American Woodmark’s 21.3% return over the past six months has outpaced the S&P 500 by 11.5%, and its stock price has climbed to $65.92 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in American Woodmark, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think American Woodmark Will Underperform?

Despite the momentum, we're swiping left on American Woodmark for now. Here are three reasons you should be careful with AMWD and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, American Woodmark struggled to consistently increase demand as its $1.60 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a low quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect American Woodmark’s revenue to drop by 5.4%. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

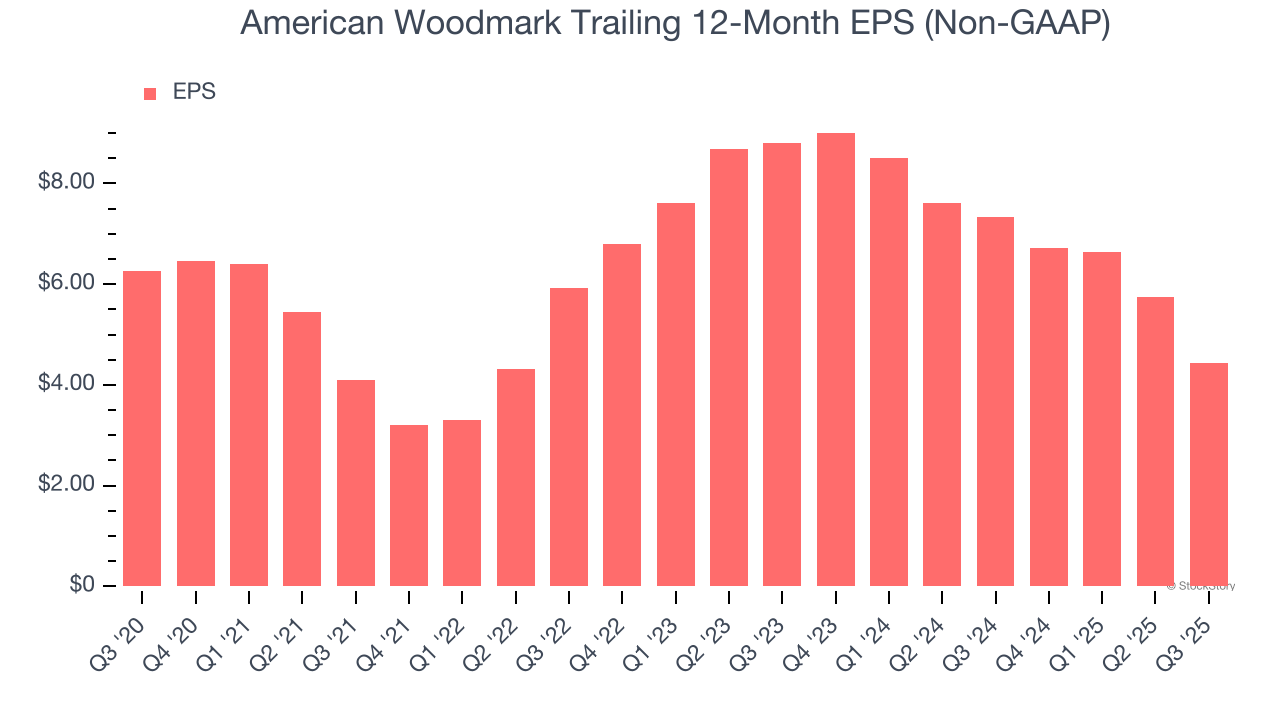

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for American Woodmark, its EPS declined by 6.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of American Woodmark, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 35.3× forward P/E (or $65.92 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of American Woodmark

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.