Nike’s iconic swoosh is limping into 2026. Their Q4 CY2025 revenue came in at $12.43 billion, topping forecasts even though sales were flat from a year earlier. That “beat-without-growth” pattern is showing up across footwear as demand cools and classic styles lose momentum.

Nike’s bigger headache right now is China, where weaker demand is colliding with tariff-driven cost pressure. This has translated directly into pressure on the share price, not just the headlines, as the stock has been repriced lower to reflect slower growth and tighter profitability.

With shares hovering in the high‑$50s and 2026 rapidly approaching, a crucial question hangs over the swoosh. Is Nike’s pullback a rare chance to buy a blue‑chip leader at a discount, or a value trap in the making for the year ahead? Let’s find out.

Nike’s Premium Numbers

Nike (NKE) designs, markets, and sells athletic footwear, apparel, and equipment worldwide from its base in Beaverton, Oregon, and carries a market value of about $84.6B. Their capital‑return profile includes a forward annual dividend of $1.64 per share, which equates to a cash yield of roughly 2.79% for shareholders at today’s levels.

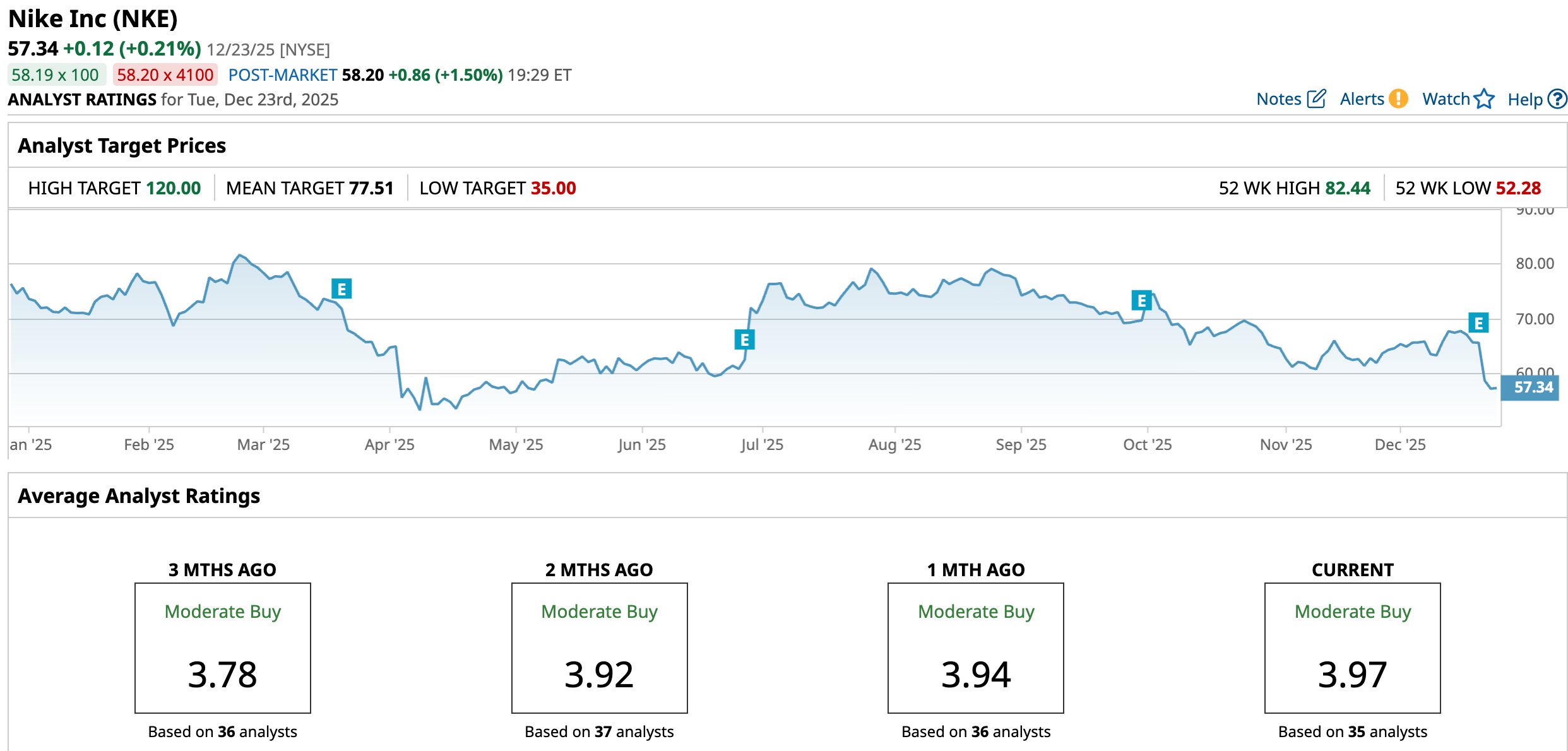

NKE is trading at $57.34 as of Dec. 23, down 24.22% year-to-date (YTD) and 25.3% over the past 52 weeks, keeping the stock firmly in “dip” territory for 2026‑focused investors.

This pricing still reflects expectations for a recovery rather than a broken story. It trades at a forward P/E of 36.75x versus a sector median of 19.90x, signaling that the market continues to assign Nike a clear premium on earnings power and growth, even after the recent slide.

Their recent earnings snapshot, for the quarter ending November 2025, helps explain why the market has not fully abandoned that stance while still punishing the stock. This report showed EPS of $0.53 against a $0.37 estimate, a $0.16 beat that translated into a 43.24% positive surprise and reinforced that execution remains stronger than headlines around China softness and tariffs might suggest.

It also detailed Q4 CY2025 revenue of $12.43 billion versus a $12.22 billion consensus, a 1.7% beat that still left sales essentially flat year on year and highlighted how growth has cooled even as guidance continues to clear a lowered bar. The release noted adjusted EBITDA of $1.19B versus expectations of $917.3 million, implying a 9.6% margin and roughly a 30% beat; this shows that Nike is still finding efficiencies and protecting profitability where it can while the top line pauses.

