Wrapping up Q3 earnings, we look at the numbers and key takeaways for the healthcare technology stocks, including GoodRx (NASDAQ: GDRX) and its peers.

Healthcare technology companies develop software, data analytics, and digital platforms supporting clinical operations, administrative functions, and patient engagement across healthcare systems. Tailwinds include healthcare digitization driving demand for electronic health records, telehealth platforms, and AI-powered diagnostic tools. Regulatory incentives promote interoperability and data sharing, while labor shortages increase automation demand. Headwinds include lengthy sales cycles with risk-averse healthcare buyers, complex regulatory requirements including data privacy compliance, and integration challenges with legacy systems. Competition from established technology giants entering healthcare and reimbursement uncertainties for digital health solutions add market complexity.Add to Conversation

The 7 healthcare technology stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 5% while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

GoodRx (NASDAQ: GDRX)

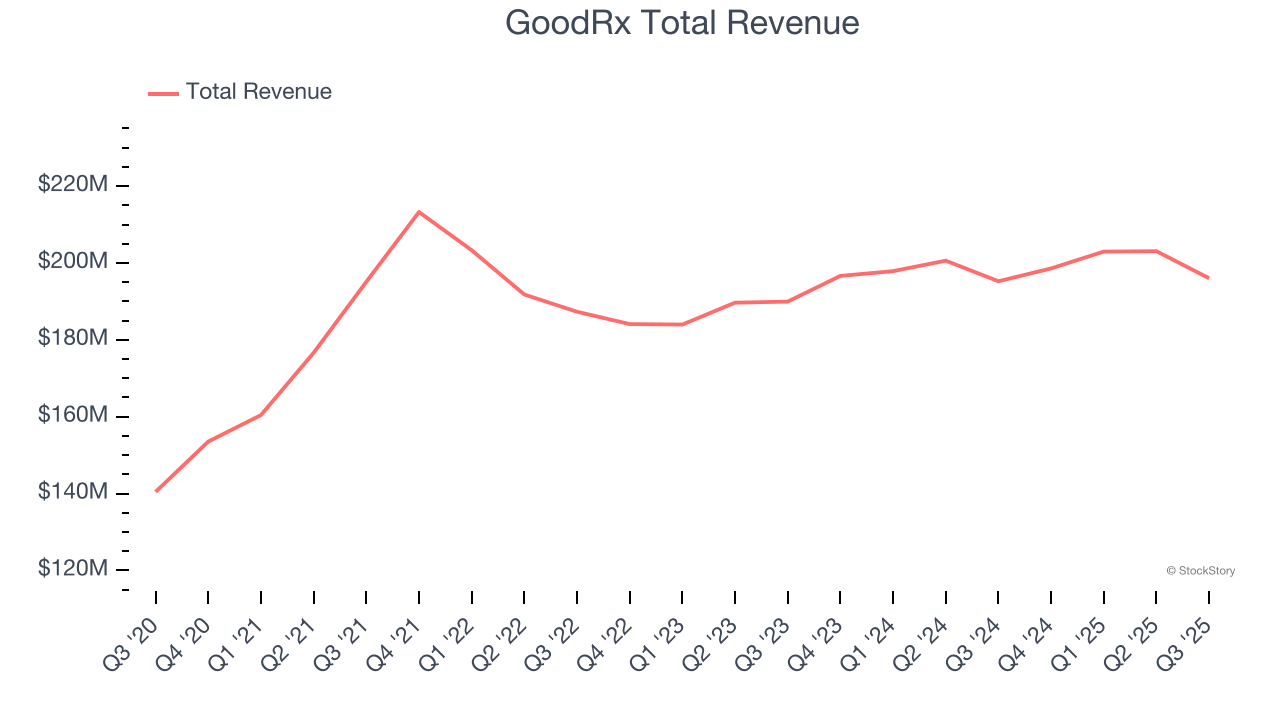

Started in 2011 to tackle the problem of high prescription drug costs in America, GoodRx (NASDAQ: GDRX) operates a digital platform that helps consumers find lower prices on prescription medications through price comparison tools and discount codes.

GoodRx reported revenues of $196 million, flat year on year. This print exceeded analysts’ expectations by 1.1%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS estimates and a slight miss of analysts’ customer base estimates.

