As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at financial exchanges & data stocks, starting with Morningstar (NASDAQ: MORN).

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 10 financial exchanges & data stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.9%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Morningstar (NASDAQ: MORN)

Founded in 1984 by Joe Mansueto with just $80,000 in personal savings, Morningstar (NASDAQ: MORN) provides independent investment data, research, and analysis tools that help investors, advisors, and institutions make informed financial decisions.

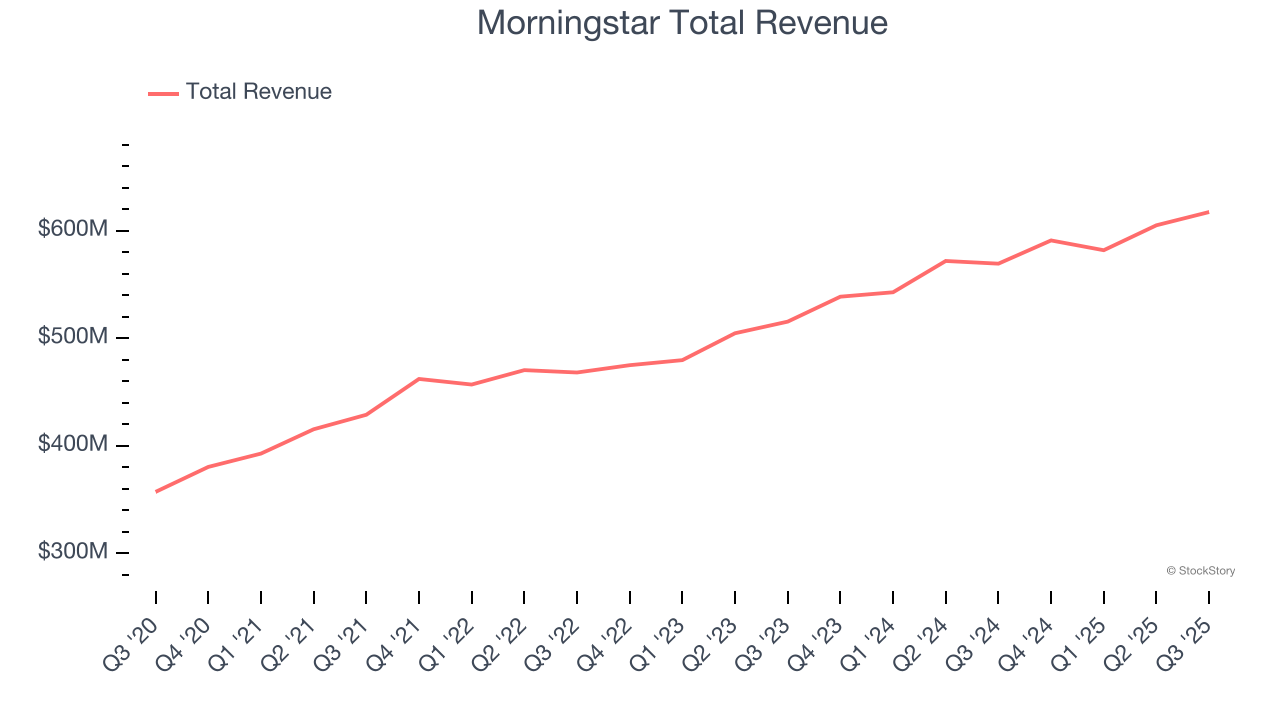

Morningstar reported revenues of $617.4 million, up 8.4% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ Transaction-Based segment estimates but a miss of analysts’ EPS estimates.

“Morningstar Credit delivered a standout quarter driven by strong performance across asset classes and regions, while Morningstar Direct Platform and PitchBook also contributed meaningfully to consolidated growth," said Kunal Kapoor, Morningstar's chief executive officer.

Interestingly, the stock is up 1.5% since reporting and currently trades at $212.02.

Is now the time to buy Morningstar? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Moody's (NYSE: MCO)

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE: MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

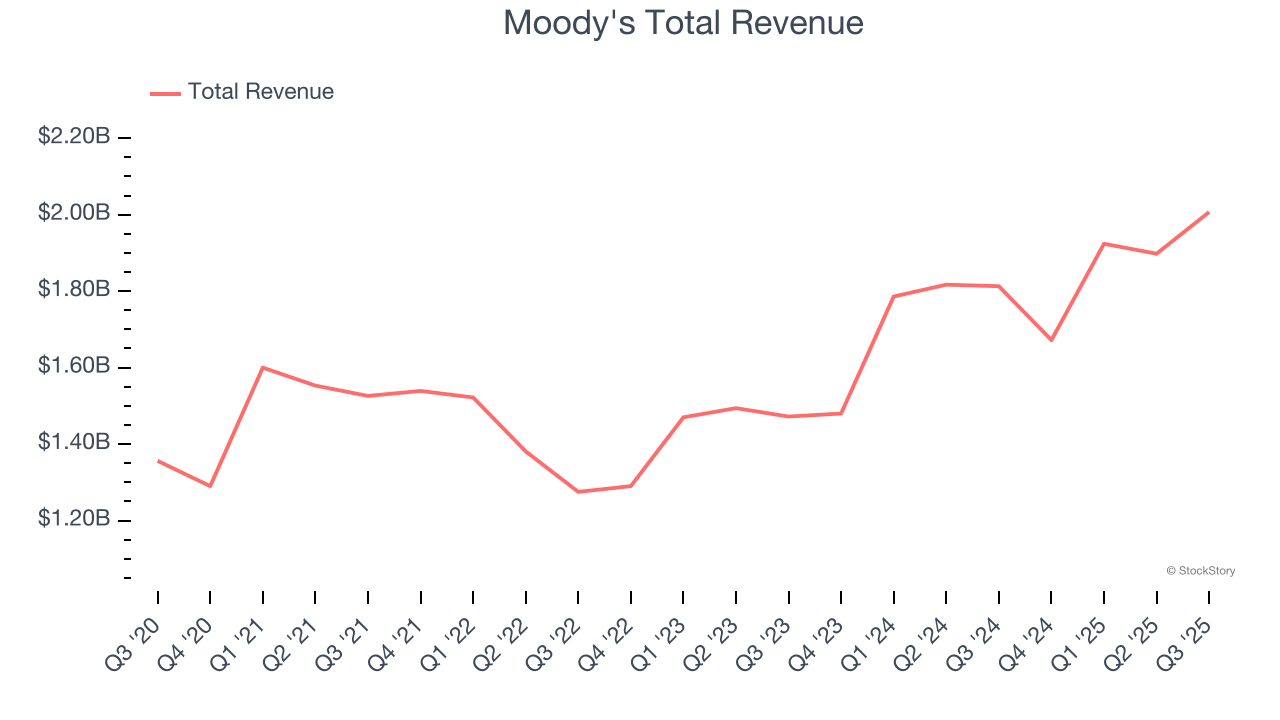

Moody's reported revenues of $2.01 billion, up 10.7% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with an impressive beat of analysts’ Investor Services segment estimates and a solid beat of analysts’ EBITDA estimates.

Moody's delivered the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $480.34.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: FactSet (NYSE: FDS)

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE: FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

FactSet reported revenues of $596.9 million, up 6.2% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted full-year EPS guidance meeting analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 18.1% since the results and currently trades at $275.26.

Read our full analysis of FactSet’s results here.

S&P Global (NYSE: SPGI)

Tracing its roots back to 1860 when it published the first railroad industry manual, S&P Global (NYSE: SPGI) provides credit ratings, market intelligence, commodity data, automotive analytics, and financial indices that help investors and businesses make decisions.

S&P Global reported revenues of $3.89 billion, up 8.8% year on year. This result beat analysts’ expectations by 1.1%. It was a strong quarter as it also produced an impressive beat of analysts’ Ratings segment estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 4.6% since reporting and currently trades at $494.64.

Read our full, actionable report on S&P Global here, it’s free for active Edge members.

MarketAxess (NASDAQ: MKTX)

Pioneering the shift from phone-based to electronic bond trading since 2000, MarketAxess (NASDAQ: MKTX) operates electronic trading platforms that enable institutional investors and broker-dealers to efficiently trade fixed-income securities like corporate and government bonds.

MarketAxess reported revenues of $208.8 million, up 1% year on year. This number topped analysts’ expectations by 0.7%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The stock is up 5.7% since reporting and currently trades at $175.13.

Read our full, actionable report on MarketAxess here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.