Itron trades at $108.58 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 10.4% while the S&P 500 is down 5.5%. This may have investors wondering how to approach the situation.

Given the weaker price action, is this a buying opportunity for ITRI? Find out in our full research report, it’s free.

Why Does Itron Spark Debate?

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ: ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Two Things to Like:

1. Outstanding Long-Term EPS Growth

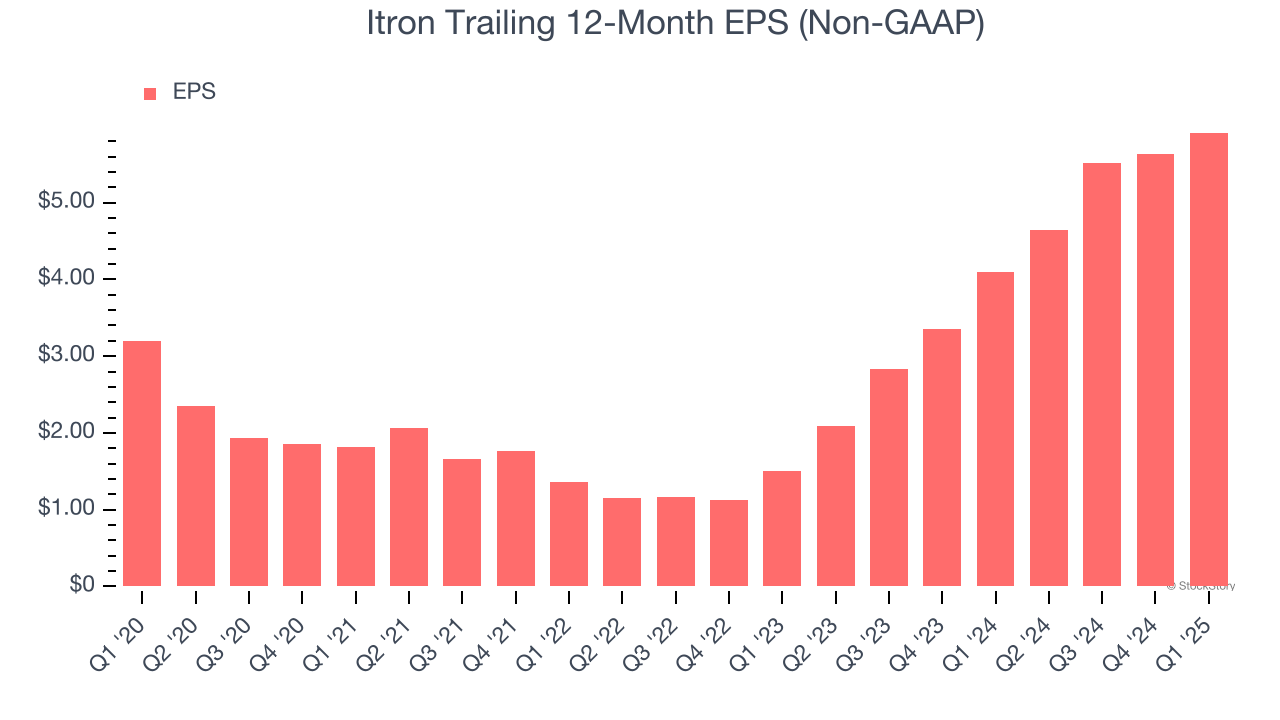

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Itron’s EPS grew at a remarkable 13.1% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

2. Increasing Free Cash Flow Margin Juices Financials

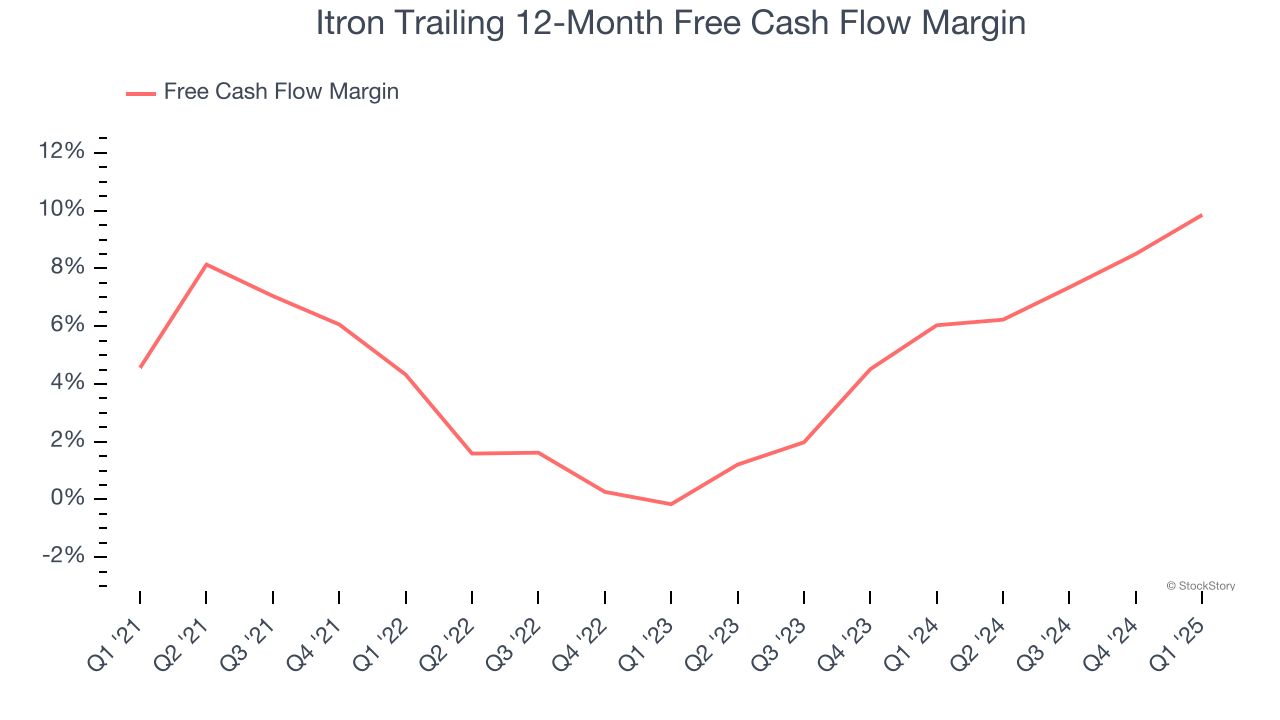

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Itron’s margin expanded by 5.3 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Itron’s free cash flow margin for the trailing 12 months was 9.9%.

One Reason to be Careful:

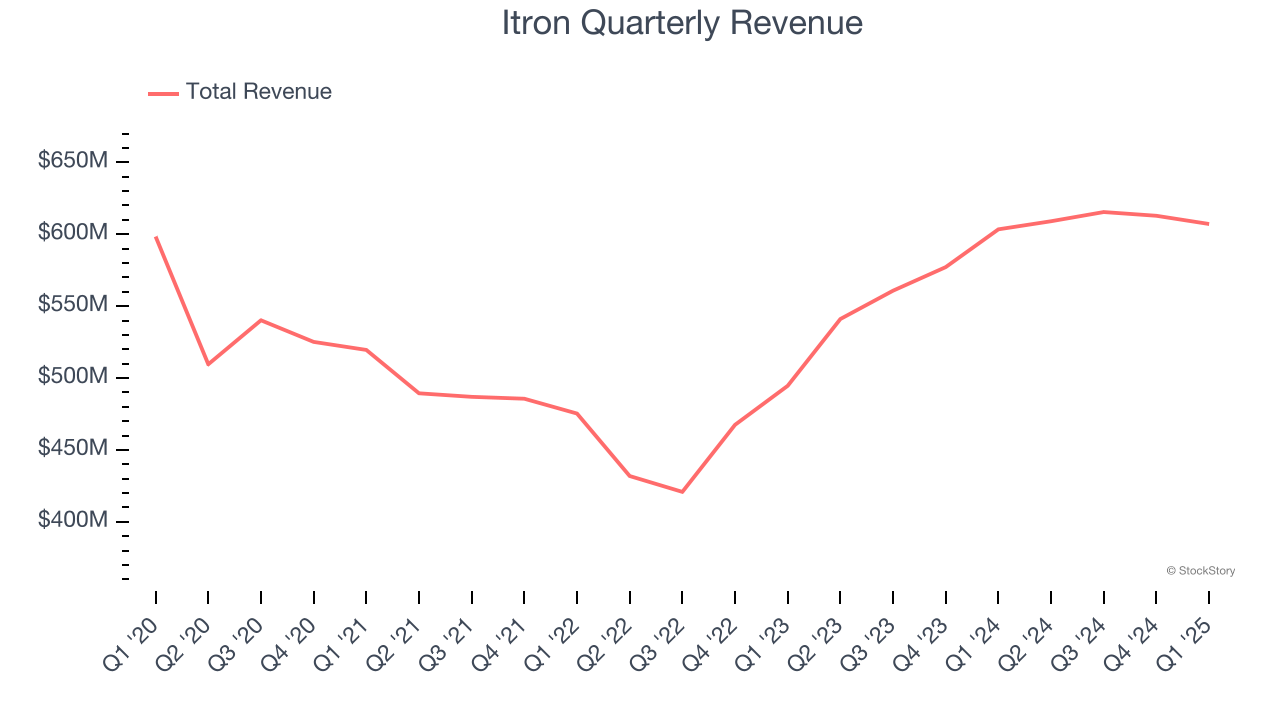

Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Itron struggled to consistently increase demand as its $2.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result, but there are still things to like about Itron.

Final Judgment

Itron’s merits more than compensate for its flaws. With the recent decline, the stock trades at 19.8× forward P/E (or $108.58 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.