Booking has been treading water for the past six months, recording a small return of 1.6% while holding steady at $4,447. However, the stock is beating the S&P 500’s 11% decline during that period.

Is there still a buying opportunity in BKNG, or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Is Booking a Good Business?

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

1. Room Nights Booked Skyrocket, Fueling Growth Opportunities

As an online travel company, Booking generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Booking’s room nights booked, a key performance metric for the company, increased by 13.6% annually to 261 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

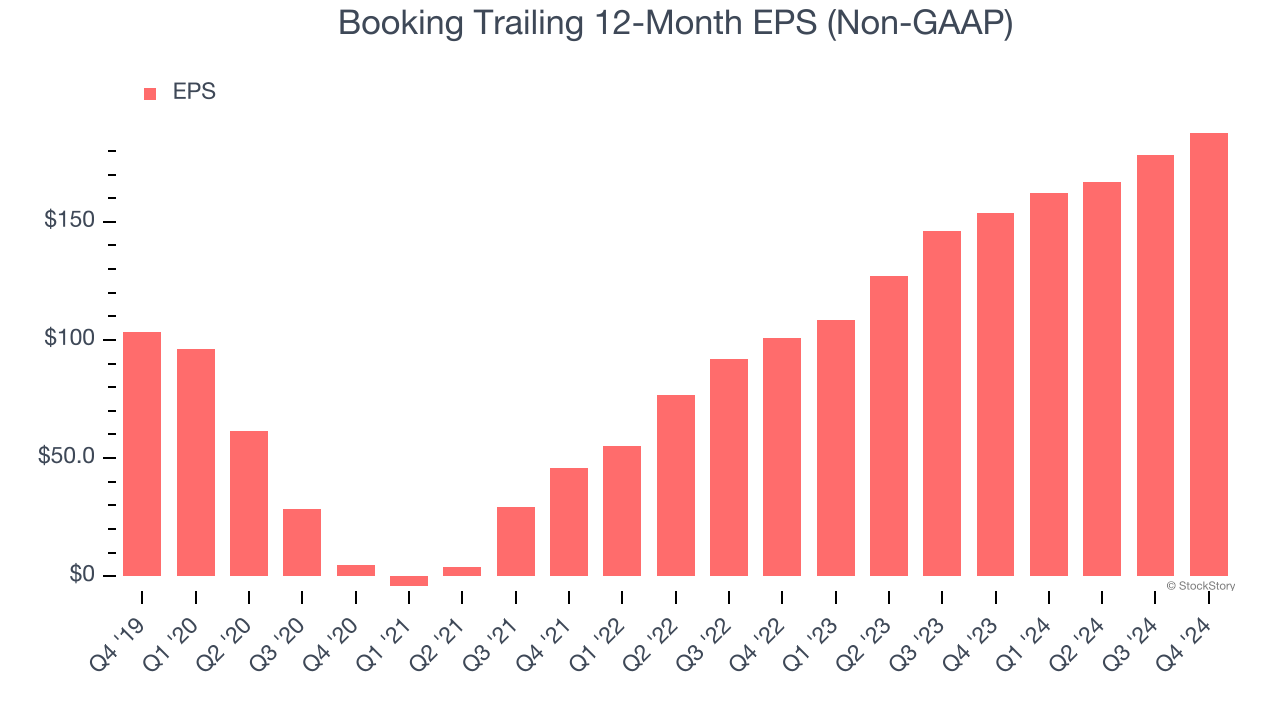

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Booking’s EPS grew at an astounding 60.1% compounded annual growth rate over the last three years, higher than its 29.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

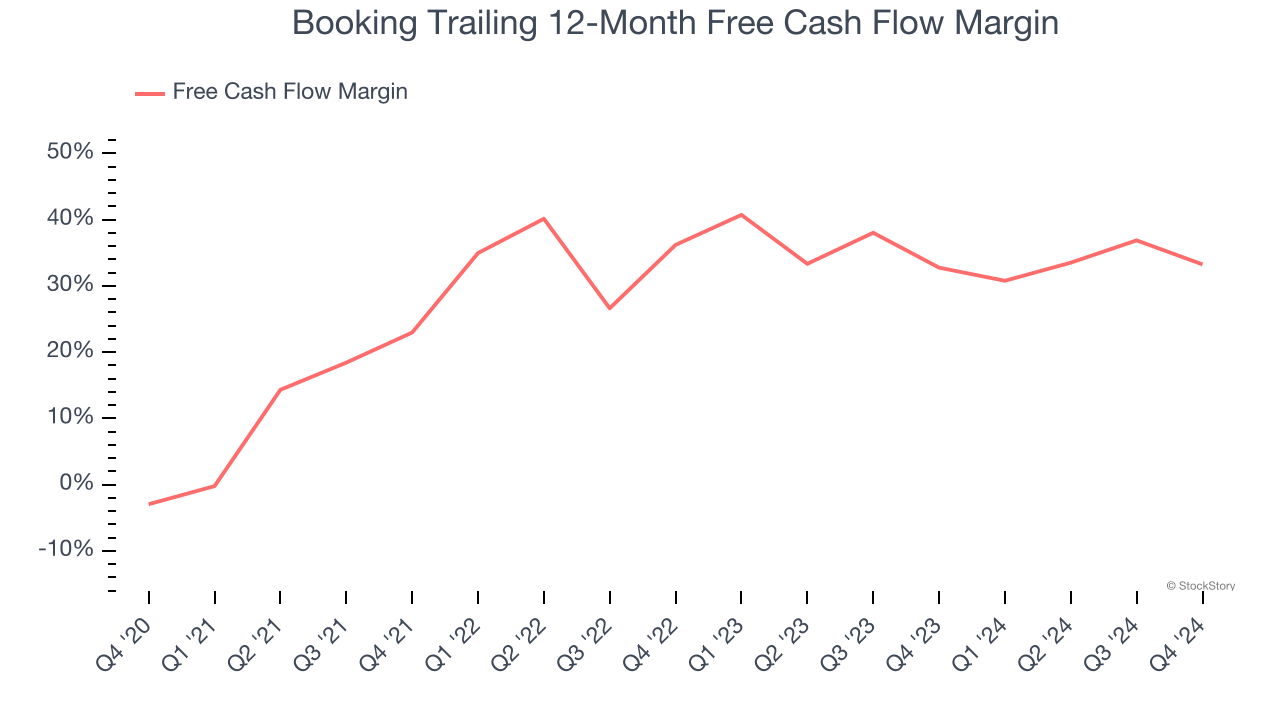

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Booking has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 33% over the last two years.

Final Judgment

These are just a few reasons why we think Booking is a high-quality business, and with its recent outperformance in a weaker market environment, the stock trades at 16.4× forward EV-to-EBITDA (or $4,447 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Booking

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.