While the broader market has struggled with the S&P 500 down 2.4% since December 2024, Asure has surged ahead as its stock price has climbed by 5.6% to $9.59 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Asure, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Asure Not Exciting?

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why we avoid ASUR and a stock we'd rather own.

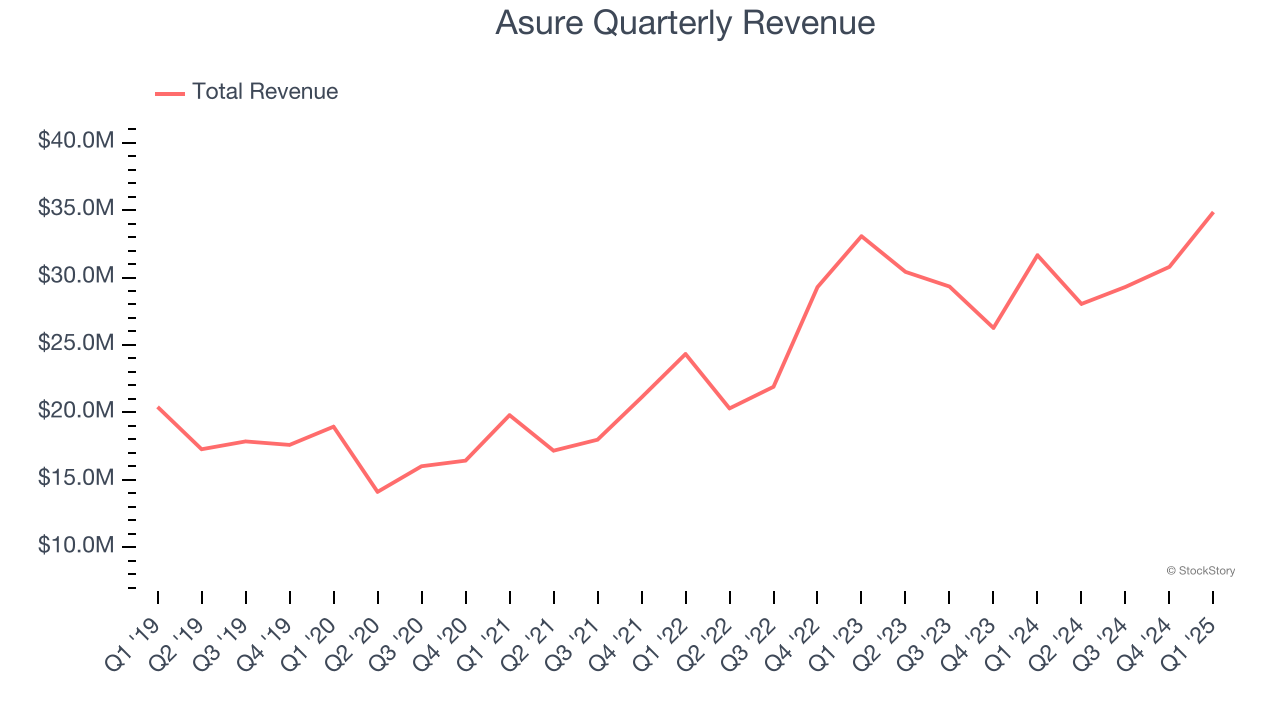

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Asure grew its sales at a 15.1% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

