Healthcare solutions company Evolent Health (NYSE: EVH) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 24.4% year on year to $483.6 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $455 million was less impressive, coming in 9.4% below expectations. Its non-GAAP profit of $0.06 per share was 37.7% below analysts’ consensus estimates.

Is now the time to buy Evolent Health? Find out by accessing our full research report, it’s free.

Evolent Health (EVH) Q1 CY2025 Highlights:

- Revenue: $483.6 million vs analyst estimates of $461.2 million (24.4% year-on-year decline, 4.9% beat)

- Adjusted EPS: $0.06 vs analyst expectations of $0.10 (37.7% miss)

- Adjusted EBITDA: $36.86 million vs analyst estimates of $33.82 million (7.6% margin, 9% beat)

- The company reconfirmed its revenue guidance for the full year of $2.09 billion at the midpoint

- EBITDA guidance for the full year is $150 million at the midpoint, in line with analyst expectations

- Operating Margin: -0.3%, up from -2.1% in the same quarter last year

- Free Cash Flow was -$4.03 million compared to -$438,000 in the same quarter last year

- Sales Volumes fell 99.9% year on year (19.5% in the same quarter last year)

- Market Capitalization: $1.21 billion

Seth Blackley, Co-Founder and Chief Executive Officer of Evolent stated, "Evolent Health kicked off 2025 with first quarter results at the high end of our expectations, and we are reiterating our outlook for full year 2025 revenue and Adjusted EBITDA. We continue to see a very strong selling environment and we achieved significant organic growth with five new revenue agreements announced today. Operationally, we continue scaling our innovative oncology condition management solution to help Evolent further impact specialty care member experience, costs and outcomes. Performance Suite margins, including leading indicators on utilization, and AI-based automation initiatives, like Auth Intel, are both currently tracking favorably. From an innovation perspective we remain focused on improving member and provider experience in specialty care, while continuing to manage affordability for the system – a combination we believe Evolent is uniquely positioned to deliver. In the time ahead we'll remain disciplined in capital allocation, prioritizing cash generation and debt paydown. I am proud of our recent progress and I believe that our strong pipeline, low market penetration, innovative product stack and highly engaged team of 4,500 professionals, positions Evolent to deliver sustained value to our shareholders, partners and members in the short and long term."

Company Overview

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Sales Growth

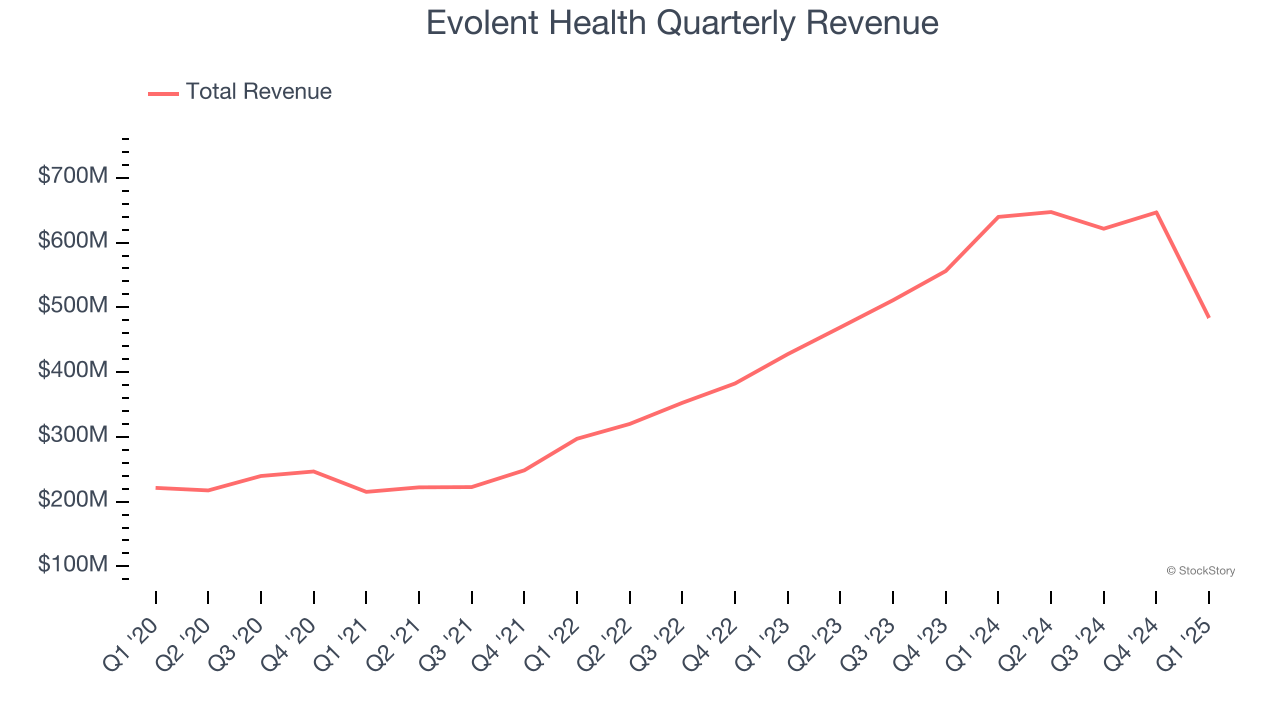

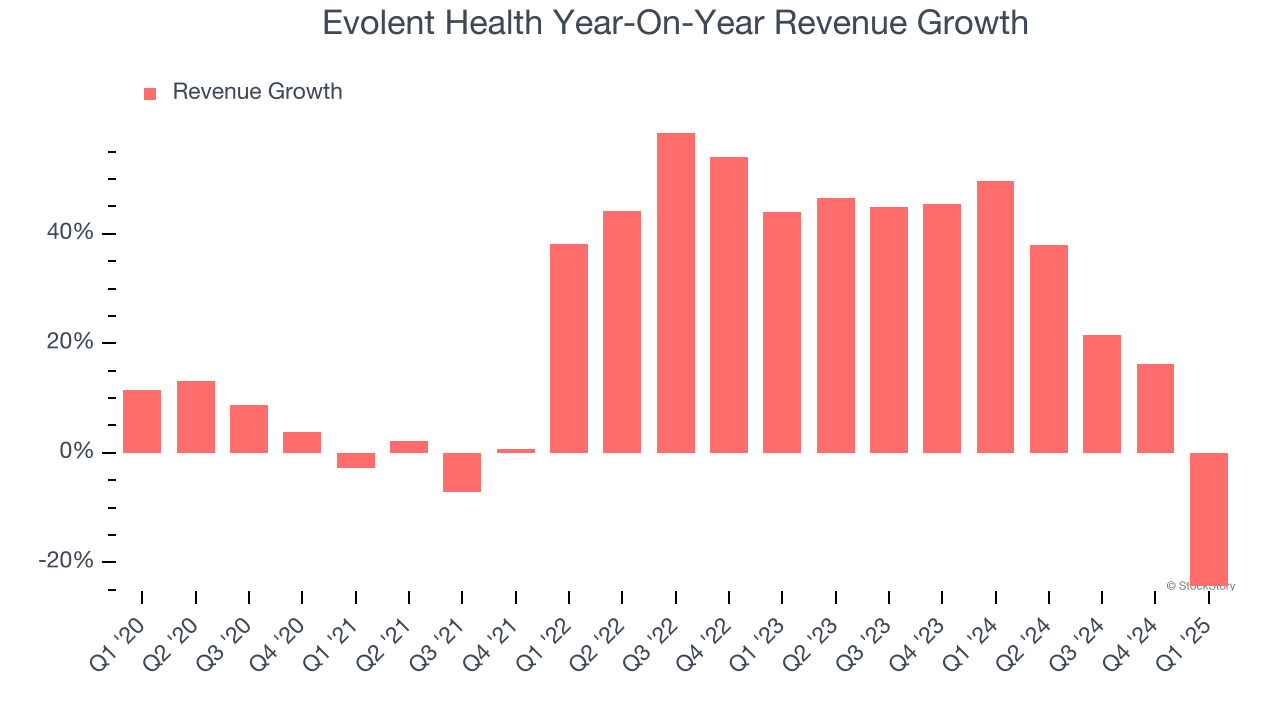

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Evolent Health grew its sales at an excellent 22.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Evolent Health’s annualized revenue growth of 27.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

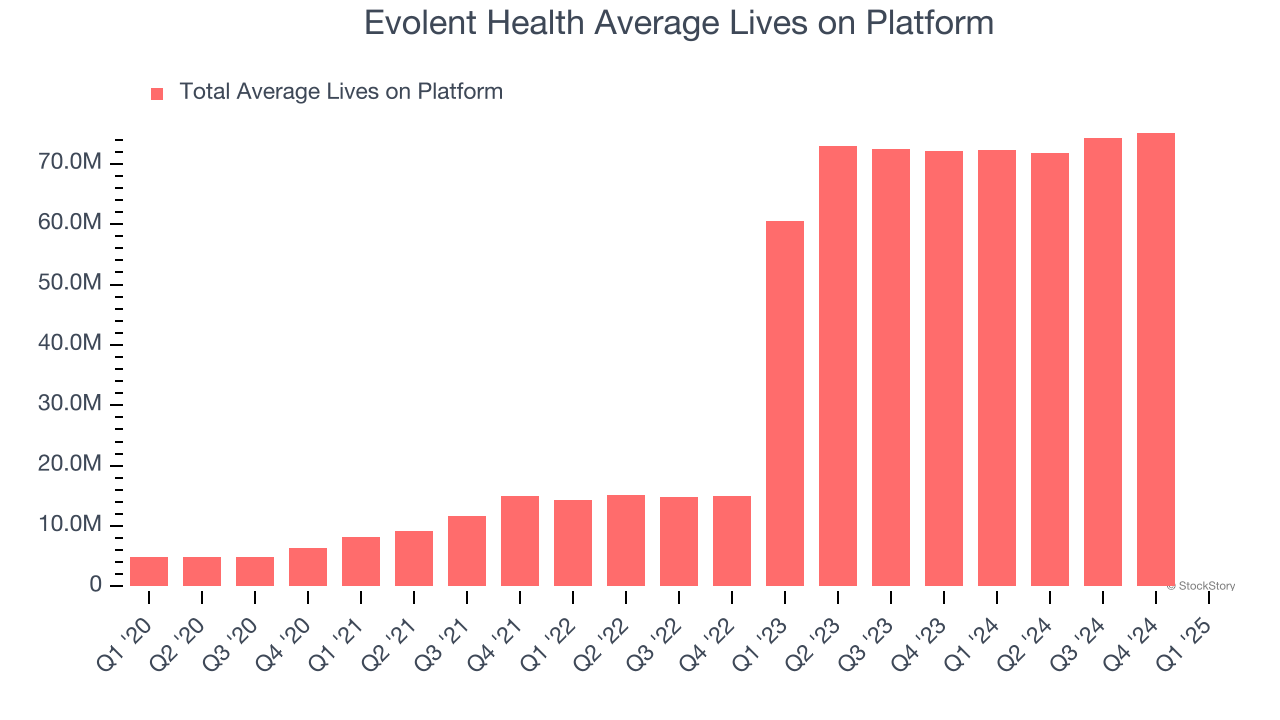

We can dig further into the company’s revenue dynamics by analyzing its number of average lives on platform, which reached 77,079 in the latest quarter. Over the last two years, Evolent Health’s average lives on platform averaged 134% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Evolent Health’s revenue fell by 24.4% year on year to $483.6 million but beat Wall Street’s estimates by 4.9%. Company management is currently guiding for a 29.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 8.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

