Over the past six months, Taboola’s stock price fell to $3.41. Shareholders have lost 6.3% of their capital, which is disappointing considering the S&P 500 has climbed by 4.3%. This might have investors contemplating their next move.

Is now the time to buy Taboola, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Taboola Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why we avoid TBLA and a stock we'd rather own.

1. EPS Trending Down

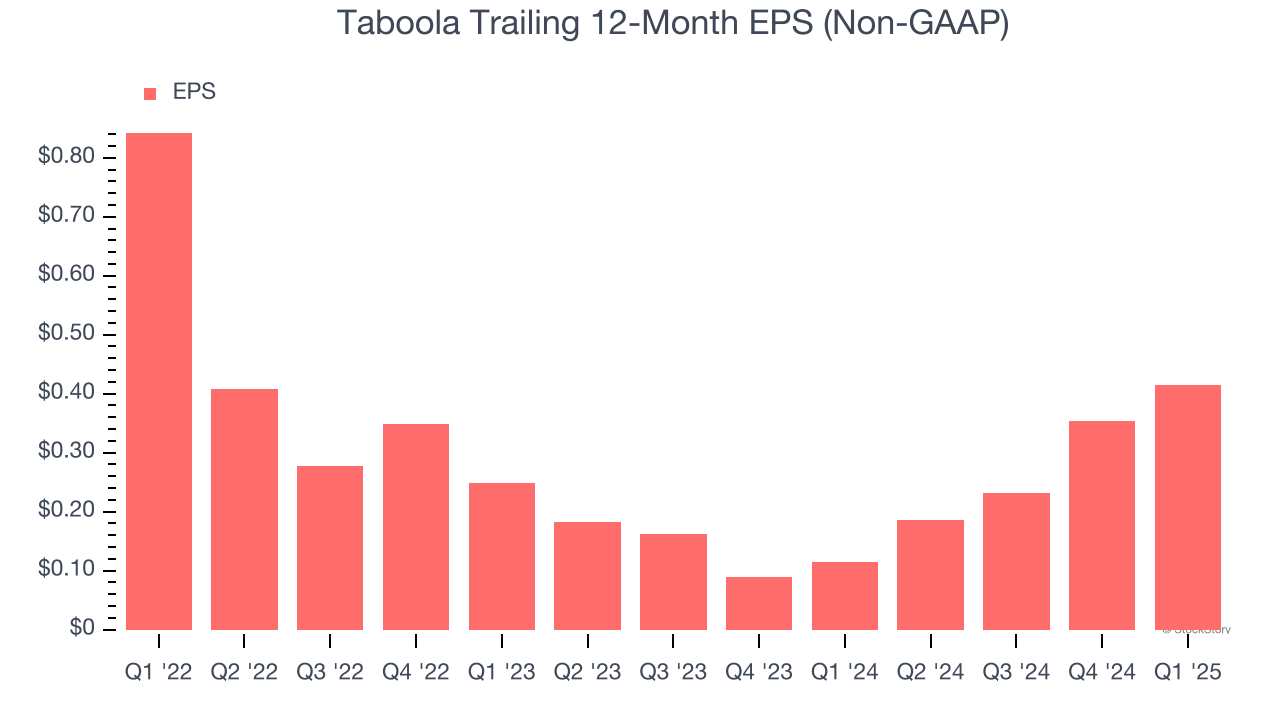

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Taboola’s full-year EPS dropped significantly over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Taboola’s low margin of safety could leave its stock price susceptible to large downswings.

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Taboola’s margin dropped meaningfully over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Taboola’s free cash flow margin for the trailing 12 months was 8.8%.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Taboola’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Taboola isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 6.5× forward EV-to-EBITDA (or $3.41 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Taboola

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.