Cathie Wood's Ark Invest is doubling down on CoreWeave (CRWV) amid a brutal selloff in AI infrastructure stocks. On Monday, the investment firm purchased over 136,000 shares of the cloud computing provider across its Ark Innovation (ARKK) and Ark Next Generation Internet (ARKW) funds, even as CoreWeave's stock plunged another 8%.

Shares of the AI-focused company are now down almost 62% from all-time highs, joining a broader retreat in once-hot AI names. CoreWeave's drawdown mirrors growing investor skepticism about the generative AI boom that propelled these stocks earlier this year.

The company, which leases GPU-heavy data centers to AI developers, faces mounting concerns over its balance sheet, which one analyst described as “the ugliest in technology.” With interest costs exceeding its 4% operating margins and a debt load of 7.5%, questions swirl about how CoreWeave will generate sustainable profits.

However, Wood remains bullish on the AI infrastructure stock despite the ongoing turbulence. CoreWeave CEO Michael Intrator argued that the market has yet to understand the company’s disruptive business model. Alternatively, CoreWeave continues to expand partnerships with OpenAI and Microsoft (MSFT), enabling it to grow revenue rapidly.

Let’s see if you should also buy the dip in CRWV stock.

Should You Invest in CoreWeave Stock Right Now?

CoreWeave positions itself as the AI hyperscaler, delivering high-performance GPU compute to major tech companies and AI labs. The company leases data centers, fills them with Nvidia (NVDA) GPU clusters, and rents out the processing power to customers running AI workloads. It's a capital-intensive business model that relies heavily on debt financing, a major concern for investors.

The numbers tell a complicated story. CoreWeave reported 134% revenue growth last quarter and boasts a $55 billion backlog that's ten times its current revenue run rate. Management insists demand remains insatiable, with customers signing longer contracts and committing to multiyear deals. CoreWeave claims it's struggling to bring capacity online fast enough to meet customer needs.

CoreWeave carries $14 billion in debt while it reported an adjusted EBITDA of $3.4 billion, indicating a gross leverage ratio of 4x. The company recently lowered its revenue and operating income guidance after construction delays pushed some data center deployments from the fourth quarter into early next year. While management attributed the miss to timing issues rather than fundamental problems, it rattled investors already nervous about AI spending.

The bear case centers on CoreWeave's financial structure. The company borrows at 7.5%, while hyperscalers like Alphabet (GOOGL) (GOOG) enjoy much lower interest rates. Its operating margin of 4% barely covers interest costs on the debt used to fund expansion.

CoreWeave emphasized that it is building only what customers have already contracted for under long-term agreements. Its recent renewals came in at 5% of the original pricing, indicating sustained demand even for older GPU generations. The company is also working toward investment-grade status by onboarding creditworthy customers and structuring nonrecourse financing tied directly to customer contracts.

Whether Wood's bet pays off depends on a simple question: Will AI infrastructure demand continue to grow fast enough to justify the massive capital expenditures, or are we witnessing another dot-com-style overbuild?

What Is the CRWV Stock Price Target?

Analysts tracking CRWV stock forecast revenue to increase from $5.13 billion in 2025 to $29 billion in 2028. The company is forecast to end 2028 with adjusted earnings of $4.23 per share, compared to a loss of $1.31 per share in 2025. If CRWV is priced at 30x forward earnings, which is reasonable, it should trade around $125 in late 2027, indicating an upside potential of 90% from current levels.

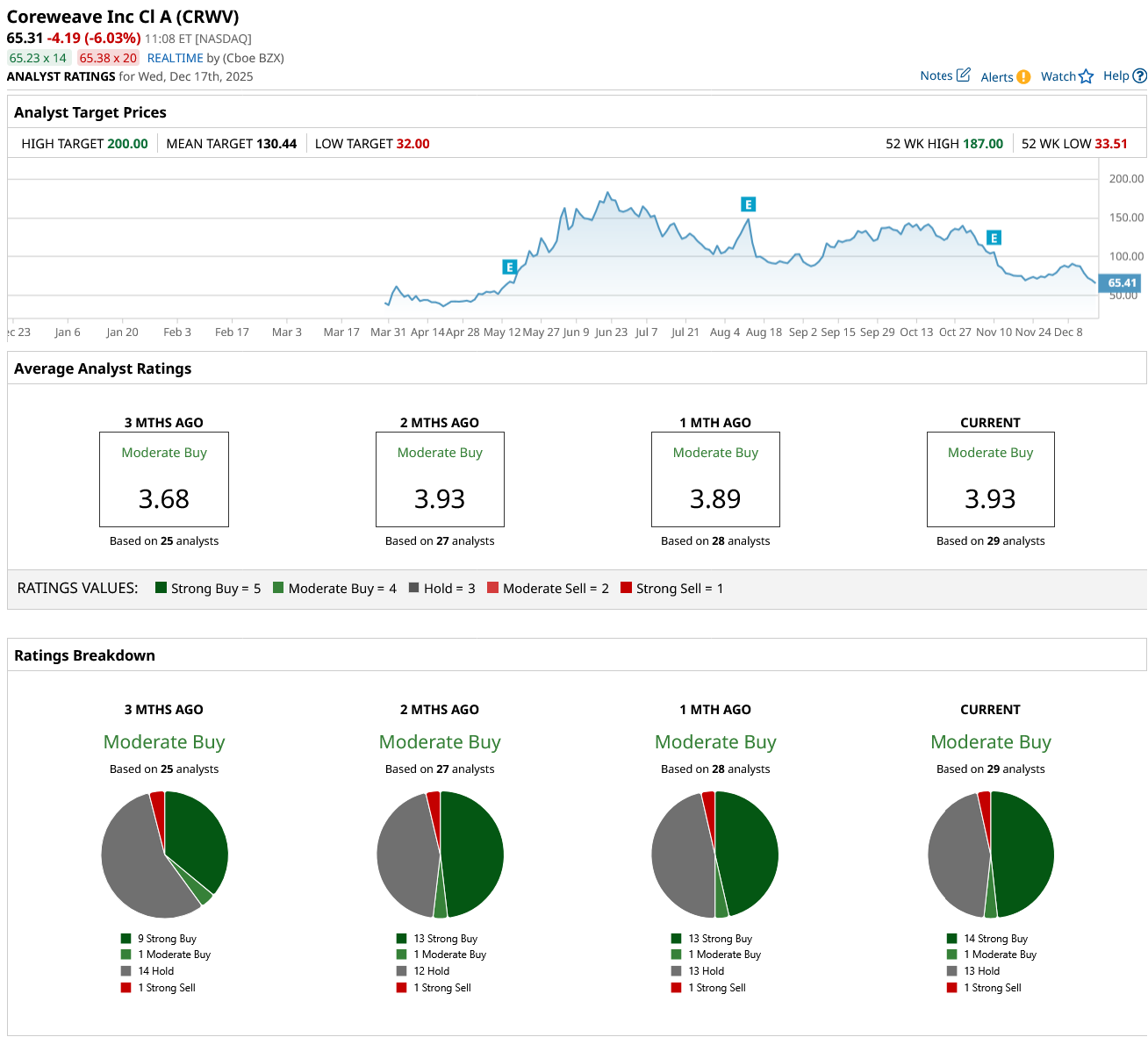

Out of the 29 analysts covering CRWV stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 13 recommend “Hold,” and one recommends “Strong Sell.” The average CRWV price target is $130.44, above the current price of about $65.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns That During Bubbles, Stock Prices and Earnings Will ‘Diverge,’ But They Can’t ‘Continuously Overperform Their Businesses’

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?