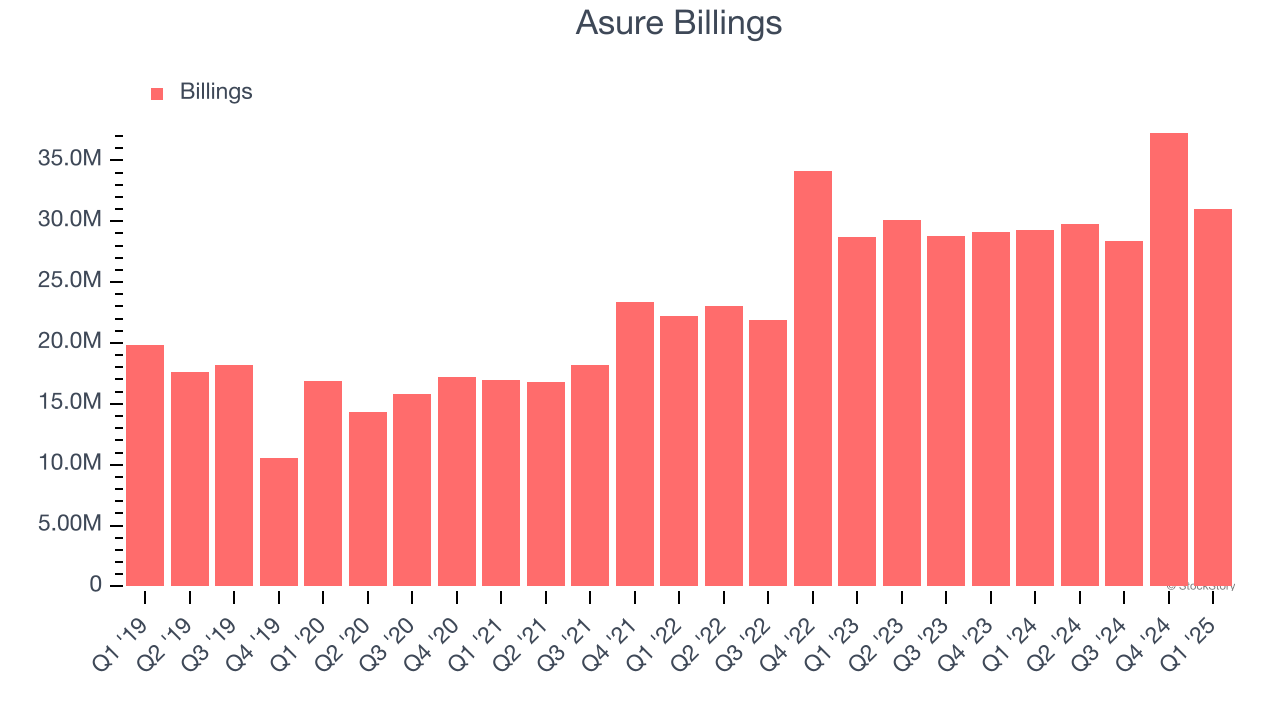

2. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Asure’s billings came in at $31.04 million in Q1, and over the last four quarters, its year-on-year growth averaged 7.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

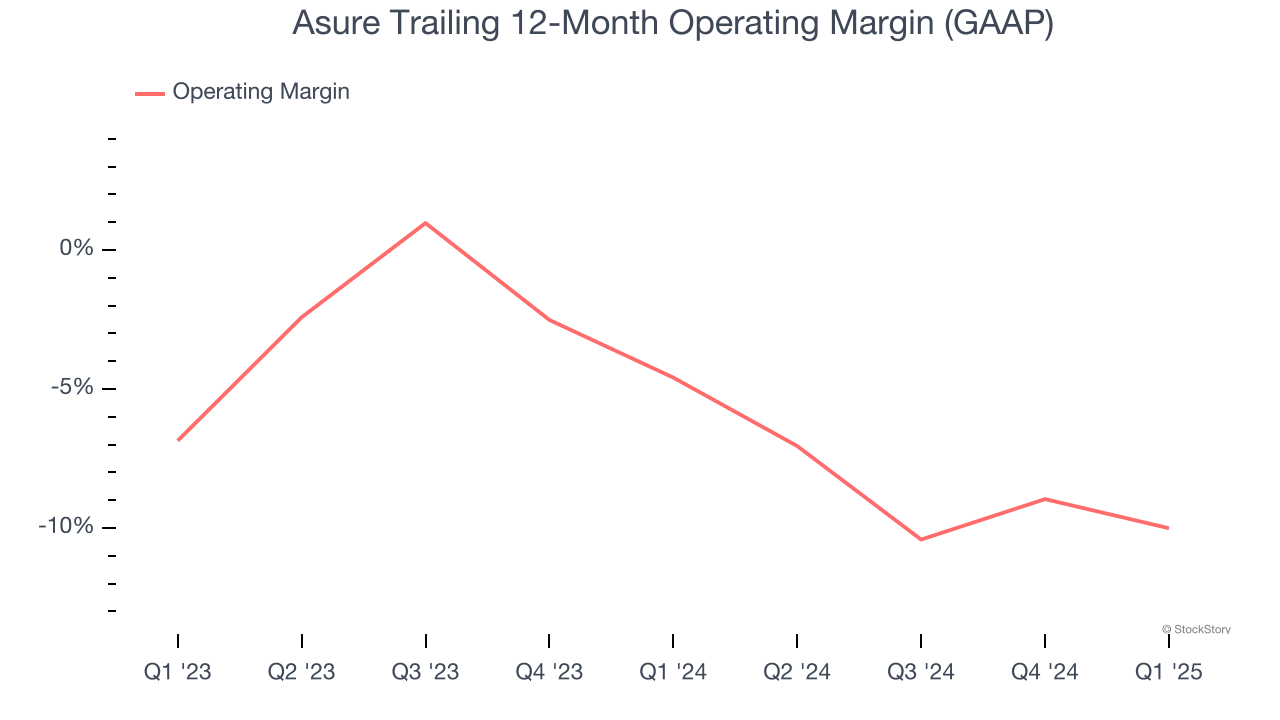

3. Shrinking Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Asure’s operating margin decreased by 5.4 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Asure’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 10%.

Final Judgment

Asure isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 1.9× forward price-to-sales (or $9.59 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.