Detroit-based General Motors Company (GM) is a leading global automotive manufacturer with a diversified portfolio spanning internal combustion vehicles, electric vehicles (EVs), autonomous technology, and mobility services. With a market cap of $77.5 billion, GM designs, manufactures, and markets vehicles under well-known brands including Chevrolet, GMC, Cadillac, and Buick, with operations across North America, China, and select international markets.

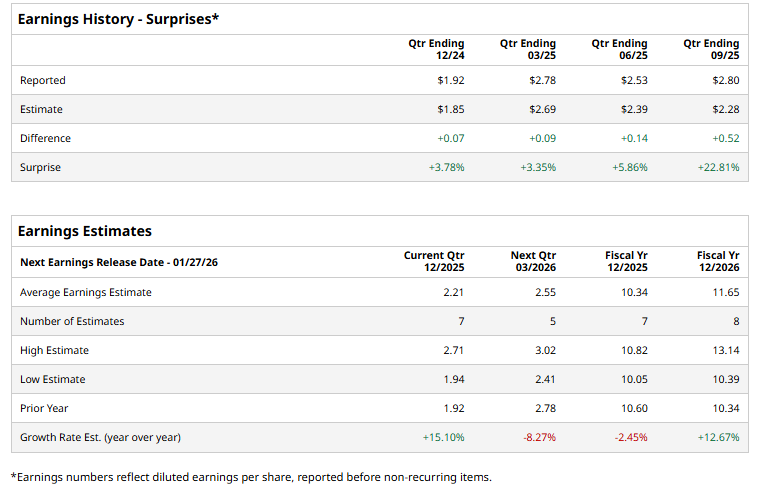

The auto manufacturing giant is set to release its Q4 results soon. Ahead of the event, analysts expect GM to report an adjusted profit of $2.21 per share, up 15.1% from $1.92 per share reported in the year-ago quarter. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

In fiscal 2025, GM’s adjusted EPS is expected to drop 2.5% to $10.34, down from $10.60 reported in 2024. However, in fiscal 2026, its earnings are expected to rebound 12.7% year over year to $11.65 per share.

GM stock prices have gained 57.4% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 15.7% returns and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.6% gains during the same time frame.

On Dec. 1, General Motors reached a new 10-year high in morning trading, reflecting growing investor confidence in the automaker. GM has undergone a dramatic transformation, rising to industry dominance, entering bankruptcy during the financial crisis, and reemerging shortly thereafter as a more resilient company. Today, it is focused on building a strong presence in the electric vehicle market, supported by its Ultium Drive modular battery platform and a broader shift toward an all-electric future.

GM has a consensus “Moderate Buy” rating overall. Of the 28 analysts covering the stock, opinions include 13 “Strong Buys,” three “Moderate Buys,” nine “Holds,” and three “Strong Sells.” It currently trades above the mean price target of $74.85, and its Street-high target price of $110 suggests a 32.9% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 Dividend Kings Quietly Beating the Market This Year

- If You Were Gifted $10,000 of Nvidia Stock Last Christmas, Here’s How Much It Would Be Worth Today

- Virgin Galactic Stock Is Challenging This Key Resistance Level as Trump Goes All In on Space

- Should You Buy FJET Stock After the Starfighters Space IPO?