While the broader market has struggled with the S&P 500 down 1.9% since November 2024, Skillz has surged ahead as its stock price has climbed by 10.7% to $6.31 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Skillz, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Skillz Will Underperform?

We’re happy investors have made money, but we're cautious about Skillz. Here are three reasons why we avoid SKLZ and a stock we'd rather own.

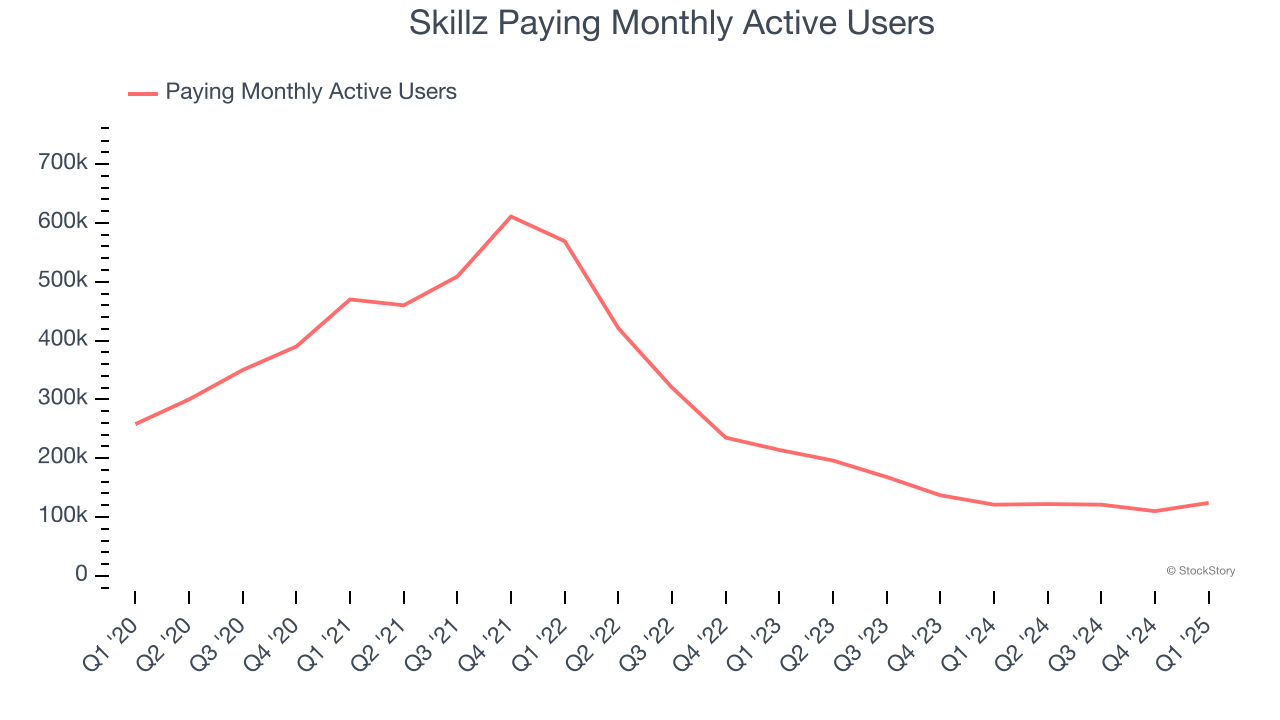

1. Declining Paying Monthly Active Users Reflect Product Weakness

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Skillz struggled with new customer acquisition over the last two years as its paying monthly active users have declined by 33.6% annually to 124,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Skillz wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

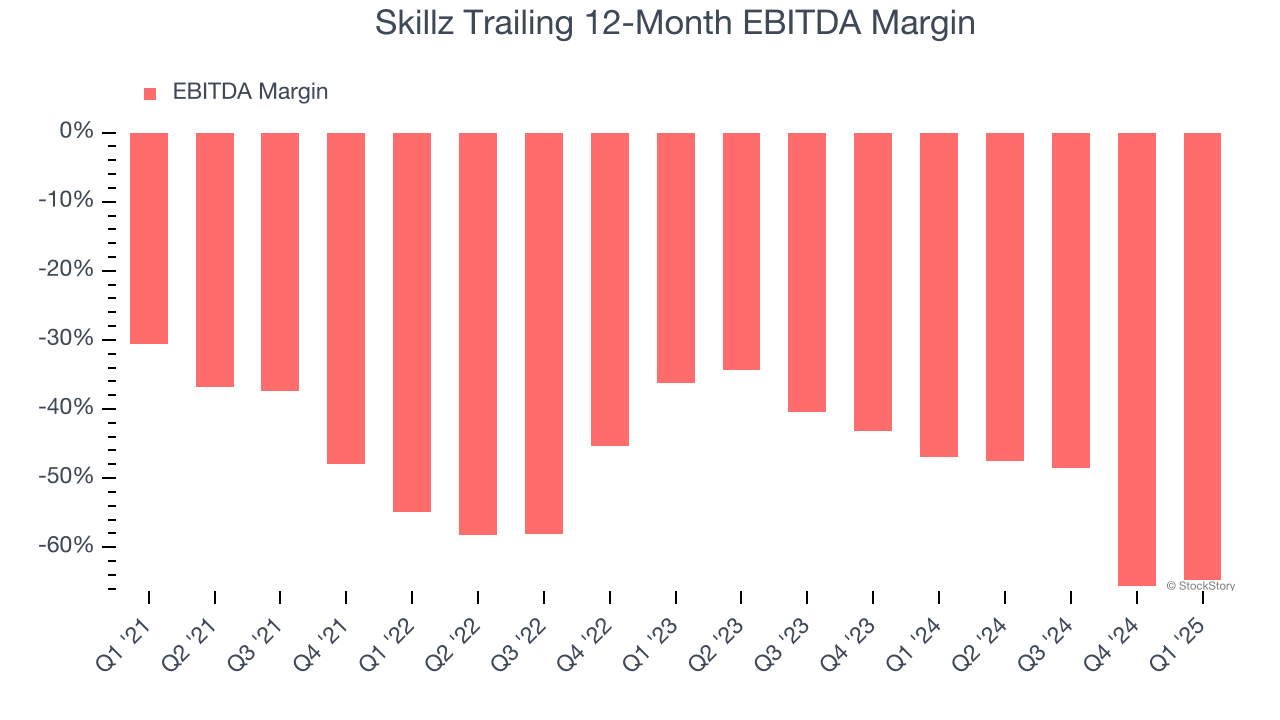

2. Operating Losses Sound the Alarms

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Skillz’s expensive cost structure has contributed to an average EBITDA margin of negative 54.3% over the last two years. Unprofitable consumer internet companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Skillz reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

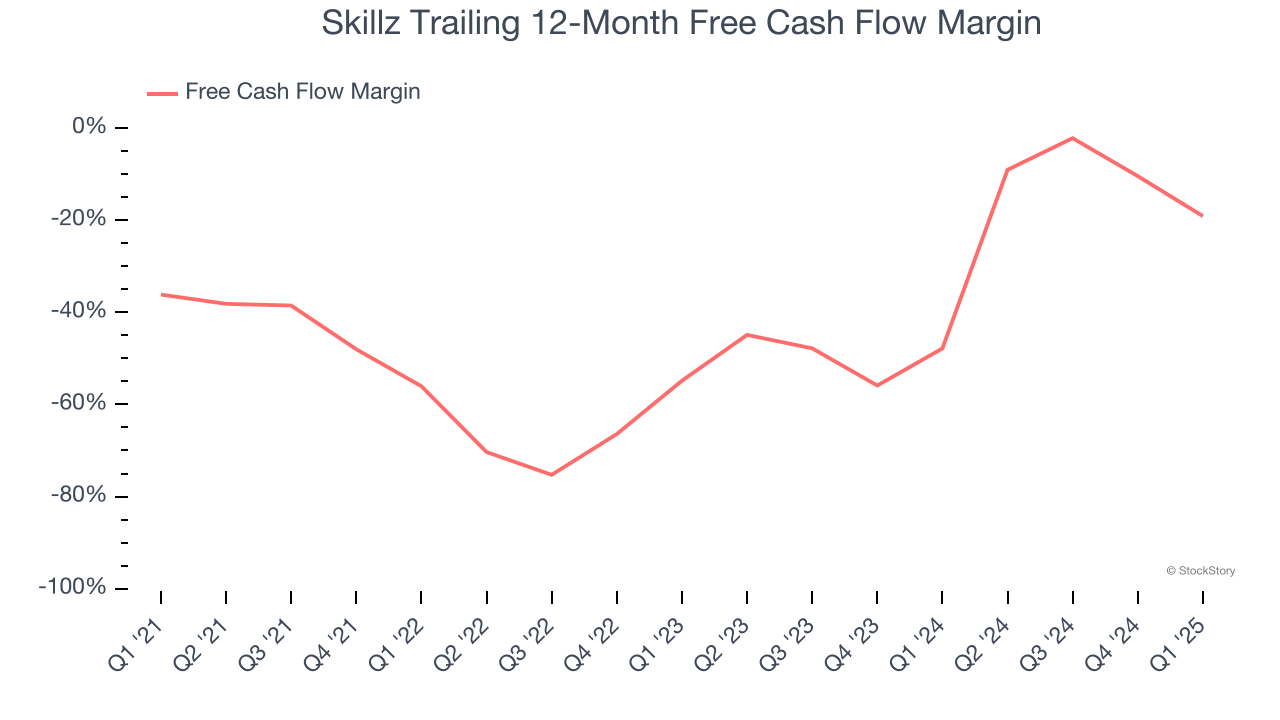

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Skillz’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 36%, meaning it lit $36.04 of cash on fire for every $100 in revenue.

Final Judgment

We see the value of companies helping consumers, but in the case of Skillz, we’re out. With its shares beating the market recently, the stock trades at 1.3× forward price-to-gross profit (or $6.31 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Skillz

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.