Intuitive Machines (NASDAQ: LUNR) is a small-cap space stock that has one massively ambitious long-term goal among its priorities: helping to create human settlements on the moon. The company has over tripled in value this year, and analysts still see upside in the name. I’ll break down the company’s technology and why its shares jumped over 70% in two days last week.

Intuitive Machines Lands NASA Contract Worth Up to $4.8 Billion

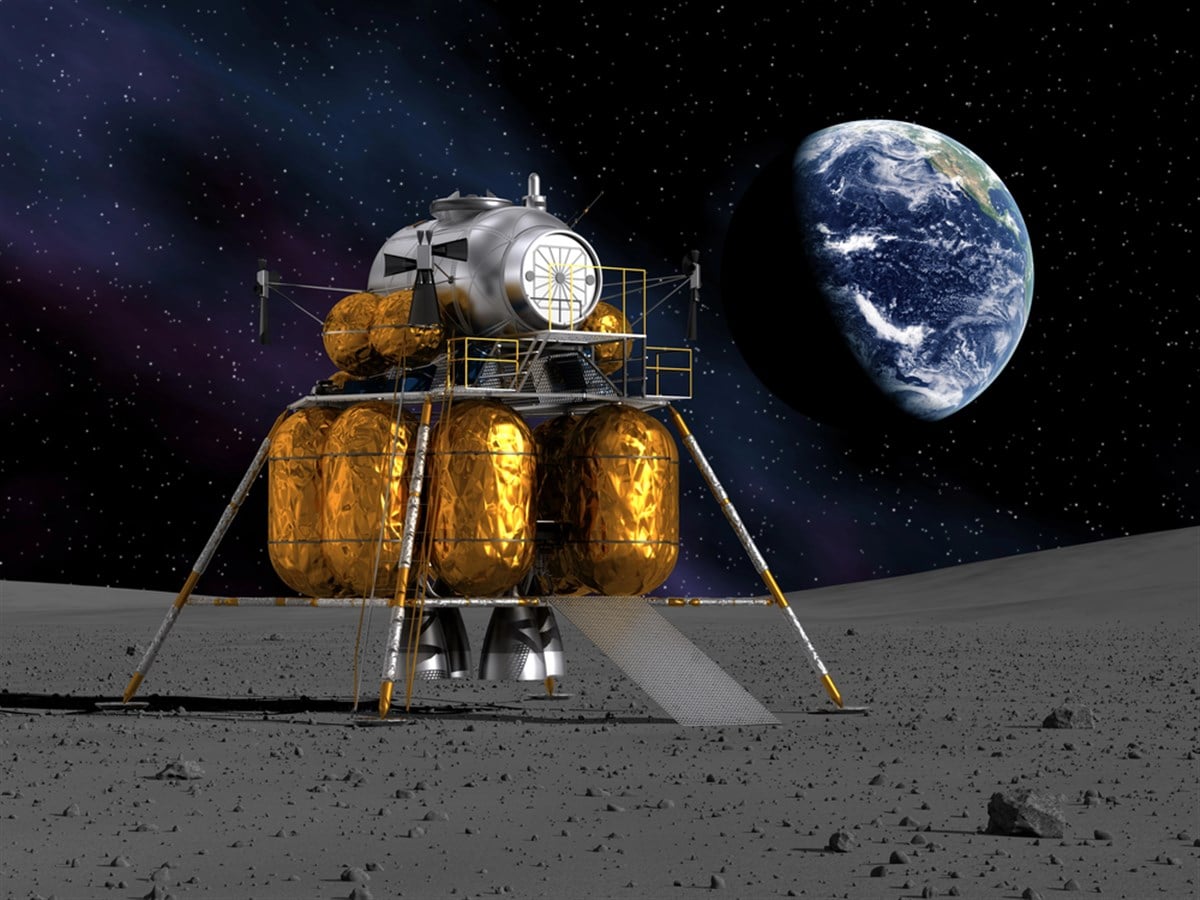

Intuitive Machines saw a massive spike in its shares last week due to an announcement that it secured a contract with NASA. The contract has a value of up to $4.8 billion. It’s part of NASA’s Artemis project, which aims to establish a sustainable presence on the Moon. Intuitive’s role will be to help provide lunar relay services.

These services will help enhance communications between technologies on the Moon and Earth. The company plans to put satellites in orbit around the Moon. These satellites will relay information from the Moon's surface to Earth and from systems beyond the Moon.

It's important to note that if the full value of this contract is awarded, it would be over 10 years through 2034. It will start off with an initial award of $150 million, which Intuitive can recognize as revenue over time after meeting milestones.

A long-term investment in a company like Intuitive Machines depends on whether inhabiting the Moon is a feasible project and whether government support for the idea will continue. A big positive is that NASA’s budget has been steadily increasing. Its budget was up 30% from 2013 to 2022 through both Democratic and Republican administrations. This shows some limit of political risk.

Intuitive Has Already Had Historical Success

Whether Intuitive Machines can beat out the competition is a key question. One big win the company has is the fact that its Odysseus lander was the first U.S. craft to softly land on the Moon since 1972. The fact that the landing took place is monumental alone, but its details show the capabilities of Intuitive Machines' technology.

Eric Berger at ARS Technica says the craft lost its ability to calculate its altitude from the Moon's surface about 12 minutes before landing. The company’s CEO said that the craft experienced 11 separate crises while in flight. The company's ability to land the craft after all these issues is a testament to Intuitive's technology and its employees' resourcefulness.

Another important factor is that customers who had their systems on the lander were able to receive much of the data they wanted. This preserves the incentive to pay the company for the service. The company said it expects to receive 95% of the award payments that the project was meant to receive.

NASA Keeps Putting More Trust in Intuitive’s Hands

It's important to note that Intuitive has a longstanding relationship with NASA. The company has been involved in the Artemis project since nearly its beginning in 2017. It was one of the nine companies to be a part of NASA’s Commercial Lunar Payload Services (CLPS) awards in 2018.

Since then, it has seemingly been winning new awards every year through NASA. Since 2021, these awards have been becoming exponentially larger. Its 2021 CLPS contract was worth $78 million. In 2023, it received another contract for $719 million. The newest $4.8 billion contract shows the progression in this relationship with NASA. Given this progression, it certainly feels possible Intuitive can keep gaining bigger contracts.

It has clearly garnered NASA's trust, influencing it to award the firm more dollars. Intuitive was the only firm to receive an award for these lunar relay technologies. This further proves NASA’s trust and shows Intuitive is differentiating itself from other firms.

It is also good to see that the company is winning contracts for different technologies, including landers and satellites. This shows it's not entirely dependent on one technology. It is also working on building lunar terrain vehicles.

However, this relationship cuts both ways. One of the biggest risks with Intuitive is its strong reliance on NASA contracts. Such projects are still very costly and offer limited immediate profit incentives to private firms. Thus, government support for these projects is essential for their viability. Losing favor with NASA could be devasting to the company.

Overall, Wall Street remains bullish on Intuitive. Five analysts rate the stock as a Buy, and the implied upside from the average price target is 32%.