Casino, tavern, and slot machine operator Golden Entertainment (NASDAQ: GDEN) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 4% year on year to $154.8 million. Its GAAP loss of $0.18 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Golden Entertainment? Find out by accessing our full research report, it’s free for active Edge members.

Golden Entertainment (GDEN) Q3 CY2025 Highlights:

- Revenue: $154.8 million vs analyst estimates of $156.8 million (4% year-on-year decline, 1.3% miss)

- EPS (GAAP): -$0.18 vs analyst estimates of -$0.04 (significant miss)

- Adjusted EBITDA: $30.48 million vs analyst estimates of $31.5 million (19.7% margin, 3.2% miss)

- Operating Margin: 0.6%, down from 4.2% in the same quarter last year

- Free Cash Flow Margin: 12.5%, up from 9.1% in the same quarter last year

- Market Capitalization: $555.3 million

Company Overview

Founded in 2001, Golden Entertainment (NASDAQ: GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

Revenue Growth

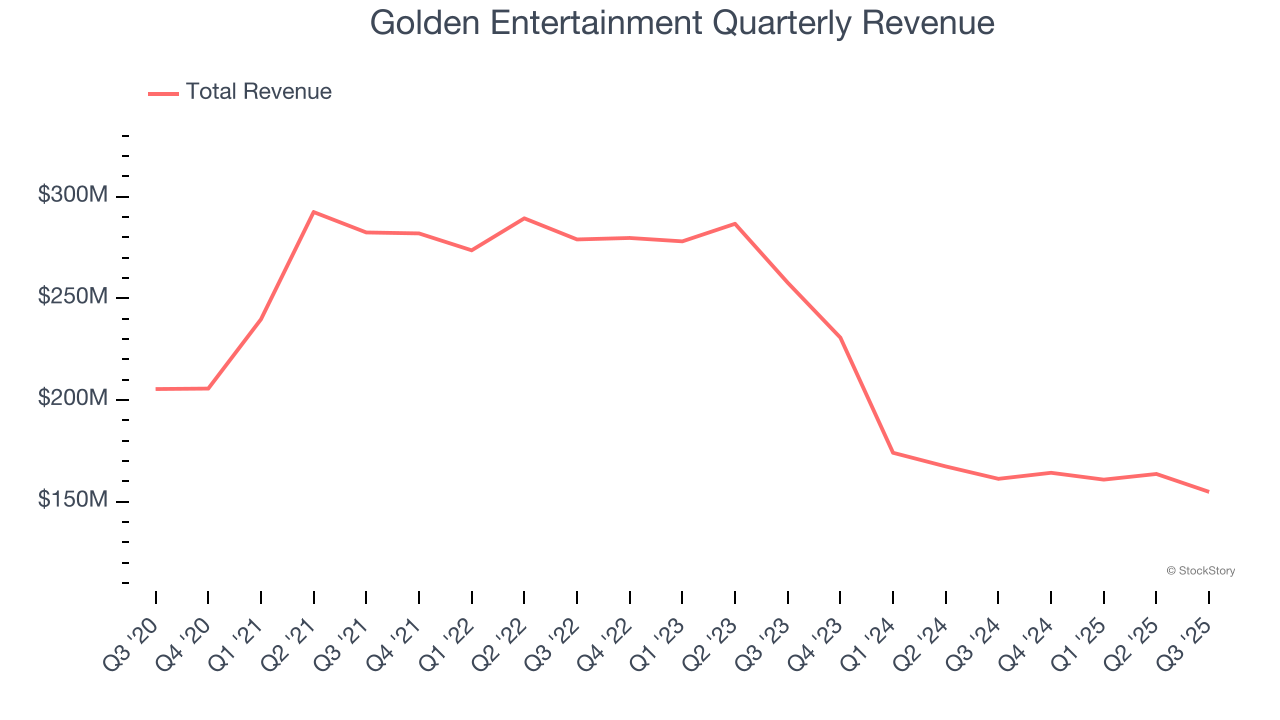

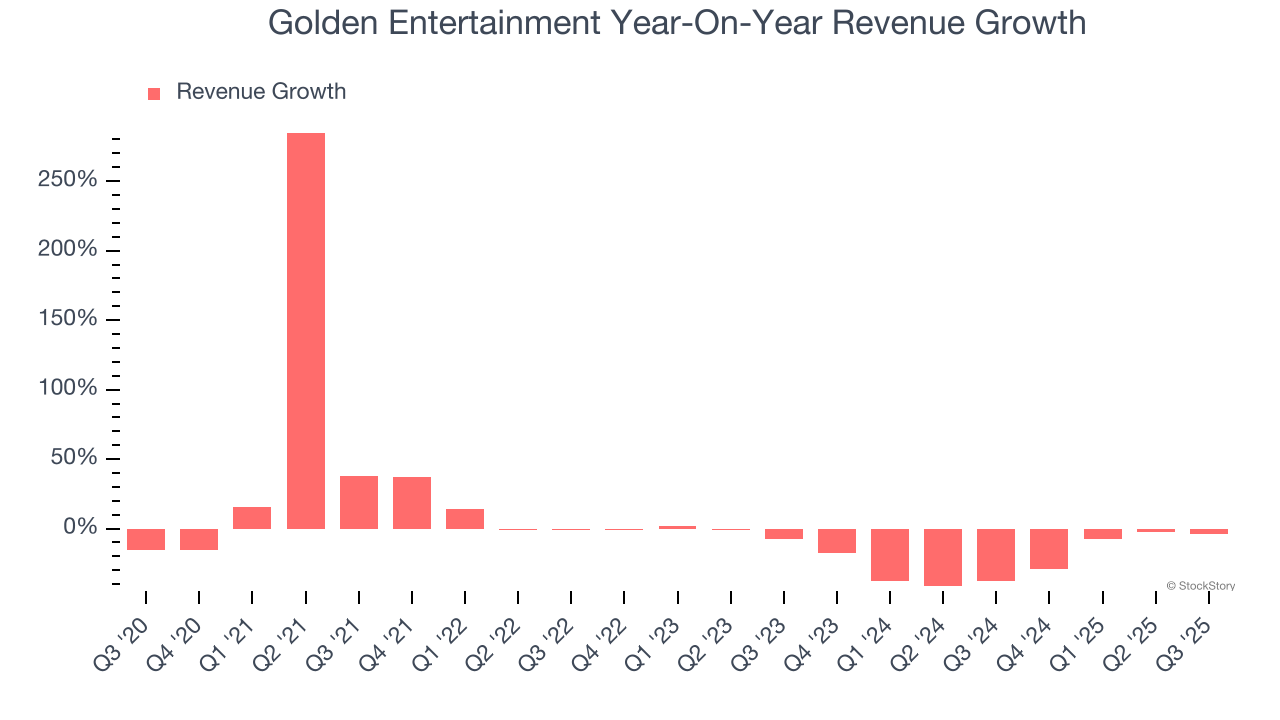

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Golden Entertainment struggled to consistently generate demand over the last five years as its sales dropped at a 2.5% annual rate. This was below our standards and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Golden Entertainment’s recent performance shows its demand remained suppressed as its revenue has declined by 23.6% annually over the last two years. Note that COVID hurt Golden Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

