What a brutal six months it’s been for Trupanion. The stock has dropped 26.2% and now trades at $38.31, rattling many shareholders. This may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy TRUP? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On TRUP?

Born from a vision to help pet owners avoid economic euthanasia when faced with expensive veterinary bills, Trupanion (NASDAQ: TRUP) provides medical insurance for cats and dogs through data-driven, vertically-integrated products priced specifically for each pet's unique characteristics.

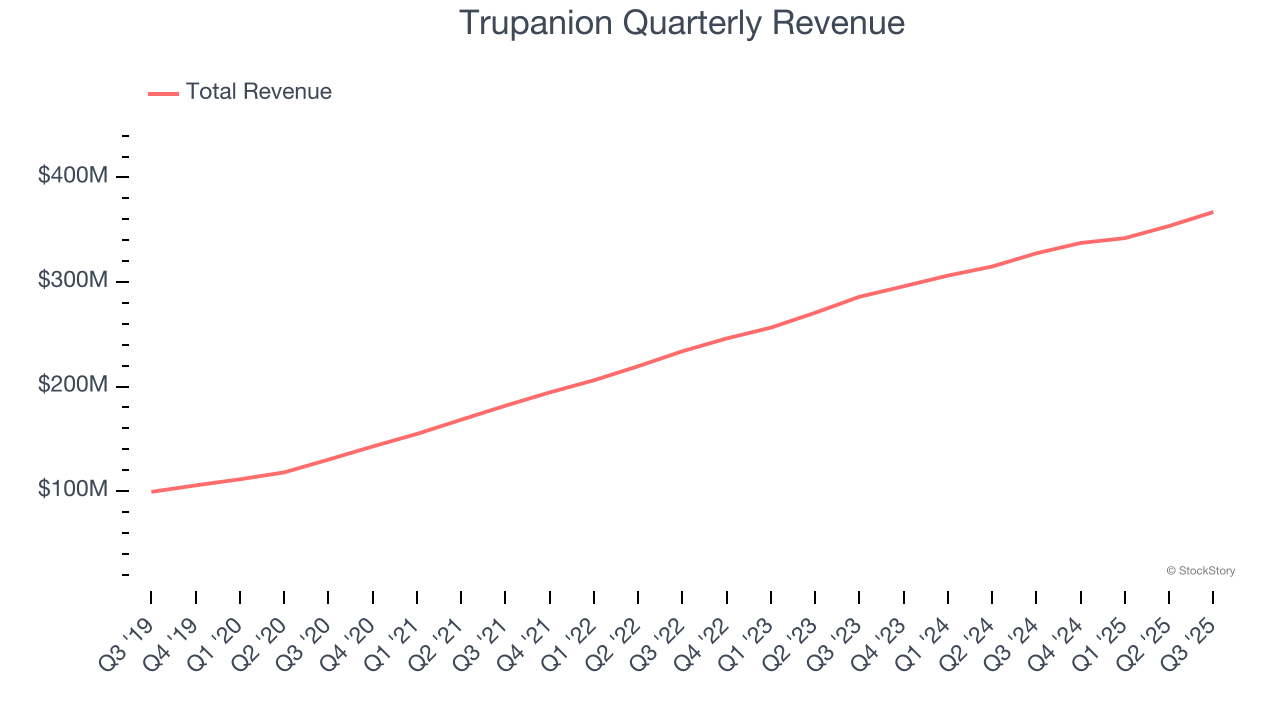

1. Skyrocketing Revenue Shows Strong Momentum

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services.

Thankfully, Trupanion’s 24.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average insurance company and shows its offerings resonate with customers.

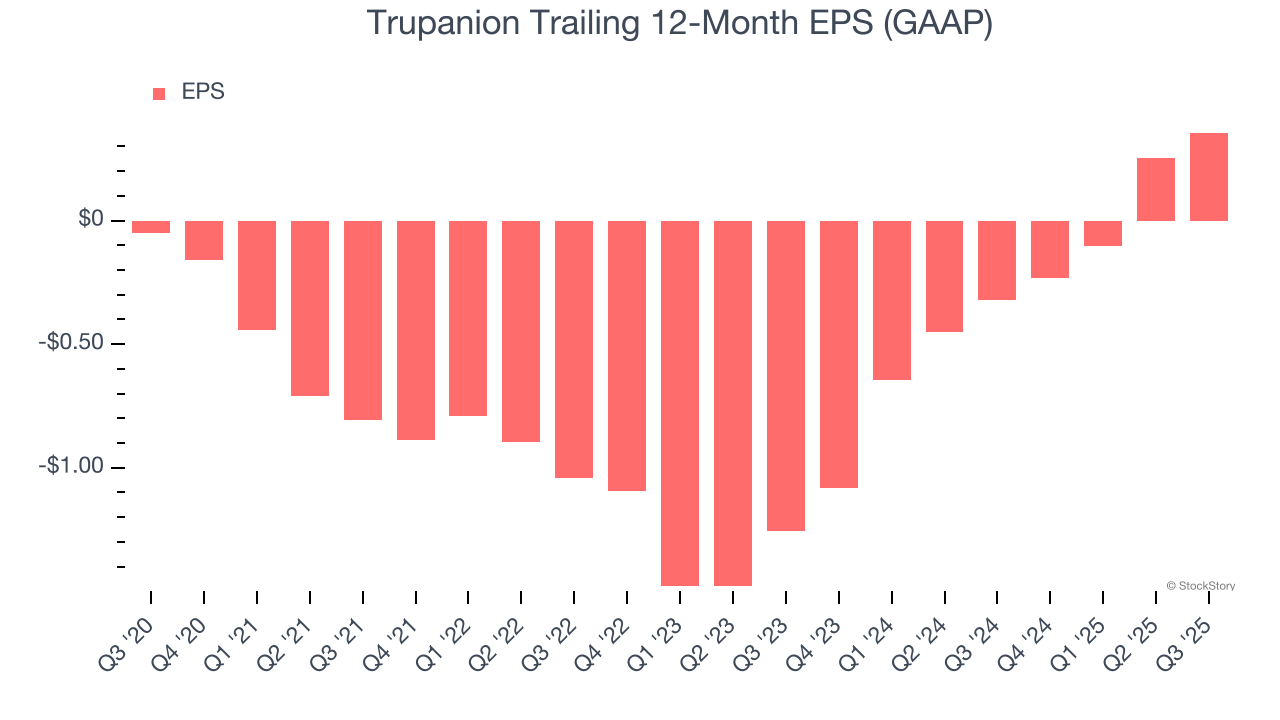

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Trupanion’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

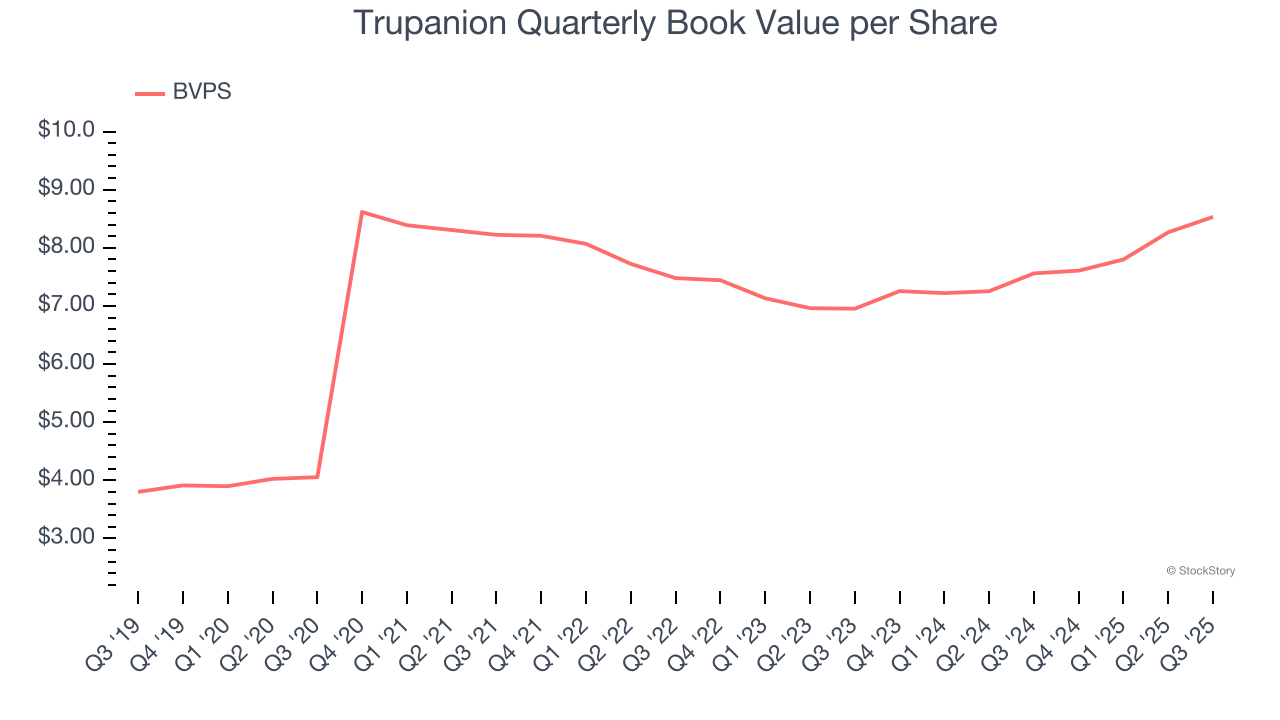

3. Substandard BVPS Growth Indicates Limited Asset Expansion

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Although Trupanion’s BVPS increased by 16% annually over the last five years, growth has recently decelerated to a mediocre 10.8% over the past two years (from $6.95 to $8.53 per share).

Final Judgment

These are just a few reasons why we think Trupanion is a high-quality business. With the recent decline, the stock trades at 4.2× forward P/B (or $38.31 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Trupanion

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.