Expedia trades at $171.01 per share and has stayed right on track with the overall market, losing 7.4% over the last six months while the S&P 500 is down 2.5%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Expedia, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Expedia Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid EXPE and a stock we'd rather own.

1. Customer Spending Decreases, Engagement Falling?

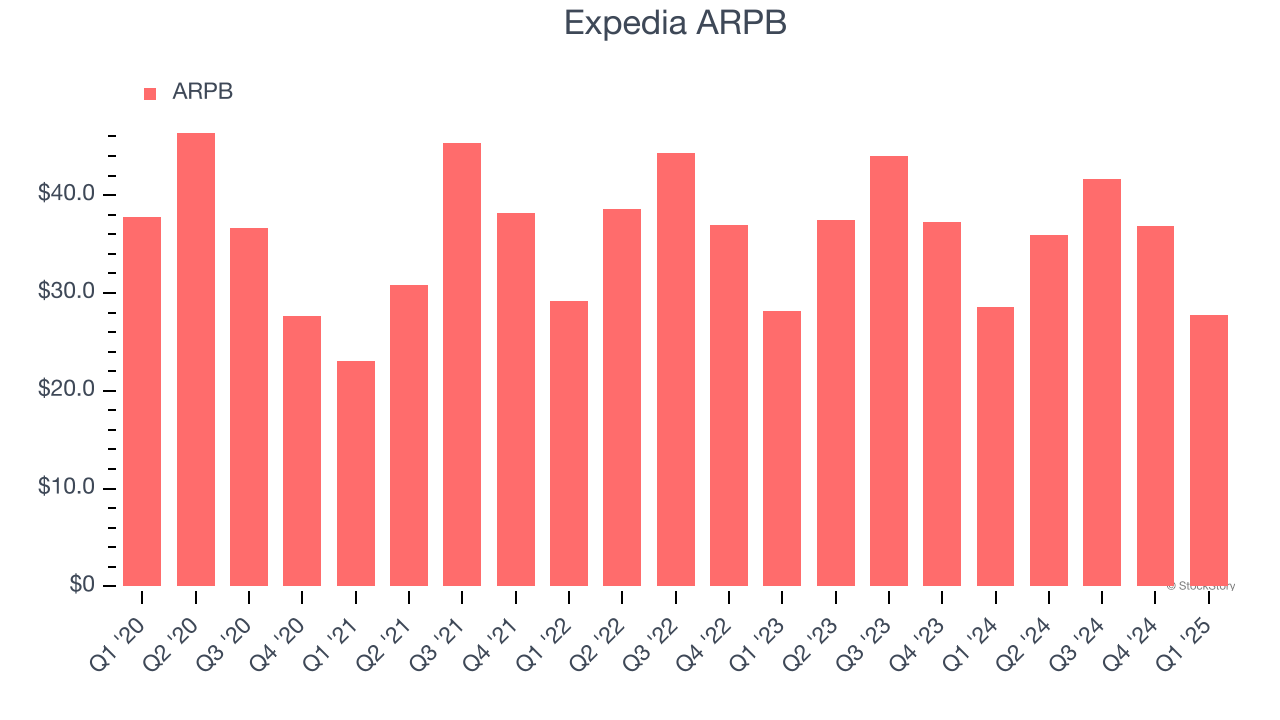

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia’s ARPB fell over the last two years, averaging 1.8% annual declines. This isn’t great, but the increase in room nights booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Expedia tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

