Ah, the new year. Time for new beginnings, unwise amounts of partying (especially for the younger crowd), and the expected uptick in the number of gym-goers in the first few weeks.

For the stock market, the new year marks a psychological reset. Investors review their past year’s performance, adjust and reassess their holdings, and formulate their market expectations for the upcoming year.

Meanwhile, for dividend-focused investors, the new year resets the countdown for their annual income targets, dividend growth expectations, and compounding goals. To this end, many rebalance their portfolios based on their needs. And if you’re gearing your holdings towards stable, sustainable income while leaving room for capital appreciation, you cannot go wrong with Dividend Kings.

Dividend Kings are companies that have paid- and increased dividends for 50 years or more. Combine that top-tier characteristic with both positive technical and fundamental metrics, and you may be looking at a fruitful 2026.

Today, let’s take a look at the Dividend Kings you need to own going into the new year.

How I Came Up With The Following Stocks

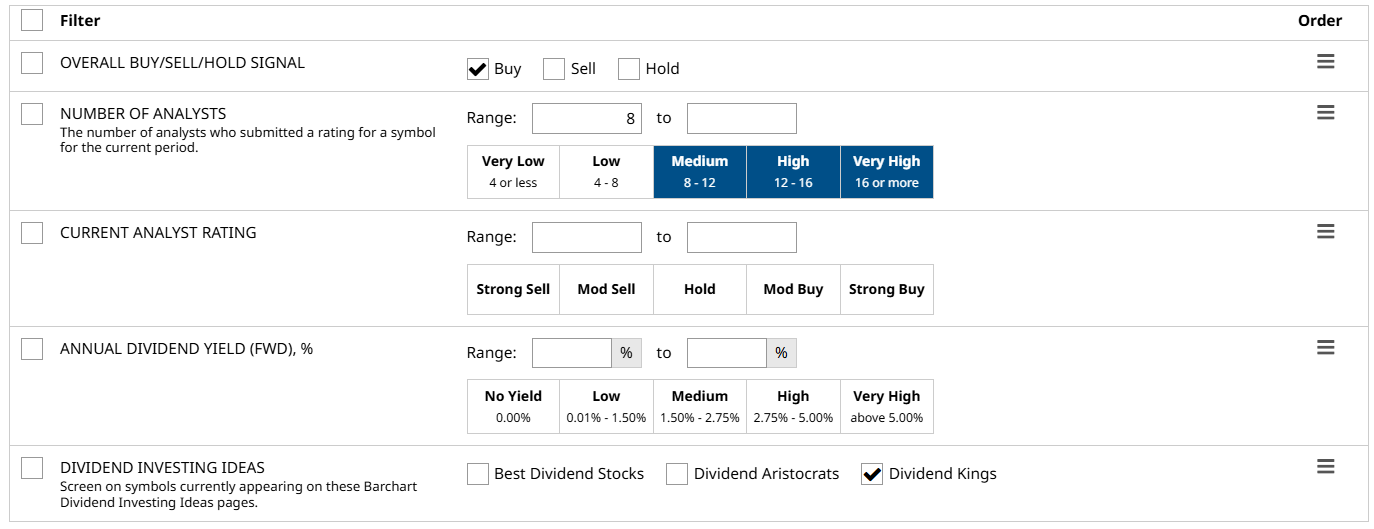

As usual, I used Barchart’s Stock Screener tool to get today’s shortlist, using the following filters:

- Overall Buy/Sell/Hold: Buy. This filter is part of Barchart’s Technical Opinion Feature, which collates data from thirteen of the most popular technical analysis indicators and presents it as a simple buy, hold, or sell rating.

- Number of Analysts: 8 or more.

- Current Analyst Ratings: Left blank so I can arrange the list based on this.

- Annual Dividend Yield: Left blank so I can see the yield on the results page.

- Dividend Investing Ideas: Dividend Kings list.

