Pool products retailer Leslie’s (NASDAQ: LESL) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 12.2% year on year to $500.3 million. The company’s full-year revenue guidance of $1.22 billion at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.20 per share was in line with analysts’ consensus estimates.

Is now the time to buy Leslie's? Find out by accessing our full research report, it’s free.

Leslie's (LESL) Q2 CY2025 Highlights:

- Revenue: $500.3 million vs analyst estimates of $524.9 million (12.2% year-on-year decline, 4.7% miss)

- Adjusted EPS: $0.20 vs analyst estimates of $0.20 (in line)

- Adjusted EBITDA: $81.57 million vs analyst estimates of $80.83 million (16.3% margin, 0.9% beat)

- The company dropped its revenue guidance for the full year to $1.22 billion at the midpoint from $1.34 billion, a 8.6% decrease

- EBITDA guidance for the full year is $55 million at the midpoint, below analyst estimates of $76.79 million

- Operating Margin: 13.7%, down from 17.2% in the same quarter last year

- Free Cash Flow Margin: 21.4%, down from 29% in the same quarter last year

- Locations: 1,000 at quarter end, down from 1,020 in the same quarter last year

- Same-Store Sales fell 12.4% year on year (-7% in the same quarter last year)

- Market Capitalization: $65.03 million

“As we announced last month in our preliminary financial results, our results were below expectations in the fiscal third quarter. Against a challenging backdrop in what is normally our peak selling season of the year, we faced significant headwinds from weather in addition to competitive pricing dynamics that were magnified in a compressed demand period,” said Jason McDonell, Leslie’s chief executive officer.

Company Overview

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ: LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.25 billion in revenue over the past 12 months, Leslie's is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

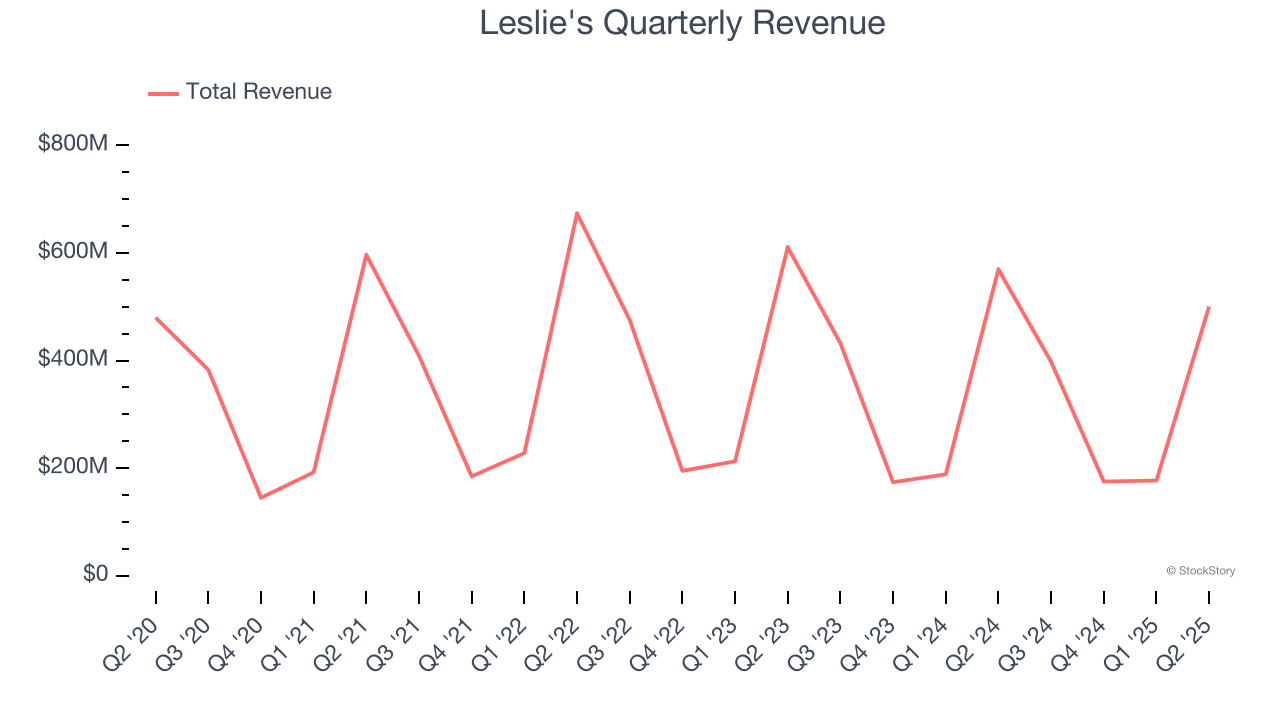

As you can see below, Leslie’s sales grew at a tepid 5.4% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Leslie's missed Wall Street’s estimates and reported a rather uninspiring 12.2% year-on-year revenue decline, generating $500.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a slight deceleration versus the last six years. Despite the slowdown, this projection is above average for the sector and suggests the market is forecasting some success for its newer products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

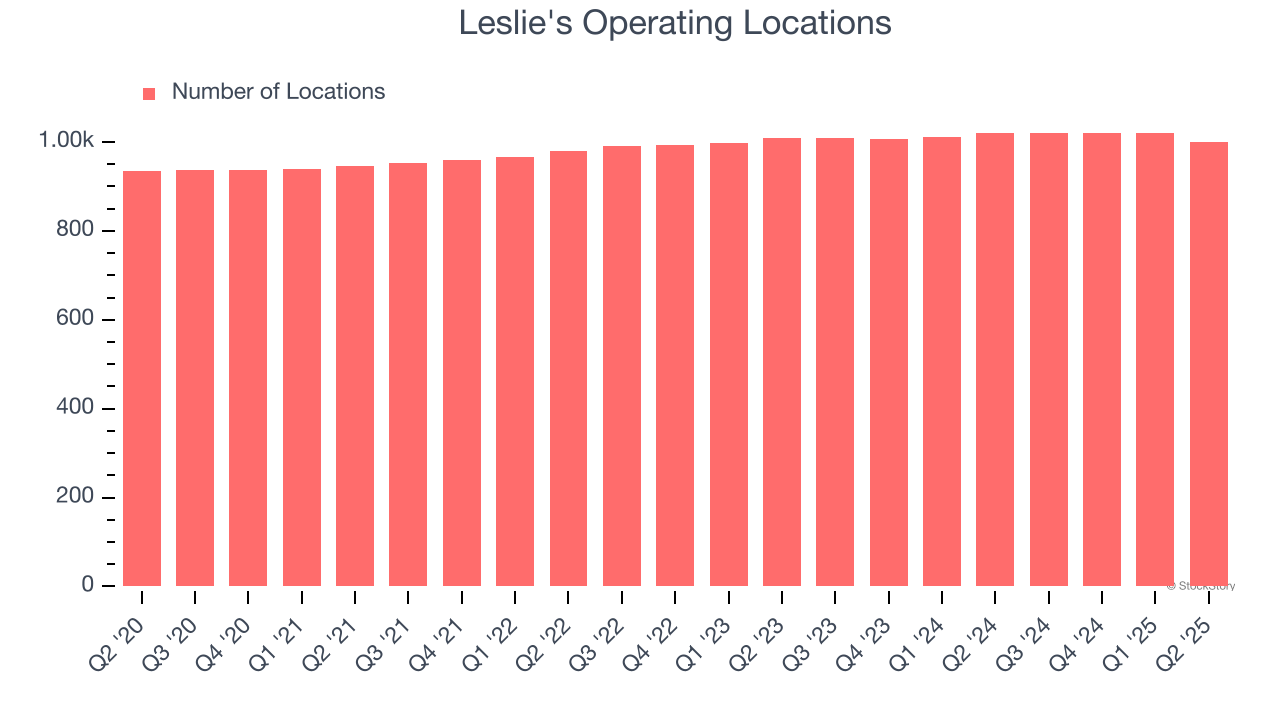

Leslie's operated 1,000 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

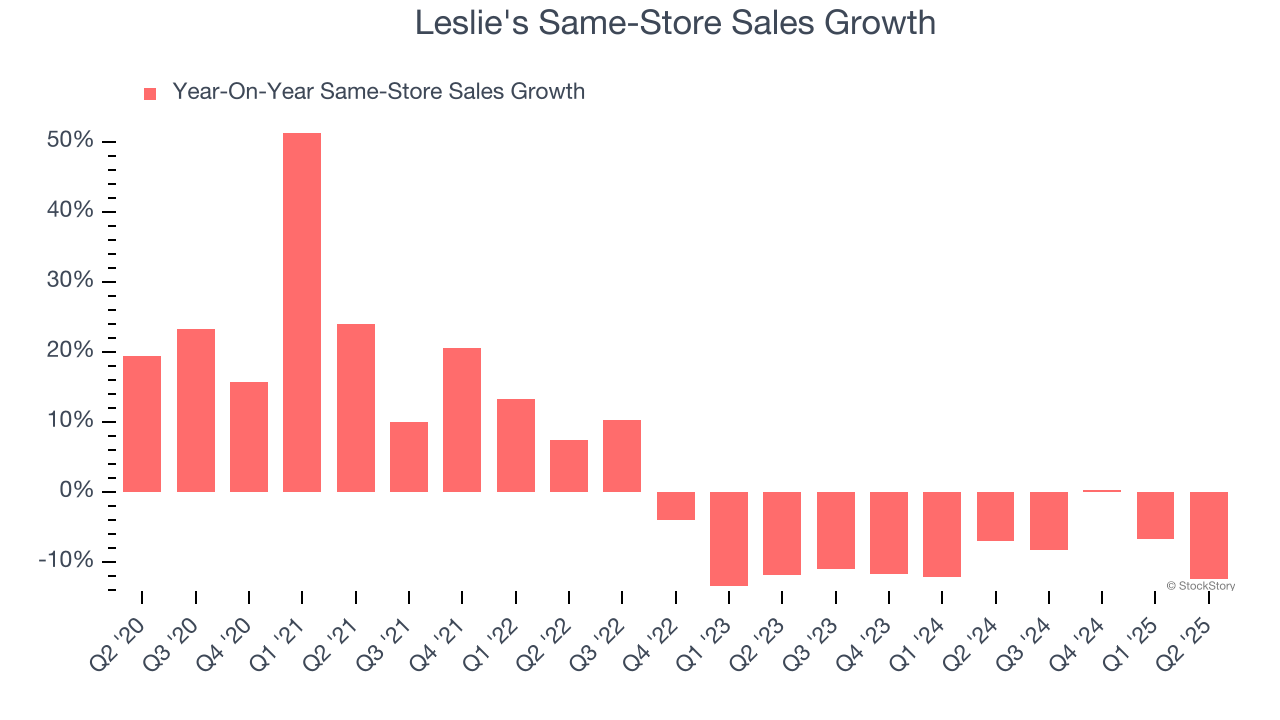

Leslie’s demand has been shrinking over the last two years as its same-store sales have averaged 8.6% annual declines. This performance isn’t ideal, and we’d be concerned if Leslie's starts opening new stores to artificially boost revenue growth.

In the latest quarter, Leslie’s same-store sales fell by 12.4% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Leslie’s Q2 Results

It was good to see Leslie's narrowly top analysts’ gross margin expectations this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.3% to $0.35 immediately after reporting.

Leslie's may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.