The electric vehicle (EV) sector is changing very quickly. Chinese EV producers now reign supreme, with the vast majority of EVs currently produced coming out of China. While BYD (BYDDF) and other top Chinese names continue to dominate most of the discussion when it comes to overall deliveries, there happen to be a number of other smaller EV automakers that are worth paying attention to.

One of the other top names in this sector? Nio (NIO), a company that just reported a new monthly deliveries record in December. Nio delivered 48,135 vehicles for the month, reflecting growth of more than 54% on a year-over-year (YOY) basis. Much of this growth has come from a new vehicle launch of Nio's FIREFLY brand, which offers commuters a smaller and more efficient vehicle with greater range. For many looking for a reliable and range-oriented option, this is an excellent move from a diversification perspective.

I have long thought Nio to be an intriguing company for investors to consider from a growth angle. Still, while NIO stock has performed well over the past five months, the longer-term five year chart highlights the kind of missed expectations over time that have led to a marked decline.

Here's why I think 2026 may be a much better year for Nio moving forward, and why this is a top Chinese EV stock to consider right now.

Nio May Have a Shot at Overtaking Tesla in Terms of Market Share

One of the more notable realities of December's record delivery number is that Nio is now inching its way higher in terms of global market share in the EV sector. Producing just under 125,000 vehicles in Q4, Nio's significant production growth of 72% YOY contrasts sharply with the 16% decline in deliveries Tesla (TSLA) saw this past quarter.

Now, in Q4, Tesla did deliver more than 418,000 vehicles in the quarter. So, there's plenty of work to be done for Nio to surpass Tesla on this front. But given each respective company's underlying growth rates, it's entirely feasible to see such a scenario take place within the next three years, holding all else equal.

Fundamentals Are Improving for Nio

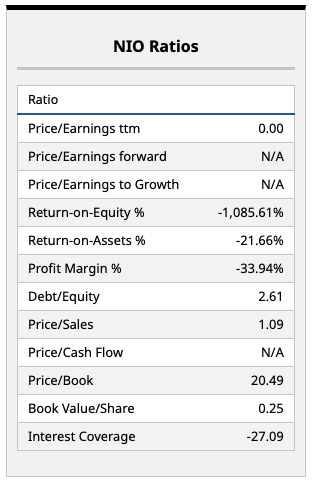

Another key factor to look at when it comes to companies like Nio is what their underlying fundamentals say about their cash flow growth prospects.

Looking at the statistics above, there's not a lot to like about NIO stock's performance on the profitability and margin front. With a negative gross margin of 33%, Nio is effectively losing one-third of its sticker price for every vehicle it sells. That's not a sustainable model, and one which has required the company to continuously raise capital in the equity and debt markets. That's a significant piece of the story around NIO stock's performance over the past five years.

That said, these metrics have been improving lately. And if Nio can indeed get to the sort of scale it hopes to achieve, turning the corner in terms of profitability in a similar way to that of Tesla could be a possibility over the course of the next year or two. That seems to be what analysts and market participants are honing in on right now.

Trading at just 1.09 times sales with an overall deliveries growth rate of more than 70%, this unprofitable growth stock could be worth a speculative bet by investors who think we'll see the electrification trend pick up steam over time.

Of course, it's important for investors to remember that U.S. or Western policy on sustainable energy and EVs isn't the gold standard everywhere in the world. China is a leader in attempting to decarbonize its industrial footprint, leaning on home-grown companies like Nio to pave the way for clearer skies and more efficient transport (with impressive technology). In such an environment, Nio could eventually be a long-term winner for investors who are patient enough to wait for margin expansion to take hold.

What Do Wall Street Analysts Have to Say About NIO?

Speaking of analyst coverage on Nio, there's certainly a mixed bag of opinions when it comes to the EV maker.

The consensus price target of $6.05 for NIO stock implies about 24% potential upside from current levels. That's alright, but not super impressive given the plethora of growth stocks with top-line growth rates above 70% to choose from.

What's perhaps most notable about Nio's analyst ratings is that most are centered around the $4 to $7 range. The low target of $3 per share stands out in particular, indicating that there is still plenty of bearish sentiment around unprofitable EV makers in the market.

Still, NIO stock looks compelling as a very small speculative portfolio position for those with a relatively high risk tolerance and long-term investing time horizon. That said, if you're not in this group, there's a reason why the 15 analysts covering NIO stock give it a consensus “Hold' rating. That's a fair assessment, given Nio's conflicting top-line growth upside and underlying fundamentals.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart