Auto and industrial parts retailer Genuine Parts (NYSE: GPC) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.4% year on year to $5.87 billion. Its non-GAAP profit of $1.75 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy Genuine Parts? Find out by accessing our full research report, it’s free.

Genuine Parts (GPC) Q1 CY2025 Highlights:

- Revenue: $5.87 billion vs analyst estimates of $5.83 billion (1.4% year-on-year growth, 0.5% beat)

- Adjusted EPS: $1.75 vs analyst estimates of $1.68 (4.2% beat)

- Adjusted EBITDA: $564.2 million vs analyst estimates of $453.9 million (9.6% margin, 24.3% beat)

- Management reiterated its full-year Adjusted EPS guidance of $8 at the midpoint

- Operating Margin: 7.9%, up from 5.5% in the same quarter last year

- Free Cash Flow was -$160.7 million, down from $202.6 million in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $15.52 billion

"We had a solid start to 2025, despite the tariffs and trade dynamics that are impacting the operating landscape," said Will Stengel, President and Chief Executive Officer.

Company Overview

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $23.57 billion in revenue over the past 12 months, Genuine Parts is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To accelerate sales, Genuine Parts likely needs to optimize its pricing or lean into international expansion.

As you can see below, Genuine Parts’s sales grew at a sluggish 4.2% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Genuine Parts reported modest year-on-year revenue growth of 1.4% but beat Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, similar to its six-year rate. This projection is above average for the sector and suggests its newer products will help sustain its historical top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

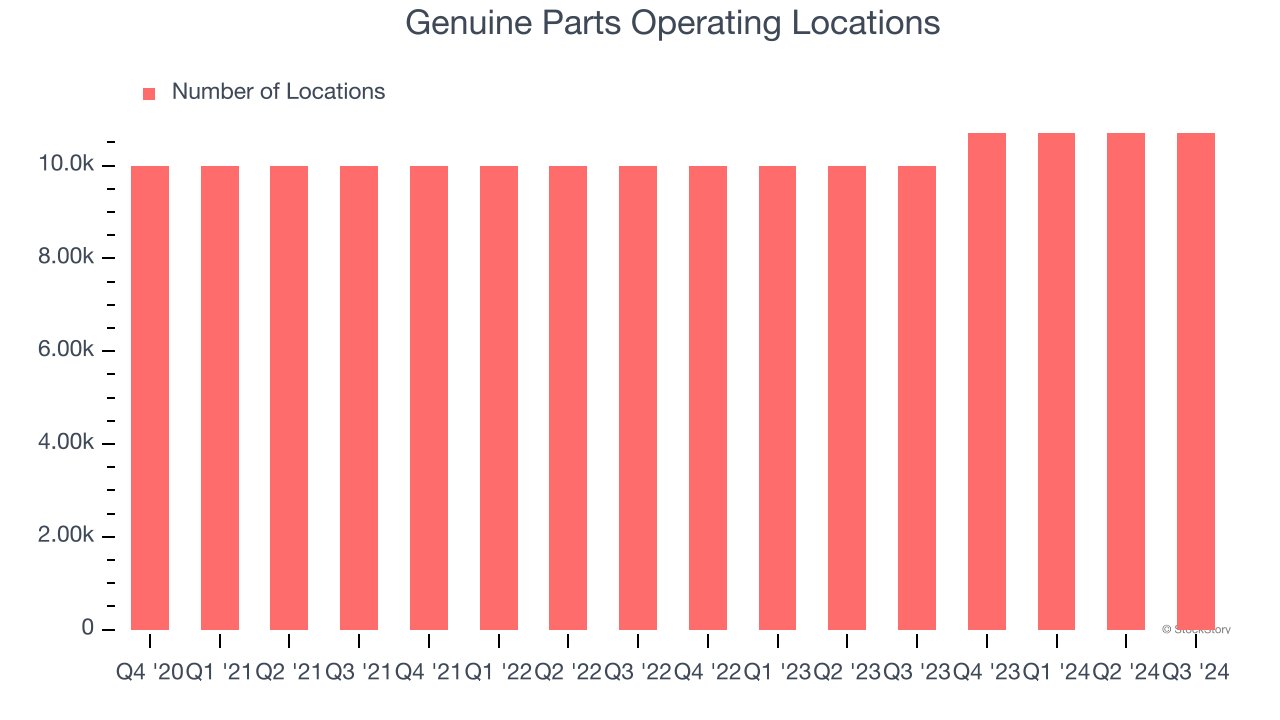

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Over the last two years, Genuine Parts opened new stores at a rapid clip by averaging 4.7% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Genuine Parts reports its store count intermittently, so some data points are missing in the chart below.

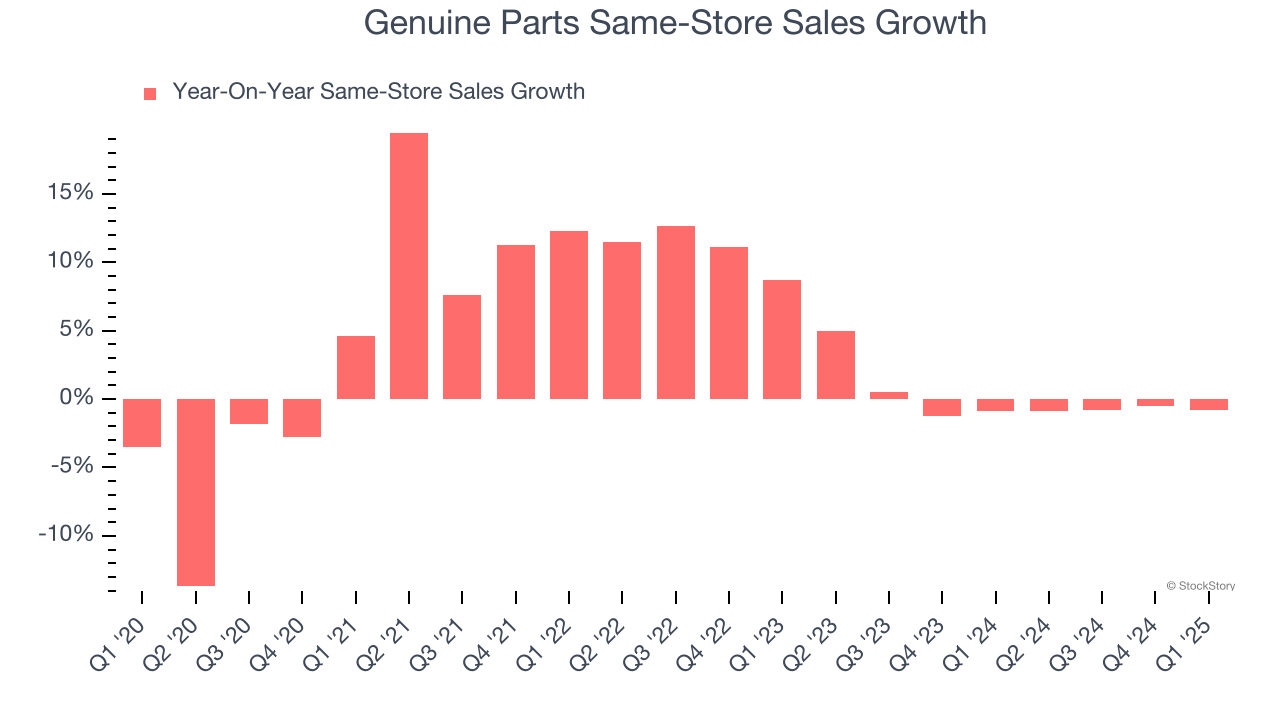

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Genuine Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Genuine Parts should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Genuine Parts’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Genuine Parts’s Q1 Results

We were impressed by how significantly Genuine Parts blew past analysts’ EBITDA expectations this quarter. We were also happy its gross margin outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.1% to $113 immediately following the results.

Sure, Genuine Parts had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.