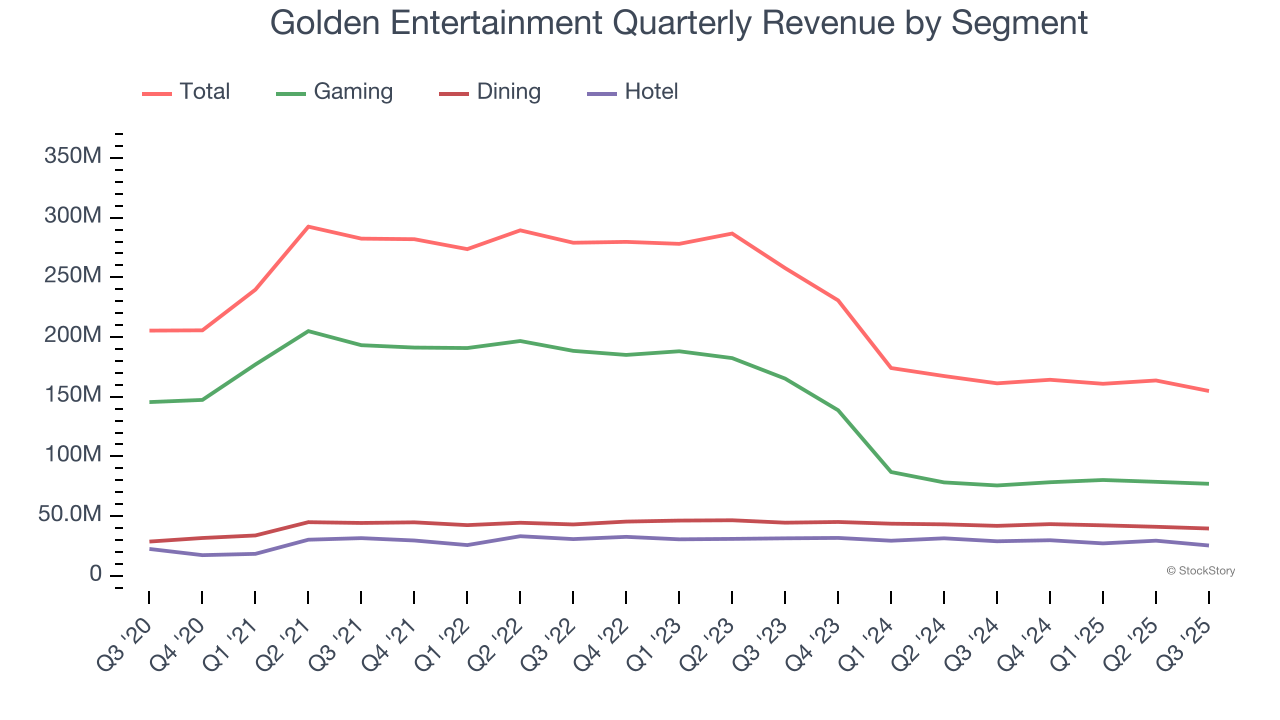

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Gaming, Dining, and Hotel, which are 49.8%, 25.6%, and 16.4% of revenue. Over the last two years, Golden Entertainment’s revenues in all three segments declined. Its Gaming revenue (Poker, Blackjack) averaged year-on-year decreases of 29.8% while its Dining (food and beverage) and Hotel (overnight stays) revenues averaged drops of 4.6% and 5.6%.

This quarter, Golden Entertainment missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $154.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

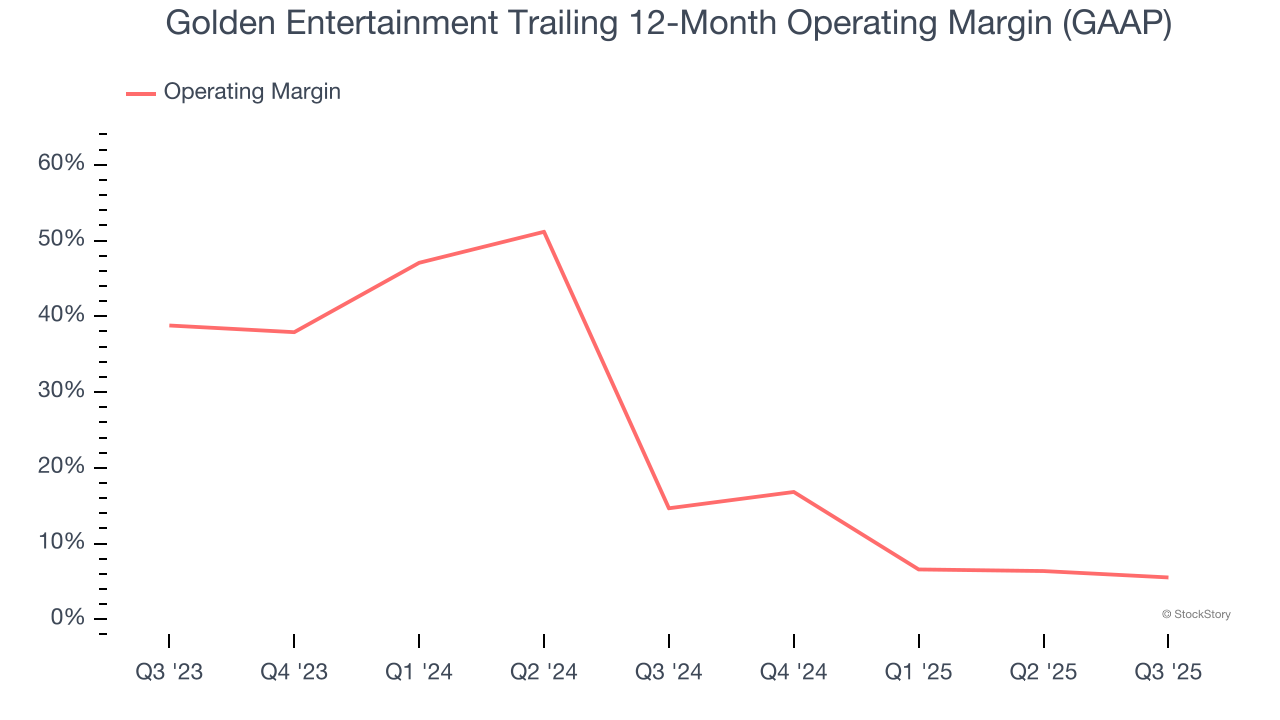

Golden Entertainment’s operating margin has shrunk over the last 12 months, but it still averaged 10.4% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

In Q3, Golden Entertainment’s breakeven margin was down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

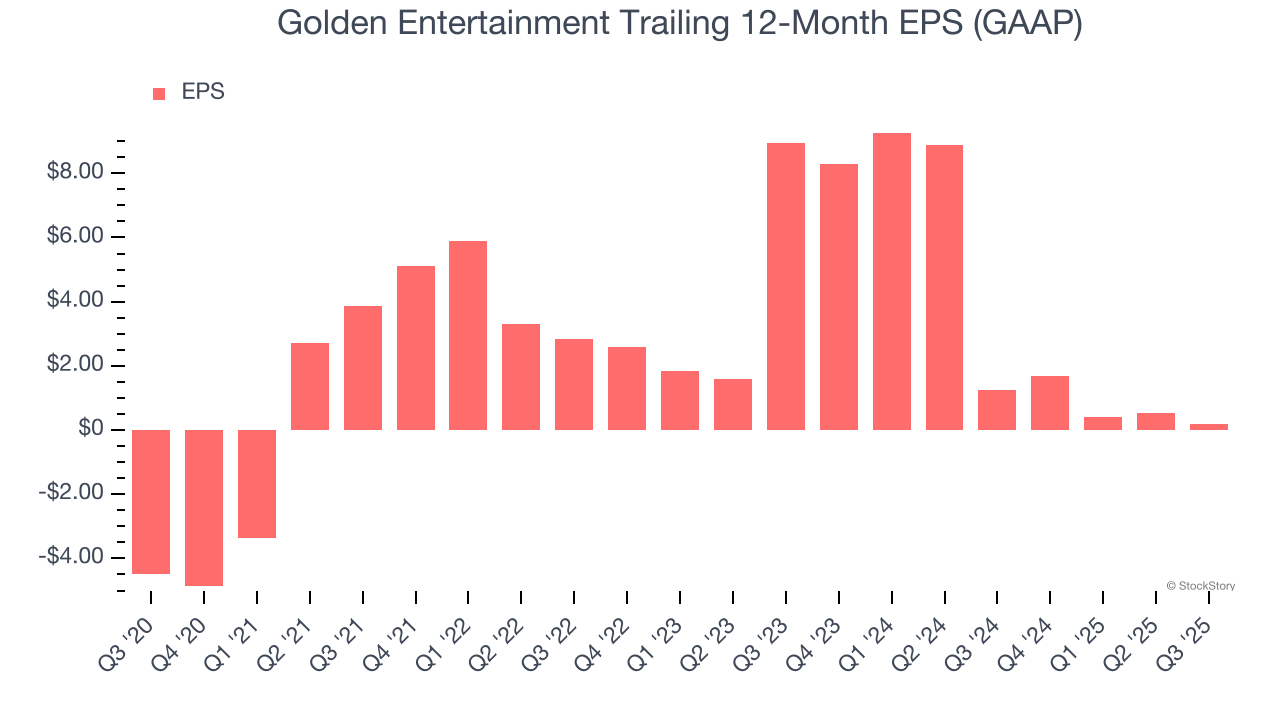

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Golden Entertainment’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Golden Entertainment reported EPS of negative $0.18, down from $0.18 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Golden Entertainment’s full-year EPS of $0.18 to grow 292%.

Key Takeaways from Golden Entertainment’s Q3 Results

It was good to see Golden Entertainment beat analysts’ Gaming revenue expectations this quarter. We were also happy its Dining revenue narrowly outperformed Wall Street’s estimates. On the other hand, its Hotel revenue missed and its adjusted operating income fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $28.52 immediately following the results.

Golden Entertainment didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.