Civil infrastructure company Construction Partners (NASDAQ: ROAD) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 53.9% year on year to $571.7 million. The company’s full-year revenue guidance of $2.8 billion at the midpoint came in 3.7% above analysts’ estimates. Its GAAP profit of $0.08 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Construction Partners? Find out by accessing our full research report, it’s free.

Construction Partners (ROAD) Q1 CY2025 Highlights:

- Revenue: $571.7 million vs analyst estimates of $559.9 million (53.9% year-on-year growth, 2.1% beat)

- EPS (GAAP): $0.08 vs analyst estimates of -$0.05 (significant beat)

- Adjusted EBITDA: $69.27 million vs analyst estimates of $53.75 million (12.1% margin, 28.9% beat)

- The company lifted its revenue guidance for the full year to $2.8 billion at the midpoint from $2.7 billion, a 3.7% increase

- EBITDA guidance for the full year is $420 million at the midpoint, above analyst estimates of $381.9 million

- Operating Margin: 4.8%, up from 0.8% in the same quarter last year

- Free Cash Flow was $28.07 million, up from -$8.08 million in the same quarter last year

- Backlog: $2.84 billion at quarter end

- Market Capitalization: $5.17 billion

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "We are pleased to report a strong second quarter marked by significant year-over-year growth in revenues, net income and Adjusted EBITDA, leading to an Adjusted EBITDA margin of 12.1%, up more than 400 basis points from the same quarter last year. Continuing the substantial momentum established in the first quarter of our fiscal year, the operational performance of our family of companies was outstanding, especially during this winter quarter, when shorter days and colder weather typically limit construction activity. Throughout our Sunbelt footprint, our local teams continued to win more project work, growing our project backlog to a record $2.84 billion. We are well-positioned for continued success to build out this record backlog as we move into the busy construction work season in the second half of our fiscal year. We continue to experience healthy federal and state project funding across our geographies in addition to a steady workflow of commercial projects, with many of our local markets representing some of the fastest growing MSAs in the Sunbelt."

Company Overview

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

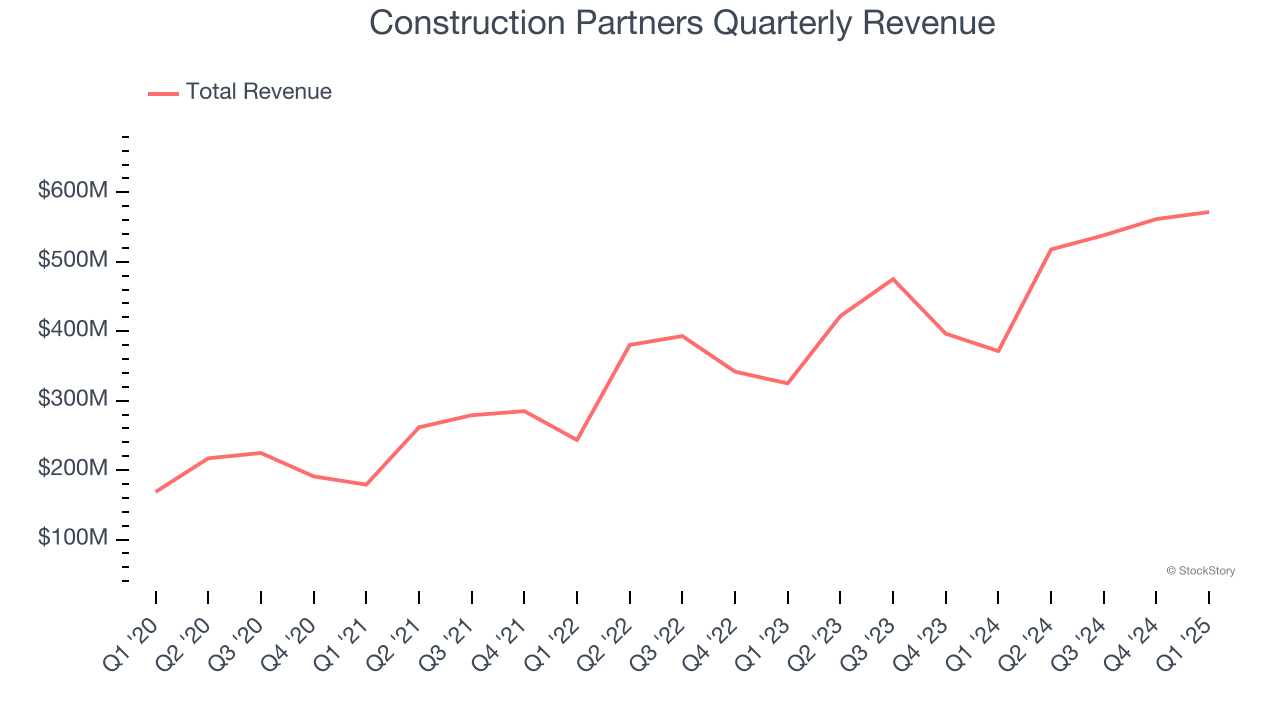

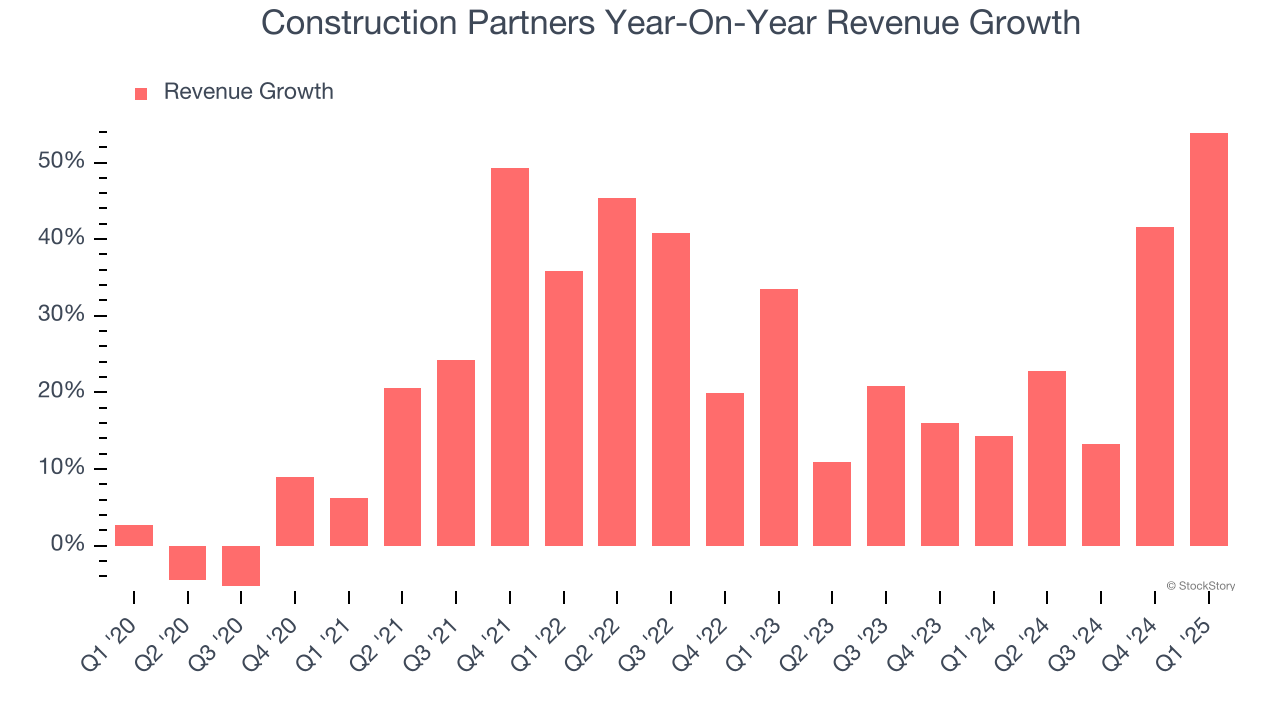

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Construction Partners’s sales grew at an incredible 22% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Construction Partners’s annualized revenue growth of 23.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Construction Partners reported magnificent year-on-year revenue growth of 53.9%, and its $571.7 million of revenue beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 30.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

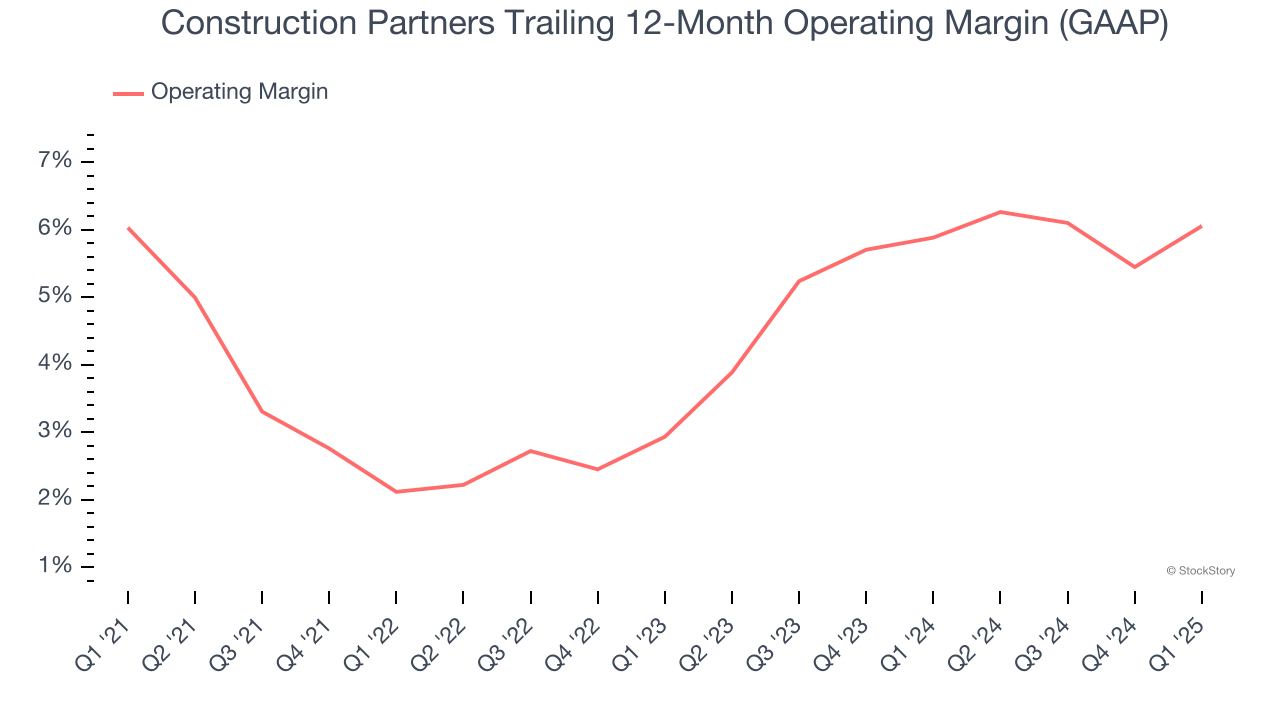

Operating Margin

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Construction Partners’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Construction Partners generated an operating profit margin of 4.8%, up 3.9 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

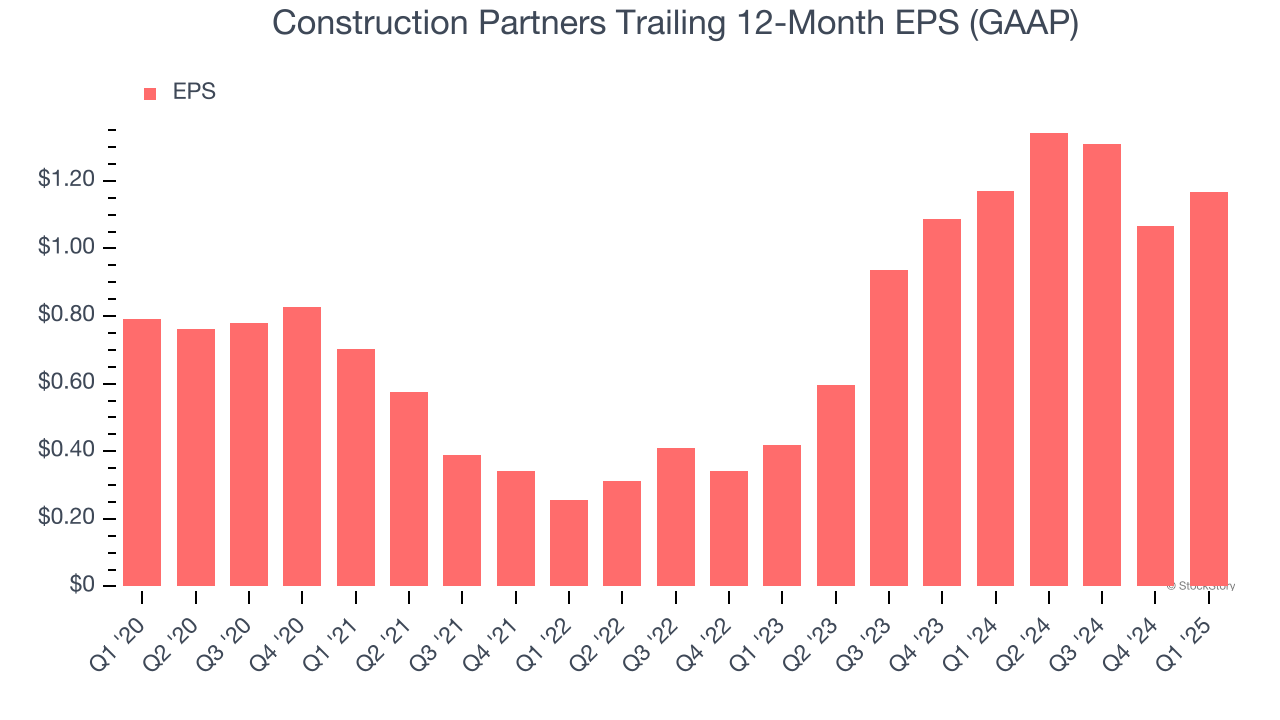

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

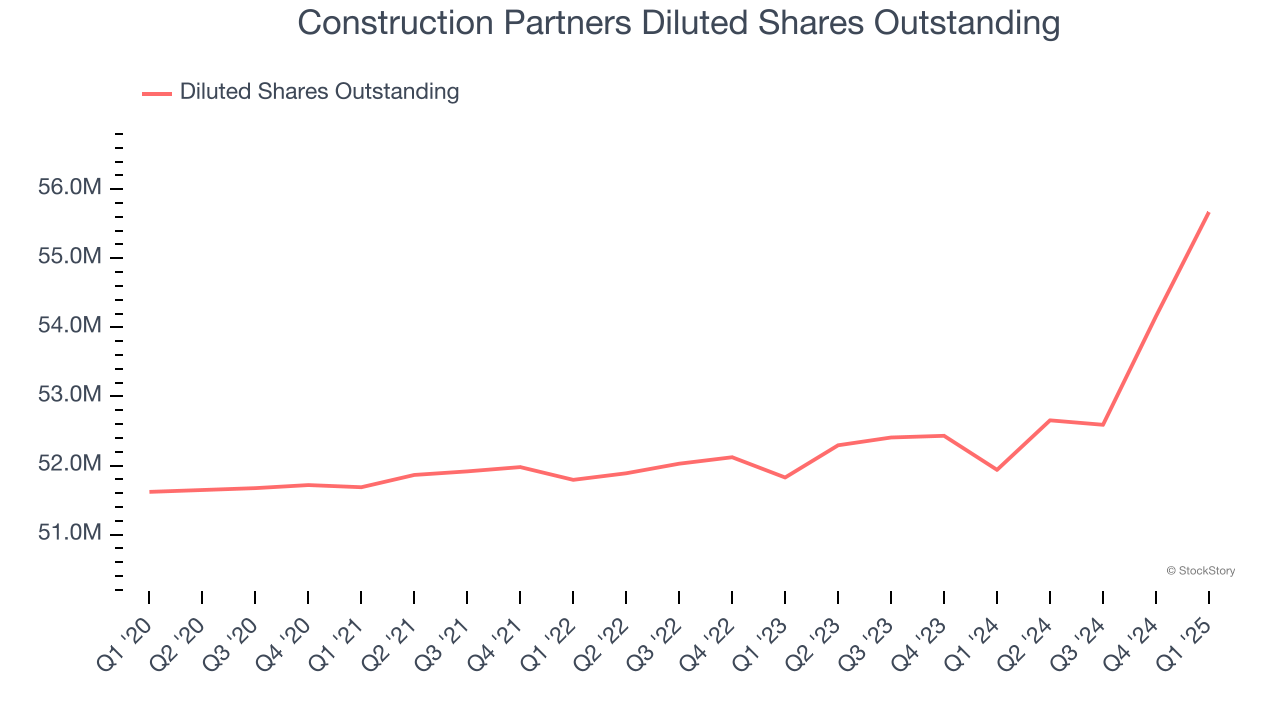

Construction Partners’s EPS grew at a decent 8.1% compounded annual growth rate over the last five years. However, this performance was lower than its 22% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Construction Partners’s earnings can give us a better understanding of its performance. A five-year view shows Construction Partners has diluted its shareholders, growing its share count by 7.8%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Construction Partners, its two-year annual EPS growth of 67.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, Construction Partners reported EPS at $0.08, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $1.17 to grow 102%.

Key Takeaways from Construction Partners’s Q1 Results

We were impressed by how significantly Construction Partners blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited it lifted its full-year revenue and EBITDA guidance. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.7% to $95.95 immediately following the results.

Construction Partners may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.