eBay’s 35.2% return over the past six months has outpaced the S&P 500 by 19.8%, and its stock price has climbed to $92.20 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy eBay, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is eBay Not Exciting?

We’re happy investors have made money, but we're cautious about eBay. Here are three reasons you should be careful with EBAY and a stock we'd rather own.

1. Active Buyers Hit a Plateau

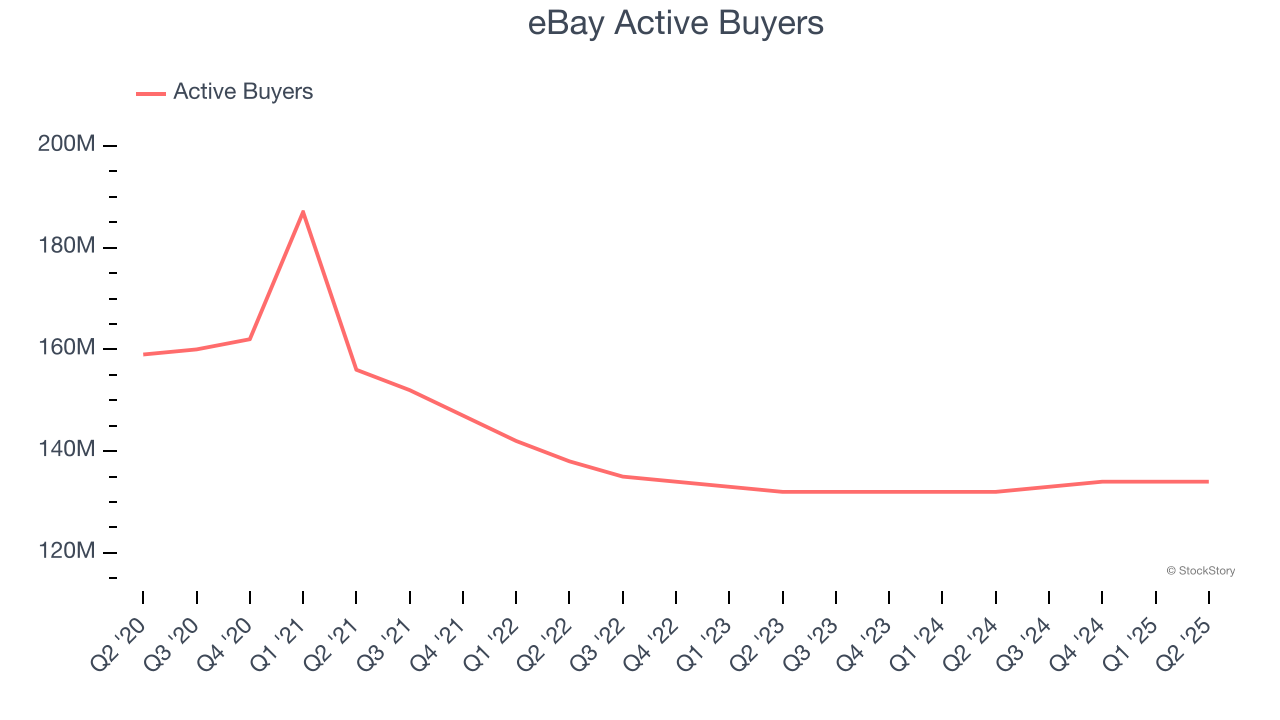

As an online marketplace, eBay generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eBay struggled with new customer acquisition over the last two years as its active buyers were flat at 134 million. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eBay wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Growth in Customer Spending Lags Peers

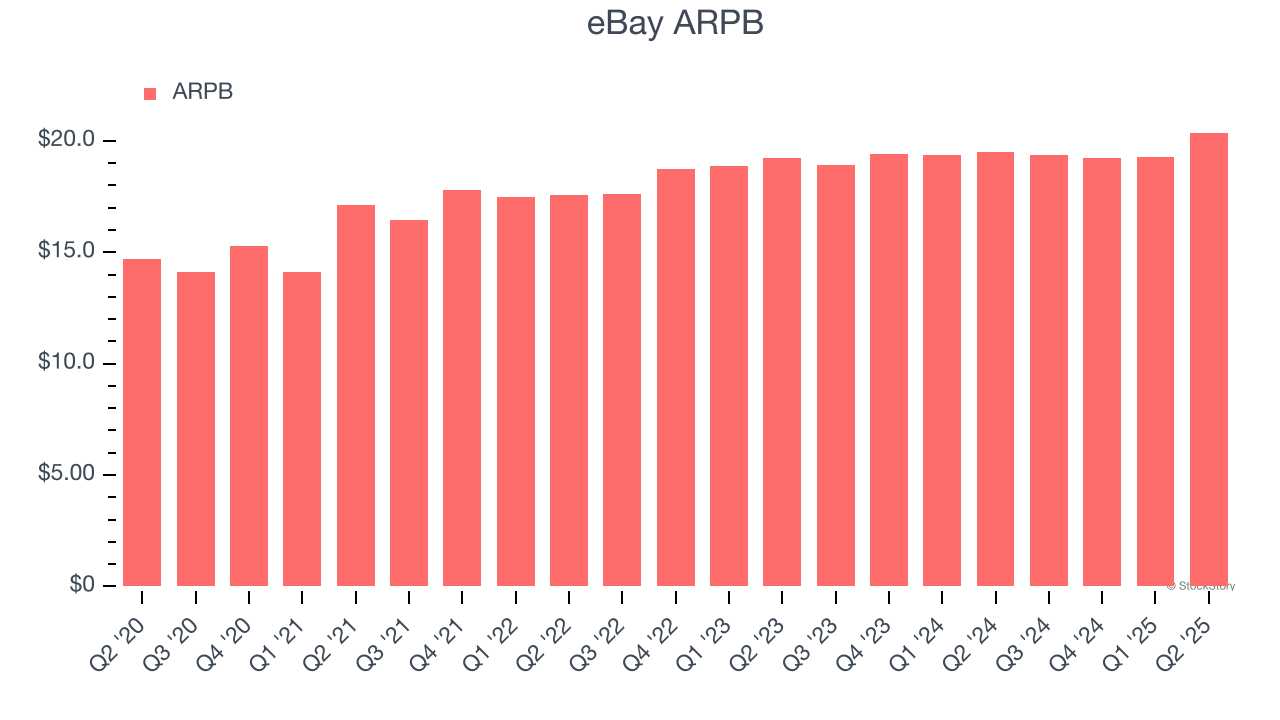

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and eBay’s take rate, or "cut", on each order.

eBay’s ARPB growth has been subpar over the last two years, averaging 2.6%. This raises questions about its platform’s health when paired with its flat active buyers. If eBay wants to grow its buyers, it must either develop new features or lower its monetization of existing ones.

3. Shrinking EBITDA Margin

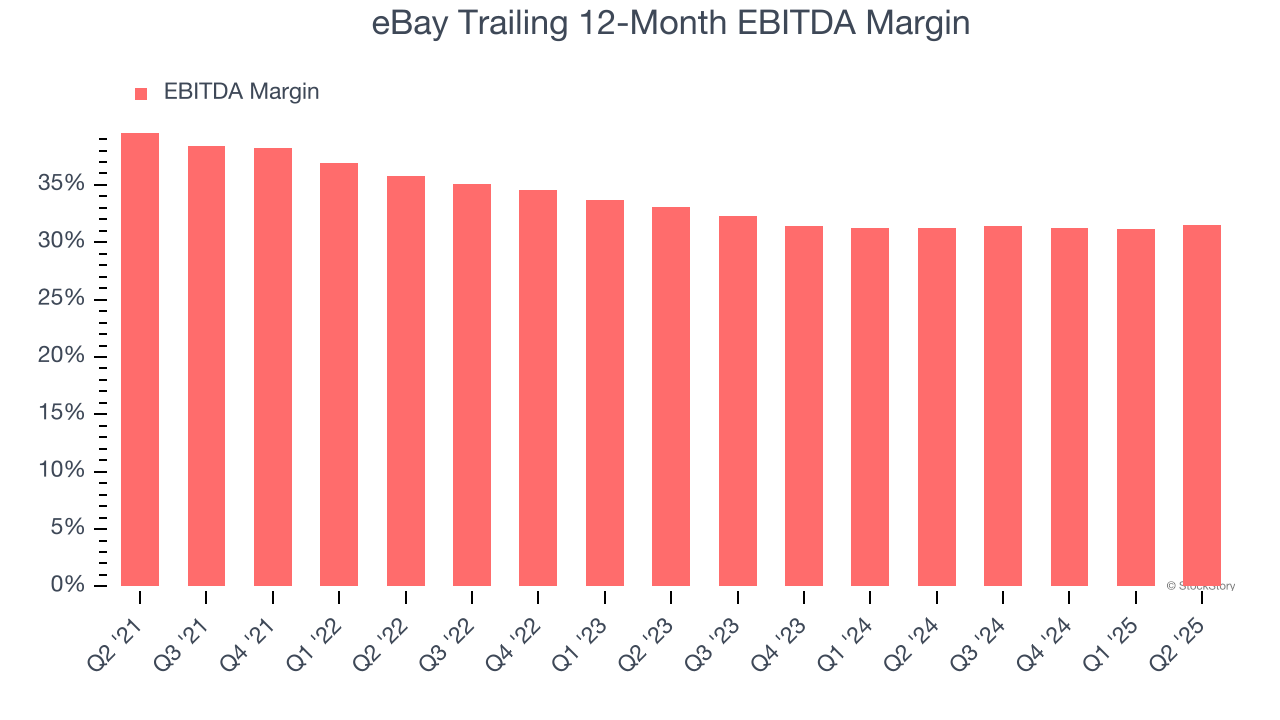

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Looking at the trend in its profitability, eBay’s EBITDA margin decreased by 4.3 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 31.5%.

Final Judgment

eBay isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 13× forward EV/EBITDA (or $92.20 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.