- Industrywide 1 in 7 Powersports Customers Failed in their Attempt to Schedule Service

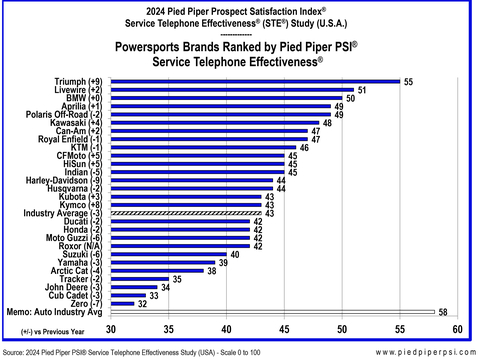

Triumph was ranked first of 27 powersports brands in Pied Piper’s 2024 PSI® Service Telephone Effectiveness® (STE®) Study, which measured the efficiency and quality of service telephone calls from a customer’s objective of quickly and easily setting up a service appointment. Following the Triumph dealers in the rankings were dealers who service Harley-Davidson’s electric Livewire brand, BMW, Aprilia and Polaris Off-Road.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240602434412/en/

Powersports Brands Ranked by 2024 Pied Piper PSI® Service Telephone Effectiveness® (STE®) Study (Graphic: Pied Piper)

“Well-run service departments focus on increasing customer loyalty, and the first service experience to drive that loyalty is a customer’s phone call to schedule an appointment,” said Fran O’Hagan, Pied Piper CEO. “Powersports customers who find scheduling service difficult vote with their feet by moving to another dealership or independent shop, or even getting rid of their vehicle.”

Brands with the greatest improvement from last year were Triumph, Kymco, CFMoto, HiSun and Kawasaki, all of whom improved their STE scores more than four points since last year’s study. The performance of 16 brands declined, including Harley-Davidson, Zero, Suzuki, Moto Guzzi and Indian.

Overall STE scores range from 0 to 100, and are calculated from a mix of individually weighted measurements that support the customer mission of quickly speaking with a service representative who can schedule a service appointment within a reasonable amount of time. 62% of the total score is determined by efficiency measurements, while 38% of the total score is determined by quality measurements.

One in seven (15%) of the study’s powersports customers hung up their phone having failed in their attempt to schedule service. Thirty three percent of the customers quickly accomplished their objective, speaking with a service advisor within one minute, and scheduling an appointment within one week. Thirteen percent of the powersports dealerships nationally went further, achieving STE scores over 70, by also providing a proactively helpful experience that went above and beyond the customer’s basic expectations.

Compared to last year, the national average STE score dropped three points, from 46 to 43. Powersports dealers in this year’s study were more likely on average to place customers on hold, less likely to give their name to the customer, less likely to ask for the customer’s contact information, and less likely to provide an estimate of how long the repair would take or what it would cost. However, dealers on average offered an earlier appointment, six days out on average compared to nine days out last year, and dealers were more likely on average to ask if there were any other services needed while the customer’s vehicle was in the shop.

Triumph, this year’s top scoring brand, improved their STE score by nine points over the previous year to achieve a score of 55, close to the automobile industry average STE score of 58. Triumph customers spoke with a service advisor within one minute and scheduled service within one week 47% of the time on average, compared to only 18 percent of the time last year. Similarly, last year Triumph customers waited on hold more than two minutes 24 percent of the time, which improved to only eight percent of the time this year.

Performance of each measurement varied by brand and dealership, and the following are examples of performance variation by brand:

-

“Mission Failure” How often did a customer hang up their phone having failed to schedule a service appointment?

- Less than 10% of the time on average: Polaris, Aprilia, Can-Am, Triumph

- More than 25% of the time on average: Tracker, Zero, Moto Guzzi, Indian, Ducati

-

“Mission Acceptable” How often was a customer able to speak with a service advisor within one minute and schedule a service appointment within one week?

- More than 40% of the time on average: Indian, Harley-Davidson, Triumph, Moto Guzzi, KTM

- Less than 20% of the time on average: Cub Cadet, John Deere, Zero, Arctic Cat

-

How many days out was the first available service appointment?

- Less than 5 days on average: KTM, Indian, Harley-Davidson, Roxor

- More than 9 days on average: Arctic Cat, Tracker, Kawasaki, Suzuki, Livewire

-

How often was a customer placed on hold for more than two minutes?

- Less than 5% of the time on average: Husqvarna, Cub Cadet, Kawasaki, Roxor, Polaris, BMW, Kubota, HiSun, Moto Guzzi

- More than 15% of the time on average: Tracker, Yamaha, Arctic Cat, Indian, KTM

-

How often was a customer asked if they were experiencing any other issues?

- More than 35% of the time on average: Triumph, Indian, John Deere, Arctic Cat, Kawasaki, Royal Enfield

- Less than 25% of the time on average: Tracker, Livewire, Harley-Davidson, Moto-Guzzi, Zero, Roxor, Cub Cadet

The first step toward improving the service telephone experience is to understand what is really happening when customers call, which is often a surprise. “The effort is worth it,” said O’Hagan. “Satisfied service customers are more likely to be long-time loyal customers not only for service work, but also when it's time to buy another vehicle.”

Pied Piper PSI industry studies have been conducted annually since 2007. The 2024 Pied Piper PSI®-STE® Powersports Study (U.S.A.) was conducted between October 2023 and April 2024 by phoning the service departments at 1,928 dealerships nationwide representing all major powersports brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps improve the omnichannel sales & service performance of retailers, by determining fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2024 Pied Piper PSI® Internet Lead Effectiveness (ILE®) Auto Industry Study (Nissan’s Infiniti brand ranked first), 2024 Pied Piper PSI® ILE® Powersports Industry Study (Polaris Inc’s Indian Motorcycle brand was ranked first), and the 2023 Pied Piper PSI® STE® Auto Dealer Group Study (Group 1 Automotive was ranked first). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240602434412/en/

Contacts

Pied Piper

Ryan Scott

(831) 648-1075

rscott@piedpipermc.com