MediaTek Gains 5G Share

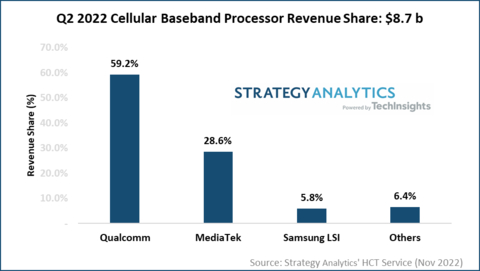

The global cellular baseband processor market grew 19 percent to $8.7 billion in Q2 2022, according to Strategy Analytics' Handset Component Technologies (HCT) service report.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221202005044/en/

Q2 2022 Cellular Baseband Processor Revenue Share: $8.7B (Source: Strategy Analytics' HCT Service, November 2022)

According to this Strategy Analytics' Handset Component Technologies (HCT) research report, "Baseband Market Share Tracker Q2 2022: Qualcomm and Unisoc Post Robust Revenue Growth," Qualcomm, MediaTek, Samsung LSI, Unisoc and Intel captured the top-five revenue share rankings in the baseband market in Q2 2022.

-

Qualcomm led the baseband market with a 59 percent revenue share, followed by MediaTek with 29 percent and Samsung LSI with 6 percent.

- 5G baseband revenues grew 40 percent year-over-year, while shipments grew 16 percent. In addition, the increased mix of higher-priced premium and high-tier 5G chips boosted ASPs (average selling price).

Sravan Kundojjala, author of the report and Director of Handset Component Technologies service at Strategy Analytics, commented, "Qualcomm posted a 53 percent growth in its 5G baseband revenue, driven by an increased mix of premium and high-tier Snapdragon apps processors. The company's continued traction in Samsung's Galaxy S22 lineup boosted its baseband ASPs to yet another all-time high. Despite strong products, Qualcomm will see a weak 2H 2022, thanks to reduced demand in its core smartphone chip market."

Mr. Kundojjala continued, "MediaTek posted its all-time high baseband revenue in Q2 2022, driven by 5G share gains. The company shifted focus to high-end but revenue contribution remains low from high-end. MediaTek, like Qualcomm, will see its baseband revenue contract in 2H 2022 due to continued inventory adjustments by its customers, including Samsung, Xiaomi, Oppo and Vivo. Despite weak market conditions, Strategy Analytics believes baseband vendors need to exercise pricing discipline in light of increasing foundry costs."

Source: Strategy Analytics, Inc.

#SA_Components

About Strategy Analytics

Strategy Analytics, Inc. (acquired by TechInsights) is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Service Name: Handset Component Technologies

Service Name: RF and Wireless Component Service

View source version on businesswire.com: https://www.businesswire.com/news/home/20221202005044/en/

5G baseband revenue grew 40 percent in Q2 2022, driven by an increased mix of premium and high-tier chips from Qualcomm and MediaTek.

Contacts

Report contacts:

European Contact: Stephen Entwistle, +44 (0)1908 423 636, sentiwstle@strategyanalytics.com

US Contact: Christopher Taylor, +1 617 614 0706, ctaylor@strategyanalytics.com

Asia Contact: Sravan Kundojjala, +44(0) 1908 423 638, skundojjala@strategyanalytics.com