2. Poor Marketing Efficiency Drains Profits

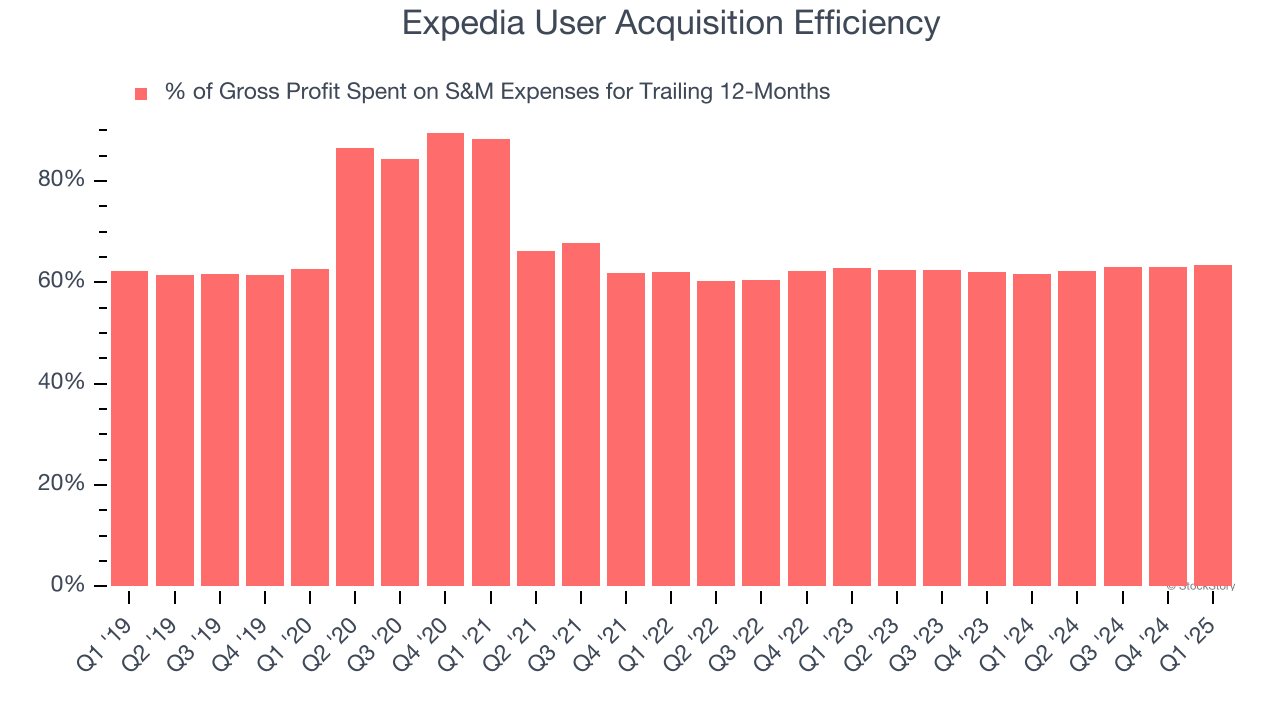

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Expedia grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for Expedia to acquire new users as the company has spent 63.5% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Expedia and its peers.

3. Free Cash Flow Margin Dropping

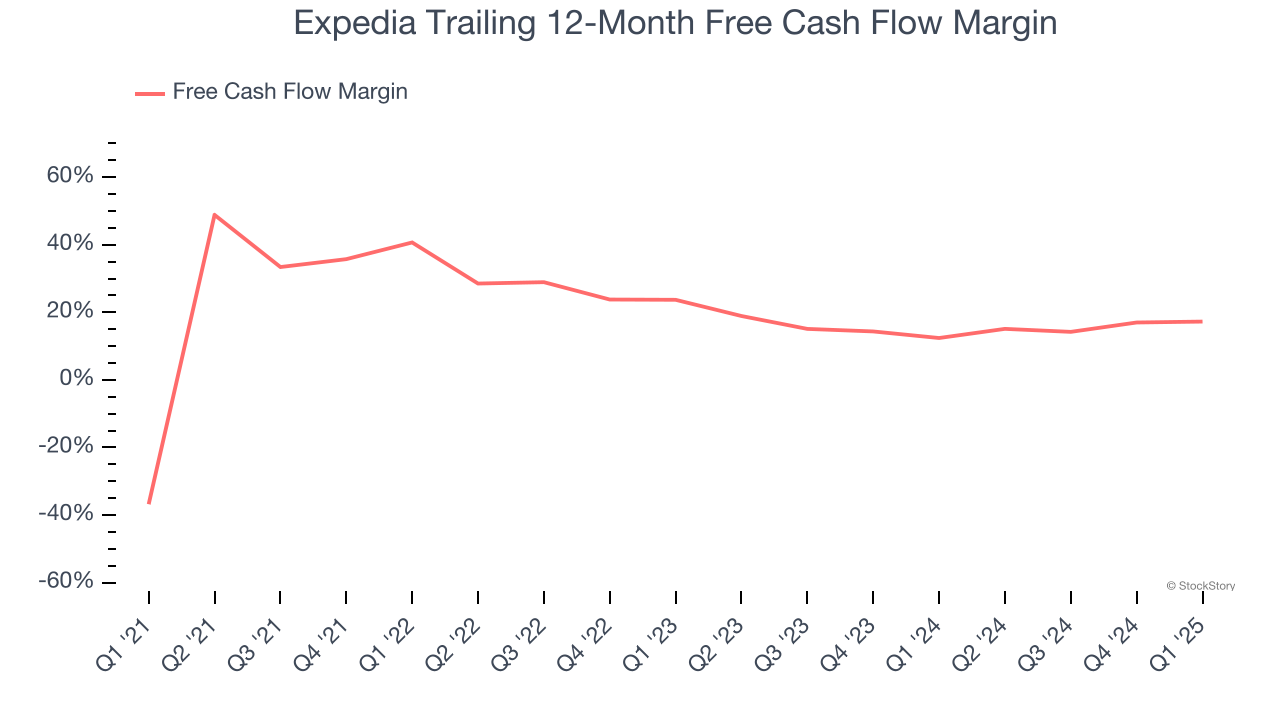

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Expedia’s margin dropped by 23.4 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Expedia’s free cash flow margin for the trailing 12 months was 17.3%.

Final Judgment

Expedia isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 6.8× forward EV/EBITDA (or $171.01 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Expedia

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.