During its fiscal second quarter, Starbucks Corporation (SBUX), a global roaster, marketer, and retailer of specialty coffee, added 464 new locations, elevating brand exposure, market potential, and financial growth. With 51% company-operated stores and 49% licensed stores, the company could experience rapid expansion and future growth.

SBUX’s trailing-12-month EBITDA margin of 18.43% is 73% higher than the 10.65% industry average. Its trailing-12-month net income margin of 10.46% is 150.3% higher than the industry average of 4.18%. In addition, the stock’s trailing-12-month levered FCF margin of 7.16% compares to the industry average of 3.93%.

Given this backdrop, let’s look at the trends of SBUX’s key financial metrics to understand why the stock could be a solid buy now.

Examining Starbucks Corporation’s Growth: Notable Increases in Revenue, Net Income, and Key Metrics from 2020 to 2023

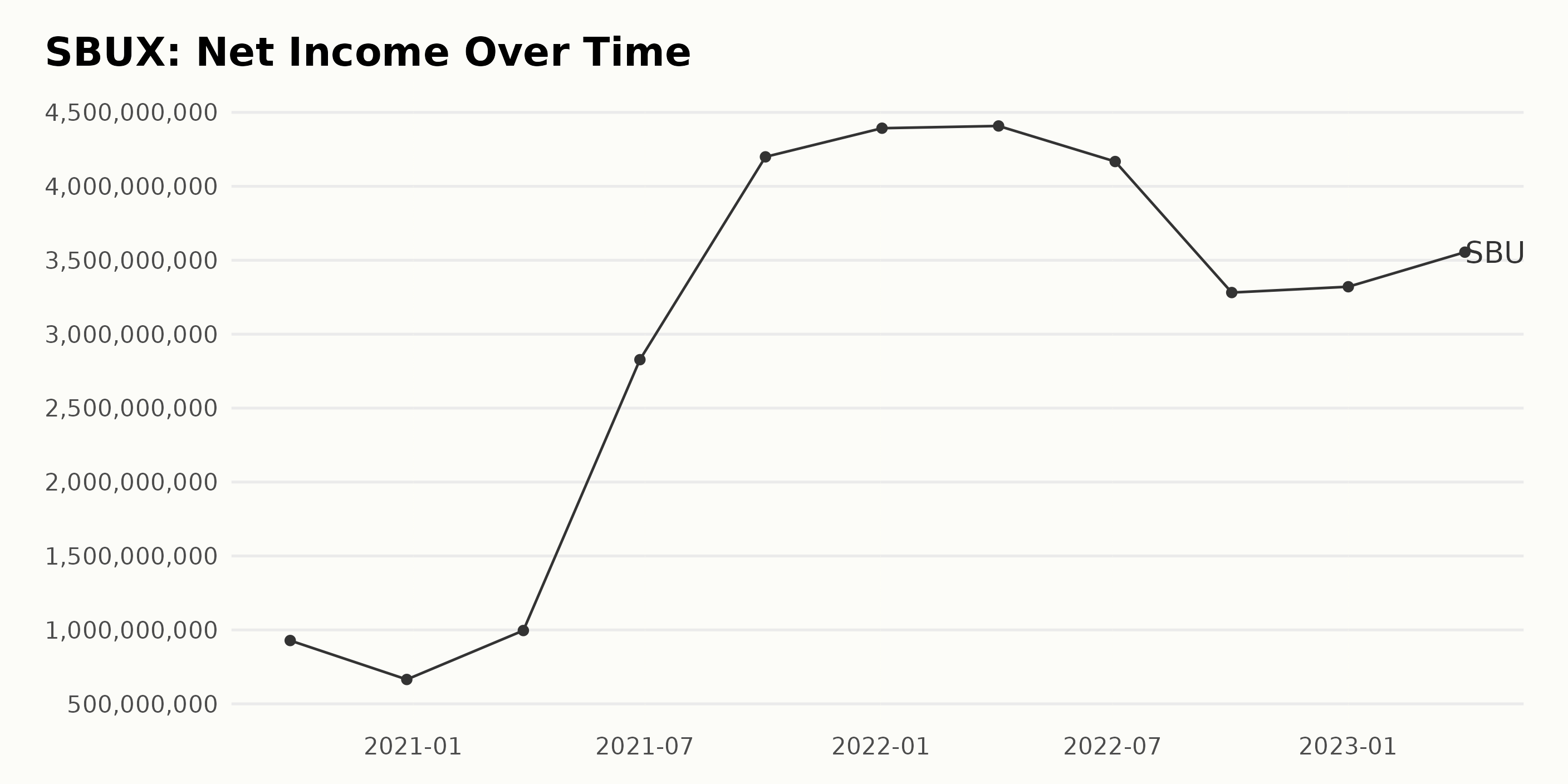

The trailing-12-month net income trend of SBUX over the period from September 2020 to April 2023 indicates a significant increase over the observed period.

- The net income reported on September 27, 2020, was $928.30 million.

- There was a decrease noticed in the next quarter ending December 27, 2020, where it came down to $664.80 million.

- In the subsequent period ending March 28, 2021, the net income saw an increase again to $995.80 million.

- A noteworthy upsurge was observed in the next quarter, with the net income reaching $2.83 billion by June 27, 2021.

- By October 3, 2021, there was a substantial increase, with net income shooting up close to $4.20 billion.

- This figure grew further to $4.39 billion and $4.41 billion in the quarters ending January 2, 2022, and April 3, 2022, respectively.

- However, a slight ebb was observed in the following quarter, as the net income decreased to $4.17 billion by July 3, 2022.

- The figure dropped further to $3.28 billion by October 2, 2022.

- SBUX saw a mild improvement in net income to $3.32 billion as of January 1, 2023.

- The most recent value stands at $3.55 billion on April 2, 2023, indicating a progressive growth rate.

From September 2020 to April 2023, SBUX's net income has grown at an impressive pace. This corresponds to a growth rate of approximately 282% over the period. The fluctuations in SBUX's net income suggest that while the company has had some periods of decreased net income, the overall trend is undoubtedly one of growth.

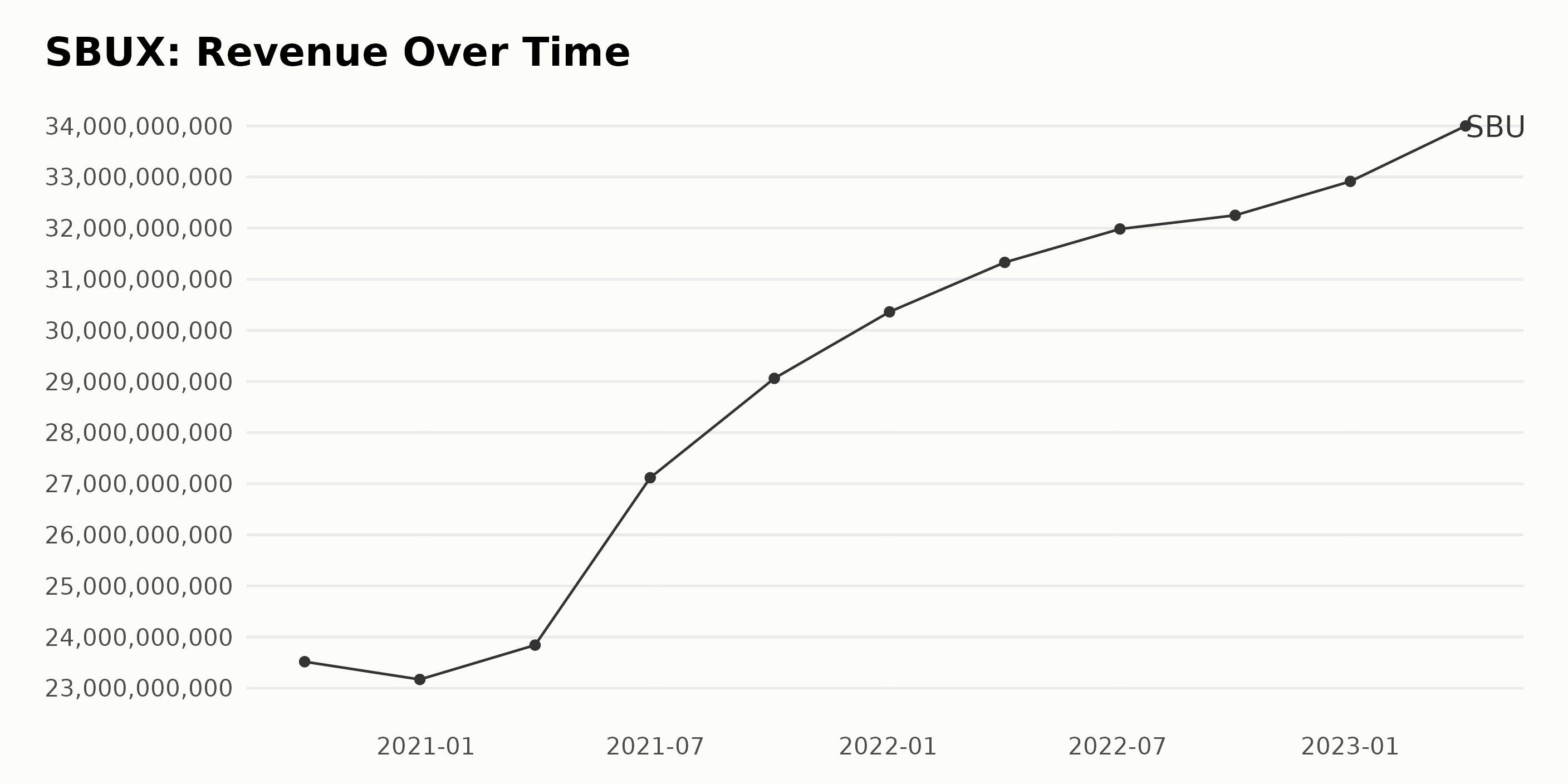

The trailing-12-month revenue of SBUX indicates a generally increasing trend with minor fluctuations. Here are the specifics:

- On September 27, 2020, the revenue was $23.52 billion.

- There was a small dip on December 27, 2020, when it dropped to $23.17 billion before rising again.

- From that period onwards, there was a steady growth in revenue: $23.84 billion on March 28, 2021, $27.12 billion on June 27, 2021, and $29.06 billion on October 3, 2021.

- By the start of 2022, January 2, the revenue grew to $30.36 billion. This upward trend continued into April 3, 2022 ($31.33 billion), July 3, 2022 ($31.98 billion), and October 2, 2022 ($32.25 billion).

- The revenue value continually rose in 2023, reaching $32.91 billion on January 1 and $33.98 billion on April 2.

The overall growth from September 27, 2020 ($23.52 billion) to April 2, 2023 ($33.98 billion) represents an increase of approximately 44.46%. Despite minor decreases, the data shows that most reported periods saw an increase in revenue.

The rate of growth has been more substantial in the more recent years in the data series, emphasizing the recent performance of SBUX.

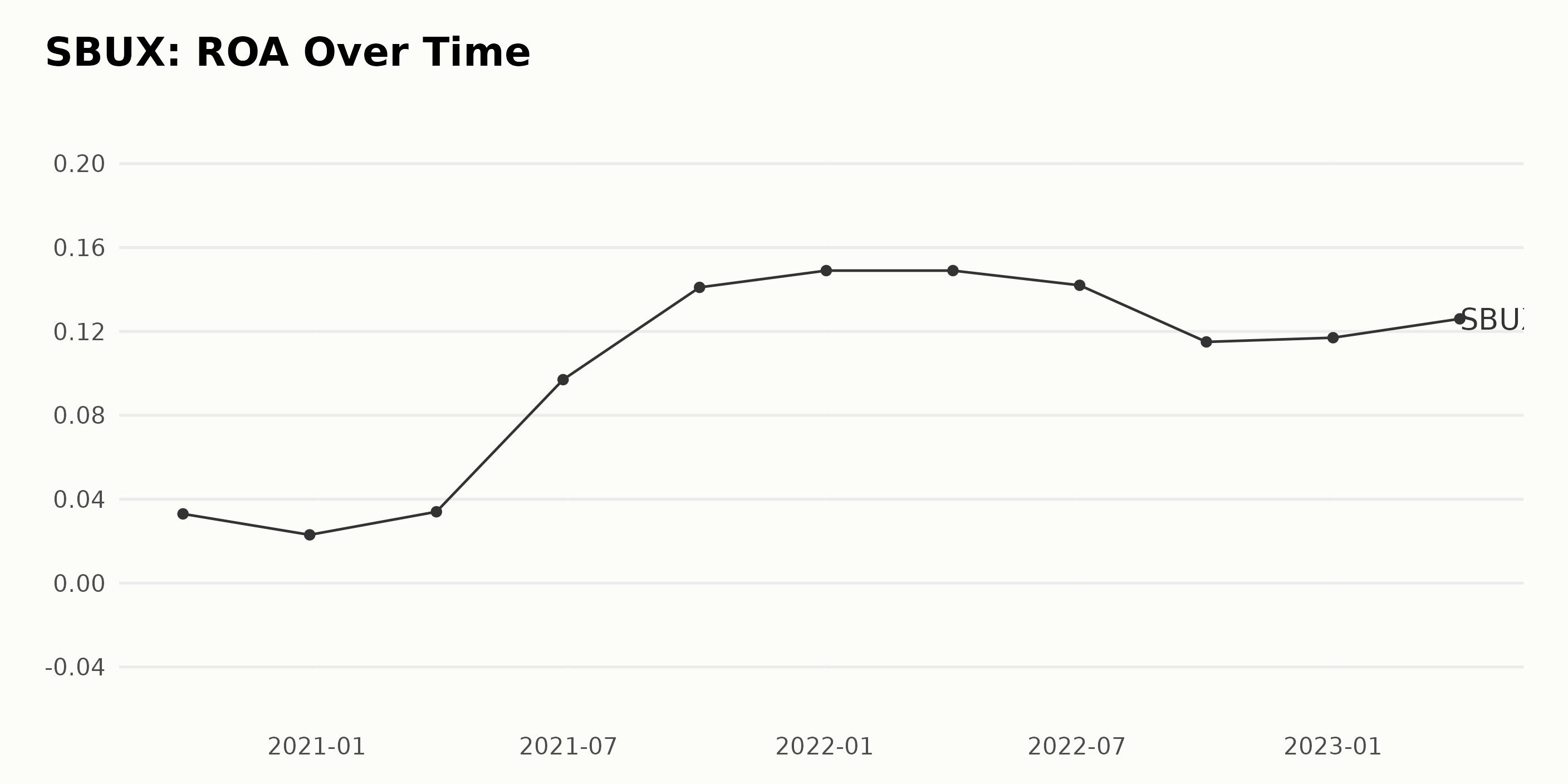

The ROA has been fluctuating over the years, demonstrating varying degrees of operational efficiency. However, an overall upward trend is evident when we observe the data from September 2020 to April 2023. Here's a brief overview:

- From September 2020 to December 2020, there was a decrease in ROA from 3.3% to 2.3%, suggesting a period of reduced profitability.

- The ROA recovered from December 2020 to March 2021, increasing from 2.3% to 3.4%.

- A sharp increase in ROA was observed between March 2021 and June 2021, where it jumped from 3.4% to 9.7%.

- By October 2021, the ROA had risen to 14.1%, showing significant growth over this period.

- There was a slight rise to 14.9% in January 2022. However, this stagnated until April 2022, indicating a temporary plateau in profitability.

- After falling slightly to 14.2% in July 2022, the ROA decreased substantially by October 2022 to 11.5%.

- Despite minor fluctuations, a consistent growth trend was maintained from October 2022 to April 2023, with the ROA ending at 12.6%.

In terms of the growth rate measured from the first value (September 2020) to the last value (April 2023), the ROA has increased approximately by 3.8 times or 282%. While there have been fluctuations, these movements underscore an overarching upward trend for SBUX’s ROA.

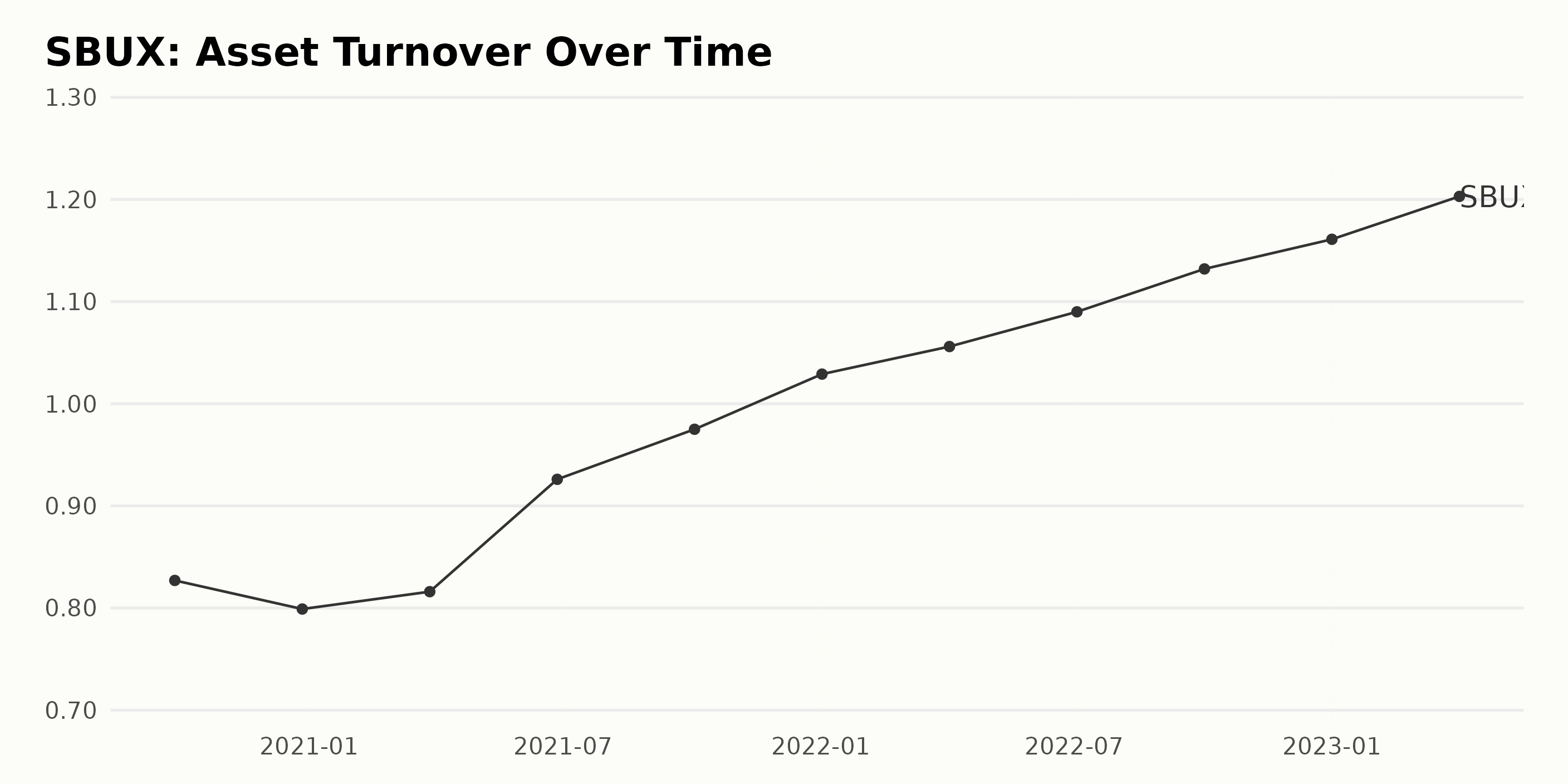

The data reports SBUX’s asset turnover from September 27, 2020, through April 2, 2023.

- On September 27, 2020, the asset turnover was 0.83

- There was a slight decrease to 0.80 on December 27, 2020.

- A gradual increasing trend can be observed afterward, with occasional fluctuations.

- By January 2, 2022, the value crossed the marker of 1, reaching 1.03.

- The recent quarters have seen a consistent growth trend, reaching 1.16 on January 1, 2023, and finally standing at 1.20 on April 2, 2023.

Comparing the first and last values in the series, the growth rate from September 27, 2020, to April 2, 2023, is approximately 44.9%. This calculation emphasizes the increase in SBUX's ability to generate sales from each unit of asset.

Analyzing SBUX’s Six-Month Stock Performance Fluctuation in 2023

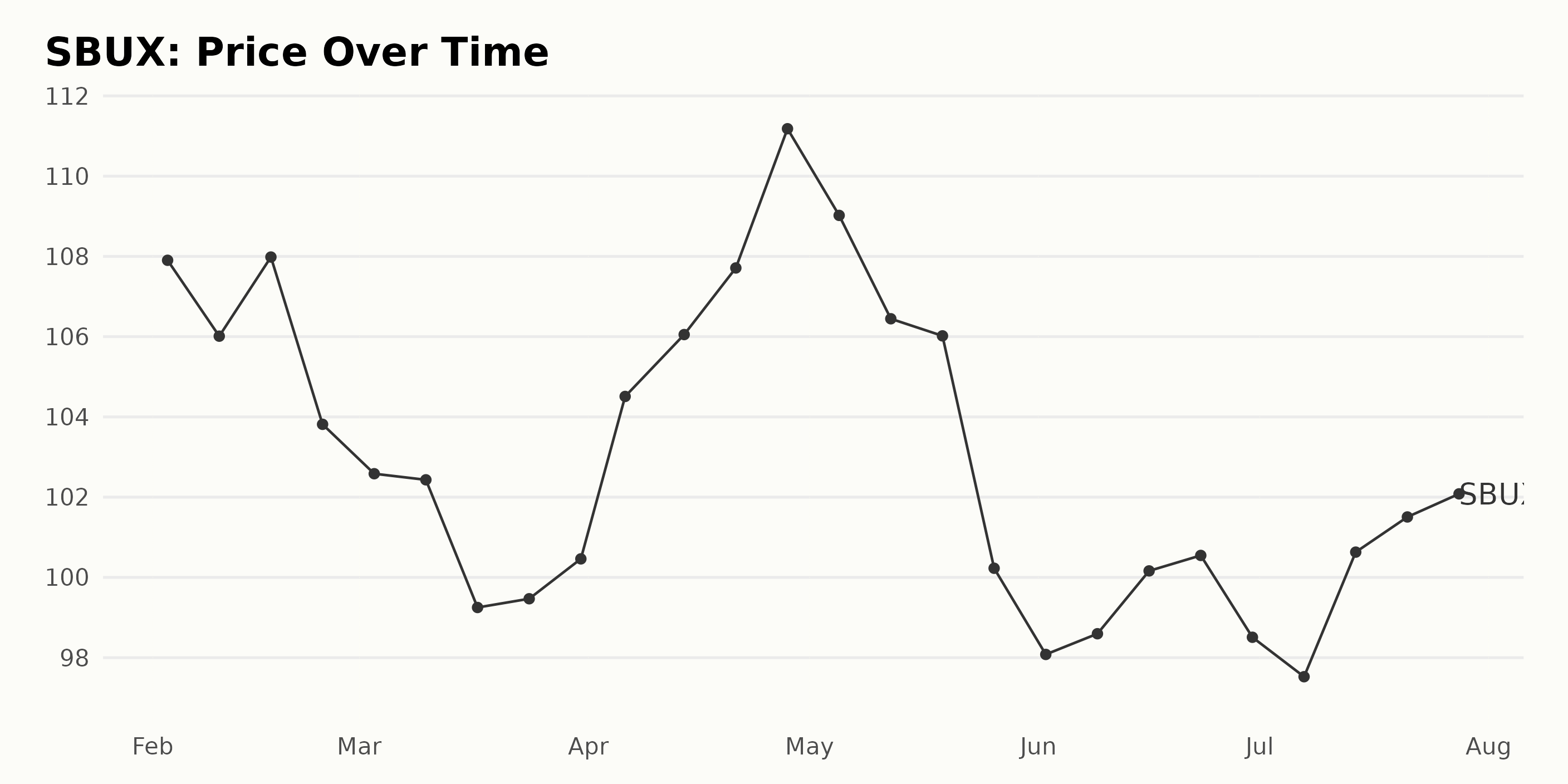

Analyzing the provided data for SBUX’s share price from February to July 2023, here are the key observations:

- On February 3, 2023, the share price stood at $107.90.

- By the end of February 2023, the share price fell to $103.82, a net decrease in the month.

- There was a slight decline in March 2023, with the price falling to $102.43 by March 10 and ending the month at $100.46.

- We noticed a rebound in April 2023, with the price escalating to its highest point in this period at $111.18 on April 28.

- This is followed by a marginal plunge over May 2023, with the price decreasing to $100.23 by the end of the month.

- The price continued to drop further until the first week of June, bottoming out at $98.08 on June 2. After that, there was an increase to $100.55 by June 23, but falling again to $98.51 at the end of June.

- Price crawled back upwards in July, peaking at $101.25 on July 28.

This data shows a fluctuating trend in SBUX’s stock prices over the examined period. The overall growth rate is negative considering the price at the beginning of February 2023 and by the end of July 2023.

The data also highlights a cycle of acceleration and deceleration within shorter periods across these six months. Here is a chart of SBUX's price over the past 180 days.

SBUX: Tracking Quality, Momentum, and Growth via POWR Ratings

The POWR Ratings grade for SBUX, in the Restaurants category, provides an insightful evaluation of its progression over recent months of 2023.

- Throughout February, SBUX saw a fluctuating status from grade B (Buy) to C (Neutral), starting the month with a B (Buy) on February 4, 2023, but then declining to a C (Neutral). Its rank in the category ranged between #17 and #21 out of 44.

- In March, the POWR grade remained at C (Neutral) until the last week, when it improved to B (Buy) on March 25, 2023. The rank in the category during this month varied from #23 down to #22.

- April showed a similar pattern with the POWR grade at C (Neutral) for the first three weeks, improving to B (Buy) by April 22, 2023. Its rank in the category was slightly worse, varying between #23 to #25 before improving to #18 by the end of the month.

- From May to July, SBUX maintained a consistent B (Buy) grade. The rank in the category continued to improve from #15 at the beginning of May to #12 in the middle of July. However, it increased towards the end of July, ending the month at #15.

- As of the end of July 2023, the latest value for SBUX's POWR grade is B (Buy), ranking #14 out of the 44 total stocks in the Restaurants category.

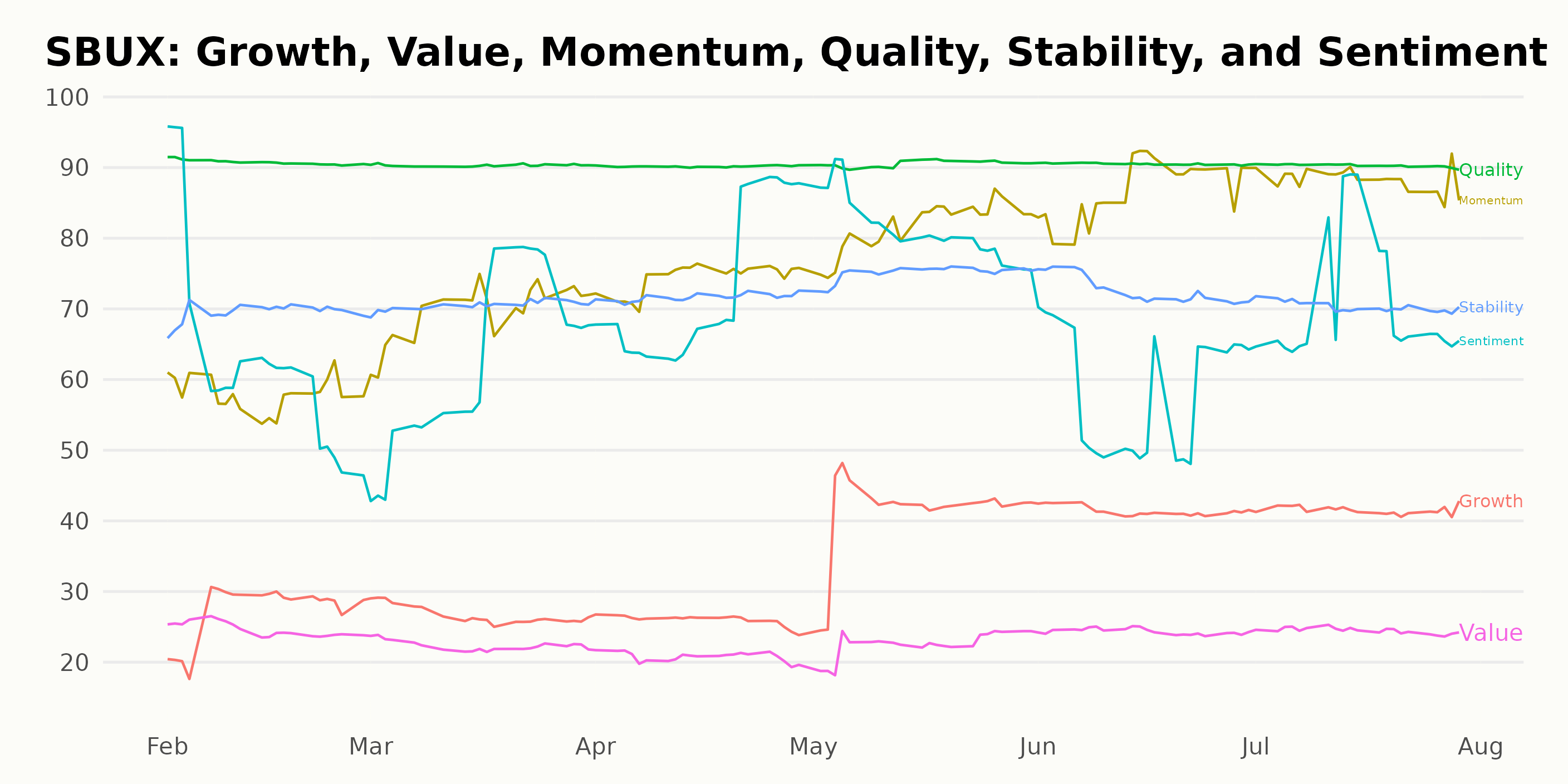

The POWR Ratings for SBUX indicate distinct trends and benchmarks across three primary dimensions: Quality, Momentum, and Growth.

Quality: SBUX consistently scores high, with ratings peaking at 91 in February 2023, March 2023, May 2023, and June 2023.

Momentum: The rating started at 58 in February 2023 and increased monthly until it reached 88 in July 2023.

Growth: Starbucks experienced a stunted growth rating of 27 from February to March 2023. However, it jumped to 41 by May 2023 and peaked at 42 in July 2023, showing a dramatic increase.

These noteworthy dimensions suggest that SBUX boasts high-quality offerings, is experiencing strong market momentum, and is witnessing substantial growth over the selected period.

How does Starbucks Corporation (SBUX) Stack Up Against its Peers?

Other stocks in the Restaurants sector that may be worth considering are Arcos Dorados Holdings Inc. (ARCO), Nathan's Famous Inc. (NATH), and Biglari Holdings Inc. (BH) - they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

SBUX shares were trading at $101.31 per share on Monday morning, up $0.06 (+0.06%). Year-to-date, SBUX has gained 3.15%, versus a 20.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Aanchal Sugandh

Aanchal's passion for financial markets drives her work as an investment analyst and journalist. She earned her bachelor's degree in finance and is pursuing the CFA program. She is proficient at assessing the long-term prospects of stocks with her fundamental analysis skills. Her goal is to help investors build portfolios with sustainable returns.

The post Is August the Time to Buy Starbucks (SBUX)? appeared first on StockNews.com