Since June 2020, the S&P 500 has delivered a total return of 83.5%. But one standout stock has more than doubled the market - over the past five years, Carvana has surged 201% to $342.50 per share. Its momentum hasn’t stopped as it’s also gained 36.3% in the last six months thanks to its solid quarterly results, beating the S&P by 38.8%.

Is now still a good time to buy CVNA? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Carvana Spark Debate?

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Two Positive Attributes:

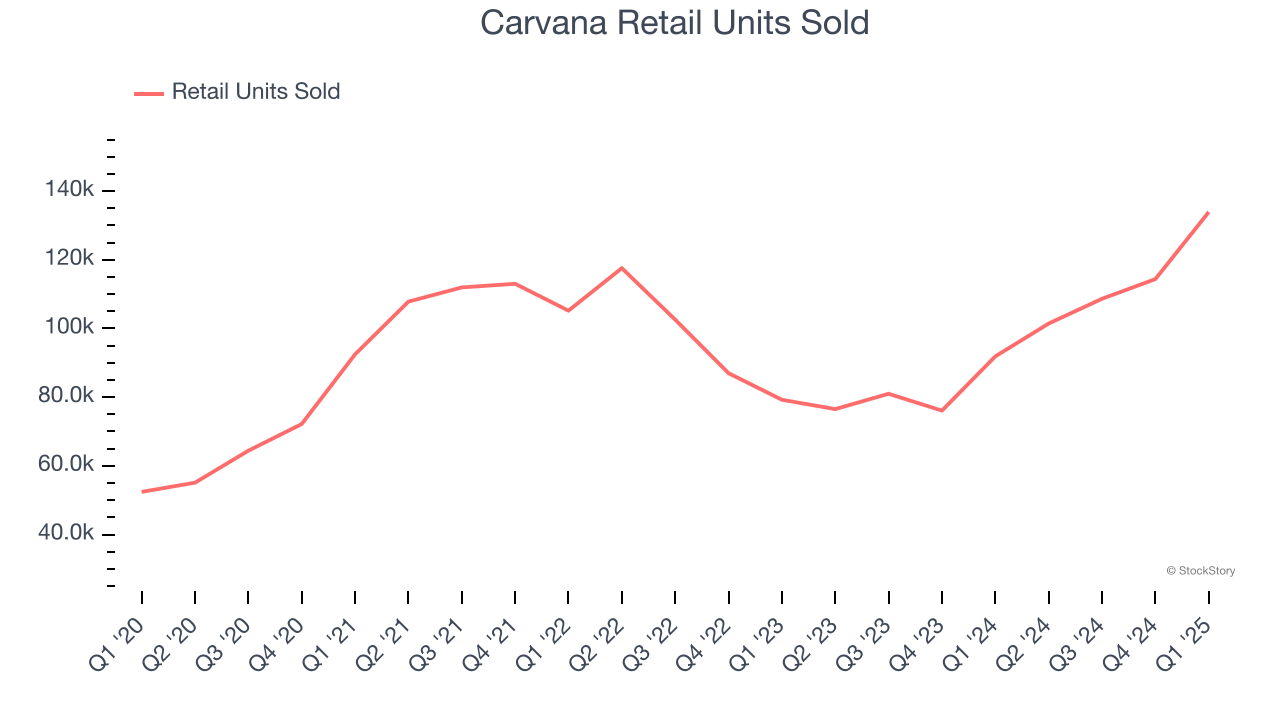

1. Retail Units Sold Skyrocket, Fueling Growth Opportunities

As an online retailer, Carvana generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Carvana’s retail units sold, a key performance metric for the company, increased by 13.8% annually to 133,898 in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

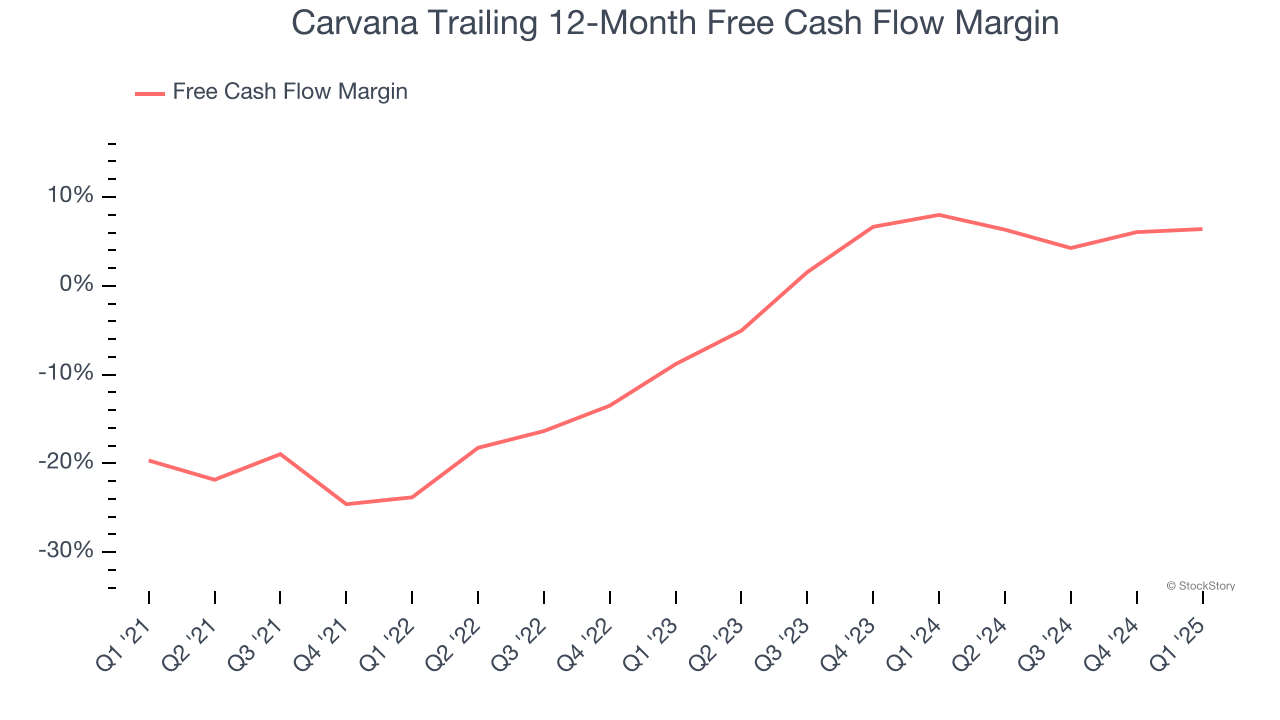

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Carvana’s margin expanded by 30.2 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Carvana’s free cash flow margin for the trailing 12 months was 6.4%.

One Reason to be Careful:

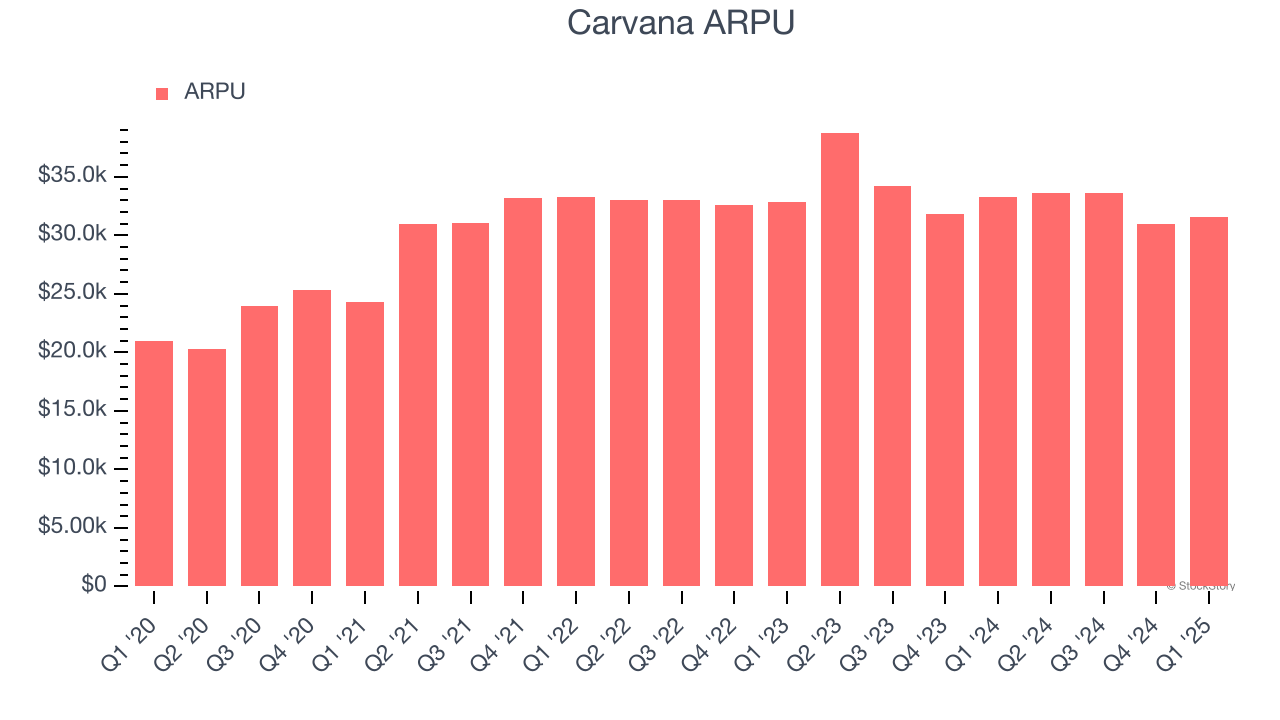

Customer Spending Stalls, Engagement Falling?

Average revenue per unit (ARPU) is a critical metric to track because it measures how much customers spend per order.

Carvana’s ARPU has been roughly flat over the last two years. This isn’t great, but the increase in retail units sold is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Carvana tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether units can continue growing at the current pace.

Final Judgment

Carvana’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 24× forward EV/EBITDA (or $342.50 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Carvana

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.