Teledyne’s 11.7% return over the past six months has outpaced the S&P 500 by 6.3%, and its stock price has climbed to $557.57 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Teledyne, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Teledyne Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Teledyne for now. Here are three reasons why TDY doesn't excite us and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

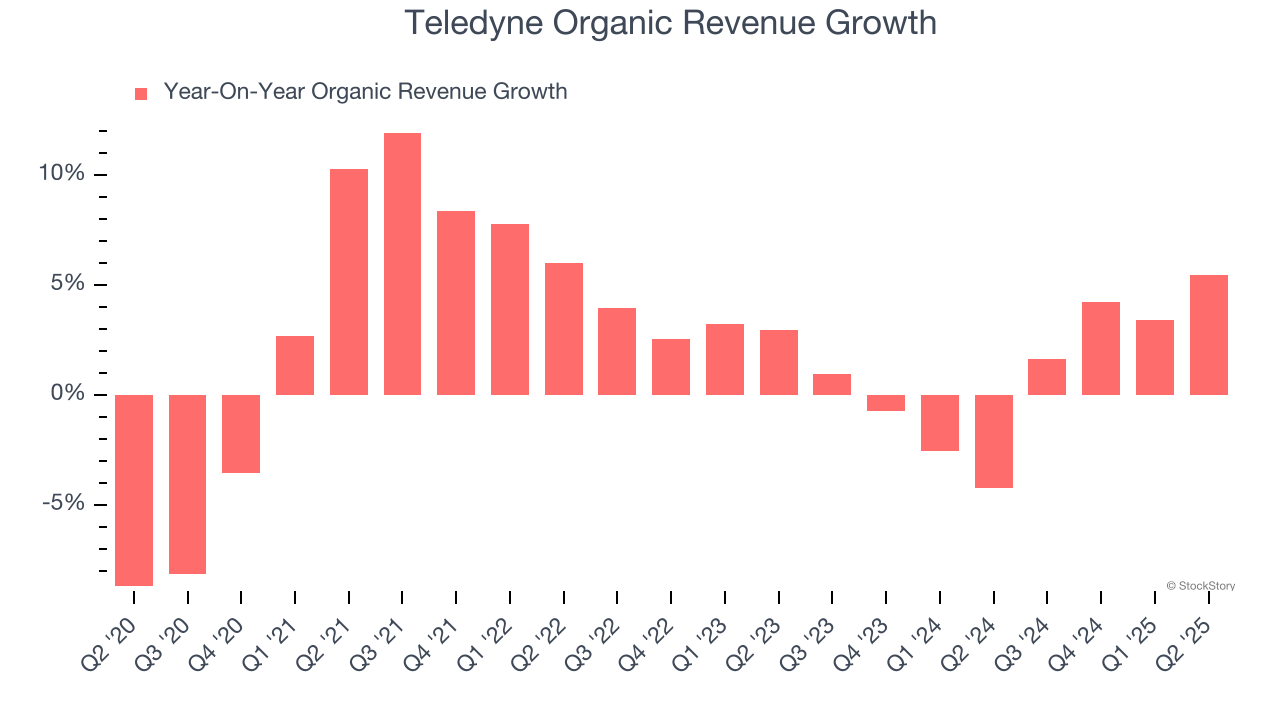

In addition to reported revenue, organic revenue is a useful data point for analyzing Inspection Instruments companies. This metric gives visibility into Teledyne’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Teledyne’s organic revenue averaged 1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Free Cash Flow Margin Dropping

