ChatGPT is a relatively new tool that’s taking the internet by storm. Essentially, it’s an artificial intelligence chatbot developed by OpenAI that launches in November 2022. In reality, this booming concept is only in its infancy – and with the ever-advancing artificial intelligence (AI) technology, it surely will only be in its infancy in terms of its potential. The mind-blowing concept of AI and its ability to learn and evolve has led to the revolutionary concept of ChatGPT. People are using it for everything from asking complex questions to asking for a detailed plan of their day to stick to. Lately, using it for investment has also reached the headlines. Below, we’ll look at whether using ChatGPT, and any other subsequent AI software, is the future of investment.

How Does Chat GPT Work?

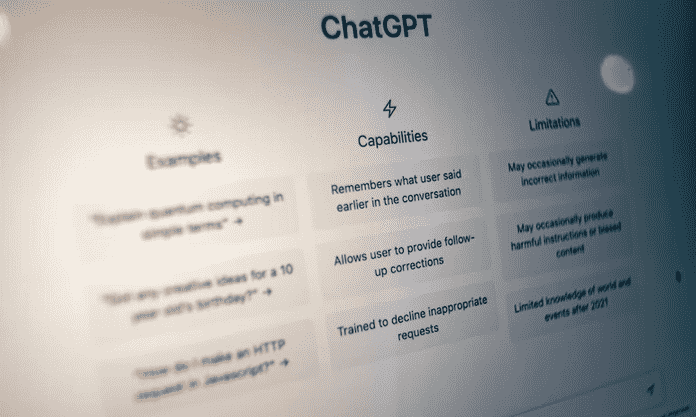

ChatGPT is a massive language model that works by using deep learning algorithms to understand and generate human-like text. Specifically, ChatGPT is based on the GPT-3.5 architecture, which is an advanced version of the GPT (Generative Pre-trained Transformer) family of language models. Technically, you should be able to ask whether to invest in the Bitrise Token Price, for example, and it should provide you with the correct answer.

Developers have fine-tuned the model for specific tasks, such as answering questions or generating text in a particular style. During fine-tuning, the model uses training on a smaller dataset specific to the task at hand, allowing it to adapt its language generation abilities to the particular context of the task. For example, you can ask the model whether to invest in a specific cryptocurrency or give you a list of cryptocurrencies to invest in. The language generation will change based on the context of the task you’ve asked it to do.

When interacting with ChatGPT, the model uses its pre-trained language generation abilities and any task-specific fine-tuning to generate text responses based on your input. The model selects the most likely response based on the context of your input and the patterns it has learned from the pre-training and fine-tuning processes.

The Risks Of Relying On ChatGPT

Investments always have associated risks, but relying on artificial intelligence would seemingly amplify the risk. Relying on anyone’s advice can be risky because most investment markets are highly volatile and can crash within minutes, sometimes unpredictably. Yes, artificial intelligence, chatGPT included, is a highly advanced field of technology with astronomical potential, but there are numerous cautions to consider.

ChatGPT doesn’t account for your individual financial circumstances, investment goals, and risk tolerance, which are crucial factors to consider when making investment decisions. The responses are based on the data available at the time of training. Therefore, it may not have access to the latest market trends or news that could affect investment decisions. Additionally, it cannot predict unexpected events, such as natural disasters, pandemics, or political upheavals, which can significantly impact the market.

With that in mind, there’s also no guarantee of accuracy. ChatGPT’s responses are generated based on statistical probabilities and patterns, which may not always be accurate. While it can provide helpful insights, there is no guarantee that its responses will always be correct, and there is always a risk of error or bias.

The Concept Of Using Artificial Intelligence For Prediction

That’s not to say that the concept of using artificial intelligence for prediction isn’t intriguing. Perhaps, should we say, it’s the future of artificial intelligence prediction and its ability to understand various investment markets that we should be interested in. The concept of using artificial intelligence for prediction involves using algorithms and statistical models to analyze large sets of data and make predictions about future events or outcomes. Artificial intelligence (AI) can learn from the data that it consumes, identifies relevant patterns, and makes predictions based on findings.

While ChatGPT openly admits that it might not be accurate as many of the current learning models might be outdated, that’s not to say that the future of AI for prediction will stem from a learning model that’s constantly evolving and learning every second. That concept could become a new powerful model that can help amateur investors gain access to data they once found hard to divulge – simply asking AI what to invest in and getting a ligament and accurate answer in seconds is much easier than trying to understand never-ending data sets, terminology, and predictions.

New Software To Rival ChatGPT

ChatGPT conjured up a storm, with many brands now eager to create rival technology that promises to be better – Google is one of the latest. Bard, Google’s attempt at rivaling ChatGPT, launched recently and wants to be bigger and better. But is it better than the Microsoft-backed ChatGPT? That’s undecided. The release of Bard by Google is, however, indicative that companies are about to invest mass amounts of money into the rising AI technology.

Everyone knows about the power of artificial intelligence, but the release of trained models like ChatGPT is perhaps the most real-world access we’ve had to it. Currently, it would seem that AI technology in the realm of investment prediction carries a heavily weighted risk. In the future, however, it could bring many people closer to successful investments.

Featured Image: Unsplash

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube