Regions Financial has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10.3% to $27.08 per share while the index has gained 9.9%.

Is now the time to buy Regions Financial, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Regions Financial Not Exciting?

We don't have much confidence in Regions Financial. Here are three reasons we avoid RF and a stock we'd rather own.

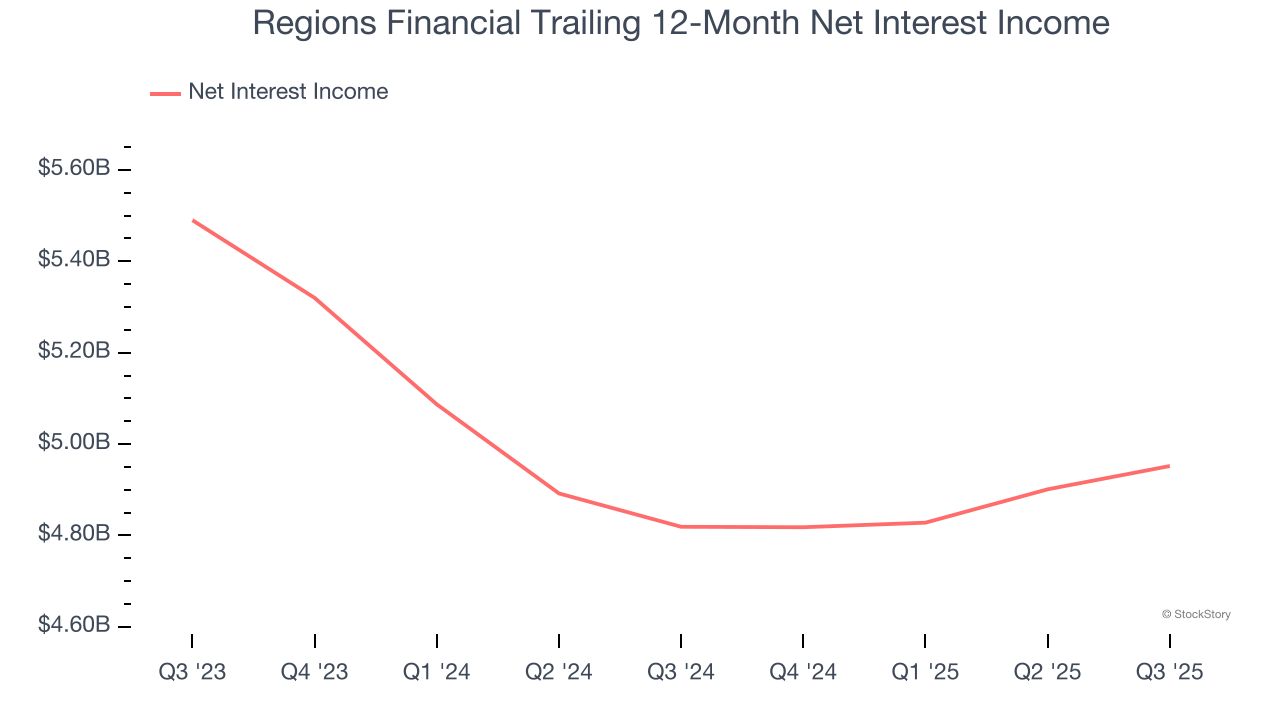

1. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Regions Financial’s net interest income has grown at a 5.4% annualized rate over the last five years, much worse than the broader banking industry and in line with its total revenue. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

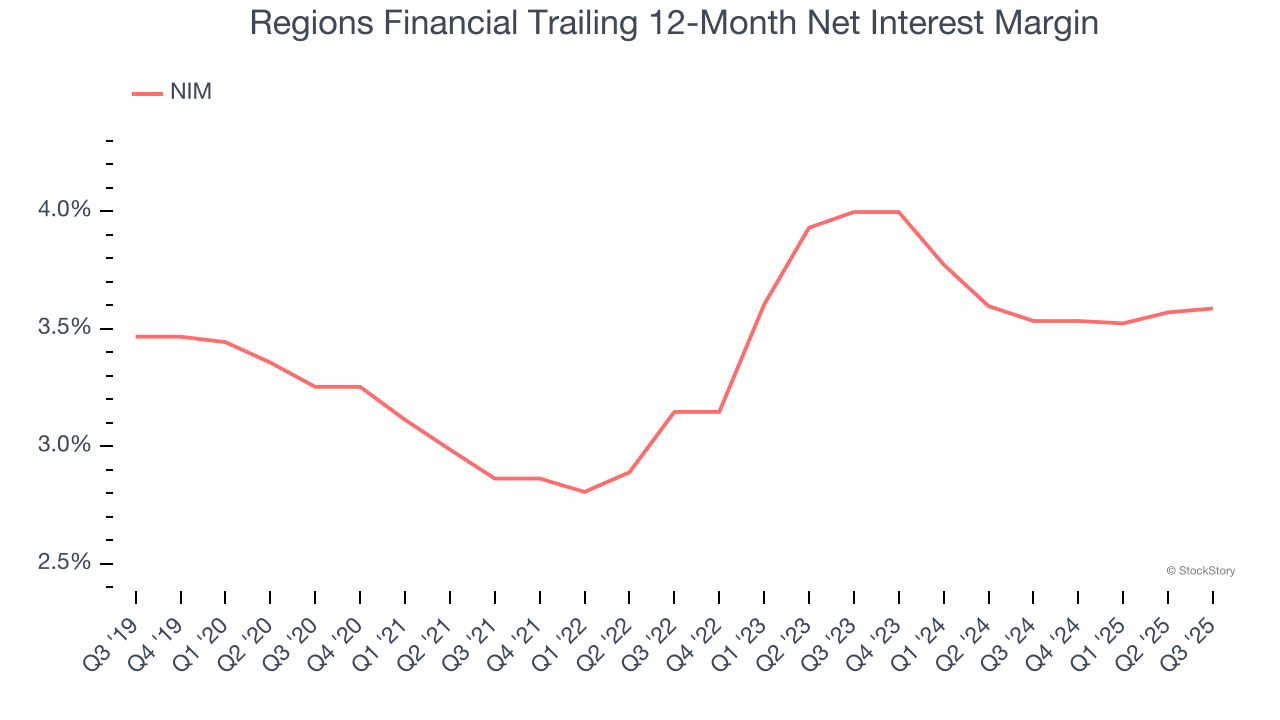

2. Net Interest Margin Dropping

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, Regions Financial’s net interest margin averaged 3.6%. However, its margin contracted by 41 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Regions Financial either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

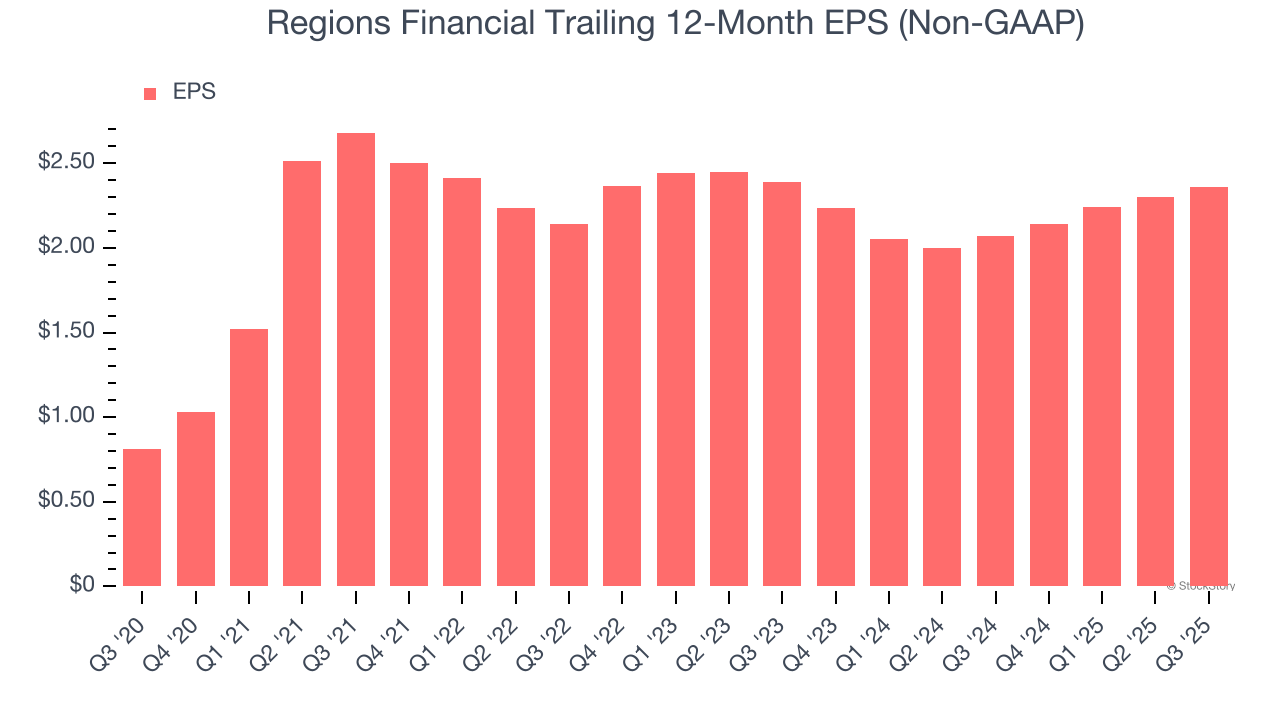

3. EPS Growth Has Stalled Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Regions Financial’s flat EPS over the last two years was weak. On the bright side, this performance was better than its 1.4% annualized revenue declines.

Final Judgment

Regions Financial isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.3× forward P/B (or $27.08 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.