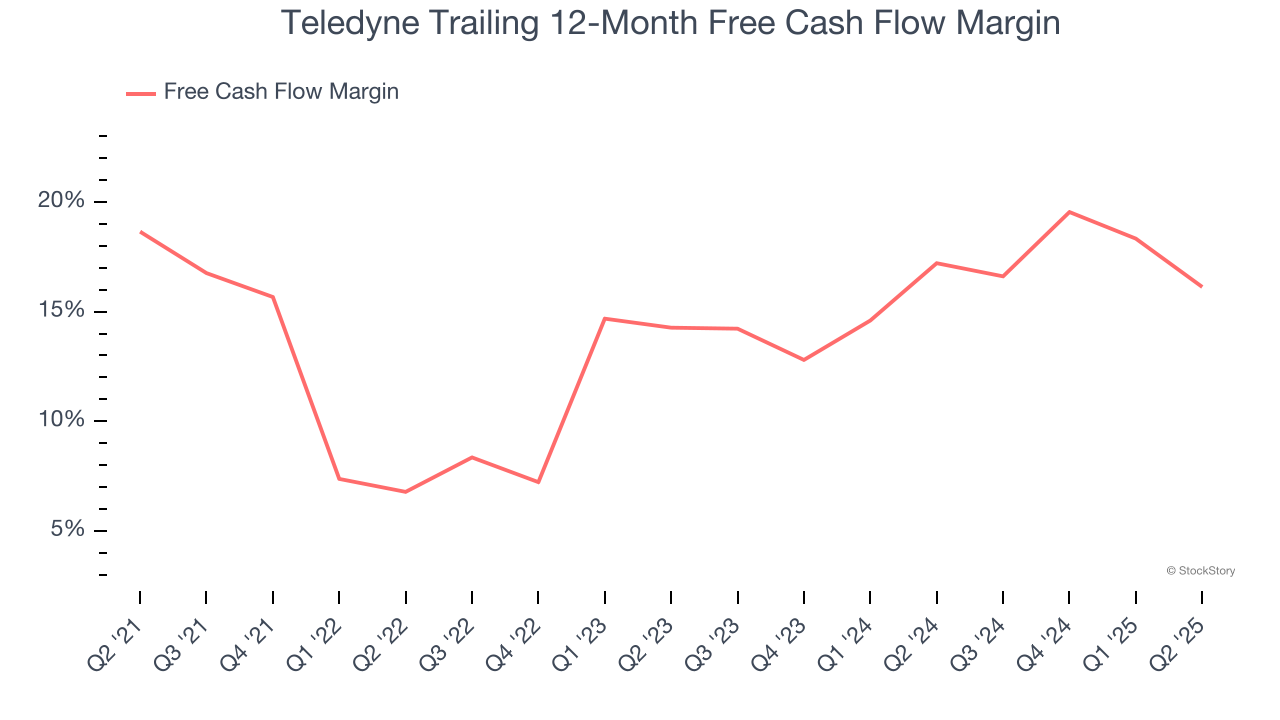

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Teledyne’s margin dropped by 2.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Teledyne’s free cash flow margin for the trailing 12 months was 16.1%.

3. Previous Growth Initiatives Haven’t Impressed

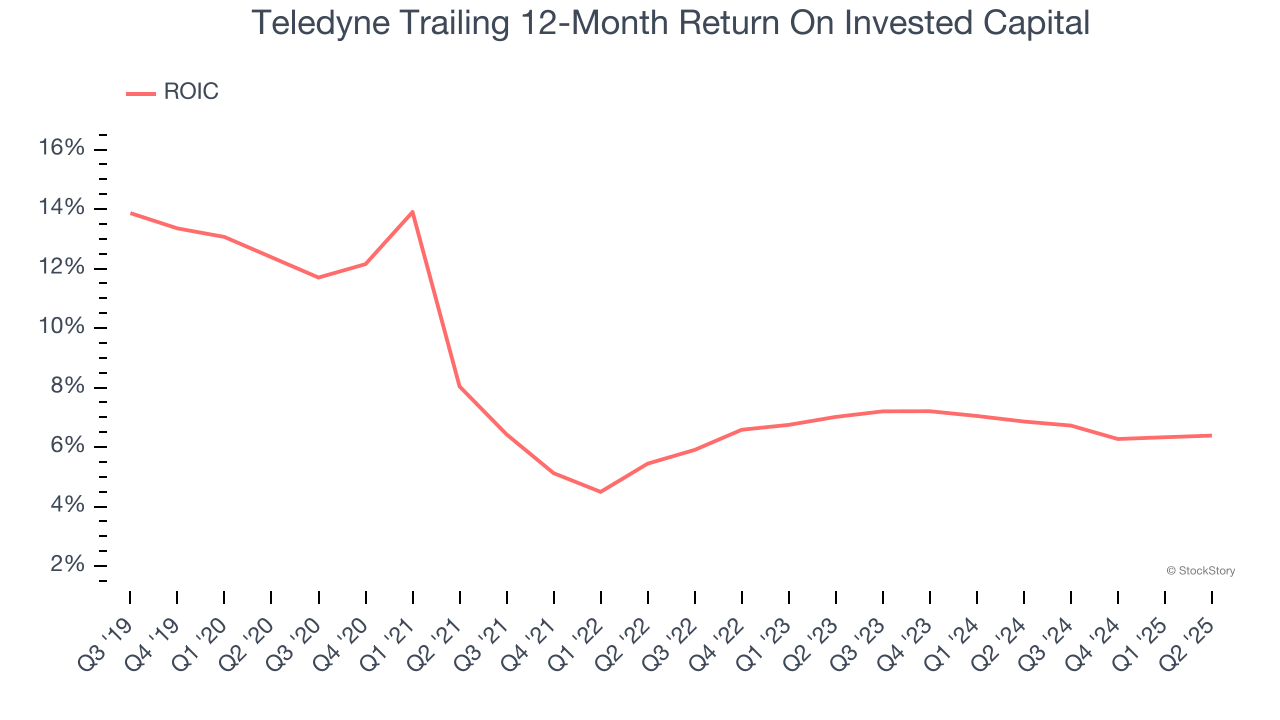

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Teledyne historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Teledyne isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 24.5× forward P/E (or $557.57 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.