That same update confirmed the operating margin slipped to 8.1% from 11.2% a year ago, and constant‑currency revenue was flat after a prior 9% decline. Meanwhile, same‑store sales fell 3% versus a 2% drop in the comparable period, reminding investors that the current dip in the share price reflects real pressure on demand and margins.

What’s Really Changing for Nike

Nike just caught a break on one of the biggest swing factors for its cost base, and it came from Vietnam rather than China. The company sources roughly half of its footwear from Vietnam. So the new U.S.–Vietnam trade agreement announced earlier in July is a big deal for its evolving 2026 earnings story.

President Donald Trump signed off on a 20% tariff on many Vietnamese imports, a number that matters because it replaces an initially threatened 46% rate and is also below market fears of a 25%–30% range. This outcome does not remove tariff pressure, but it sharply narrows the downside and gives Nike clearer visibility as it works through inventory, pricing, and margin decisions into next year.

Additionally, Nike is moving aggressively on the internal side of the turnaround with notable senior leadership changes that tie directly into its “Win Now” plan. The company created a new EVP, Chief Operating Officer role for Venkatesh Alagirisamy (“Venky”), elevating the long‑time executive who previously served as Chief Supply Chain Officer to oversee Technology along with Supply Chain, Planning, Operations, Manufacturing, and Sustainability. This consolidation aims to integrate better end‑to‑end technology across Nike's creation, production, and delivery of its products.

What Wall Street Expects From Nike in 2026

The next earnings release is set for March 19th, and expectations already show how tough the near-term setup looks. For the current quarter ending February 2026, the average EPS estimate is $0.37 versus $0.54 a year ago, implying -31.48% year-over-year (YOY) growth.

Looking out to the full fiscal year ending 05/2026, the average EPS estimate is $1.60 versus $2.16 in the prior year, a projected -25.9% YOY decline. Those numbers explain the reason the market has been quick to punish the stock after headlines around China's demand and tariff pressure.

However, Wall Street still isn’t treating Nike like a broken brand.

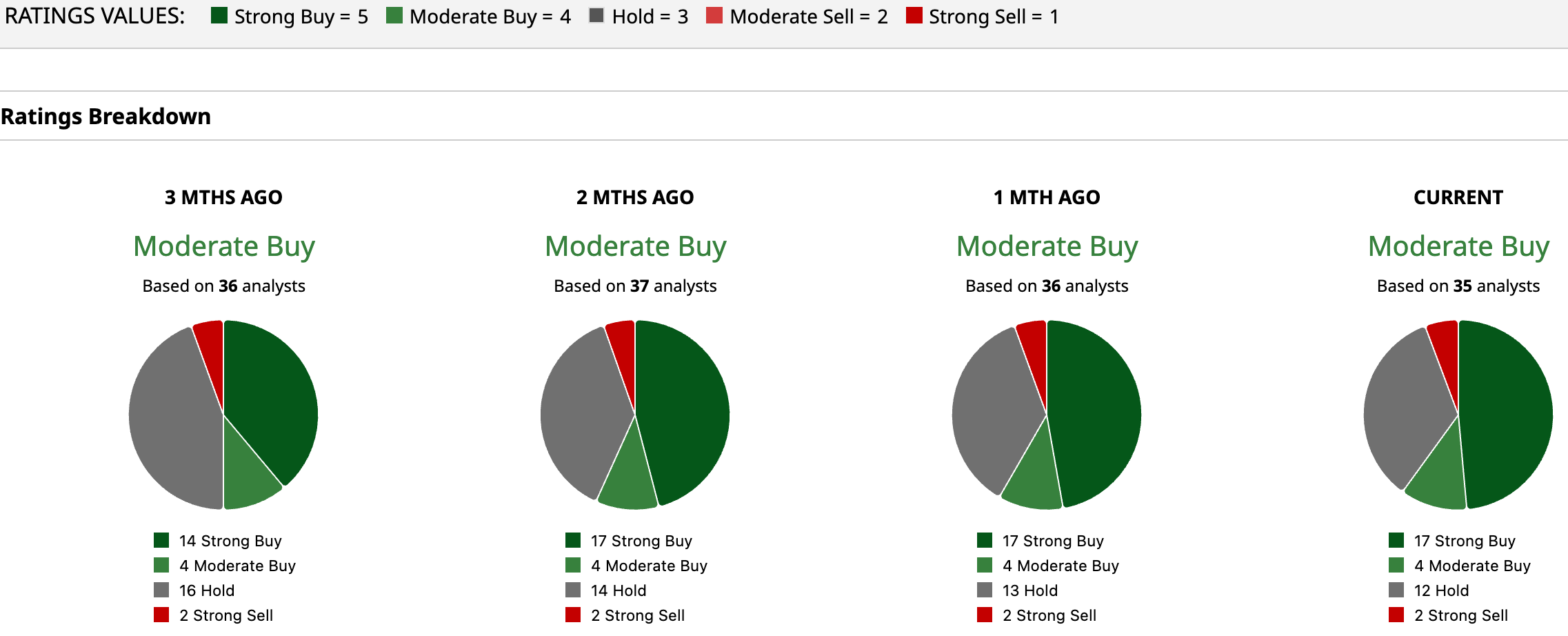

The current consensus sits at “Moderate Buy” based on 35 analysts, of which 17 list it as a “Strong Buy,” four as a “Moderate Buy,” 12 as a “Hold,” and two as a “Strong Sell.” The average 12‑month price target stands at $77.51, implying a roughly 35.18% upside from here. And with the Street's high target of $120, the stock could soar 109.28%.

Conclusion

Long-term investors still get a “yes, but know what you’re buying” dip here. Nike is a premium brand with real earnings pressure now, yet the balance of evidence points to slow repair, not structural collapse. The odds favor a choppy recovery over the next 12–24 months rather than a sustained leg lower from here. Traders may want to treat it as a buy on weakness, not something to chase on strength.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart