As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the automotive and marine retail industry, including OneWater (NASDAQ: ONEW) and its peers.

At their essence, cars and boats get you from point A to point B, but the former is usually a necessity in everyday life while the latter is a luxury or leisure product. The retailers that sell these vehicles therefore cater to different needs and populations. There are also retailers that may not sell cars and boats themselves but the parts and accessories needed to keep these complex machines in tip top shape.

The 11 automotive and marine retail stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 2.5% on average since the latest earnings results.

OneWater (NASDAQ: ONEW)

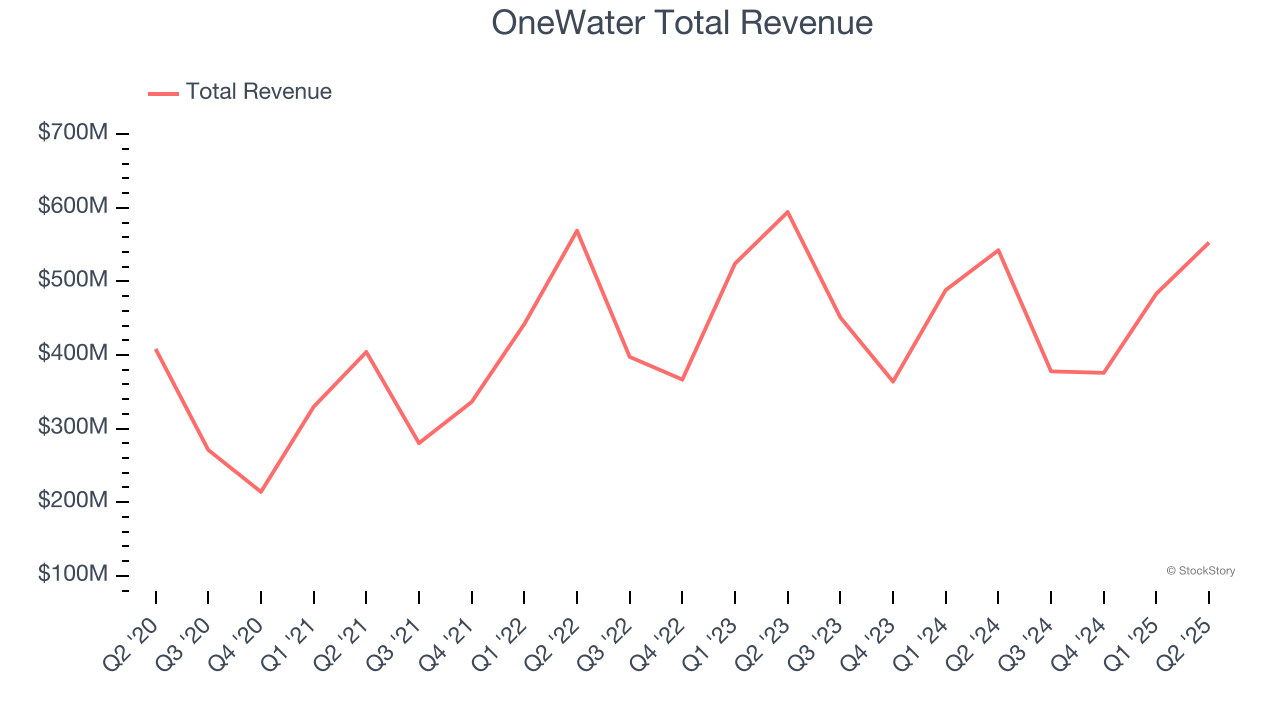

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $552.9 million, up 1.9% year on year. This print exceeded analysts’ expectations by 4%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA and gross margin estimates.

“The quarter highlighted our ability to outperform broader industry trends, despite macroeconomic uncertainty. As expected, a highly competitive environment and significant promotional activity across the industry continues to pressure margins,” commented Austin Singleton, Chief Executive Officer at OneWater.

OneWater pulled off the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 8.5% since reporting and currently trades at $15.81.

Read our full report on OneWater here, it’s free.

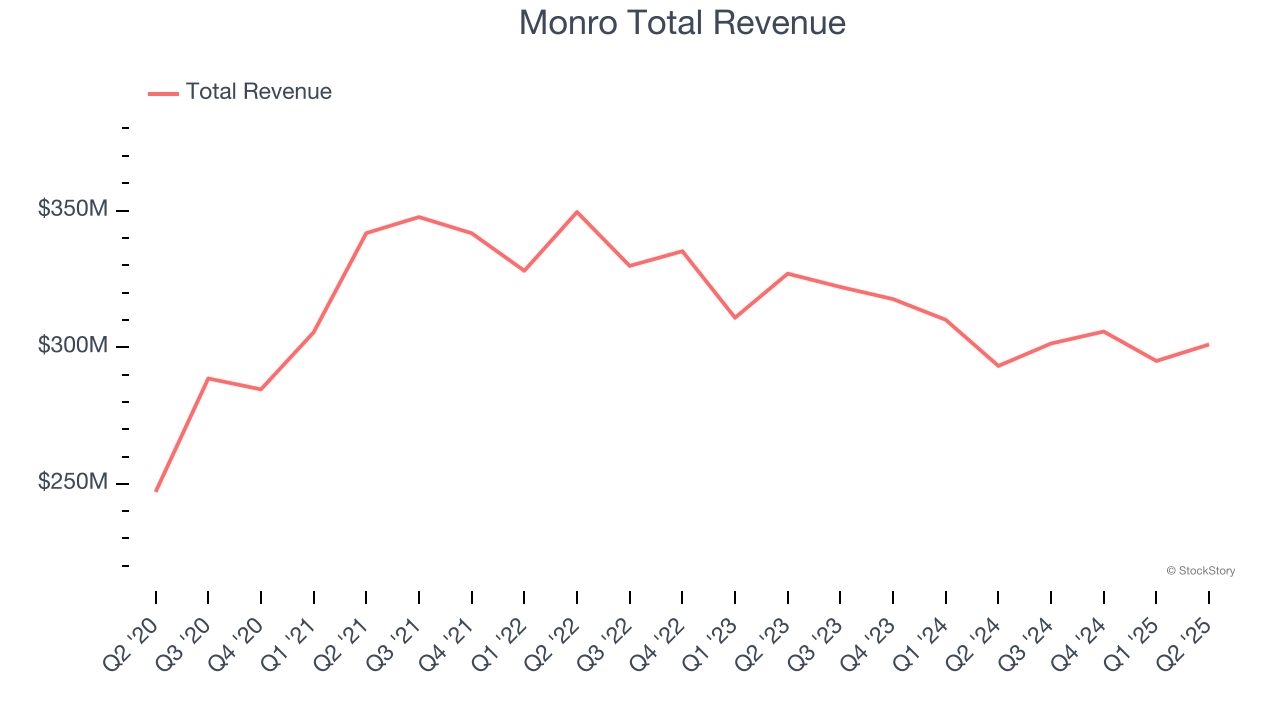

Best Q2: Monro (NASDAQ: MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ: MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $301 million, up 2.7% year on year, outperforming analysts’ expectations by 1.7%. The business had an exceptional quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 10% since reporting. It currently trades at $17.96.

Is now the time to buy Monro? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: America's Car-Mart (NASDAQ: CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ: CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $341.3 million, down 1.5% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 23.6% since the results and currently trades at $34.

Read our full analysis of America's Car-Mart’s results here.

Genuine Parts (NYSE: GPC)

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $6.16 billion, up 3.4% year on year. This result beat analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter as it also recorded a solid beat of analysts’ gross margin estimates.

The stock is up 12.2% since reporting and currently trades at $139.04.

Read our full, actionable report on Genuine Parts here, it’s free.

Advance Auto Parts (NYSE: AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE: AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.01 billion, down 7.7% year on year. This number surpassed analysts’ expectations by 1%. However, it was a slower quarter as it logged full-year EPS guidance missing analysts’ expectations.

Advance Auto Parts had the weakest full-year guidance update among its peers. The stock is up 3.5% since reporting and currently trades at $64.

Read our full, actionable report on Advance Auto Parts here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.