Back in the middle of January I wrote the article below discussing why stocks would continue to struggle in the new year on a wave of uncertainty.

Stock Market Expert Predicts 3-6 Months of Pain

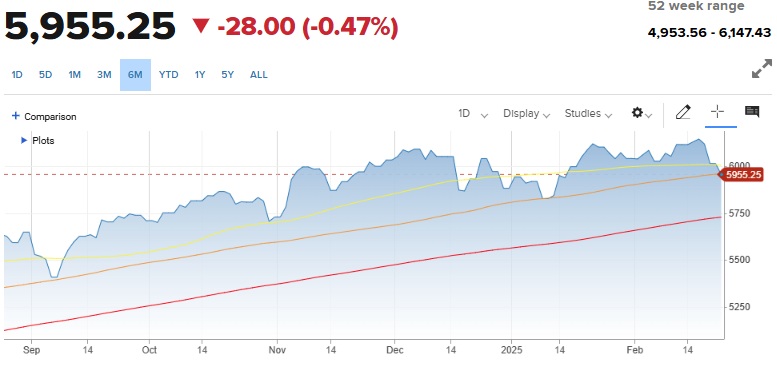

That pain was short lived as stocks soon resurrected from a low around 5,800 on the S&P 500 (SPY) to actually make new highs of 6,147 in late February.

Just when investors were getting comfortable once again...the rug got pulled out and we are back below 6,000.

Why? And what happens next?

That will be the focus of today’s Reitmeister Total Return commentary.

Market Outlook

As you have no doubt heard many times in the past...The market HATES uncertainty!

Uncertainty = risk aversion = stocks head lower

Indeed, we have an interesting cocktail of elements leading to the current round of uncertainty. Let’s do a roll call:

Tariff Effects on the Economy: This is an ongoing saga where we have not seen the full extent of what the US is planning to do, nor the retaliatory tariffs from other nations. Note that the most recent Fed minutes talked about the likely inflationary nature of tariffs as yet another reason that they won’t be lowering the Fed funds rate any time soon.

Elevated Inflation: The most recent round of PPI, CPI and Average Hourly Earnings (aka wage inflation) shows inflation ticking higher after a long pause. That is the wrong direction and only exacerbates the aforementioned issue of when we get the next rate cut from the Fed. And yes, that becomes doubly worse if tariffs prove inflationary as many economists believe.

Consumer Question Marks: First came the warning of weakening demand from WalMarts recent earnings report. That got magnified Tuesday with much weaker than expected Consumer Confidence report (the lowest reading in 4 years).

Why is the consumer struggling even with strong employment? Sticky inflation + uncertainty over the effects of Trump administration policies. Remember that 49% of the nation did not want him in charge. And now their preferred news outlets are scaring them to death about the negative impacts of tariffs and DOGE = a potential tightening of purse strings that could weaken future GDP and corporate profit results.

I guess you could say “the consumer hates uncertainty too”.

DOGE (Department Of Government Efficiency): Most Americans agree that the government is too big and that it is unwise to run such large deficits. What they disagree on is WHERE the cuts should be made and HOW the cuts are enacted.

More importantly for our economic and stock market discussion, I want to share the following math. Let’s imagine that DOGE was actually able to cut $2 trillion per year in government spending. When you appreciate that the US GDP is $29 trillion then that reduction is spending creates a nearly 7% drop in GDP which is not a recession...that’s a depression!

Yes, in the long run a balanced budget, or better yet a surplus, is vital for staving off a future debt crisis (picture Greece debt crisis times 100). But the path to get there may very well lead to recession/depression which is what famed investor, and NY Mets owner Steve Cohen was saying last week.

The sum total of these uncertainties has the market quickly pushing back from the recent highs as can be seen in the chart below:

(Yellow = 50 Day Moving Average / Orange = 100 Day MA / Red = 200 Day MA).

Note that we ended Tuesday’s session tangling with the 100 day moving average which proved to be support back in January in the low 5,800’s.

My gut tells me if there is that much uncertainty, that we will finally spend some time below the 100 day moving average. That means that the 200 day @ 5,713 is in play for the first time in a long, long time.

Note that if the fears from recent uncertainty prove unfounded, and US GDP keeps rolling in positive territory, then this will prove to be but a brief detour on the way to new highs in the months ahead.

On the other hand, there is often momentum to fear and greed cycles. If the fear keeps increasing, then it can take on a life of its own creating the reality of lower spending that does lead to recession and bear market with much lower lows for stock prices on the way.

This uncertainty precisely why we have such a large cash position on hand (29.5%).

Right now, I put the highest odds on this being a brief detour for the bull market. If true, then as stocks press to new lows, we will put that extra cash to work in the best stocks at stellar entry prices.

However, if things turn more bearish...like increasing odds of recession...and/or a serious break below the 200 day moving average, then we will get more defensive. That starts by the selling of most aggressive positions to raise more cash. And possibly the addition of inverse ETFs if it looks like a full blown bear is on the way.

You know I don’t enjoy scaring you just for effect. This just so happens to be an honest discussion of the facts in hand.

Again, the bullish outcome is most likely, but we do have to appreciate that the odds of recession and bear market have modestly increased.

Forewarned is forearmed. And we are now armed for any potential outcome.

What To Do Next?

Check out my portfolio with hand selected picks for the current market environment:

- 8 stocks to buy

- 1 stock to short

- 1 ETF to buy

All the stocks have been selected using the proven outperformance that comes from our POWR Ratings stock selection model which has done 4X better than the S&P 500 since 1999.

Now add in my 44 years of investing experience seeing bull markets...bear markets...and everything between. This helps me pick the right stocks for the current environment.

If you are curious to learn more, and want to see my current 10 recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Recommendations >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

Editor, Reitmeister Total Return

SPY shares were trading at $594.33 per share on Tuesday afternoon, down $2.88 (-0.48%). Year-to-date, SPY has gained 1.41%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Why is Stock Market Outlook So Uncertain? appeared first on StockNews.com