Autodesk has been treading water for the past six months, recording a small loss of 3% while holding steady at $298.49.

Does this present a buying opportunity for ADSK? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Autodesk Spark Debate?

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ: ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Two Positive Attributes:

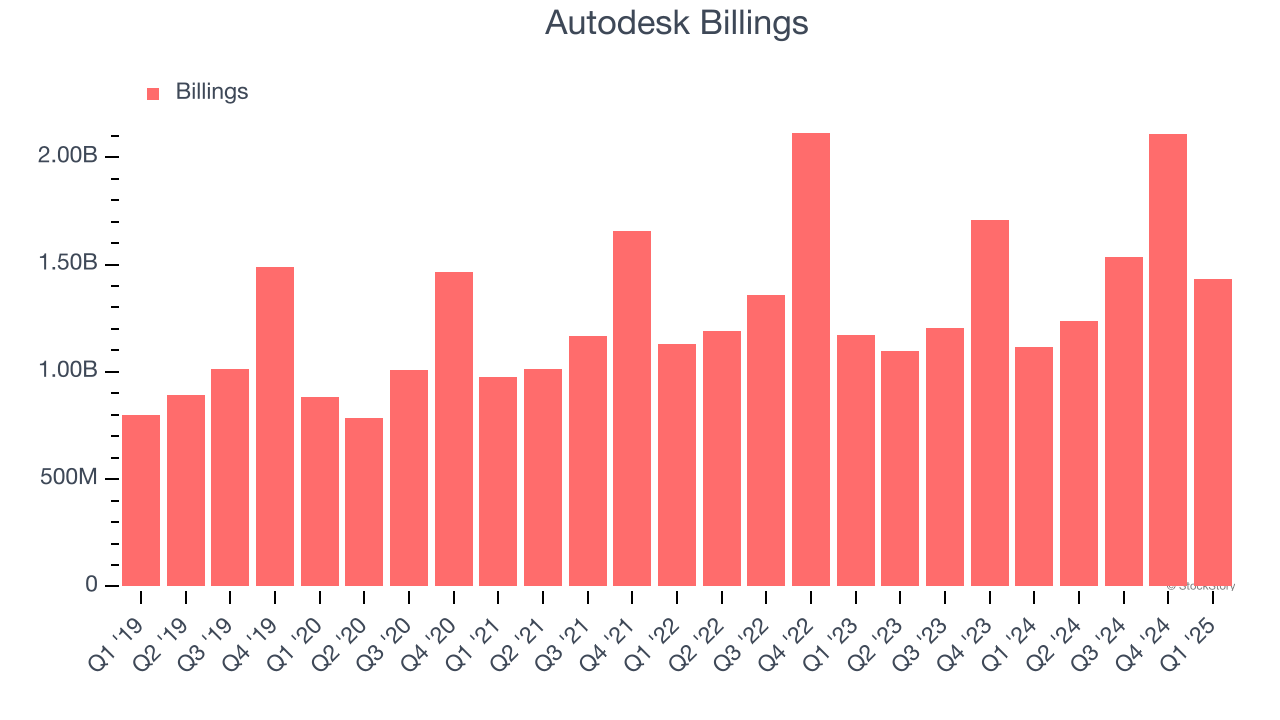

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Autodesk’s billings punched in at $1.43 billion in Q1, and over the last four quarters, its year-on-year growth averaged 23.1%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

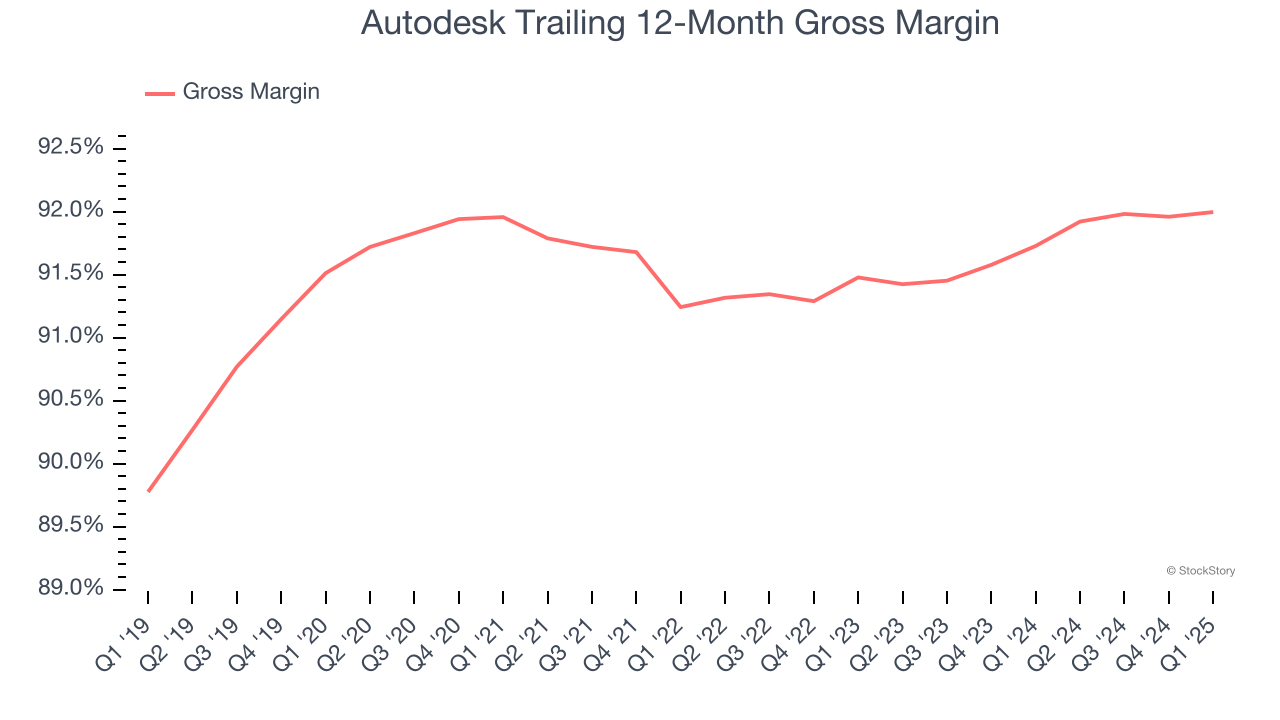

2. Elite Gross Margin Powers Best-In-Class Business Model

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Autodesk’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 92% gross margin over the last year. Said differently, roughly $92.00 was left to spend on selling, marketing, and R&D for every $100 in revenue.

One Reason to be Careful:

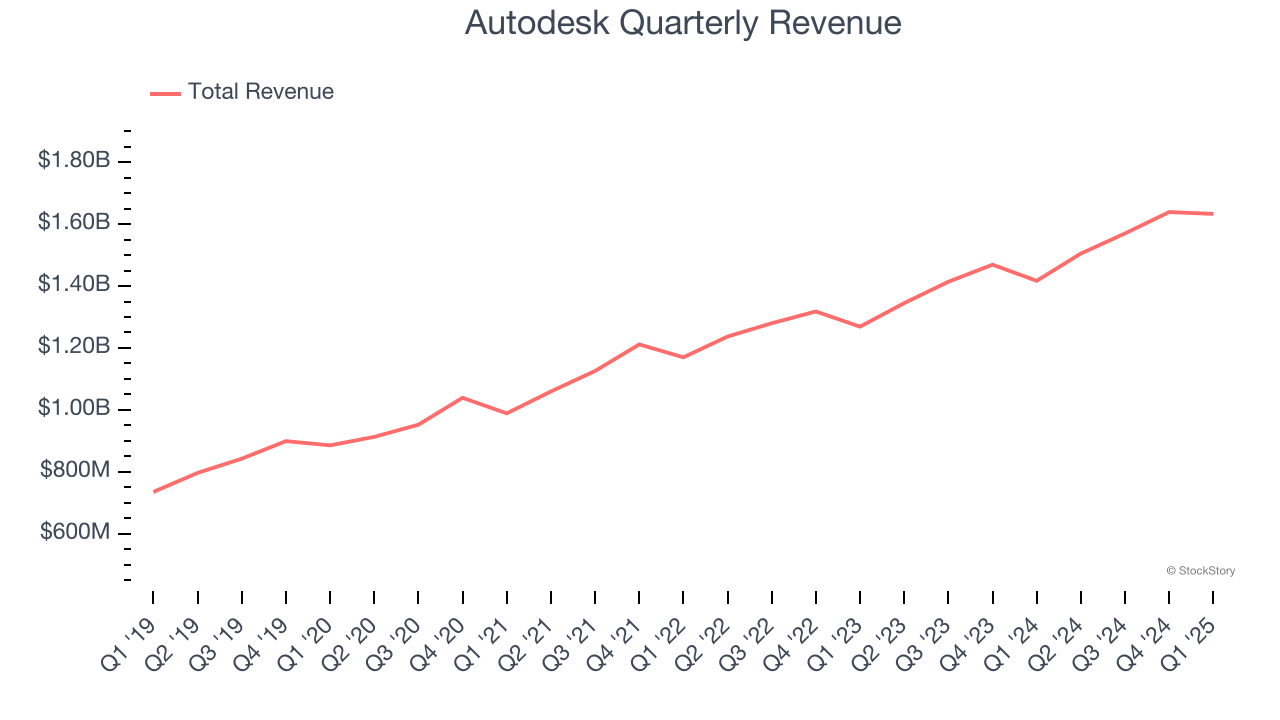

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Autodesk grew its sales at a 11.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Autodesk.

Final Judgment

Autodesk’s merits more than compensate for its flaws, but at $298.49 per share (or 9× forward price-to-sales), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Autodesk

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.