Coastal Financial trades at $117.99 per share and has stayed right on track with the overall market, gaining 15.4% over the last six months. At the same time, the S&P 500 has returned 10.8%.

Is now the time to buy CCB? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Coastal Financial?

Pioneering the intersection of traditional banking and financial technology in the Pacific Northwest, Coastal Financial (NASDAQ: CCB) operates as a bank holding company that provides traditional banking services and Banking-as-a-Service (BaaS) solutions to consumers and businesses.

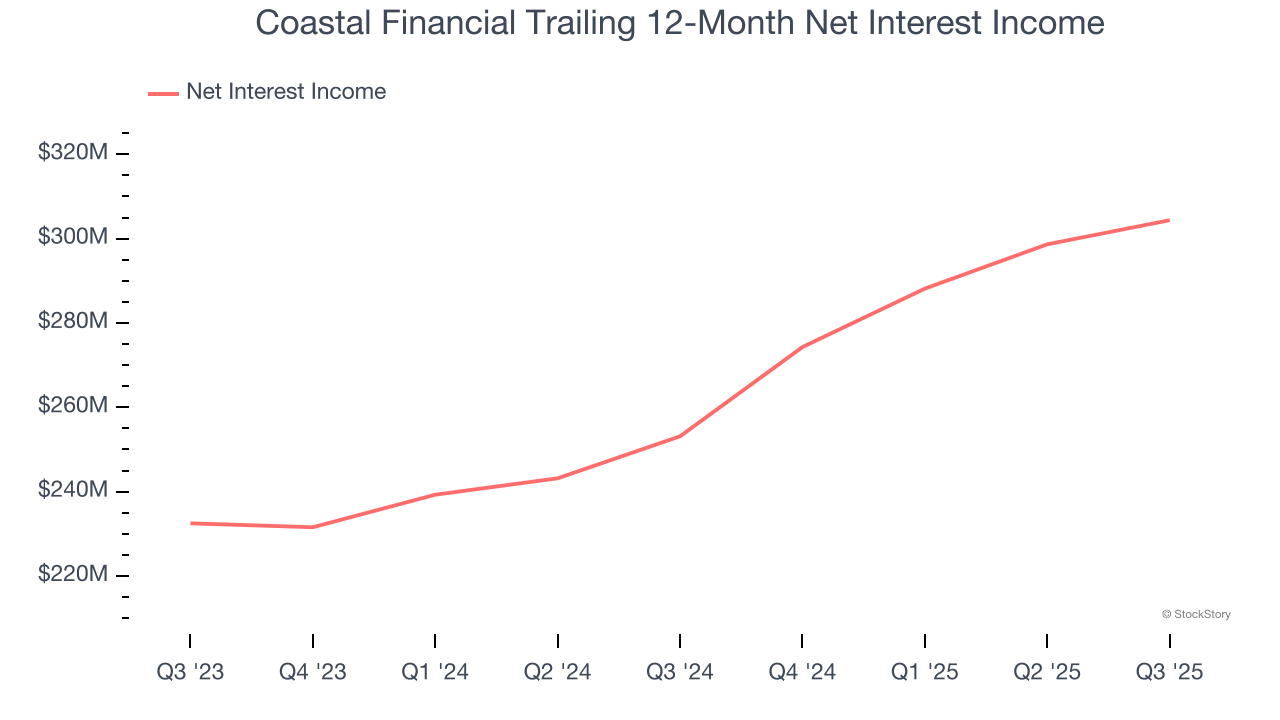

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Coastal Financial’s net interest income has grown at a 42.5% annualized rate over the last five years, much better than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

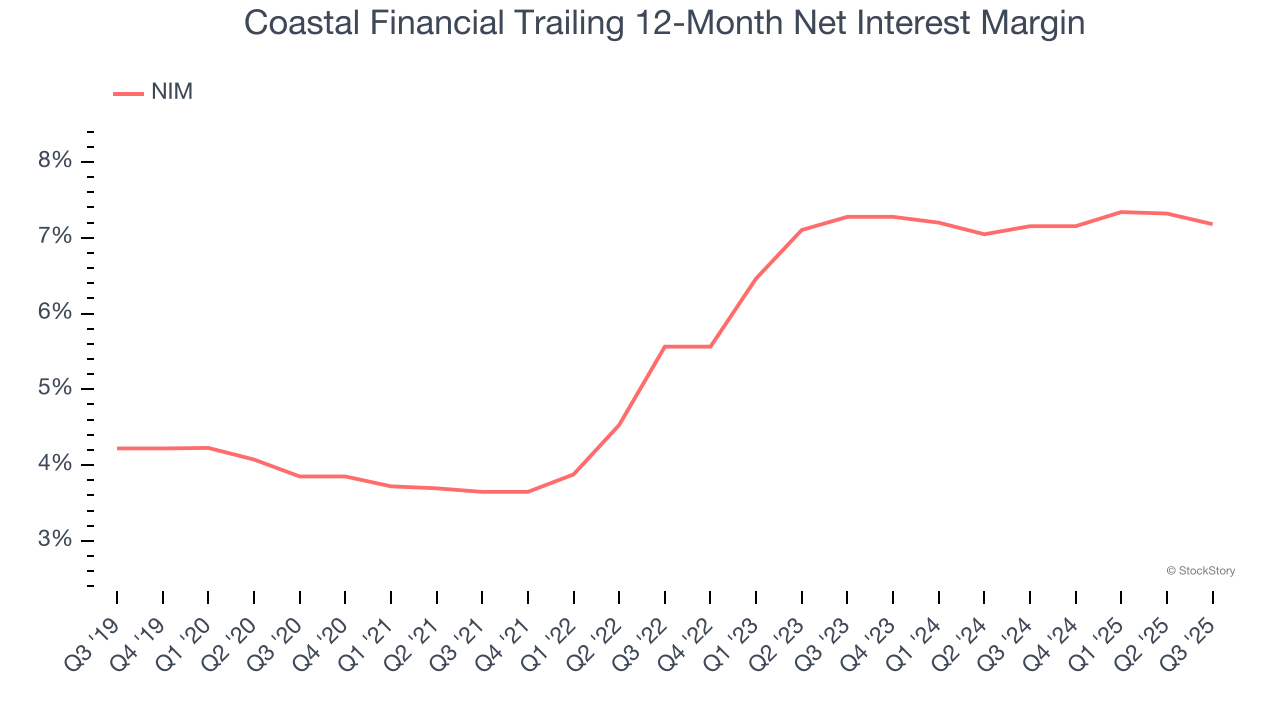

2. Elite Net Interest Margin Powers Best-In-Class Loan Book

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that Coastal Financial’s net interest margin averaged an elite 7.2%, indicating the company has a high-yielding loan book and a low cost of funds.

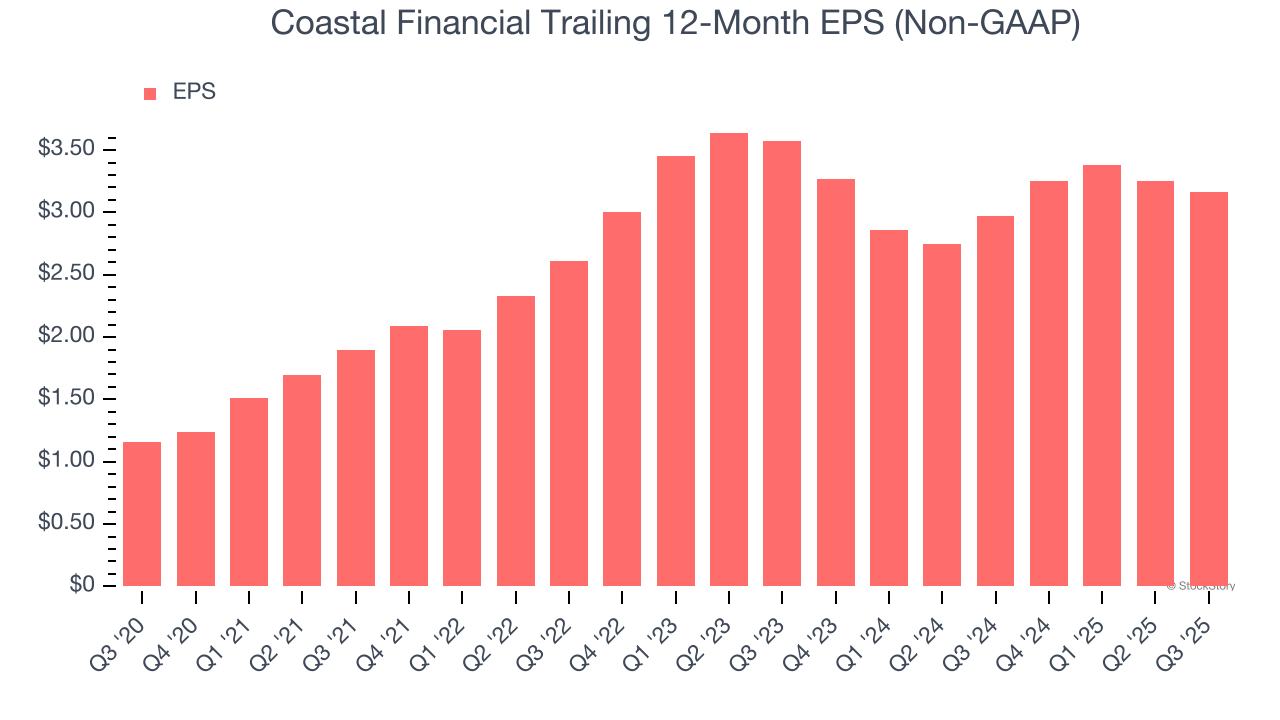

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Coastal Financial’s EPS grew at an astounding 22.2% compounded annual growth rate over the last five years. This performance was better than most banking businesses.

Final Judgment

These are just a few reasons Coastal Financial is a high-quality business worth owning, but at $117.99 per share (or 3.5× forward P/B), is now the right time to buy the stock? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Coastal Financial

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.