Unsurprisingly, the stock is down 21.5% since reporting and currently trades at $2.56.

Read our full report on GoodRx here, it’s free.

Best Q3: Privia Health (NASDAQ: PRVA)

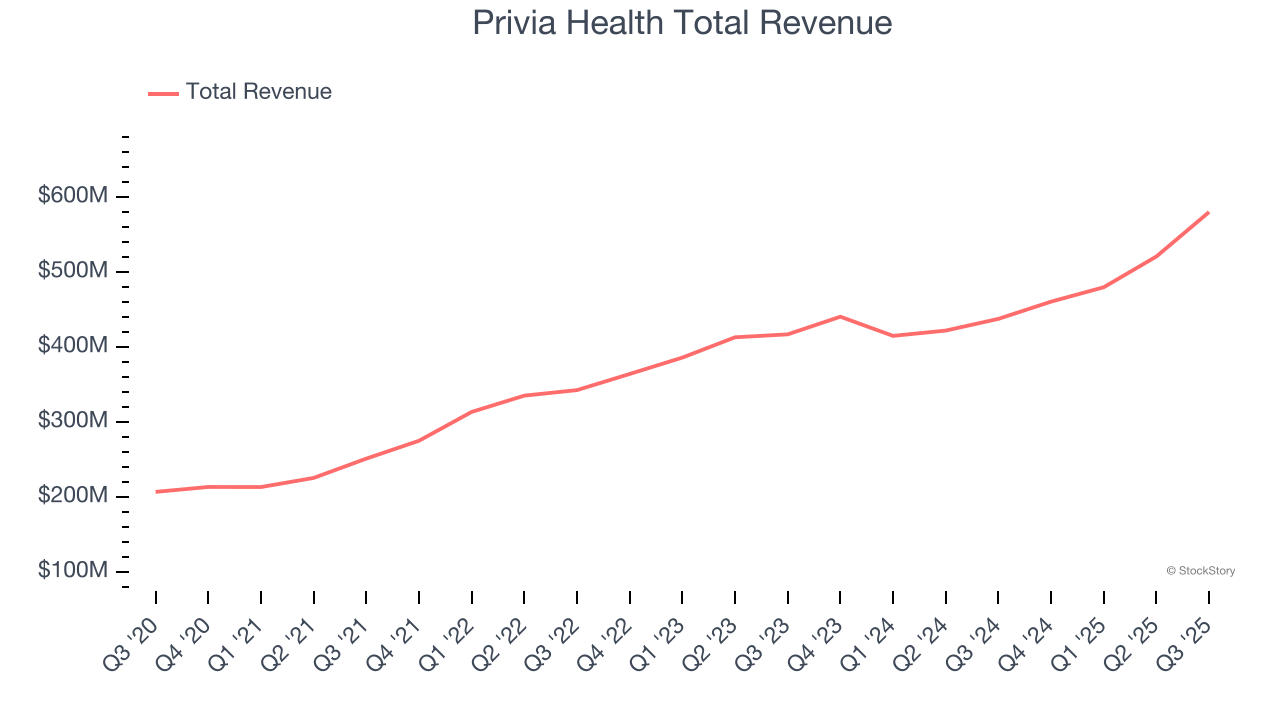

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ: PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $580.4 million, up 32.5% year on year, outperforming analysts’ expectations by 16.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

Privia Health achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.3% since reporting. It currently trades at $23.94.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $956 million, up 99.7% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Astrana Health delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 18.7% since the results and currently trades at $27.12.

Read our full analysis of Astrana Health’s results here.

Evolent Health (NYSE: EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $479.5 million, down 22.8% year on year. This number topped analysts’ expectations by 2.6%. More broadly, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Evolent Health delivered the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is down 34.3% since reporting and currently trades at $3.95.

Read our full, actionable report on Evolent Health here, it’s free.

Hims & Hers Health (NYSE: HIMS)

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Hims & Hers Health reported revenues of $599 million, up 49.2% year on year. This result surpassed analysts’ expectations by 3.3%. Taking a step back, it was a mixed quarter as it also logged a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The company added 32,000 customers to reach a total of 2.47 million. The stock is down 33.3% since reporting and currently trades at $29.62.

Read our full, actionable report on Hims & Hers Health here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.