A much-needed and surprise boost in the form of strong iPhone 17 sales to close the year set Apple (AAPL) stock soaring. Still, amid all the optimism, shares of Apple are up just 10.6% over the past year. An AI strategy that stumbled out of the blocks and still lacks clarity has been deemed to be the main culprit behind the underperformance. Heady valuations have also not helped matters.

Now, analysts at the leading brokerage, Raymond James, have added to the clamor of Apple naysayers, opining that the stock will undergo a consolidation in 2026. Citing limited upside potential from current levels, the brokerage resumed coverage on the stock with a “market perform” rating. It points towards muted shipment rises, a lack of near-term catalysts, supply-chain concentration in China, and overvaluation as the reasons behind its subdued sentiments around the consumer tech giant.

Then, how does Apple stack up as an investment now? Is it going to stagnate this year (per Raymond James)? And if so, would this year be a golden opportunity to load up on one of the seminal tech companies of the last century? Let's find out.

Financial Powerhouse

Whether it is criticisms around its AI strategy, softer-than-expected iPhone sales in the previous years, or the company's failure to fulfill high expectations of its consumer base and the wider tech world. Nothing has put a dent in Apple's financial prowess. Notably, the last 10 years have seen the company report revenue and earnings CAGRs of 5.94% and 7.69%, respectively, which is not bad at all for a company of this scale and size.

Apple's fiscal fourth-quarter 2025 results showed steady growth, with net sales reaching $102.5 billion—an 8% rise from the prior year. Product revenue climbed to $73.2 billion from $70 billion a year earlier, while the higher-margin services business advanced 15.1% to $28.8 billion. iPhone sales, the company's core offering, increased to $49 billion from $46.2 billion in the comparable quarter.

Adjusted earnings per share nearly doubled to $1.85 from $0.97, topping the $1.78 consensus estimate. This performance extends Apple's streak of exceeding bottom-line forecasts to over two years, underscoring consistent profitability.

Operating cash flow eased to $111.5 billion from $118.2 billion in the year-ago period, yet the figure remains substantial and supports considerable financial flexibility. The quarter ended with $35.9 billion in cash and equivalents, comfortably exceeding short-term obligations of $20.3 billion.

Consensus for the December quarter projects revenue of $132.3 billion and EPS of $2.53.

What Lies Ahead for Apple?

If one followed the share price performance of Apple since my last analysis, one would find logic in Raymond James's assertions, as the stock is down 4.3% since then. Not a dramatic decline, but a decline nonetheless.

Meanwhile, Apple's active device base exceeds 2 billion units, creating a distribution channel that's hard for anyone else to rival. That massive reach gives the company a strong launchpad to shake up the AI landscape, even if it's starting a bit behind. Users already chatting with ChatGPT or programmers using Claude AI are doing it on Macs or other Apple devices they bought for daily use. Apple can roll out AI upgrades straight to those machines without making users change their routines.

Further, the M5 chip series coming across iPads, Macs, and iPhones is getting less attention than it deserves but could spark real growth ahead. By running private AI jobs on its own Private Cloud Compute centers, using Apple Silicon, Apple avoids the hefty fees competitors hand over to outside cloud firms, helping keep margins intact. Notably, pushing forward on 2-nanometer chips and smarter material recycling also lets the company hold down production costs better.

Lastly, Apple's tried-and-true advantages are still there. The brand keeps topping global value lists, giving it room to price products higher. The ecosystem locks everything together nicely with shared software matching hardware, making switching a hassle. And the devoted customers worldwide mean there's always an eager audience ready for the next release.

However, apart from the AI hurdles and increased competition, the AAPL stock trades at levels materially above the sector median. Its forward P/E, P/S, and P/CF of 32.85, 8.84, and 28.34 are all above the sector medians of 24.81, 3.33, and 19.43, respectively.

Analyst Opinion on AAPL Stock

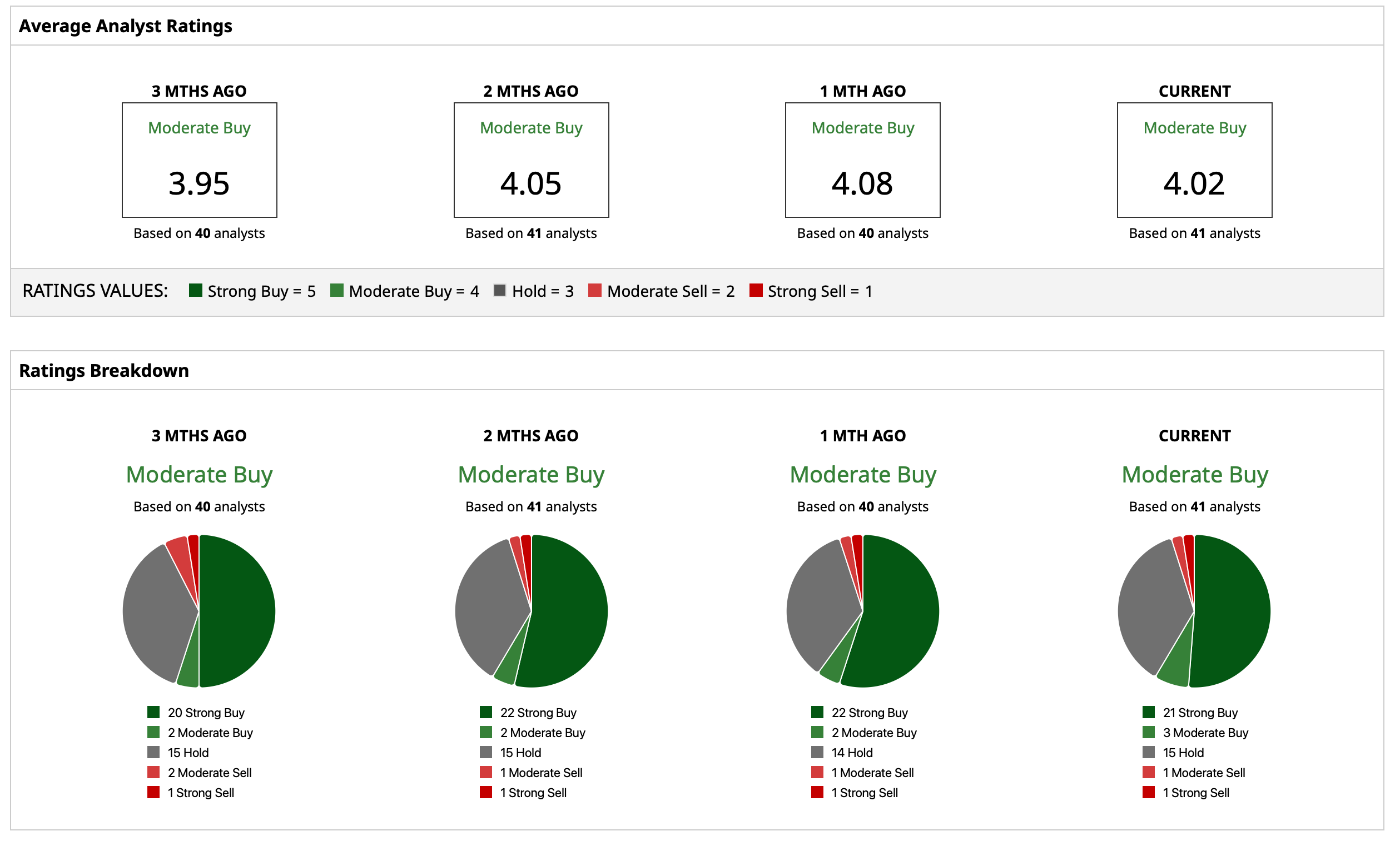

Thus, analysts have attributed an overall rating of “Moderate Buy” for AAPL stock, with a mean target price of $290.85. This target price implies an upside potential of about 7.3% from current levels. Out of 41 analysts covering the stock, 21 have a “Strong Buy” rating, three have a “Moderate Buy” rating, 15 have a “Hold” rating, one has a “Moderate Sell” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- If You Like Digital Asset Treasury Stocks, You Need to Mark Your Calendars for January 15

- Baidu Is Spinning Off Its AI Chip Unit. Should You Buy BIDU Stock First?

- Why ConocoPhillips Is One of the Top Oil Stocks to Buy After Venezuela

- Chevron, ConocoPhillips, and Gold: Your Critical Watchlist After the U.S.–Venezuela Oil Market Shock