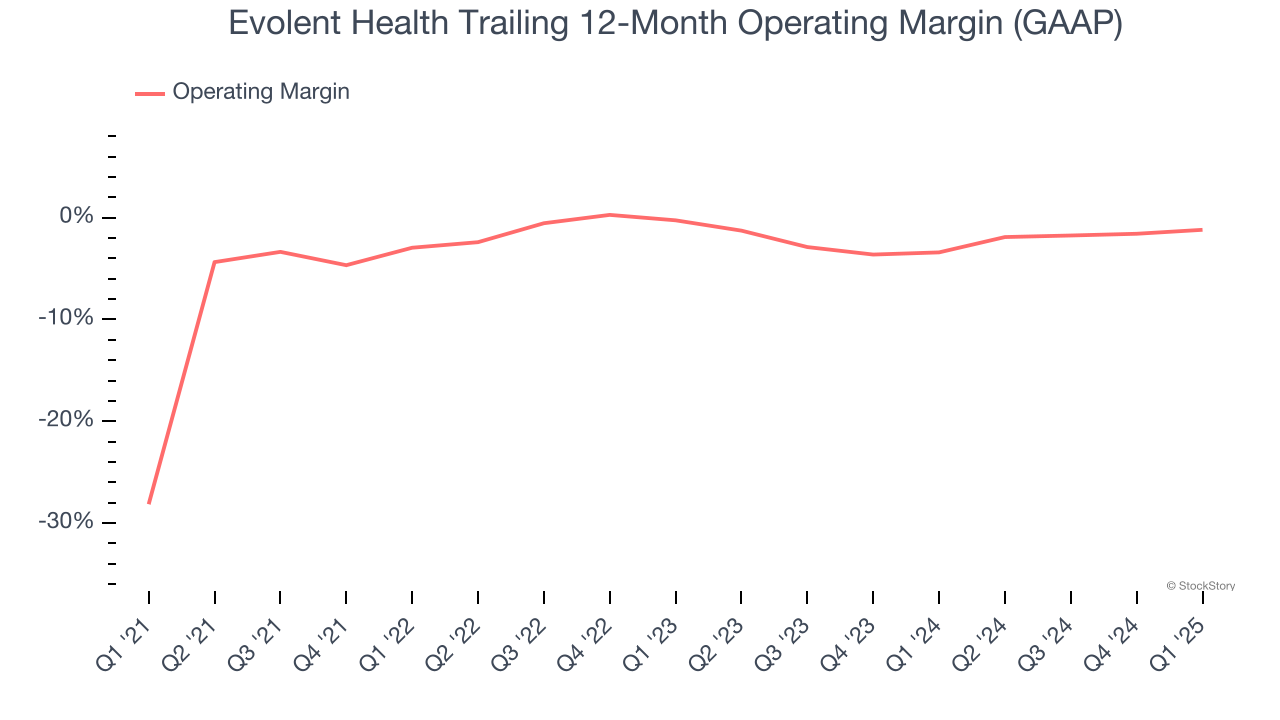

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Although Evolent Health broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Evolent Health’s operating margin rose by 26.9 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its past improvements as the company’s margin was relatively unchanged on two-year basis.

Evolent Health’s operating margin was negative 0.3% this quarter. The company's consistent lack of profits raise a flag.

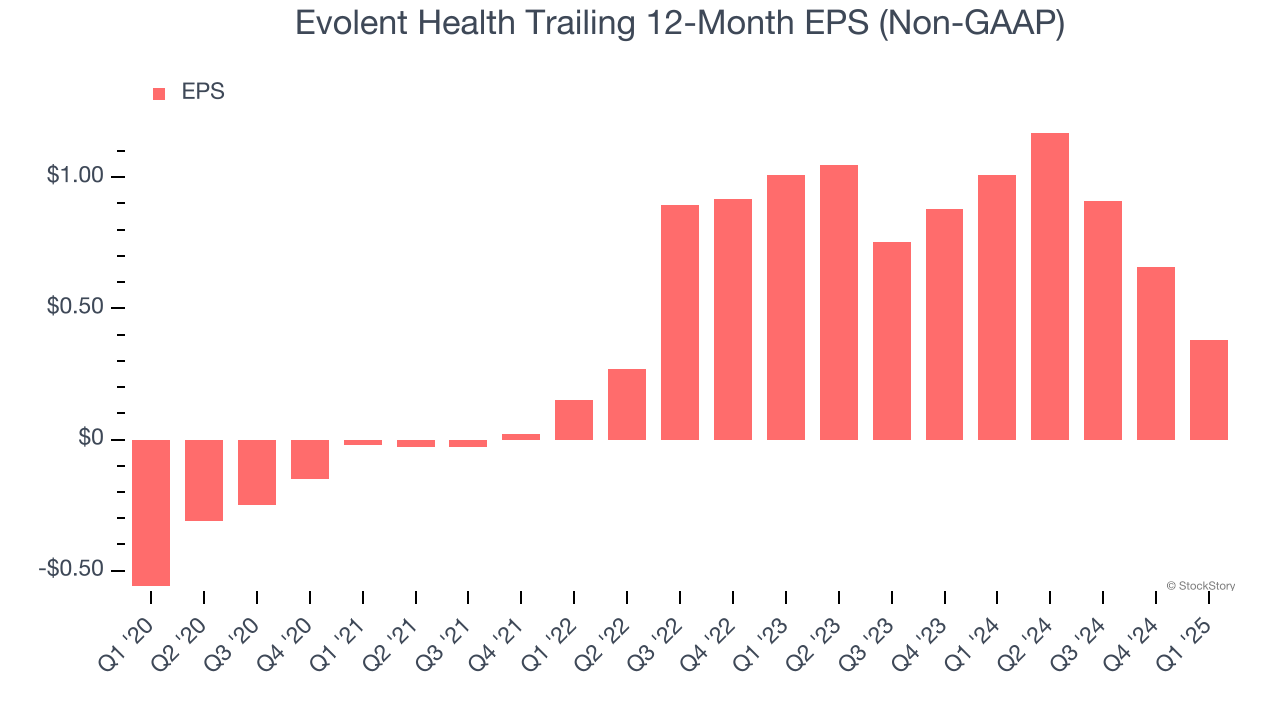

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Evolent Health’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Evolent Health reported EPS at $0.06, down from $0.34 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Evolent Health’s full-year EPS of $0.38 to grow 46.3%.

Key Takeaways from Evolent Health’s Q1 Results

We enjoyed seeing Evolent Health beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $10.72 immediately following the results.

Evolent Health’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.