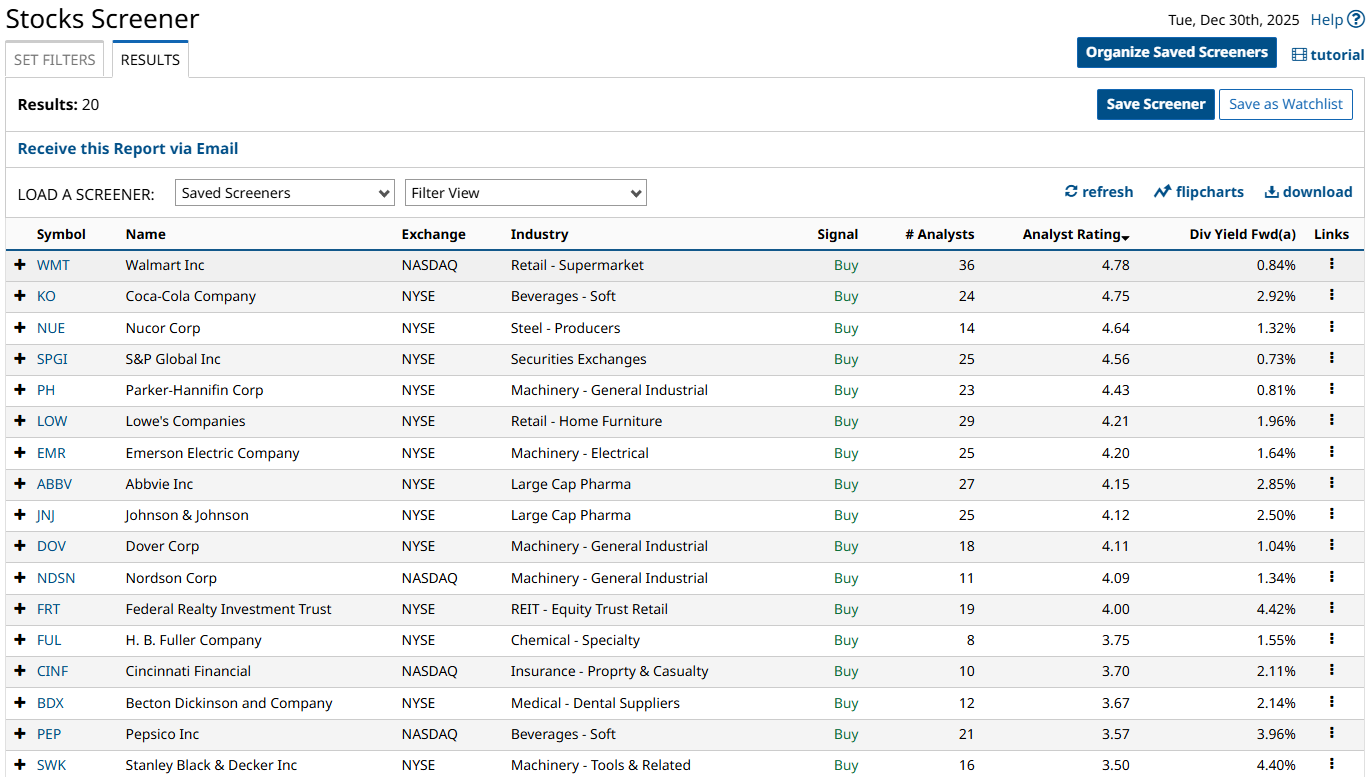

I ran the screen and got 20 results:

Again, I arranged the list by highest analyst ratings and selected the top three.

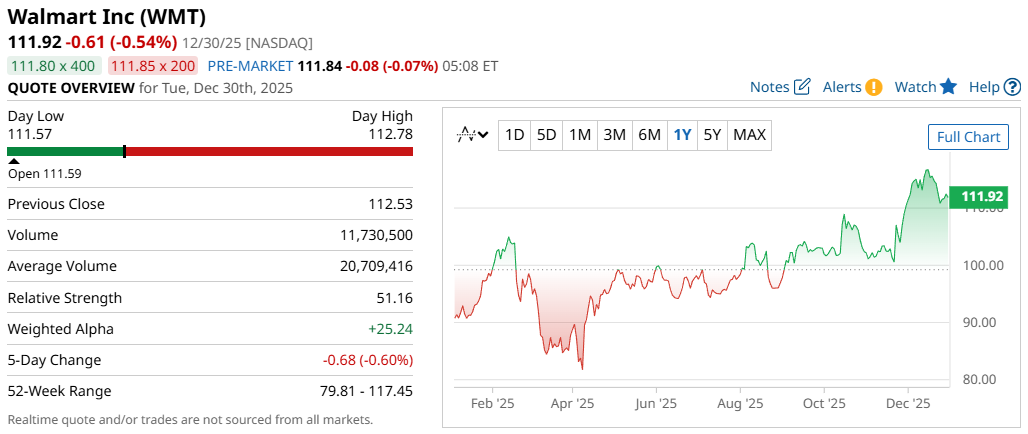

Walmart Inc (WMT)

Walmart is one of, if not the, biggest retailers in the world. The company operates brick-and-mortar stores and its e-commerce platform, allowing it to scale massively in an increasingly digitized commerce environment while still appealing to shoppers who want the in-store experience. Walmart’s established supply chain also helps the company sell a wide range of products while keeping prices low, which is a definite plus in this day and age.

Today, the company pays 94 cents per share per year, which translates to a roughly 0.84% yield. It’s not the highest, I admit, but a consensus among 36 analysts rates the stock a strong buy with a near-perfect average score of 4.78 out of 5. It also has an 88% buy rating from Barchart Technical Opinion, making it an attractive choice for long-term investors.

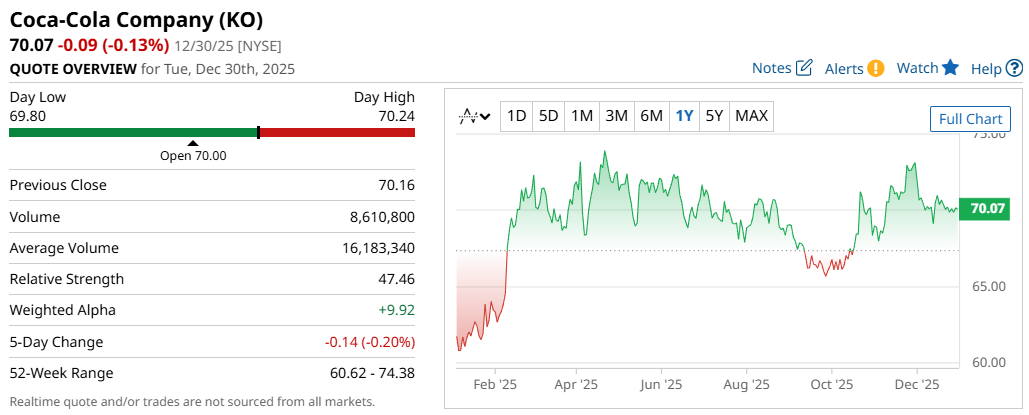

Coca-Cola Company (KO)

Next up is the Coca-Cola Company, the premier beverage seller with a presence around the world. It’s so popular worldwide that “Do you have Coke?” is practically a universal phrase all in itself. The company also sells coffee, sparkling water, sports drinks, and other soda beverages.

Coca-Cola is one of the most popular dividend stocks in the world- and for good reason. The company currently pays $2.04 per share annually, reflecting a decent 2.92% yield. Wall Street also isn’t sleeping on the stock: a consensus among 24 analysts rates it a strong buy with an average score of 4.75 out of 5. Meanwhile, it has a 24% buy rating from Barchart Opinion, suggesting slight short-term weakness but a relatively good long-term outlook.

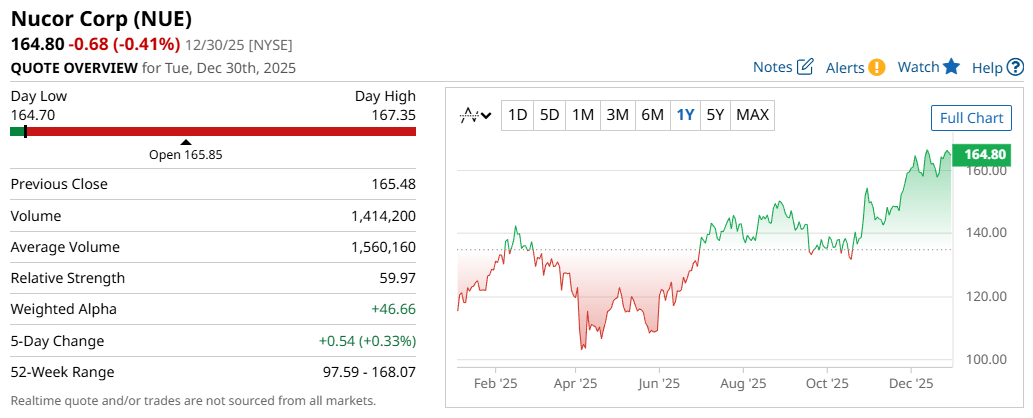

Nucor Corp (NUE)

Last but not least is Nucor Corporation. The American steel manufacturer is one of the largest in the world and offers a variety of steel products used in everything from construction, infrastructure, automotive, and other industrial applications. The company operates several well-known brands, including American Buildings, Centria, Rytec, Verco Decking, and more.

Today, the company pays $2.20 per share annually, which translates to a forward yield of 1.32%. Like with the other two stocks, a consensus among 14 analysts rates Nucor stock a strong buy, with an average score of 4.64 out of 5. It also has a 100% buy rating from Barchart Opinion across short-, medium-, and long-term indicators.

Final Thoughts

Starting the year right can set the stage for a profitable 2026. These Dividend Kings can provide steady and reliable income while offering long-term appreciation potential. Their status as mature companies with rock-solid businesses and income streams also provides a measure of defense against uncertain market conditions.

Still, there’s never a one-size-fits-all recommendation for your portfolio. Do they fit your investment thesis, or are you looking for more aggressive growth? Like always, your risk tolerance and goals will dictate your choices.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart