Hotel franchisor Choice Hotels (NYSE: CHH) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 2% year on year to $426.4 million. Its non-GAAP profit of $1.92 per share was 1% above analysts’ consensus estimates.

Is now the time to buy Choice Hotels? Find out by accessing our full research report, it’s free.

Choice Hotels (CHH) Q2 CY2025 Highlights:

- Revenue: $426.4 million vs analyst estimates of $428.3 million (2% year-on-year decline, in line)

- Adjusted EPS: $1.92 vs analyst estimates of $1.90 (1% beat)

- Adjusted EBITDA: $165 million vs analyst estimates of $165.8 million (38.7% margin, in line)

- Management reiterated its full-year Adjusted EPS guidance of $7.04 at the midpoint

- EBITDA guidance for the full year is $625 million at the midpoint, above analyst estimates of $617.7 million

- Operating Margin: 29.2%, down from 30.5% in the same quarter last year

- Free Cash Flow Margin: 28.9%, up from 16.3% in the same quarter last year

- RevPAR: $58.22 at quarter end, up 10.5% year on year

- Market Capitalization: $5.76 billion

"Choice Hotels delivered another quarter of record financial performance despite a softer domestic RevPAR environment, underscoring the successful execution and diversification of our growth strategy," said Patrick Pacious, President and Chief Executive Officer.

Company Overview

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE: CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Revenue Growth

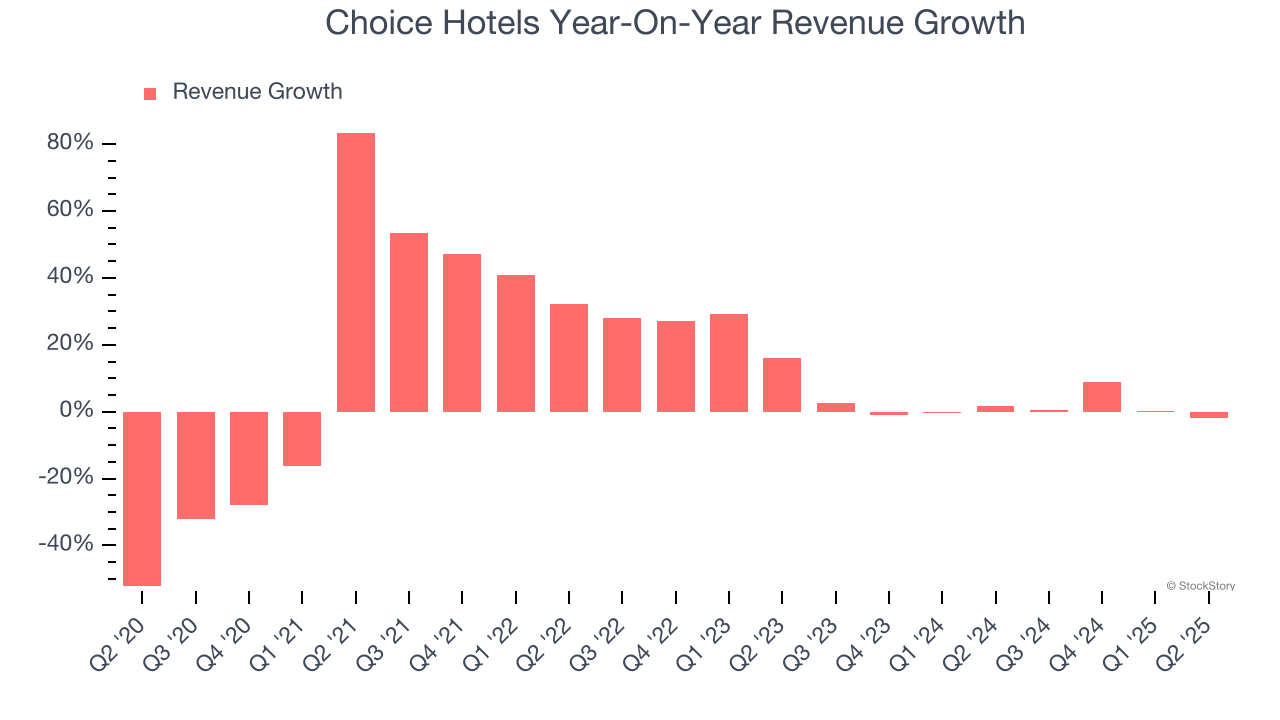

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Choice Hotels grew its sales at a 10.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Choice Hotels’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.

Choice Hotels also reports revenue per available room, which clocked in at $58.22 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Choice Hotels’s revenue per room was flat. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Choice Hotels reported a rather uninspiring 2% year-on-year revenue decline to $426.4 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Choice Hotels’s operating margin has risen over the last 12 months and averaged 26.9% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q2, Choice Hotels generated an operating margin profit margin of 29.2%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

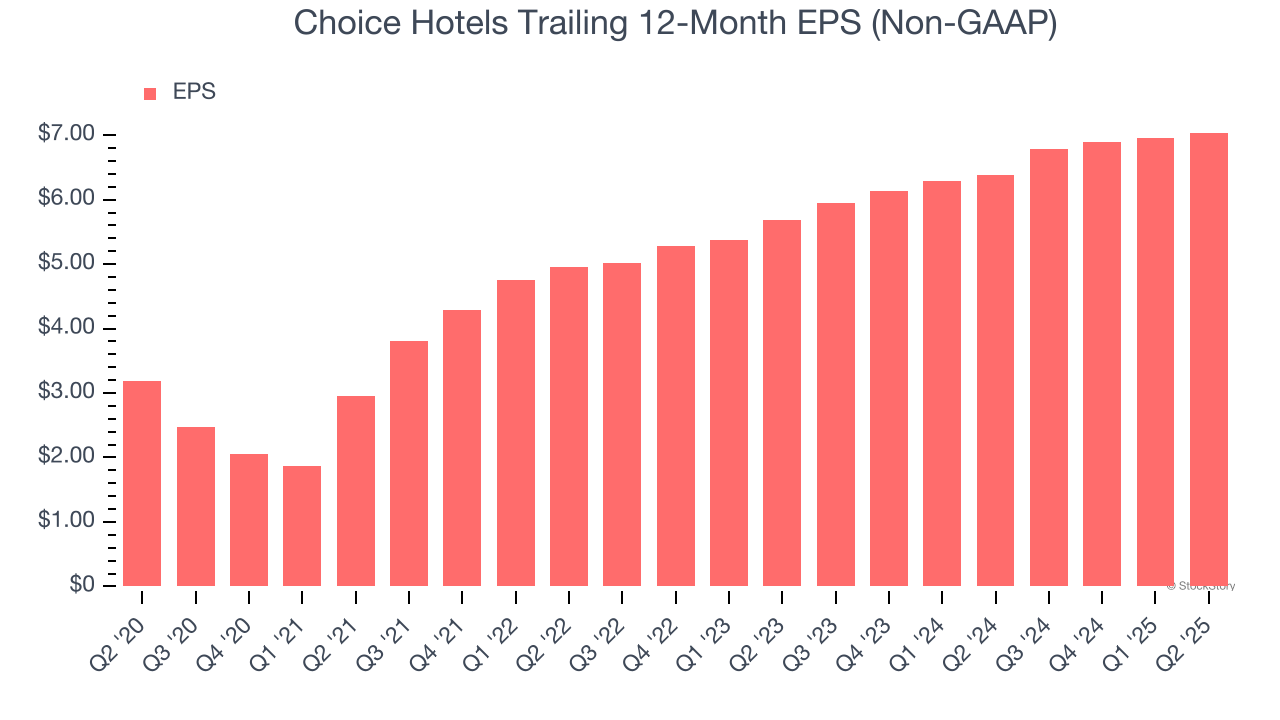

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Choice Hotels’s EPS grew at a remarkable 17.2% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Choice Hotels reported adjusted EPS at $1.92, up from $1.84 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Choice Hotels’s full-year EPS of $7.04 to grow 1.2%.

Key Takeaways from Choice Hotels’s Q2 Results

This was a quarter without many surprises, with revenue and EBITDA both roughly in line. Looking ahead, management reiterated full-year EPS guidance. The stock remained flat at $126.26 immediately following the results.

So should you invest in Choice Hotels right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.