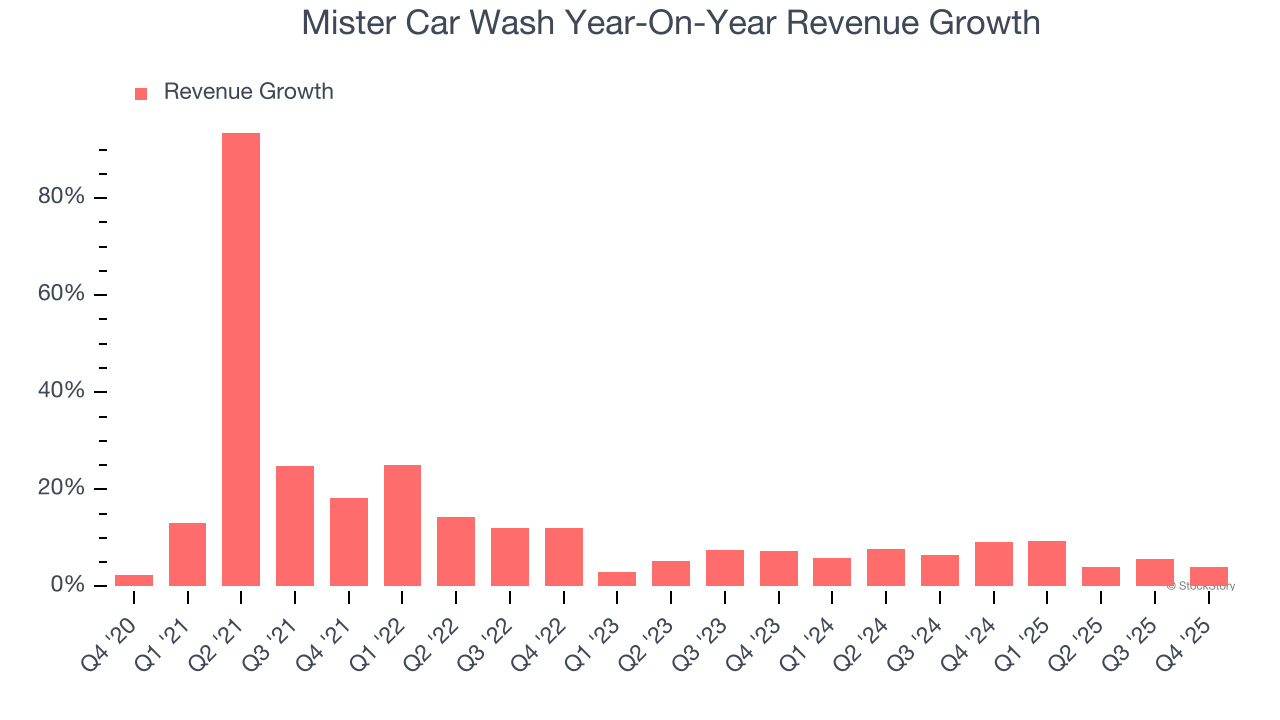

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Mister Car Wash grew its sales at a 12.8% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Mister Car Wash’s recent performance shows its demand has slowed as its annualized revenue growth of 6.5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Mister Car Wash’s same-store sales averaged 3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Mister Car Wash grew its revenue by 4% year on year, and its $261.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

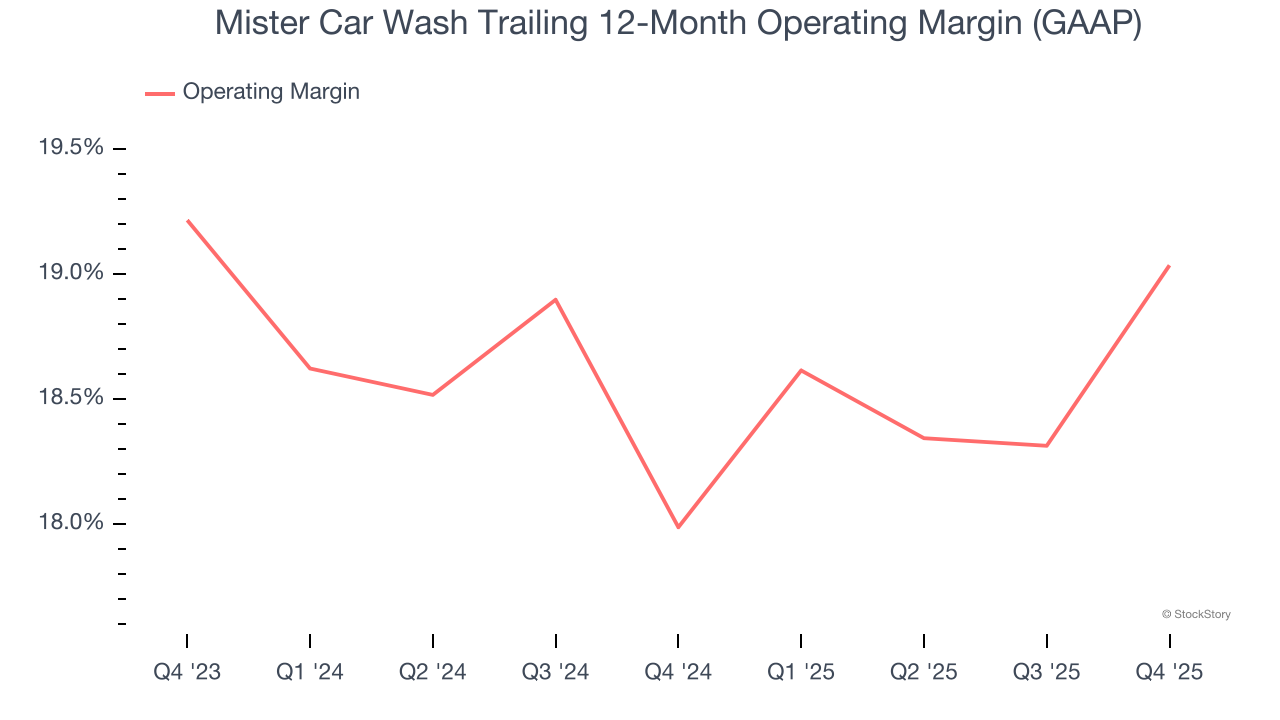

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Mister Car Wash’s operating margin has risen over the last 12 months and averaged 18.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Mister Car Wash generated an operating margin profit margin of 15.8%, up 3.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

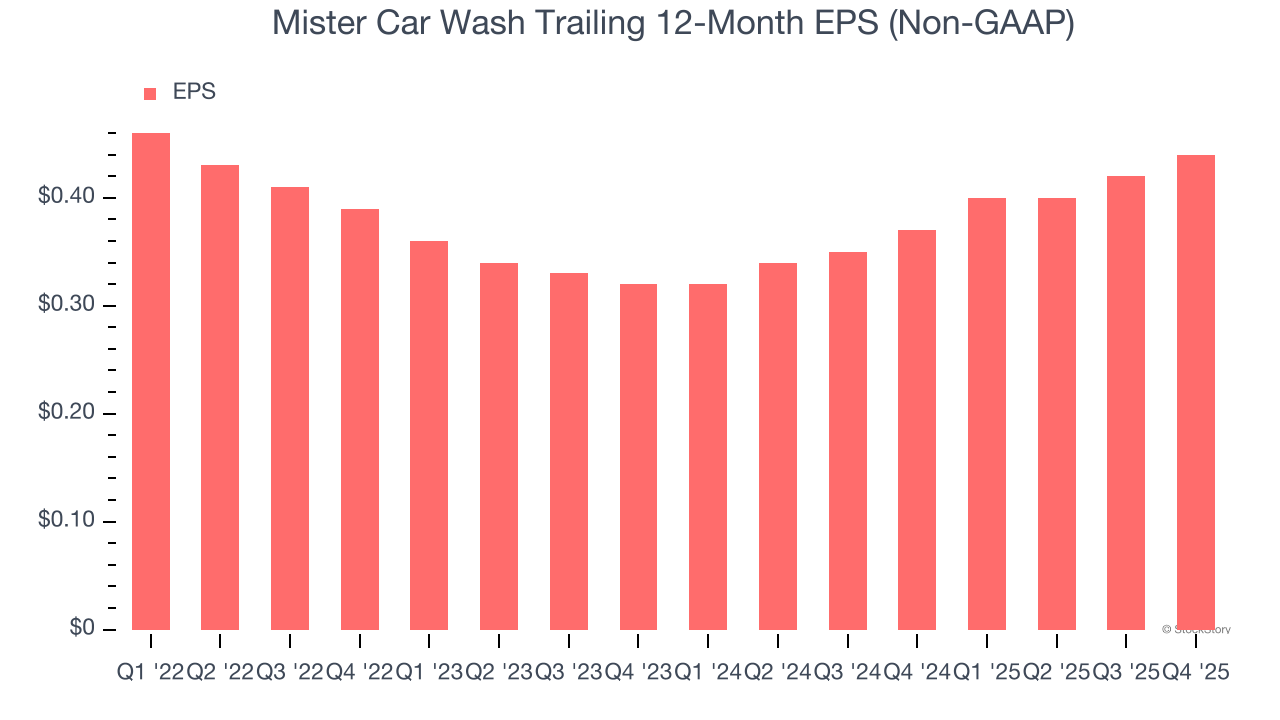

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mister Car Wash’s full-year EPS dropped 6%, or 1.5% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Mister Car Wash’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, Mister Car Wash reported adjusted EPS of $0.11, up from $0.09 in the same quarter last year. This print beat analysts’ estimates by 10%. Over the next 12 months, Wall Street expects Mister Car Wash’s full-year EPS of $0.44 to grow 7.1%.

Key Takeaways from Mister Car Wash’s Q4 Results

It was encouraging to see Mister Car Wash meet analysts’ EPS expectations this quarter. We were also happy its adjusted operating income outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $6.99 immediately after reporting.

So should you invest in Mister Car Wash right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).