Huron trades at $162.26 per share and has stayed right on track with the overall market, gaining 6.7% over the last six months. At the same time, the S&P 500 has returned 11.3%.

Is now the time to buy HURN? Find out in our full research report, it’s free for active Edge members.

Why Is Huron a Good Business?

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group (NASDAQ: HURN) is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

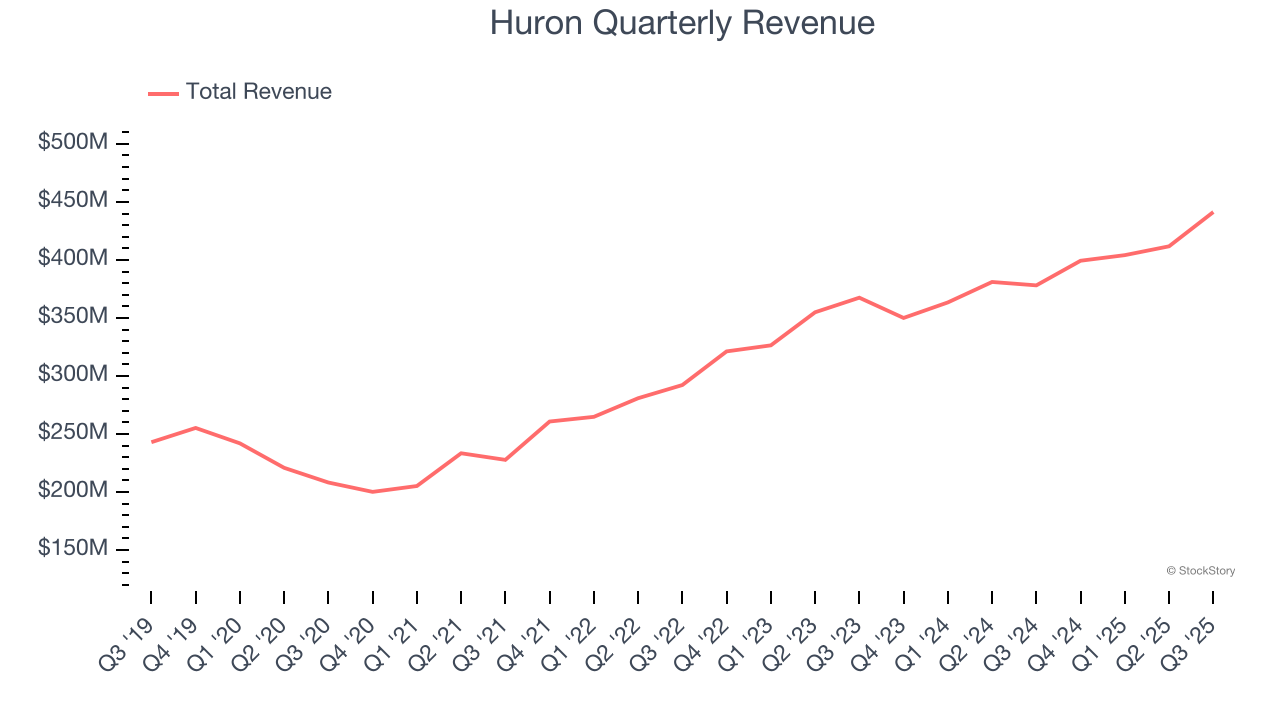

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Huron’s 12.3% annualized revenue growth over the last five years was excellent. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Huron’s EPS grew at an astounding 24.8% compounded annual growth rate over the last five years, higher than its 12.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

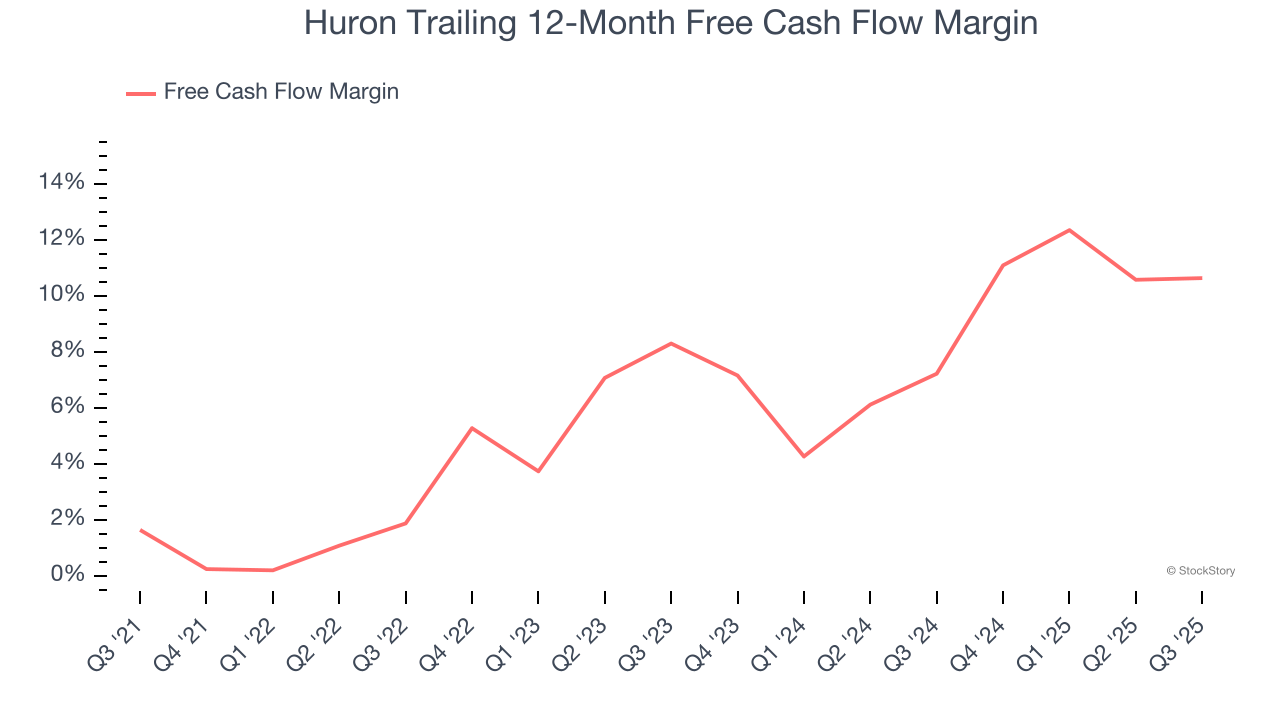

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Huron’s margin expanded by 9 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Huron’s free cash flow margin for the trailing 12 months was 10.6%.

Final Judgment

These are just a few reasons why we think Huron is a great business, but at $162.26 per share (or 19.7× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.