Vertex Pharmaceuticals Incorporated (VRTX) is a global biotechnology firm that discovers, develops, and commercializes transformative medicines for serious diseases, with a particular focus on treatments for cystic fibrosis and other genetic disorders. The company’s product portfolio includes several approved therapies, such as Trikafta/Kaftrio, and emerging drugs for conditions like sickle cell disease and acute pain, supported by a robust clinical pipeline across multiple therapeutic areas. Vertex is headquartered in Boston, Massachusetts. Its market cap is about $124.8 billion, reflecting its status as one of the larger biotech stocks.

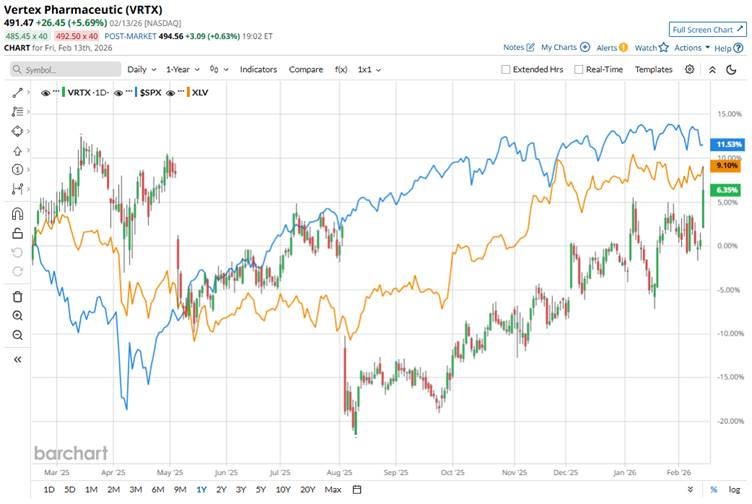

Shares of the company have underperformed the broader market over the past 52 weeks. VRTX has gained 6.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. However, the stock has risen 8.4% on a YTD basis, outperforming SPX’s marginal decline.

In comparison, the Health Care Select Sector SPDR Fund (XLV) has gained 7.7% over the past 52 weeks and 1.9% YTD.

Vertex stock has been gaining in 2026 largely due to strong fundamentals and positive investor sentiment around its growth prospects. The company reported solid Q4 2025 revenue growth 10%, underscoring continued growth from its core cystic fibrosis franchise and newer products, which have boosted confidence. Investors are also encouraged by pipeline progress in gene therapies and potential kidney disease treatments, as well as several analyst upgrades and higher price targets reflecting optimism about future earnings and drug potential.

For the fiscal year ending in December 2026, analysts expect VRTX’s EPS to grow 6.2% year-over-year to $17.49. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on one other occasion.

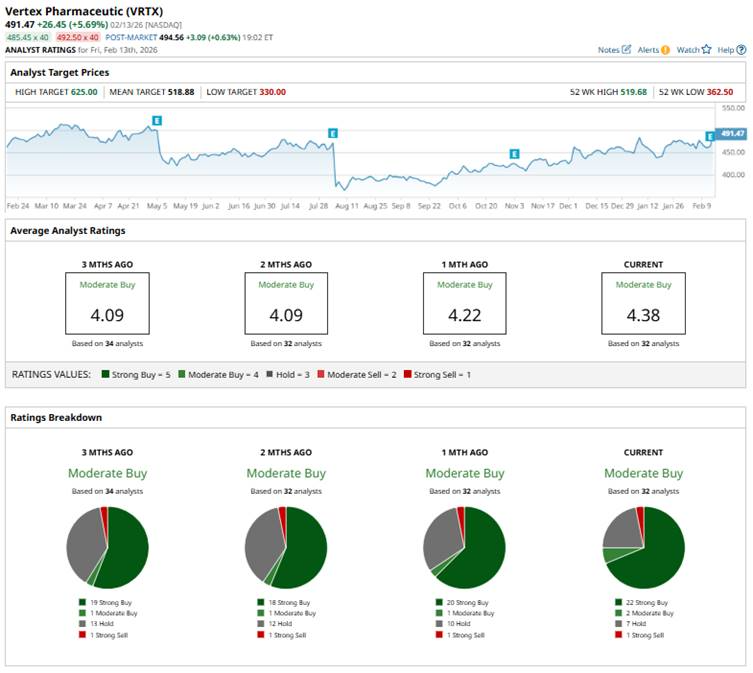

Among the 32 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 22 “Strong Buy” ratings, two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration is more bullish than one month ago, when there were 20 “Strong Buy” ratings.

Recently, Cantor Fitzgerald raised its price target on Vertex Pharmaceuticals to $590 from $485, maintaining an “Overweight” rating, citing strong confidence in the company’s expanding renal franchise.

VRTX’s mean price target of $518.88 suggests an upside of 5.6%. The Street-high price target of $625 implies a potential upside of 27.2% from the current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart